Ashok Leyland

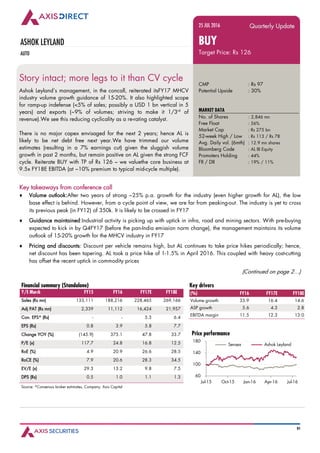

- 1. 01 ASHOK LEYLAND AUTO Story intact; more legs to it than CV cycle Ashok Leyland’s management, in the concall, reiterated itsFY17 MHCV industry volume growth guidance of 15-20%. It also highlighted scope for ramp-up indefense (<5% of sales; possibly a USD 1 bn vertical in 5 years) and exports (~9% of volumes; striving to make it 1/3rd of revenue).We see this reducing cyclicality as a re-rating catalyst. There is no major capex envisaged for the next 2 years; hence AL is likely to be net debt free next year.We have trimmed our volume estimates (resulting in a 7% earnings cut) given the sluggish volume growth in past 2 months, but remain positive on AL given the strong FCF cycle. Reiterate BUY with TP of Rs 126 – we valuethe core business at 9.5x FY18E EBITDA (at ~10% premium to typical mid-cycle multiple). 25 JUL 2016 Quarterly Update BUY Target Price: Rs 126 CMP : Rs 97 Potential Upside : 30% MARKET DATA No. of Shares : 2,846 mn Free Float : 56% Market Cap : Rs 275 bn 52-week High / Low : Rs 113 / Rs 78 Avg. Daily vol. (6mth) : 12.9 mn shares Bloomberg Code : AL IB Equity Promoters Holding : 44% FII / DII : 19% / 11% Key takeaways from conference call ♦ Volume outlook:After two years of strong ~25% p.a. growth for the industry (even higher growth for AL), the low base effect is behind. However, from a cycle point of view, we are far from peaking-out. The industry is yet to cross its previous peak (in FY12) of 350k. It is likely to be crossed in FY17 ♦ Guidance maintained:Industrial activity is picking up with uptick in infra, road and mining sectors. With pre-buying expected to kick in by Q4FY17 (before the pan-India emission norm change), the management maintains its volume outlook of 15-20% growth for the MHCV industry in FY17 ♦ Pricing and discounts: Discount per vehicle remains high, but AL continues to take price hikes periodically; hence, net discount has been tapering. AL took a price hike of 1-1.5% in April 2016. This coupled with heavy cost-cutting has offset the recent uptick in commodity prices (Continued on page 2…) Financial summary (Standalone) Y/E March FY15 FY16 FY17E FY18E Sales (Rs mn) 133,111 188,216 228,465 269,166 Adj PAT (Rs mn) 2,339 11,112 16,424 21,957 Con. EPS* (Rs) - - 5.3 6.4 EPS (Rs) 0.8 3.9 5.8 7.7 Change YOY (%) (145.9) 375.1 47.8 33.7 P/E (x) 117.7 24.8 16.8 12.5 RoE (%) 4.9 20.9 26.6 28.5 RoCE (%) 7.9 20.6 28.3 34.5 EV/E (x) 29.3 13.2 9.8 7.5 DPS (Rs) 0.5 1.0 1.1 1.3 Source: ^Consensus broker estimates, Company, Axis Capital Key drivers (%) FY16 FY17E FY18E Volume growth 33.9 16.4 14.6 ASP growth 5.6 4.3 2.8 EBITDA margin 11.5 12.3 13.0 Price performance 60 100 140 180 Jul-15 Oct-15 Jan-16 Apr-16 Jul-16 Sensex Ashok Leyland

- 2. 02 25 JUL 2016 Quarterly Update ASHOK LEYLAND AUTO (…Continued from page 1) ♦ Net debt:Rs 16 bn vs. Rs 36 bn YoY. Leverage down to 0.3x vs. 2.3x a couple of years back. From a peak of Rs 62 bn over the past 2 years, debt has reduced sharply on the back of uptick in cash from operations, tight leash on capex/investment, and divestment of non-core businesses. This has reflected in lower interest outgo this quarter (down 52% YoY/44% QoQ) ♦ Defense: AL has won 11 tenders it applied for in the mobility solutions (it is the largest logistic suppliers to military troops). Management indicated there could be exponential growth from defense – revenue from the