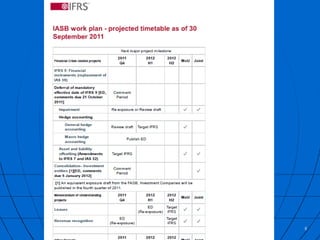

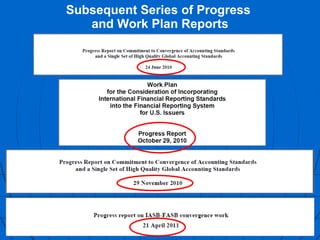

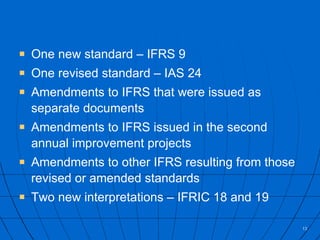

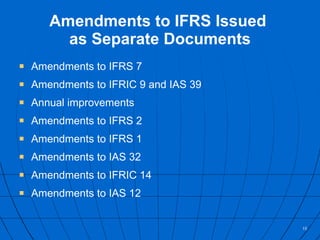

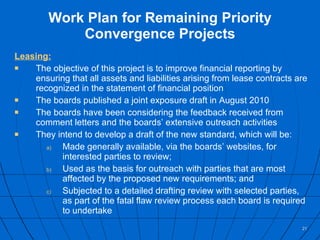

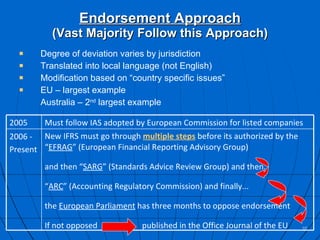

- The document summarizes recent developments in International Financial Reporting Standards (IFRS), including delays in convergence projects between the IASB and FASB, new standards and pronouncements issued, and differences in IFRS adoption across countries.

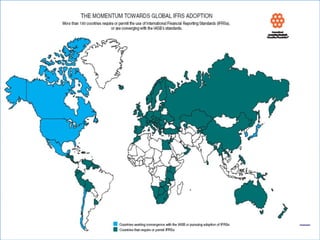

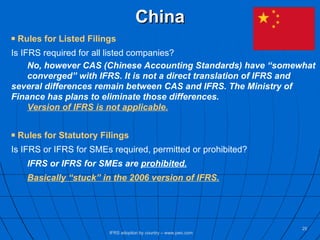

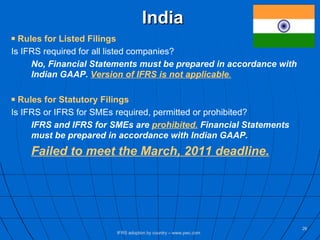

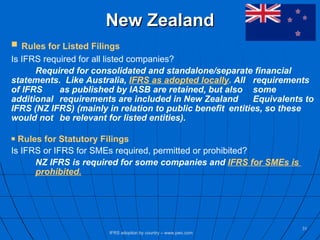

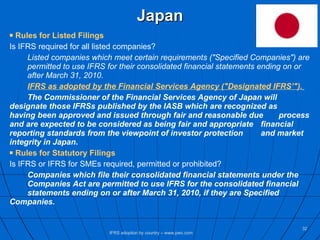

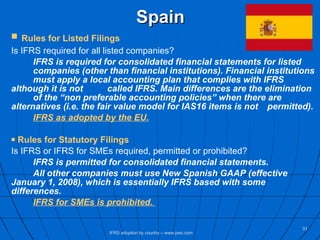

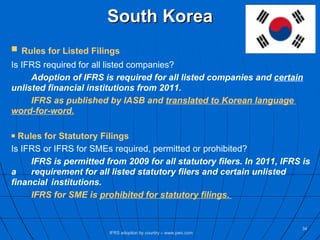

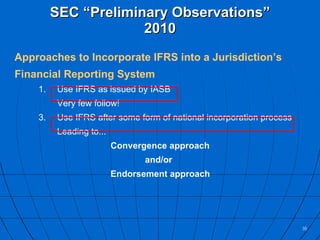

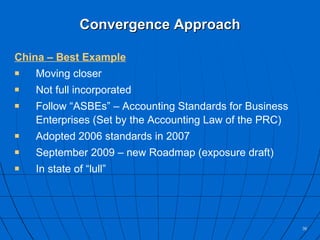

- Key countries' approaches to adopting IFRS for statutory versus listed company filings are reviewed, with most requiring IFRS for consolidated listed company filings but maintaining local GAAP for statutory filings.

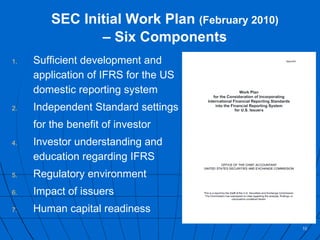

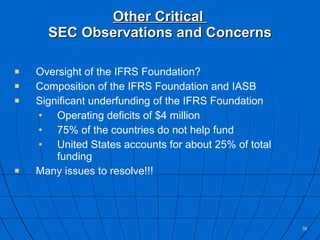

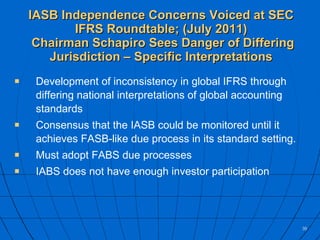

- Oversight of the IASB and concerns about independence are discussed, as well as recommendations for the SEC as it considers a potential future adoption of IFRS in the US.

![Thank You Stephen G. Austin, MBA, CPA [email_address] www.SwensonAdvisors.com www.swentrack.com www.swensonforensic.com](https://image.slidesharecdn.com/latestifrsdevelopmentsoct2011-111003105242-phpapp02/85/Latest-IFRS-Developments-44-320.jpg)