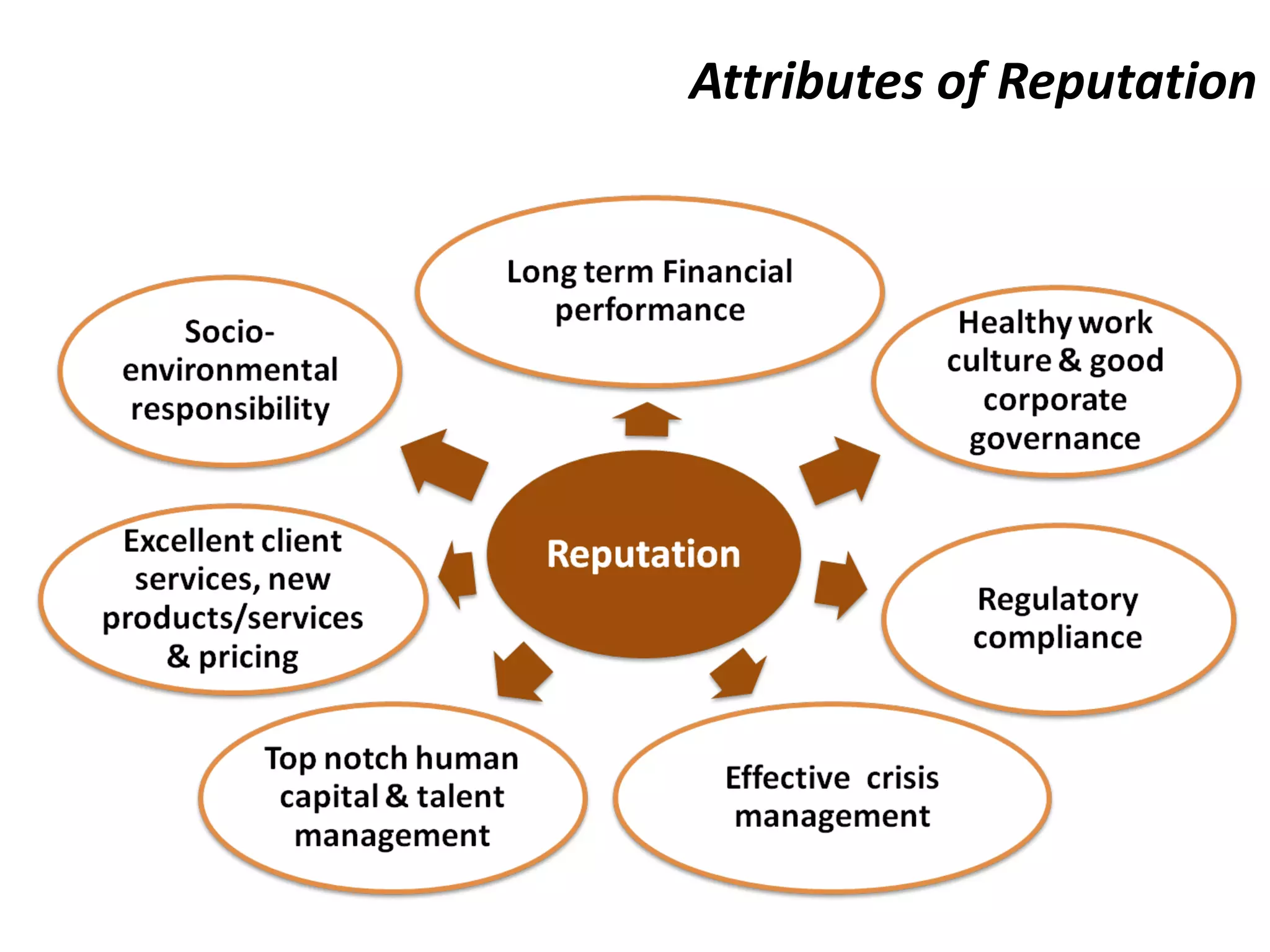

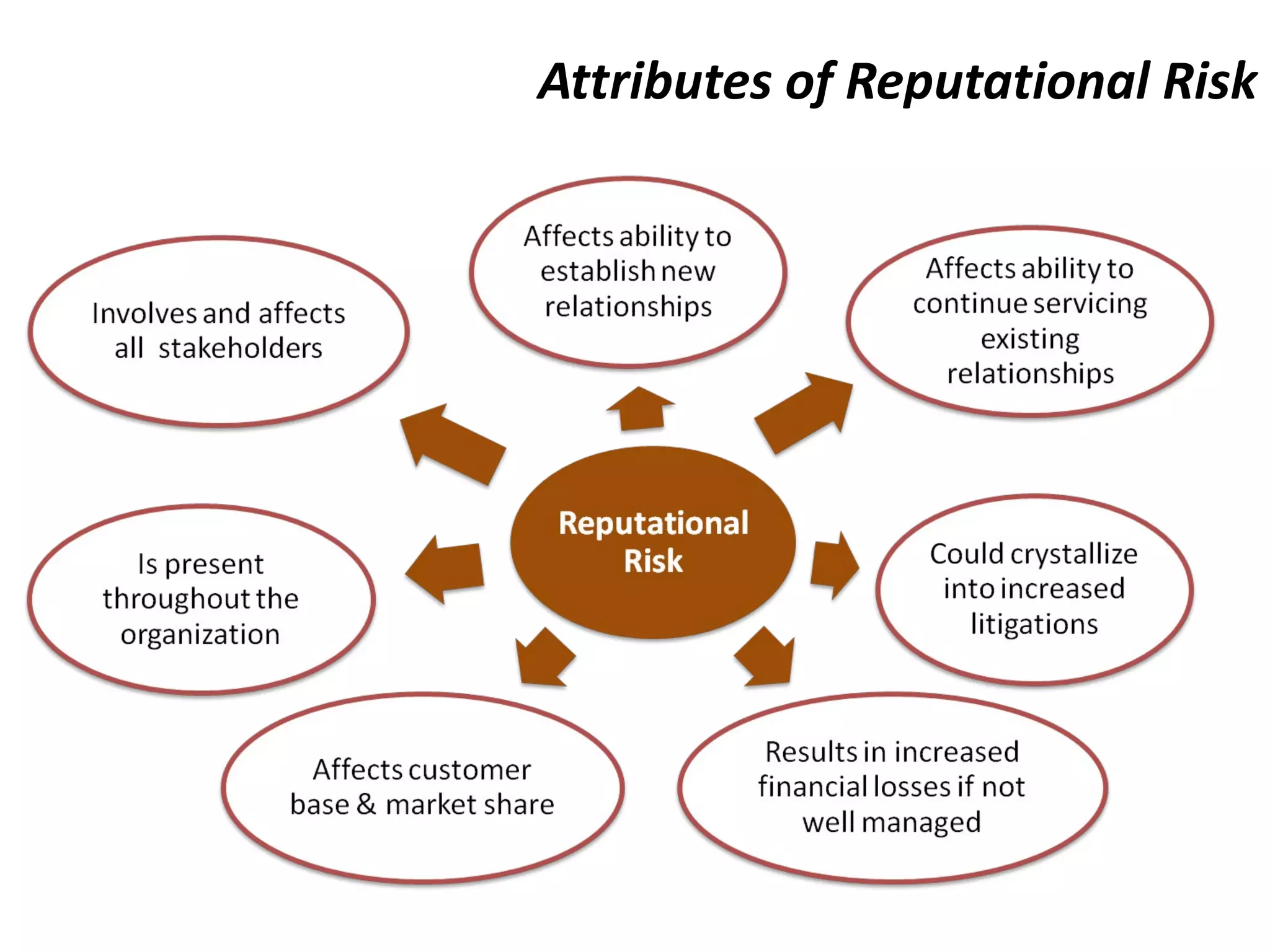

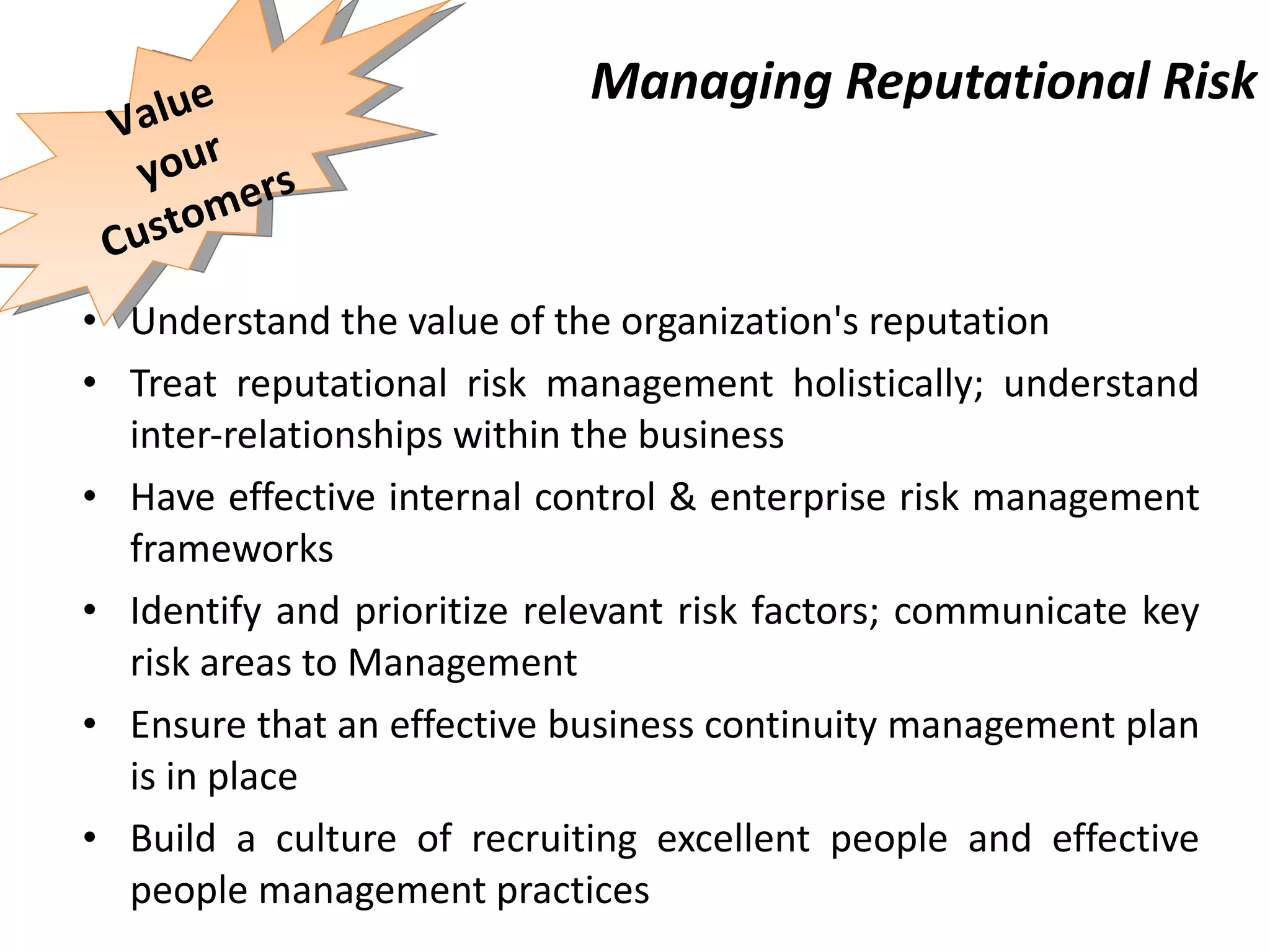

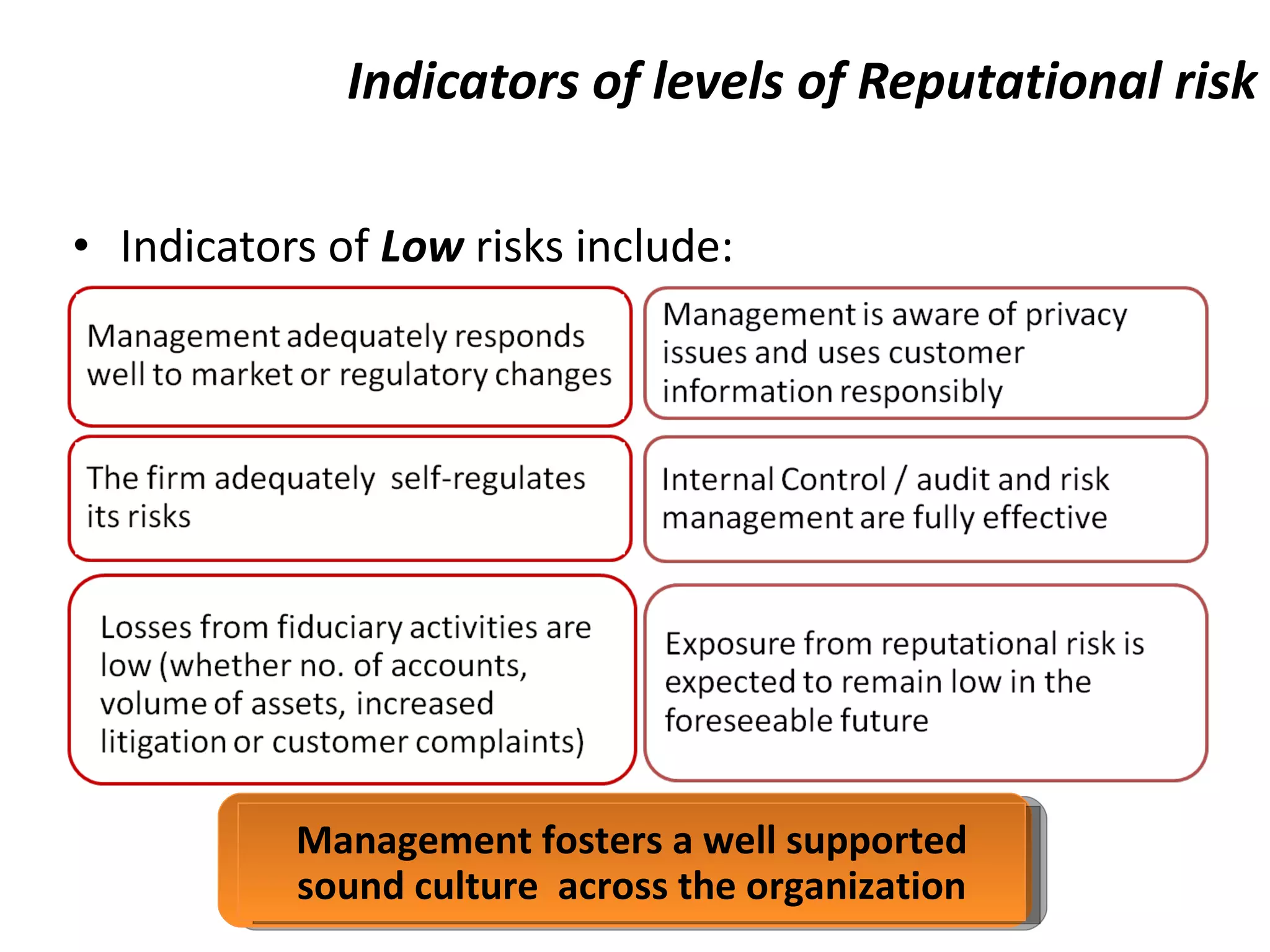