segment stood at ~Rs 5 bn in FY16 (<5% of revenue) and, the management expects defense to eventually grow to USD750mn – USD 1 bn over the next 5 years. This would drive revenue and improve margins ♦ Exports: Shipment to key export markets were impacted this quarter due to delay in invoicing. This is expected to reverse next quarter onwards. Overall, exports account for ~9% of volumes and, the company targets export to eventually account for 1/3rd of its business. This coupled with rising share of defense will reduce AL’s exposure to cyclical businesses (India trucks), hopefully before the Indian CV cycle peaks ♦ Capex and investments: Management guided for FY17 capex (including investments) of Rs 5 bn. AL is operating at ~70% utilization (on a 2 shift basis). It could add another shift and do further bottlenecking, and as a result, there is no heavy capexrequirement for another 2 years. For most key areas (engine, transmission and chassis), AL is already well-equipped ♦ Regional growth: South (AL’s key market) has lagged other markets in terms of growth. However, given the company’s focus to become a strong pan-India player, it is relatively de-risked from this. For example, East forms now 21% of sales vs. 10% few years back ♦ GST impact: The economy as a whole will benefit from GST due to seamless movement of goods within the country. With most tolls being done away with, the movement of trucks will be freed up. While this could reduce freight rates, it would lead to better profitability for truckers and thereby further investments into fleet replacement/addition ♦ New launches: Two upcoming launches in the ICV space: (1) Sunshine school bus (well-received by the market) and (2) Guru trucks. Both will plug gaps in AL’s product portfolio

- 3. 03 25 JUL 2016 Quarterly Update ASHOK LEYLAND AUTO Exhibit 1: Results update Quarter ended 12 months ended Standalone (Rs mn) Jun-16 Jun-15 YoY (%) Mar-16 QoQ (%) FY17E FY16 YoY (%) Net sales 42,588 38,831 9.7 59,553 (28.5) 228,465 188,216 21.4 - Raw material 29,305 26,572 10.3 42,255 (30.6) 162,210 132,620 22.3 (% of net sales) 68.8 68.4 38 71.0 (214) 71.0 70.5 54 - Staff expenditure 3,581 3,287 8.9 3,408 5.1 16,785 13,988 20.0 (% of net sales) 8.4 8.5 (6) 5.7 269 7.3 7.4 (8) - Other expenditure 4,939 5,047 (2.1) 6,358 (22.3) 21,437 19,949 7.5 (% of net sales) 11.6 13.0 (140) 10.7 92 9.4 10.6 (122) Total expenditure 37,826 34,906 8.4 52,022 (27.3) 200,432 166,556 20.3 EBITDA 4,763 3,925 21.3 7,531 (36.8) 28,033 21,660 29.4 EBITDA Margin (%) 11.2 10.1 108 12.6 (146) 12.3 11.5 76 Depreciation 1,210 1,138 6.3 1,177 2.8 4,557 4,437 2.7 EBIT 3,553 2,787 27.5 6,354 (44.1) 23,477 17,223 36.3 Interest 338 701 (51.8) 602 (43.8) 1,233 2,735 (54.9) Other income 443 259 71.1 320 38.5 1,279 1,099 16.4 PBT 3,658 2,345 56.0 6,071 (39.8) 23,523 15,586 50.9 Tax 1,097 774 41.8 1,508 (27.2) 7,099 4,474 58.7 Reported PAT 2,908 1,445 101.2 770 277.5 16,772 7,218 132.4 Adjusted PAT 2,560 1,571 62.9 4,563 (43.9) 16,424 11,112 47.8 EPS (Rs) 1.0 0.5 101.2 0.3 277.5 5.8 3.9 47.8 Adjusted EPS (Rs) 0.9 0.6 62.9 1.6 (43.9) 5.8 3.9 47.8 Total volumes (Nos) 31,163 28,190 10.5 43,991 (29.2) 163,507 140,502 16.4 Net realisation (Rs) 1,366,633 1,377,485 (0.8) 1,353,750 1.0 1,397,280 1,339,597 4.3 EBITDA / Vehicle (Rs) 152,832 139,234 9.8 171,196 (10.7) 171,449 154,160 11.2 Source: Company, Axis Capital Exhibit 2: EBITDA margin related to volumes -8% -4% 0% 4% 8% 12% 16% 0 10,000 20,000 30,000 40,000 50,000 Jun-12 Jun-13 Jun-14 Jun-15 Jun-16 (Nos) Vol EBIDTA margins (RHS) Source: Company, Axis Capital Exhibit 3: Realizations up 10% YoY/3% QoQ -10% 0% 10% 20% 30% 0 400 800 1,200 1,600 Jun-13 Dec-13 Jun-14 Dec-14 Jun-15 Dec-15 Jun-16 (000' Rs) Net Realisations YoY Growth (RHS) QoQ Growth (RHS) Source: Company, Axis Capital

