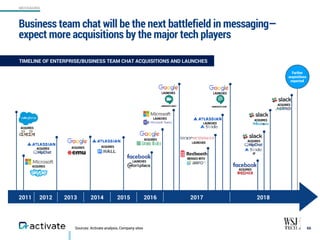

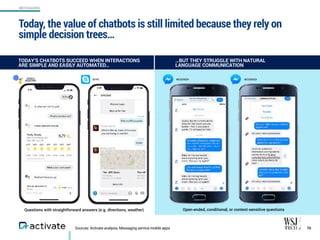

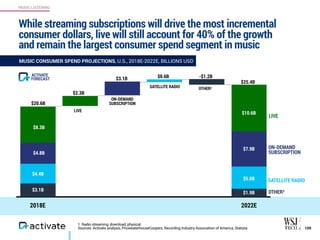

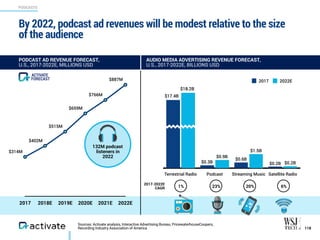

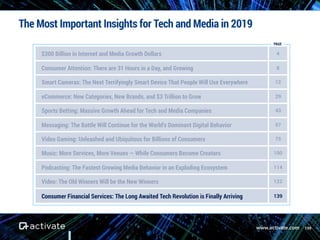

Activate's Tech and Media Outlook 2019 highlights key growth trends and insights in consumer technology, including the rise of smart cameras, the evolution of e-commerce, and advancements in gaming and podcasting. The report predicts a $300 billion growth in internet and media revenues over the next four years, with a significant shift towards subscription models in revenue generation. Additionally, it emphasizes the importance of understanding consumer behavior and preferences as a foundation for strategic planning in the tech and media sectors.