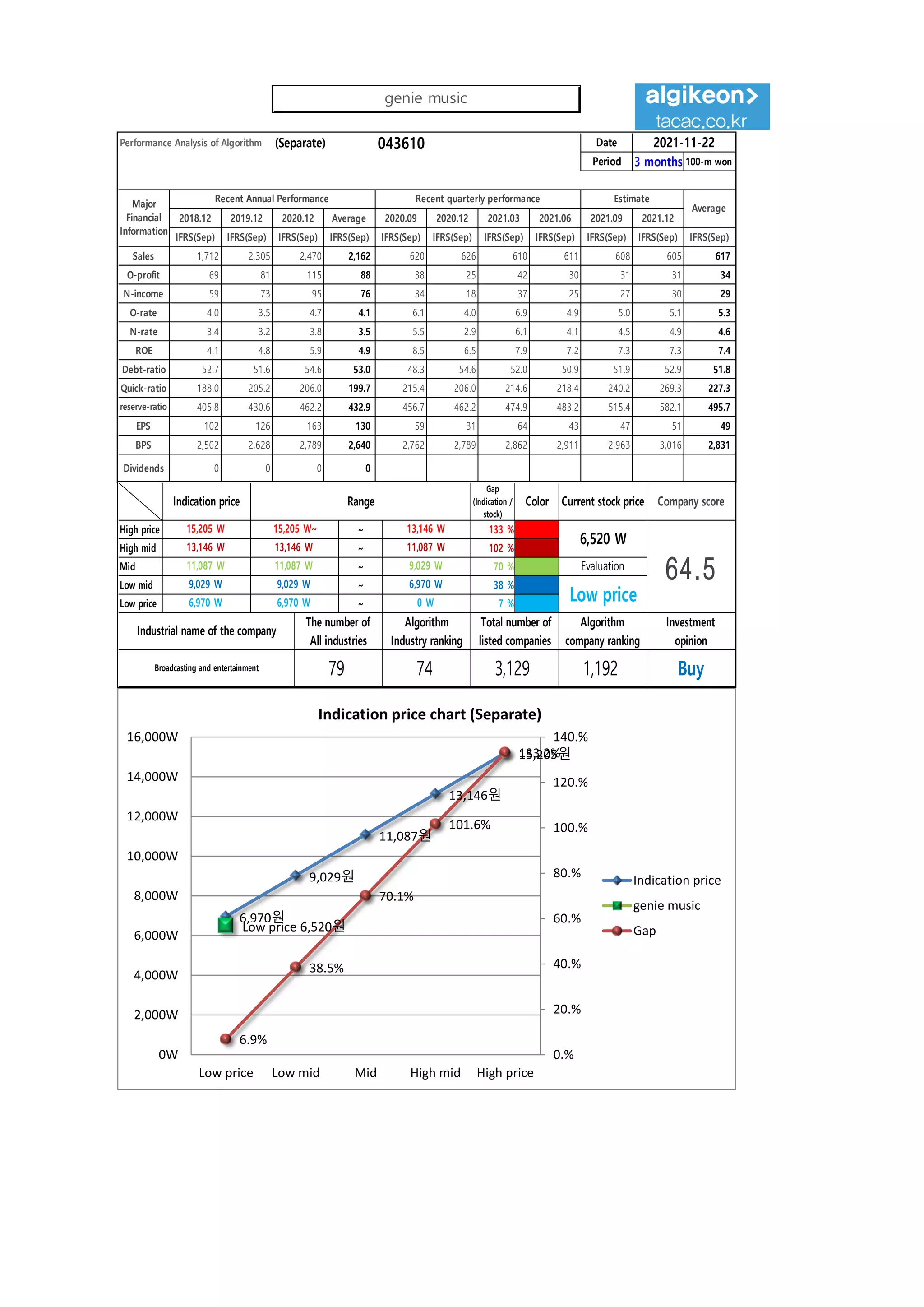

This document provides a performance analysis of an algorithm (separate) from December 2018 to November 2021. It includes quarterly and annual sales, operating profit, net income, profit margins, debt ratios, and other financial metrics. It also analyzes the company's stock price probability, trading strategies, and investment opinions. The analysis uses an algorithm program to evaluate the company and provide purchase recommendations.

![[Price for scheduled purchasing]

Arbitrarily made

Algorithm stocks Trading Strategies (Separate) 043610 Date

Period

Gap

(Indication /

stock)

Color

low price 6,970 W 6,970 W ~ 0 W 7 % -320,388 W -46

Low mid 9,029 W 9,029 W ~ 6,970 W 38 % -1,784,774 W -198

Mid 11,087 W 11,087 W ~ 9,029 W 70 % -3,249,159 W -293

High mid 13,146 W 13,146 W ~ 11,087 W 102 % -4,713,544 W All selling

Suggested Purchase

Amount 4,638,115 W

Number of stocks

purchased 711

Indication price Range Buying / Selling Buying / Selling [Stocks]

High price 15,205 W 15,205 W~ ~ 13,146 W 133 % -6,177,930 W All selling

2021-11-22

3 months

Current stock price Evaluation

Stock price rise

probability score

Investment opinion Prospective purchase amount

6,520 W Low price 44.2 Buy 10,000,000 W

Stock price rise

probability score

A Sector 54.5 52.3 45.9 46.6 48.6 48.6

44.2

B Sector 15.0 25.4 46.6 46.6 29.2 15.0

Total average 34.7 38.8 36.9 15.4 38.9 31.8

2021.06.24 2021.07.22 2021.08.20 2021.09.17 2021.10.22 2021.11.19

2021.08.20 2021.09.17 2021.10.22 2021.11.19

Total of

increase rate

Total score

A Sector -4 % -14 % 2 % 4 % 0 %

-19 % 45.3

B Sector 41 % 9 % 40 % -60 % -94 %

Total average 11 % -5 % -139 % 60 % -22 %

2021.07.22

-4%

-14%

2% 4% 0%

41%

9%

40%

-60%

-94%

11%

-5%

-139%

60%

-22%

-150%

-100%

-50%

0%

50%

100%

2021.07.22 2021.08.20 2021.09.17 2021.10.22 2021.11.19

Increase rate of stock price rise

A sector

B sector

Total average

genie music

54 52

46 47 49 49

15

25 28

47

29

15

35

39 37

15

39

32

0

10

20

30

40

50

60

2021.06.24 2021.07.22 2021.08.20 2021.09.17 2021.10.22 2021.11.19

Stock price rise probability score

A sector

B sector

Total average](https://image.slidesharecdn.com/geniemusic043610algorithminvestmentreport-211122005409/75/genie-music-043610-Algorithm-Investment-Report-2-2048.jpg)