- 4. 04 25 JUL 2016 Quarterly Update ASHOK LEYLAND AUTO Exhibit 4: Quarterly volume trend 0 10 20 30 40 50 Q1 Q2 Q3 Q4 (000's) FY12 FY13 FY14 FY15 FY16 FY17 Source: Company, Axis Capital Exhibit 5: EBITDA margin trend -8% -4% 0% 4% 8% 12% 16% Q1 Q2 Q3 Q4 FY12 FY13 FY14 FY15 FY16 FY17 Source: Company, Axis Capital Exhibit 6: FY17 Sensitivity analysis 5.8 12% 14% 16.4% 18% 20% 10.3% 4.5 4.6 4.7 4.7 4.8 11.3% 5.0 5.1 5.2 5.3 5.4 12.3% 5.5 5.7 5.8 5.9 6.0 13.3% 6.1 6.2 6.3 6.5 6.6 14.3% 6.6 6.8 6.9 7.0 7.2 (Rs) Volume growth EBITDA margin Source: Company, Axis Capital Exhibit 7: FY18 Sensitivity analysis 7.7 11% 13% 14.6% 17% 19% 11.0% 6.1 6.3 6.4 6.5 6.6 12.0% 6.8 6.9 7.1 7.2 7.3 13.0% 7.4 7.6 7.7 7.9 8.0 14.0% 8.1 8.2 8.4 8.5 8.7 15.0% 8.7 8.9 9.0 9.2 9.4 EBITDA margin (Rs) Volume growth Source: Company, Axis Capital Expect volume growth to remain strong in FY17 on the back of replacement demand, revival in MHCV industry & pre buying on BS-IV emission norms. Margin would improve on the back of positive operating leverage, further reduction in discounts and better mix. Earnings growth is further aided by a reduction in interest outgo

- 5. 05 25 JUL 2016 Quarterly Update ASHOK LEYLAND AUTO Financial summary (Standalone) Profit &loss (Rs mn) Y/E March FY15 FY16 FY17E FY18E Net sales 133,111 188,216 228,465 269,166 Other operating income - - - - Total operating income 133,111 188,216 228,465 269,166 Cost of goods sold (99,652) (132,620) (162,210) (190,973) Gross profit 33,459 55,597 66,255 78,193 Gross margin (%) 25.1 29.5 29.0 29.1 Total operating expenses (23,193) (33,937) (38,222) (43,101) EBITDA 10,266 21,660 28,033 35,092 EBITDA margin (%) 7.7 11.5 12.3 13.0 Depreciation (4,163) (4,437) (4,557) (4,652) EBIT 6,103 17,223 23,477 30,440 Net interest (3,935) (2,735) (1,233) (481) Other income 1,245 1,099 1,279 1,494 Profit before tax 3,413 15,586 23,523 31,452 Total taxation (1,074) (4,474) (7,099) (9,495) Tax rate (%) 31.5 28.7 30.2 30.2 Profit after tax 2,339 11,112 16,424 21,957 Minorities - - - - Profit/ Loss associate co(s) - - - - Adjusted net profit 2,339 11,112 16,424 21,957 Adj. PAT margin (%) 1.8 5.9 7.2 8.2 Net non-recurring items 1,009 (3,894) 348 - Reported net profit 3,348 7,218 16,772 21,957 Balance sheet (Rs mn) Y/E March FY15 FY16 FY17E FY18E Paid-up capital 2,846 2,846 2,846 2,846 Reserves & surplus 48,341 52,296 65,405 83,033 Net worth 51,187 55,141 68,251 85,879 Borrowing 33,497 27,344 13,672 6,836 Other non-current liabilities 5,103 5,356 5,356 5,356 Total liabilities 133,115 133,855 144,130 161,056 Gross fixed assets 85,554 87,469 89,969 92,469 Less: Depreciation (32,998) (36,932) (41,489) (46,141) Net fixed assets 52,556 50,537 48,480 46,328 Add: Capital WIP 1,201 757 757 757 Total fixed assets 53,757 51,293 49,237 47,085 Total Investment 26,488 19,179 21,679 24,179 Inventory 13,985 17,306 23,159 29,498 Debtors 12,577 12,509 17,526 22,123 Cash & bank 7,513 15,681 12,854 18,497 Loans & advances 15,517 16,583 18,241 18,241 Current liabilities 43,328 46,014 56,852 62,985 Net current assets 