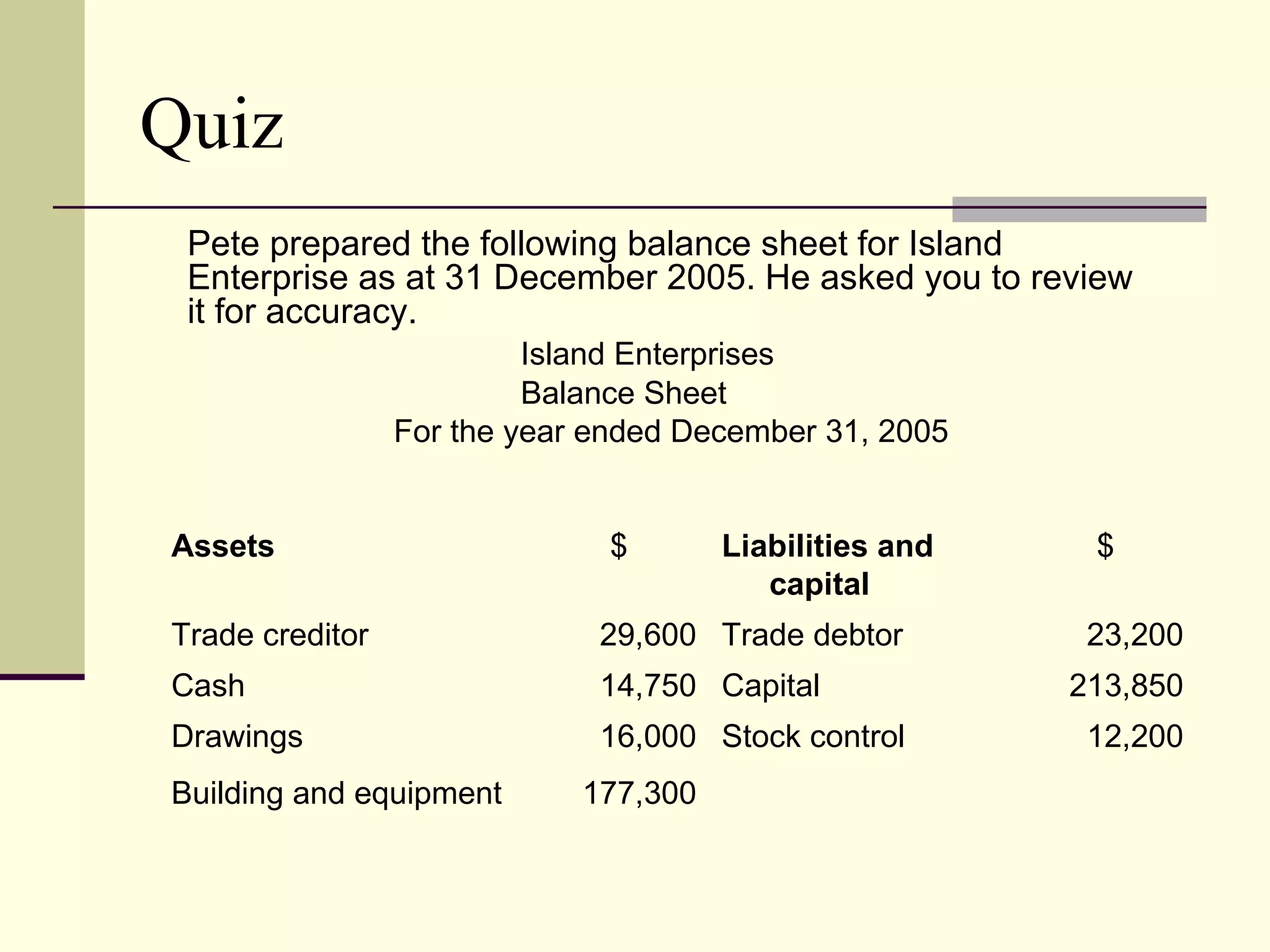

Here are the issues I see