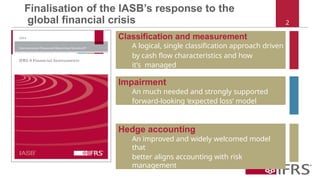

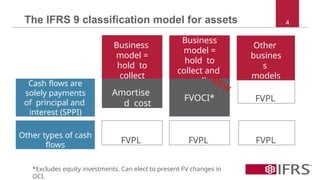

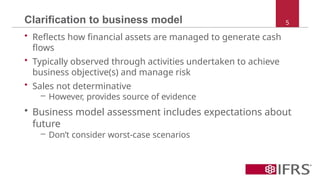

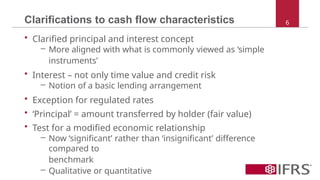

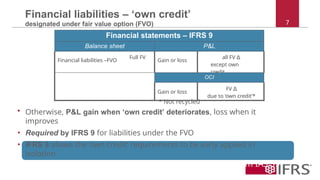

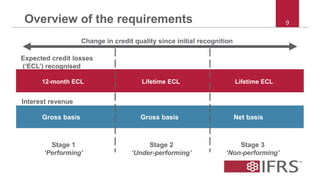

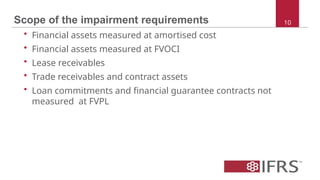

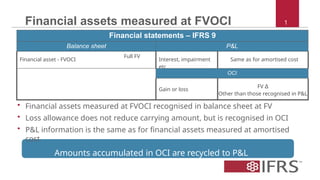

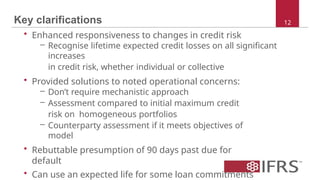

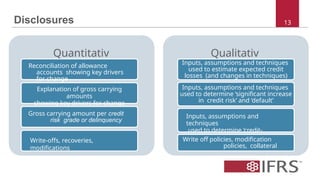

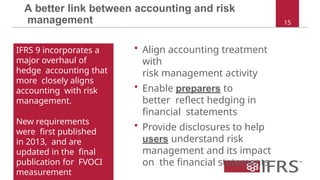

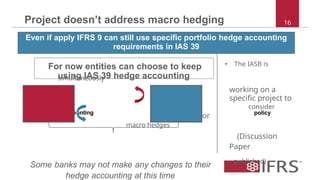

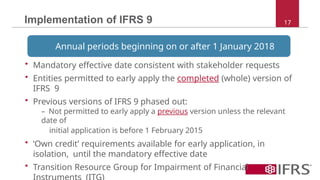

The presentation discusses IFRS 9, which includes a classification model for financial instruments driven by cash flow characteristics and management approaches. It introduces a forward-looking expected credit loss model for impairment and enhancements to hedge accounting to better align with risk management. The standards, effective from January 2018, allow for early adoption of specific provisions while providing clarity on business models and credit risk assessments.