9,542 17,369 16,363 26,807 Other non-current assets - - - - Total assets 133,115 133,855 144,130 161,056 Source: Company, Axis Capital Cash flow (Rs mn) Y/E March FY15 FY16 FY17E FY18E Profit before tax 3,413 15,586 23,523 31,452 Depreciation & Amortisation (4,163) (4,437) (4,557) (4,652) Chg in working capital 7,049 (1,239) (1,821) (4,802) Cash flow from operations 17,767 16,756 19,461 20,794 Capital expenditure (2,059) (1,425) (2,500) (2,500) Cash flow from investing 1,015 3,876 (3,721) (3,506) Equity raised/ (repaid) 6,667 - - - Debt raised/ (repaid) (14,523) (8,059) (13,672) (6,836) Dividend paid - (1,536) (3,663) (4,329) Cash flow from financing (11,791) (12,331) (18,567) (11,646) Net chg in cash 6,991 8,301 (2,827) 5,642 Key ratios Y/E March FY15 FY16 FY17E FY18E OPERATIONAL FDEPS (Rs) 0.8 3.9 5.8 7.7 CEPS (Rs) 2.6 4.1 7.5 9.4 DPS (Rs) 0.5 1.0 1.1 1.3 Dividend payout ratio (%) 38.2 37.5 18.7 16.8 GROWTH Net sales (%) 33.9 41.4 21.4 17.8 EBITDA (%) 515.7 111.0 29.4 25.2 Adj net profit (%) (149.1) 375.1 47.8 33.7 FDEPS (%) (145.9) 375.1 47.8 33.7 PERFORMANCE RoE (%) 4.9 20.9 26.6 28.5 RoCE (%) 7.9 20.6 28.3 34.5 EFFICIENCY Asset turnover (x) 1.6 2.6 3.4 3.8 Sales/ total assets (x) 1.0 1.4 1.6 1.8 Working capital/ sales (x) - - - - Receivable days 34.5 24.3 28.0 30.0 Inventory days 41.6 37.9 42.2 46.0 Payable days 84.0 56.2 62.7 63.2 FINANCIAL STABILITY Total debt/ equity (x) 0.7 0.5 0.2 0.1 Net debt/ equity (x) 0.5 0.2 - (0.2) Current ratio (x) 1.2 1.4 1.3 1.4 Interest cover (x) 1.6 6.3 19.0 63.3 VALUATION PE (x) 117.7 24.8 16.8 12.5 EV/ EBITDA (x) 29.3 13.2 9.8 7.5 EV/ Net sales (x) 2.3 1.5 1.2 1.0 PB (x) 5.4 5.0 4.0 3.2 Dividend yield (%) 0.5 1.0 1.1 1.3 Free cash flow yield (%) 5.7 5.6 6.2 6.6 Source: Company, Axis Capital

- 6. 06 25 JUL 2016 Quarterly Update ASHOK LEYLAND AUTO Disclosures: The following Disclosures are being made in compliance with the SEBI Research Analyst Regulations 2014 (herein after referred to as the Regulations). 1. Axis Securities Ltd. (ASL) is a SEBI Registered Research Analyst having registration no. INH000000297. ASL, the Research Entity (RE) as defined in the Regulations, is engaged in the business of providing Stock broking services, Depository participant services & distribution of various financial products. ASL is a subsidiary company of Axis Bank Ltd. Axis Bank Ltd. is a listed public company and one of India’s largest private sector bank and has its various subsidiaries engaged in businesses of Asset management, NBFC, Merchant Banking, Trusteeship, Venture Capital, Stock Broking, the details in respect of which are available on www.axisbank.com. 2. ASL is registered with the Securities & Exchange Board of India (SEBI) for its stock broking & Depository participant business activities and with the Association of Mutual Funds of India (AMFI) for distribution of financial products and also registered with IRDA as a corporate agent for insurance business activity. 3. ASL has no material adverse disciplinary history as on the date of publication of this report. 