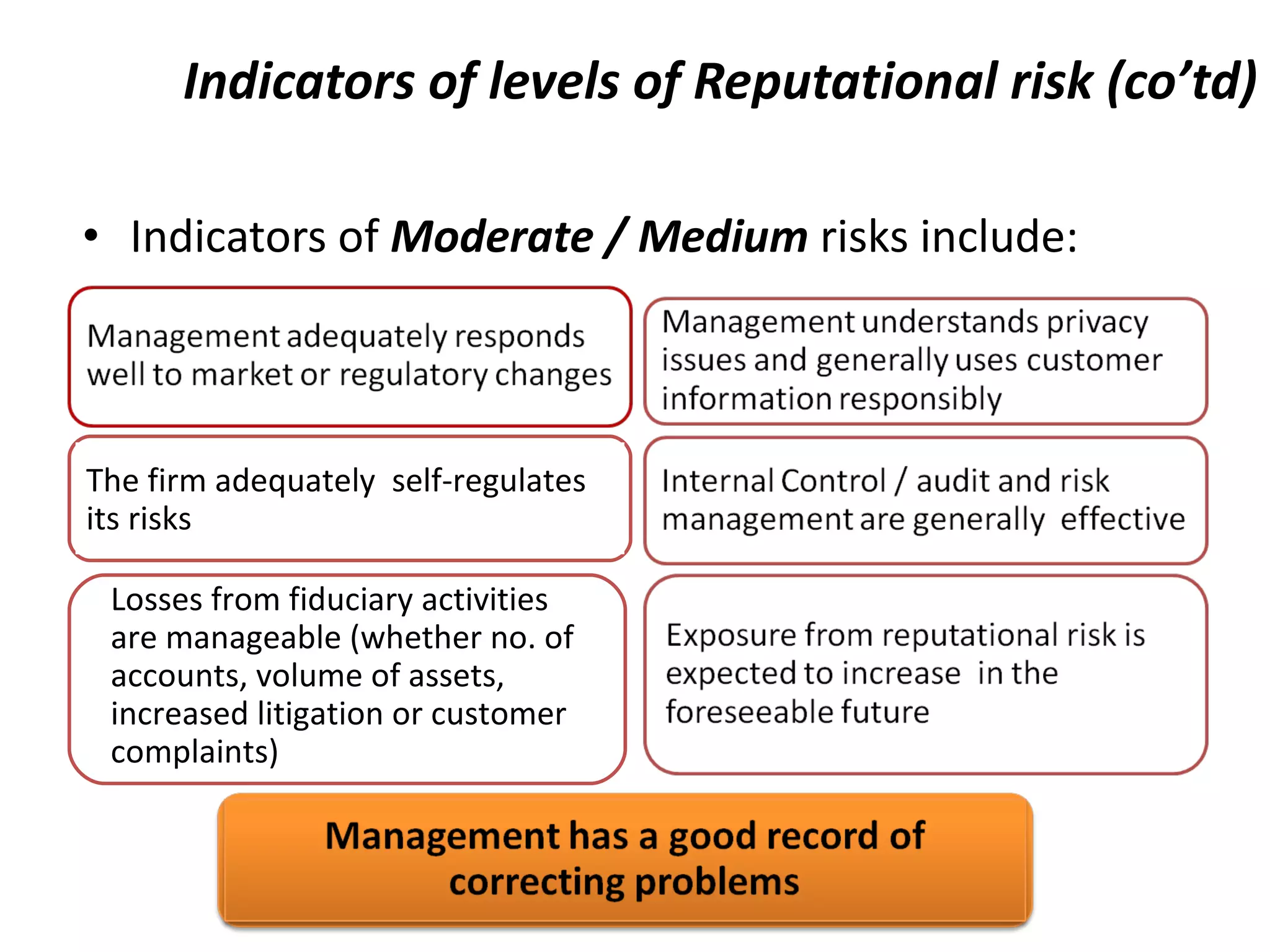

Reputational risk management involves identifying and mitigating risks that could damage an organization's reputation. It is important because reputation is an intangible asset that can impact value growth, market opportunities, and competitive advantage. Reputational risks stem from actions that reduce stakeholder trust and can include regulatory issues, fraud, management changes, or negative publicity. Effective reputational risk management identifies key risks, assesses their potential impact, and ensures timely responses to issues in order to promote trust between an organization and its stakeholders.