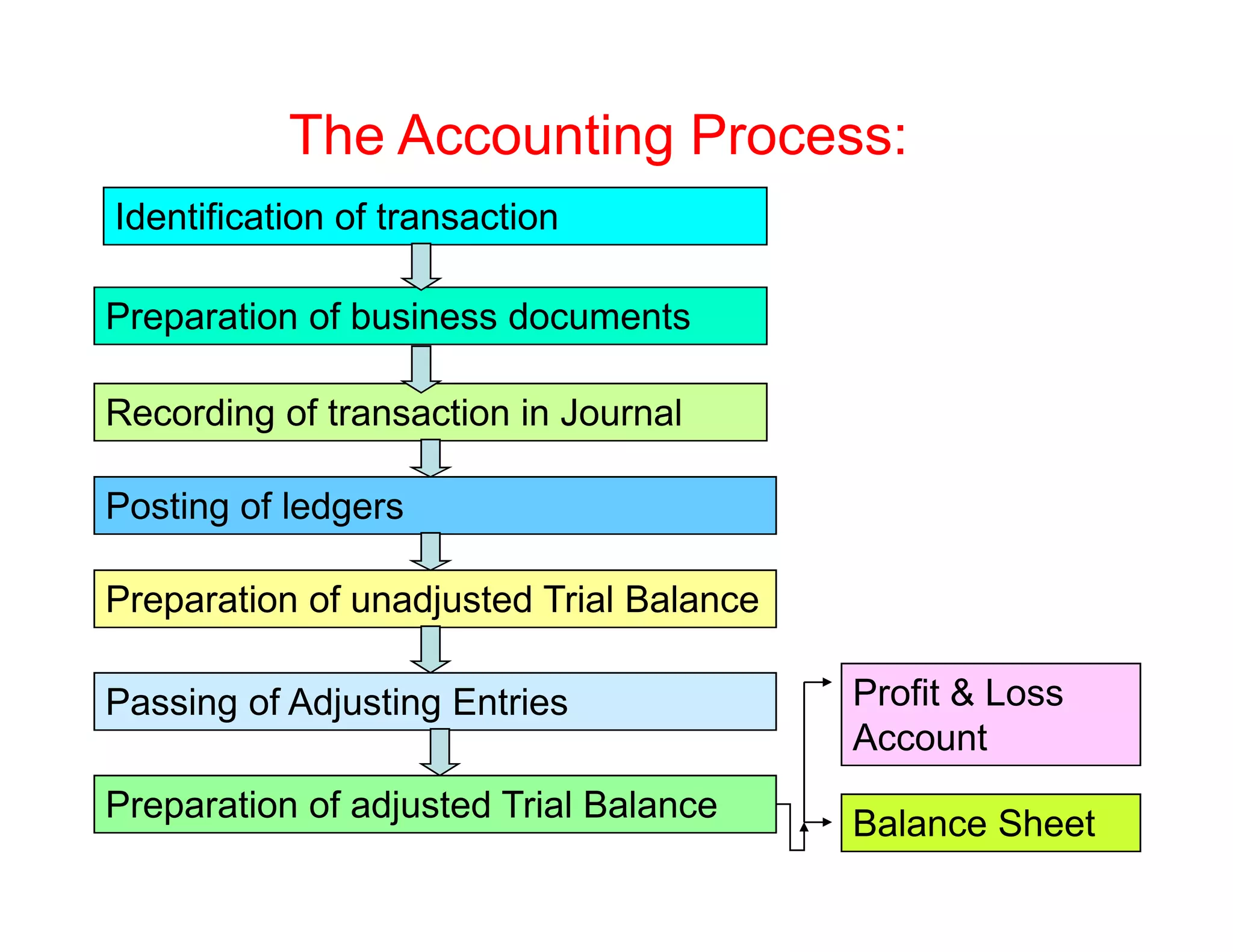

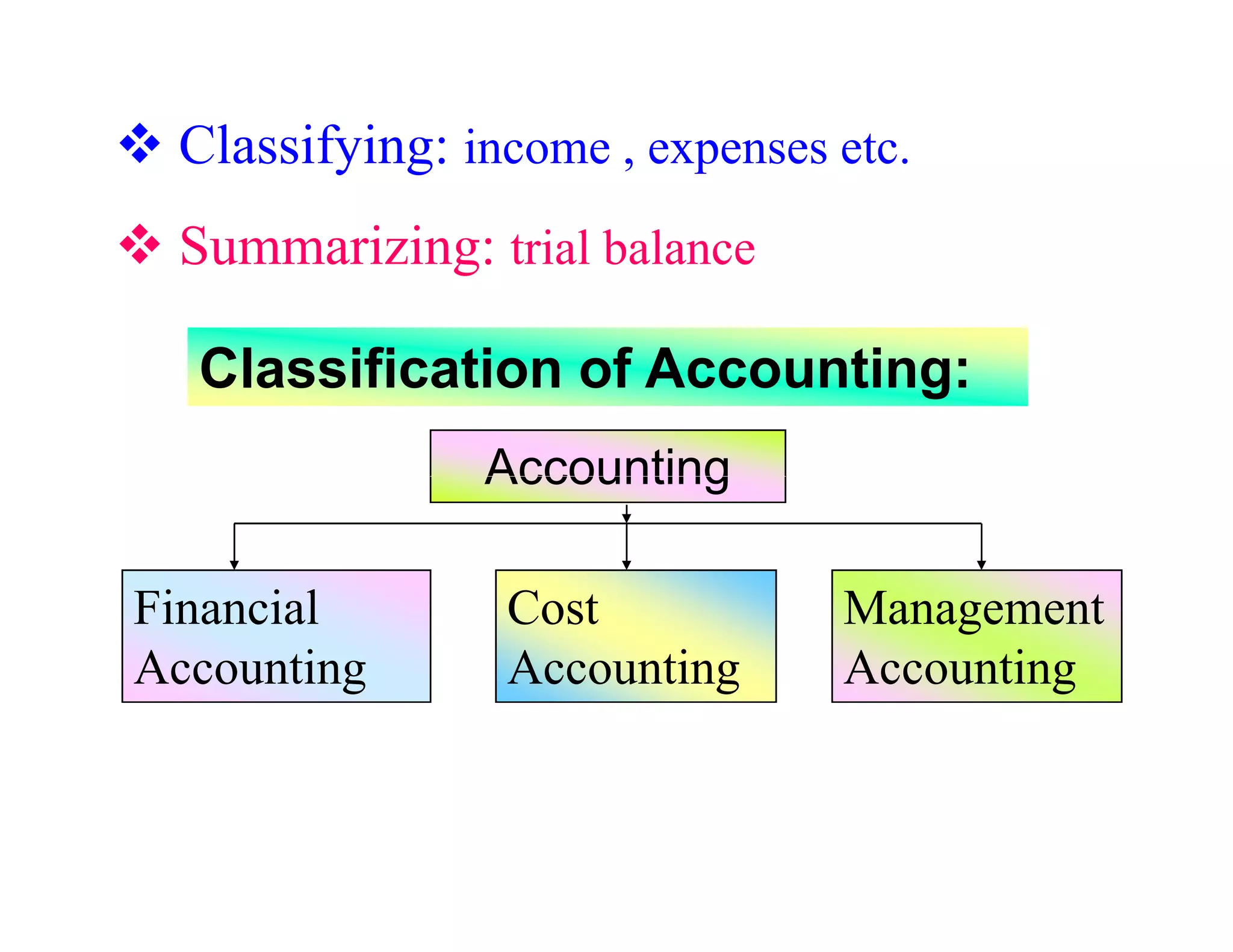

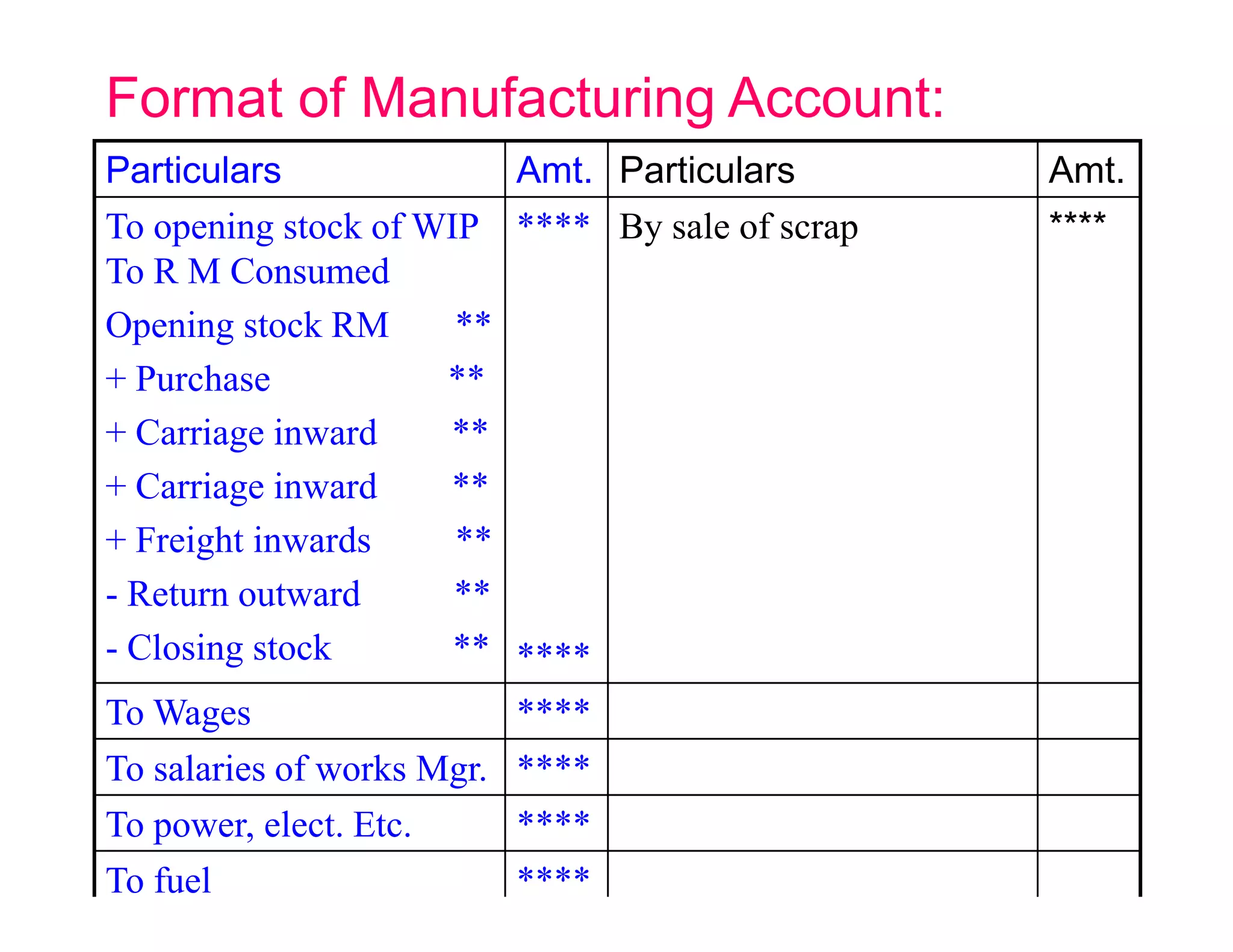