4. I/We, authors (Research team) and the name/s subscribed to this report, hereby certify that all of the views expressed in this research report accurately reflect my/our views about the subject issuer(s) or securities. I/We also certify that no part of my/our compensation was, is, or will be directly or indirectly related to the specific recommendation(s) or view(s) in this report. I/we or my/our relative or ASL does not have any financial interest in the subject company. Also I/we or my/our relative or ASL or its Associates may have beneficial ownership of 1% or more in the subject company at the end of the month immediately preceding the date of publication of the Research Report. Since associates of ASL are engaged in various financial service businesses, they might have financial interests or beneficial ownership in various companies including the subject company/companies mentioned in this report. I/we or my/our relative or ASL or its associate does not have any material conflict of interest. I/we have not served as director / officer, etc. in the subject company in the last 12-month period. Research Team Sr. No Name Designation E-mail 1 Sunil Shah Head of Research sunil.shah@axissecurities.in 2 PankajBobade Research Analyst pankaj.bobade@axissecurities.in 3 Priyakant Dave Research Analyst priyakant.dave@axissecurities.in 4 Akhand Singh Research Analyst akhand.singh@axissecurities.in 5 BuntyChawla Research Analyst bunty.chawla@axissecurities.in 5. ASL has not received any compensation from the subject company in the past twelve months. ASL has not been engaged in market making activity for the subject company. 6. In the last 12-month period ending on the last day of the month immediately preceding the date of publication of this research report, ASL or any of its associates may have: i. Received compensation for investment banking, merchant banking or stock broking services or for any other services from the subject company of this research report and / or; ii. Managed or co-managed public offering of the securities from the subject company of this research report and / or; iii. Received compensation for products or services other than investment banking, merchant banking or stock broking services from the subject company of this research report; ASL or any of its associates have not received compensation or other benefits from the subject company of this research report or any other third-party in connection with this report Term& Conditions: This report has been prepared by ASL and is meant for sole use by the recipient and not for circulation. The report and information contained herein is strictly confidential and may not be altered in any way, transmitted to, copied or distributed, in part or in whole, to any other person or to the media or reproduced in any form, without prior written consent of ASL. The report is based on the facts, figures and information that are considered true, correct, reliable and accurate. The intent of this report is not recommendatory in nature. The information is obtained from publicly available media or other sources believed to be reliable. Such information has not been independently verified and no guaranty, representation of warranty, express or implied, is made as to its accuracy, completeness or correctness. All such information and opinions are subject to change without notice. The report is prepared solely for informational purpose and does not constitute an offer document or solicitation of offer to buy or sell or subscribe for securities or other financial instruments for the clients. Though disseminated to all the customers simultaneously, not all customers may receive this report at the same time. ASL will not treat recipients as customers by virtue of their receiving this report.

