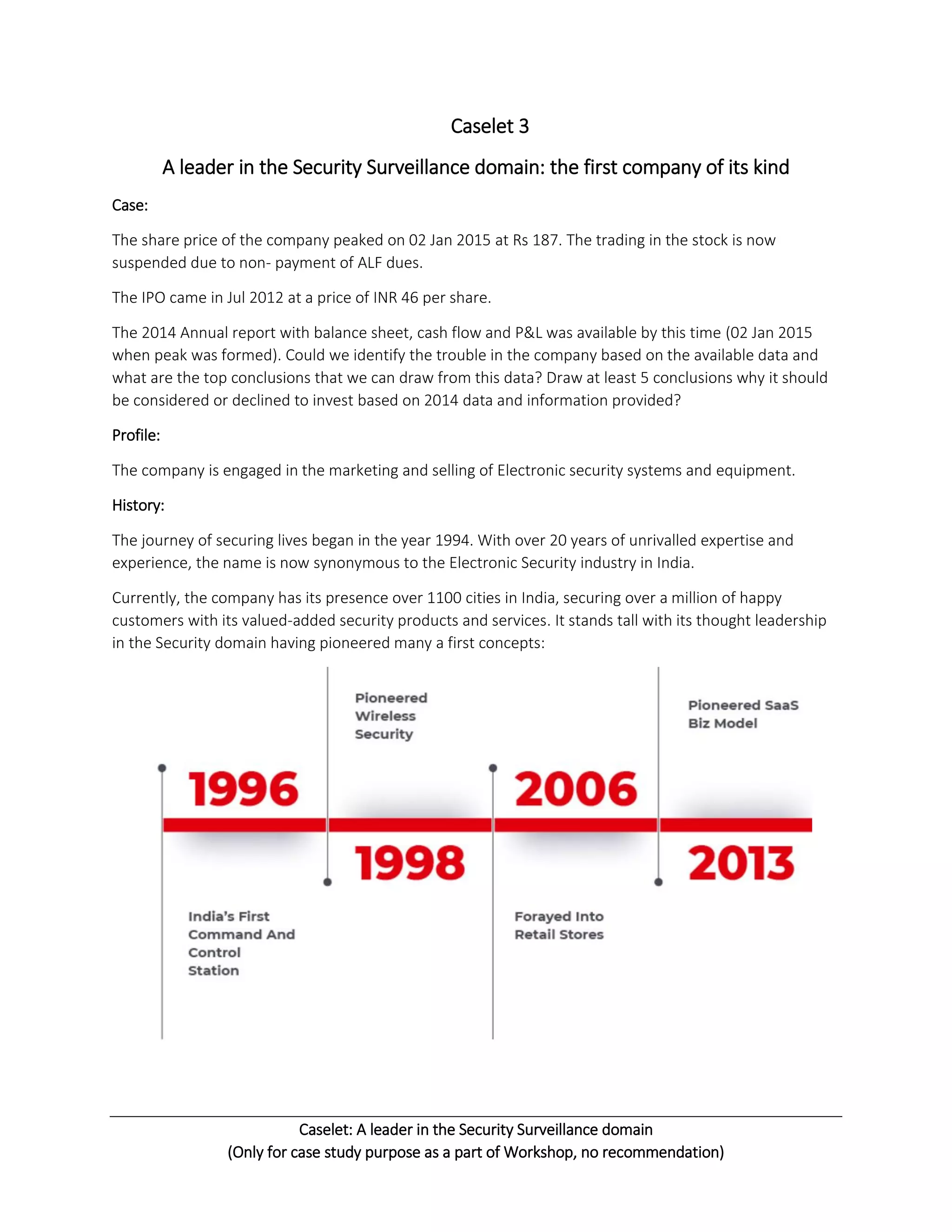

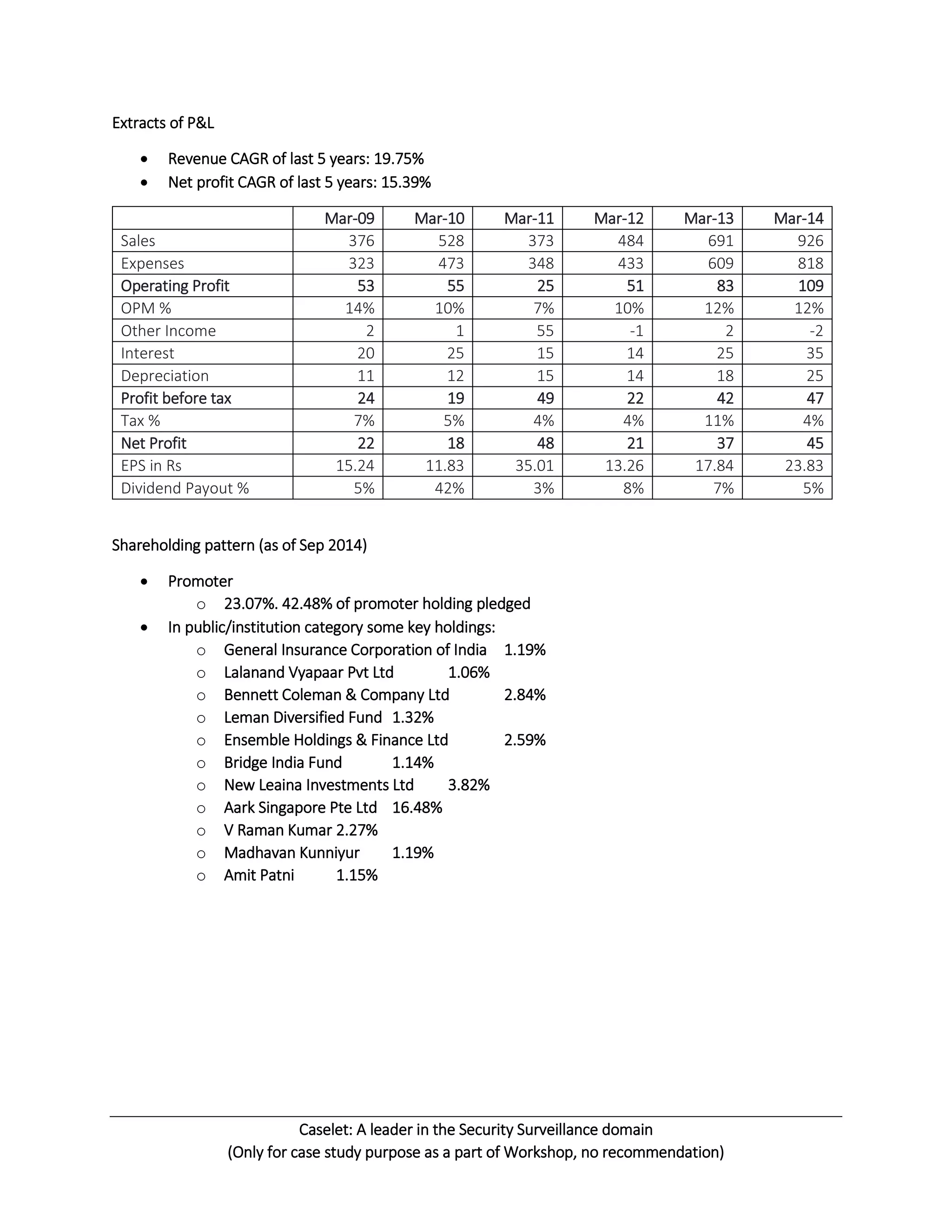

The document outlines a case study of a security surveillance company that experienced a peak share price of Rs 187 in January 2015 before trading was suspended due to unpaid dues. It provides a financial overview, including revenue growth and cash flow trends from 2009 to 2014, indicating potential investment considerations. Key points for evaluation are derived from the company's financials and history of operations in the electronic security sector since 1994.