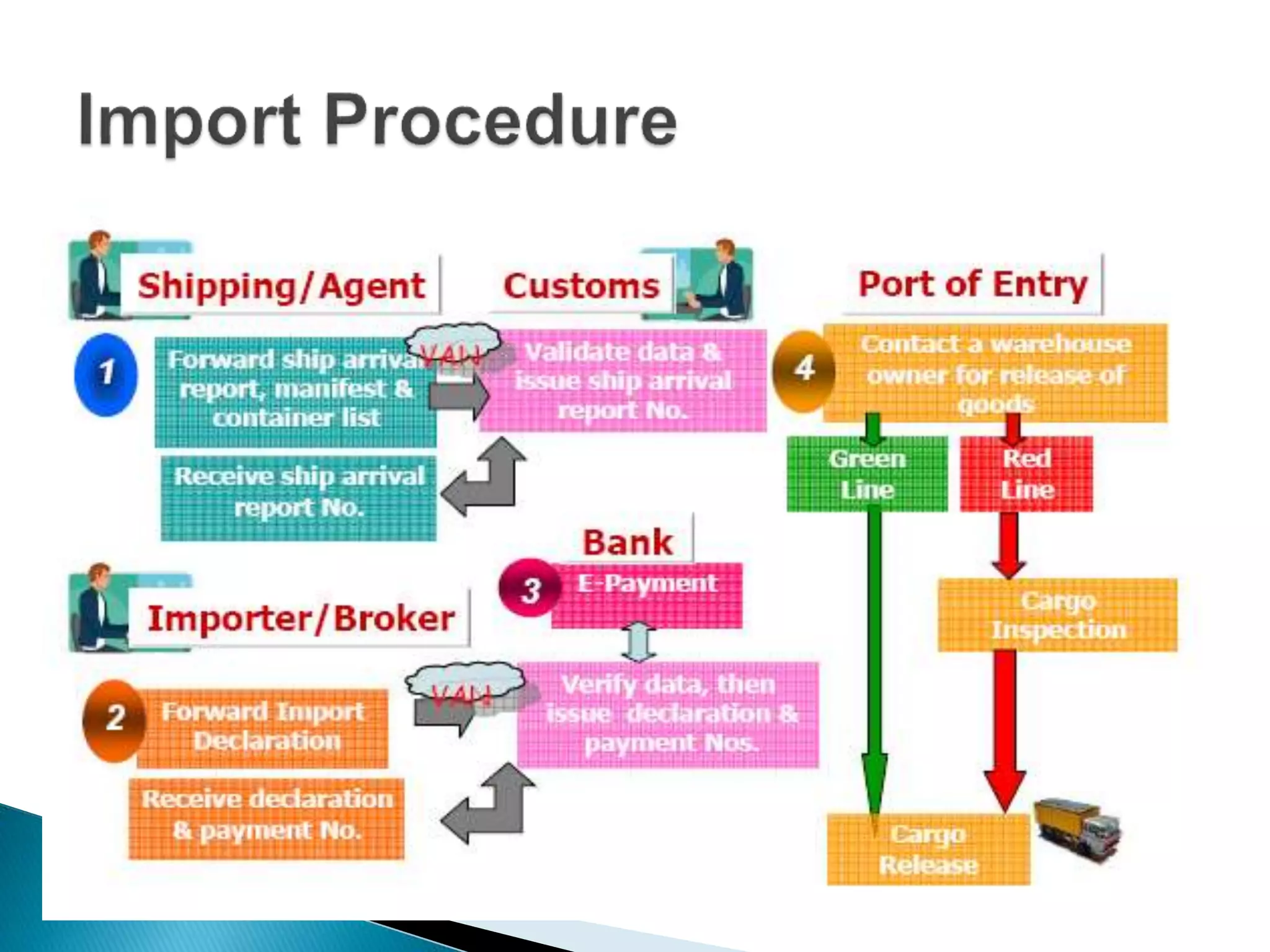

Direct import refers to a major retailer purchasing products directly from an overseas manufacturer, bypassing local suppliers. This allows the retailer to potentially save on costs compared to indirect imports, where a local supplier acts as an intermediary between the overseas manufacturer and the retailer. The key stages of direct importing are locating a foreign manufacturer, procuring the goods from them, and ensuring all required import documentation is in order, such as bills of lading, invoices, bills of entry, import licenses, insurance certificates, purchase orders, and other documents required for import customs clearance depending on the good and any applicable duty benefits.