- 7. 07 25 JUL 2016 Quarterly Update ASHOK LEYLAND AUTO # Disclaimer: Nothing in this report constitutes investment, legal, accounting and tax advice or a representation that any investment or strategy is suitable or appropriate to the recipient’s specific circumstances. The securities and strategies discussed and opinions expressed, if any, in this report may not be suitable for all investors, who must make their own investment decisions, based on their own investment objectives, financial positions and needs of specific recipient. This report may not be taken in substitution for the exercise of independent judgment by any recipient. Each recipient of this report should make such investigations as it deems necessary to arrive at an independent evaluation of an investment in the securities of companies referred to in this report (including the merits and risks involved), and should consult its own advisors to determine the merits and risks of such an investment. Certain transactions, including those involving futures, options and other derivatives as well as non-investment grade securities involve substantial risk and are not suitable for all investors. ASL, its directors, analysts or employees do not take any responsibility, financial or otherwise, of the losses or the damages sustained due to the investments made or any action taken on basis of this report, including but not restricted to, fluctuation in the prices of shares and bonds, changes in the currency rates, diminution in the NAVs, reduction in the dividend or income, etc. Past performance is not necessarily a guide to future performance. Investors are advise necessarily a guide to future performance. Investors are advised to see Risk Disclosure Document to understand the risks associated before investing in the securities markets. Actual results may differ materially from those set forth in projections. Forward-looking statements are not predictions and may be subject to change without notice. ASL and its affiliated companies, their directors and employees may; (a) from time to time, have long or short position(s) in, and buy or sell the securities of the company(ies) mentioned herein or (b) be engaged in any other transaction involving such securities or earn brokerage or other compensation or act as a market maker in the financial instruments of the company(ies) discussed herein or act as an advisor or investment banker, lender/borrower to such company(ies) or may have any other potential conflict of interests with respect to any recommendation and other related information and opinions. Each of these entities functions as a separate, distinct and independent of each other. The recipient should take this into account before interpreting this document. ASL and / or its affiliates do and seek to do business including investment banking with companies covered in its research reports. As a result, the recipients of this report should be aware that ASL may have a potential conflict of interest that may affect the objectivity of this report. Compensation of Research Analysts is not based on any specific merchant banking, investment banking or brokerage service transactions. ASL may have issued other reports that are inconsistent with and reach different conclusion from the information presented in this report. Neither this report nor any copy of it may be taken or transmitted into the United State (to U.S. Persons), Canada, or Japan or distributed, directly or indirectly, in the United States or Canada or distributed or redistributed in Japan or to any resident thereof. If this report is inadvertently sent or has reached any individual in such country, especially, USA, the same may be ignored and brought to the attention of the sender. This report is not directed or intended for distribution to, or use by, any person or entity who is a citizen or resident of or located in any locality, state, country or other jurisdiction, where such distribution, publication, availability or use would be contrary to law, regulation or which would subject ASL to any registration or licensing requirement within such jurisdiction. The securities described herein may or may not be eligible for sale in all jurisdictions or to certain category of investors. The Disclosures of Interest Statement incorporated in this document is provided solely to enhance the transparency and should not be treated as endorsement of the views expressed in the report. The Company reserves the right to make modifications and alternations to this document as may be required from time to time without any prior notice. The views expressed are those of the analyst(s) and the Company may or may not subscribe to all the views expressed therein. Copyright in this document vests with Axis Securities Limited. Axis Securities Limited, Corporate office: Unit No. 2, Phoenix Market City, 15, LBS Road, Near Kamani Junction, Kurla (west), Mumbai-400070, Tel No. – 18002100808/022-61480808, Regd. off.- Axis House, 8th Floor, Wadia International Centre, PandurangBudhkarMarg, Worli, Mumbai – 400 025. Compliance Officer: AnandShaha, Email: compliance.officer@axisdirect.in, Tel No: 022-42671582.