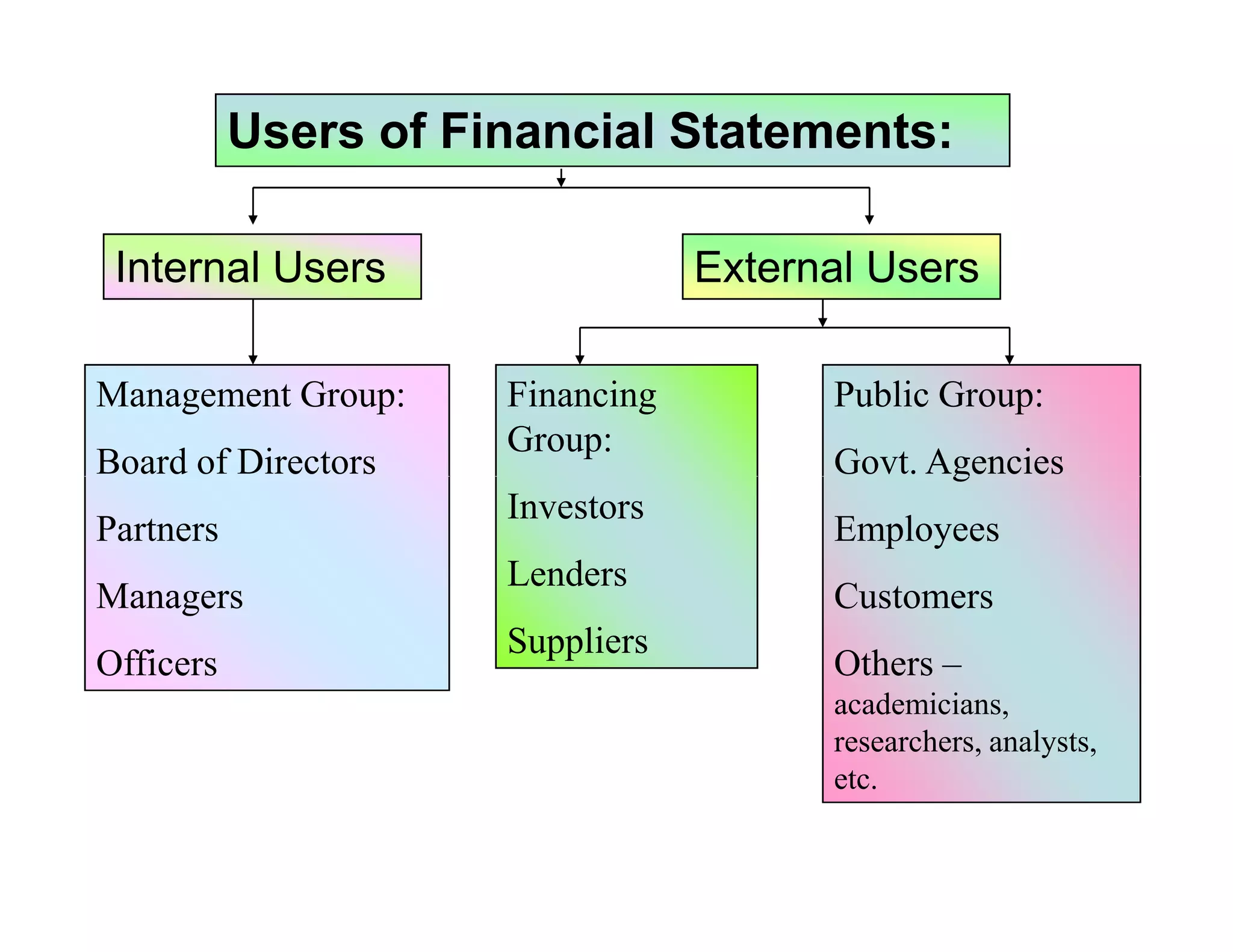

This document provides an introduction to financial accounting concepts. It defines accounting and bookkeeping, and outlines the accounting process and key financial statements. It describes the generally accepted accounting principles of materiality, money measurement, time period matching, and conservatism. It also explains the objectives of accounting and who the main users of financial statements are.