with Pete's balance sheet:

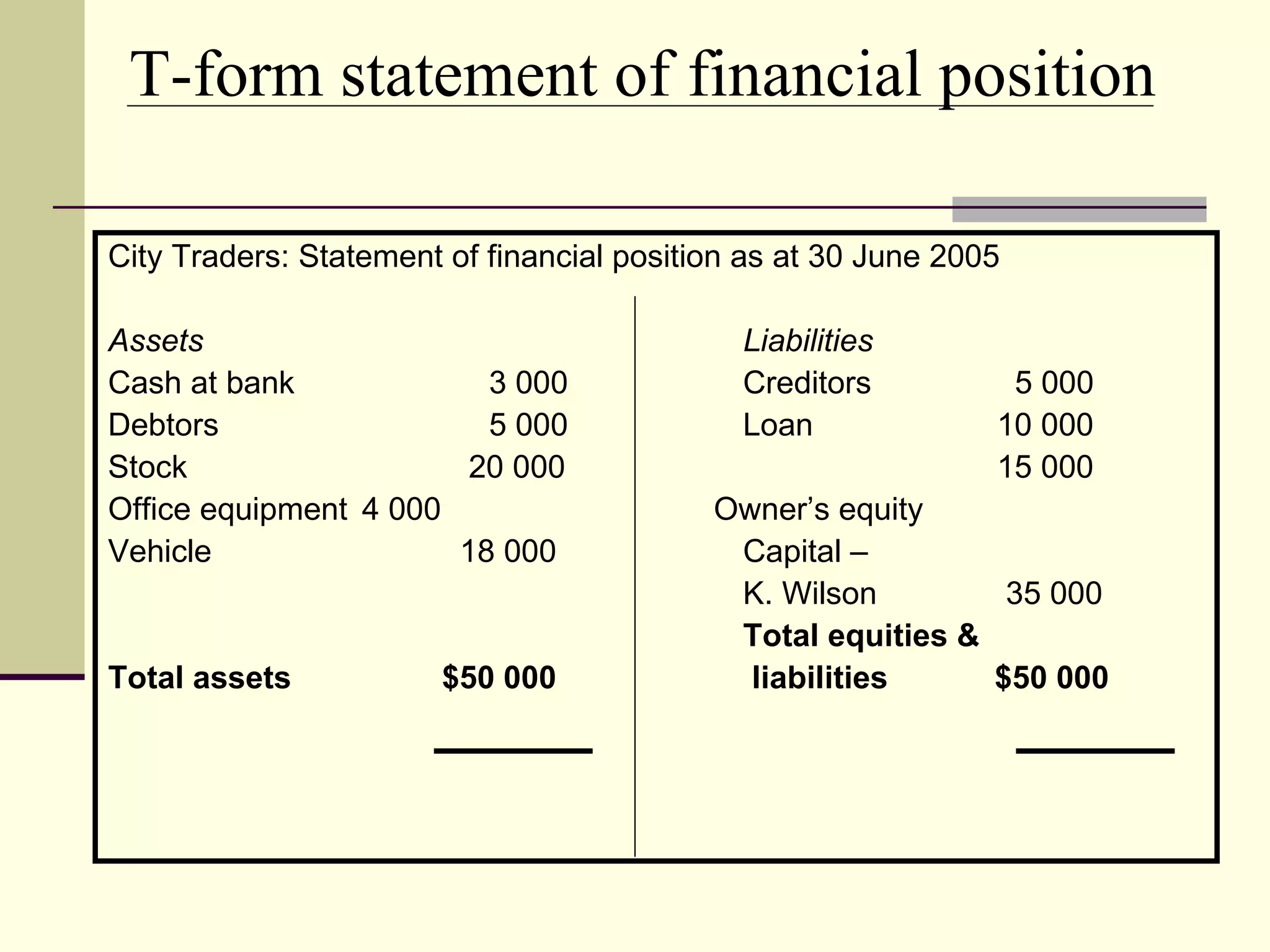

