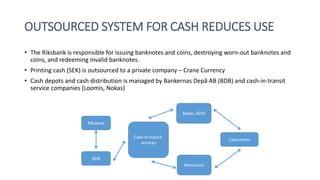

Sweden is rapidly moving towards a cashless society, with cash usage declining significantly since its peak in 2007, and projections suggest it may become practically cash-free by 2023. This trend raises social concerns about deteriorating access to cash for vulnerable populations including the elderly and disabled. While there's interest in digital currencies as a replacement for cash, challenges remain in ensuring equitable access to electronic payment systems.