1. Drawings should be shown as a reduction to capital, not as an asset.

2. The title should specify it is a balance sheet "as at" December 31, 2005 rather than "for the year ended".

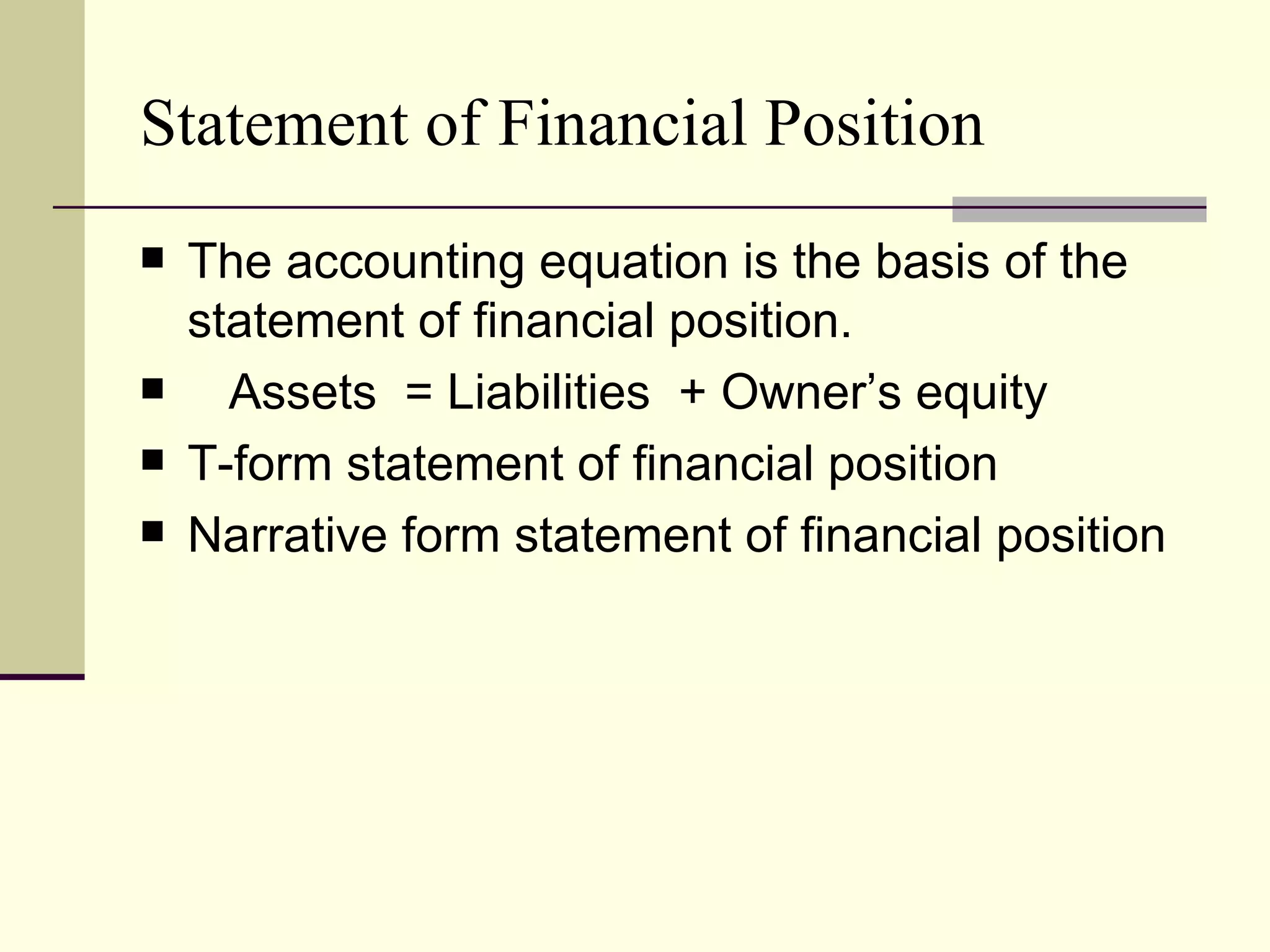

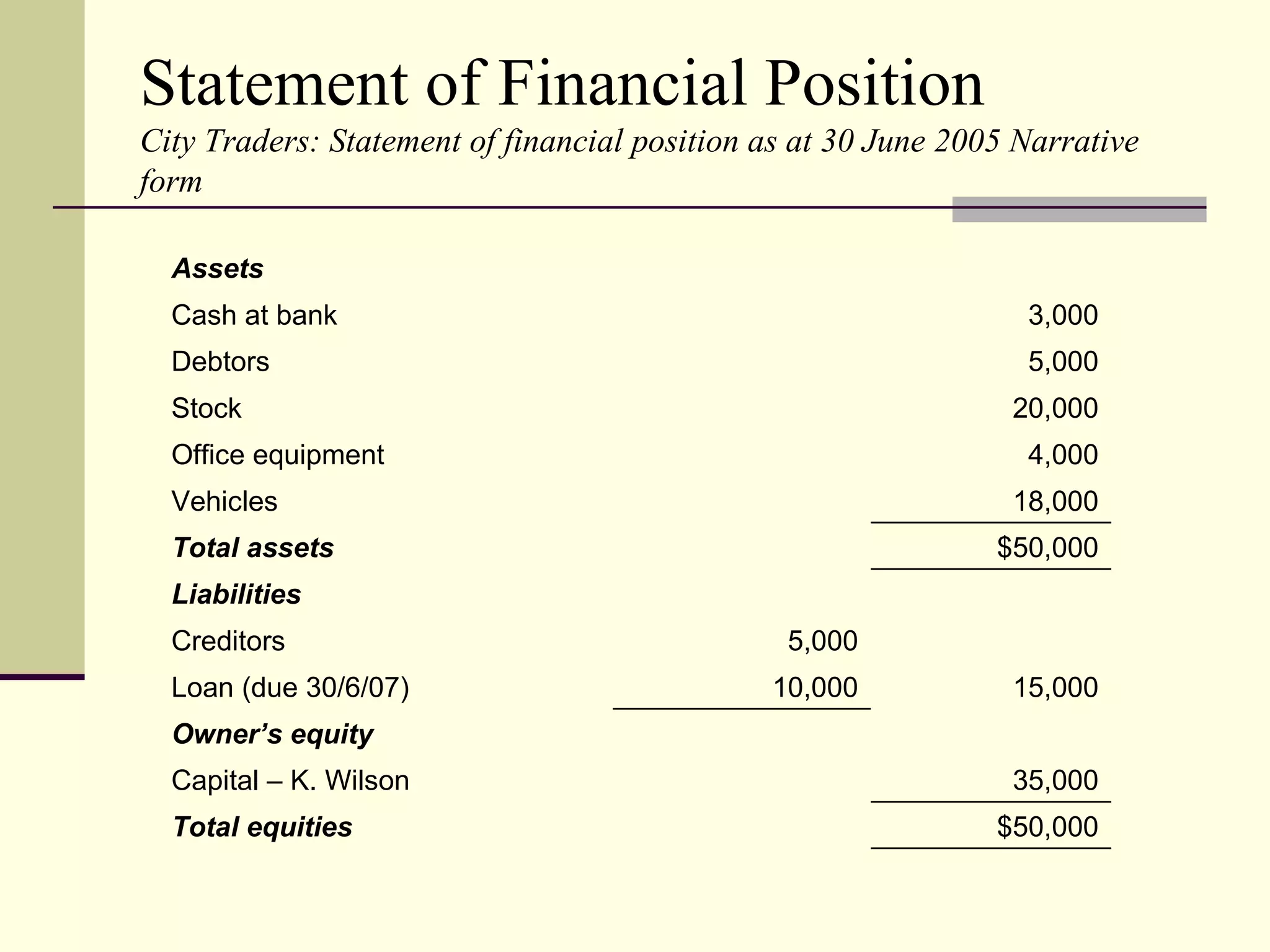

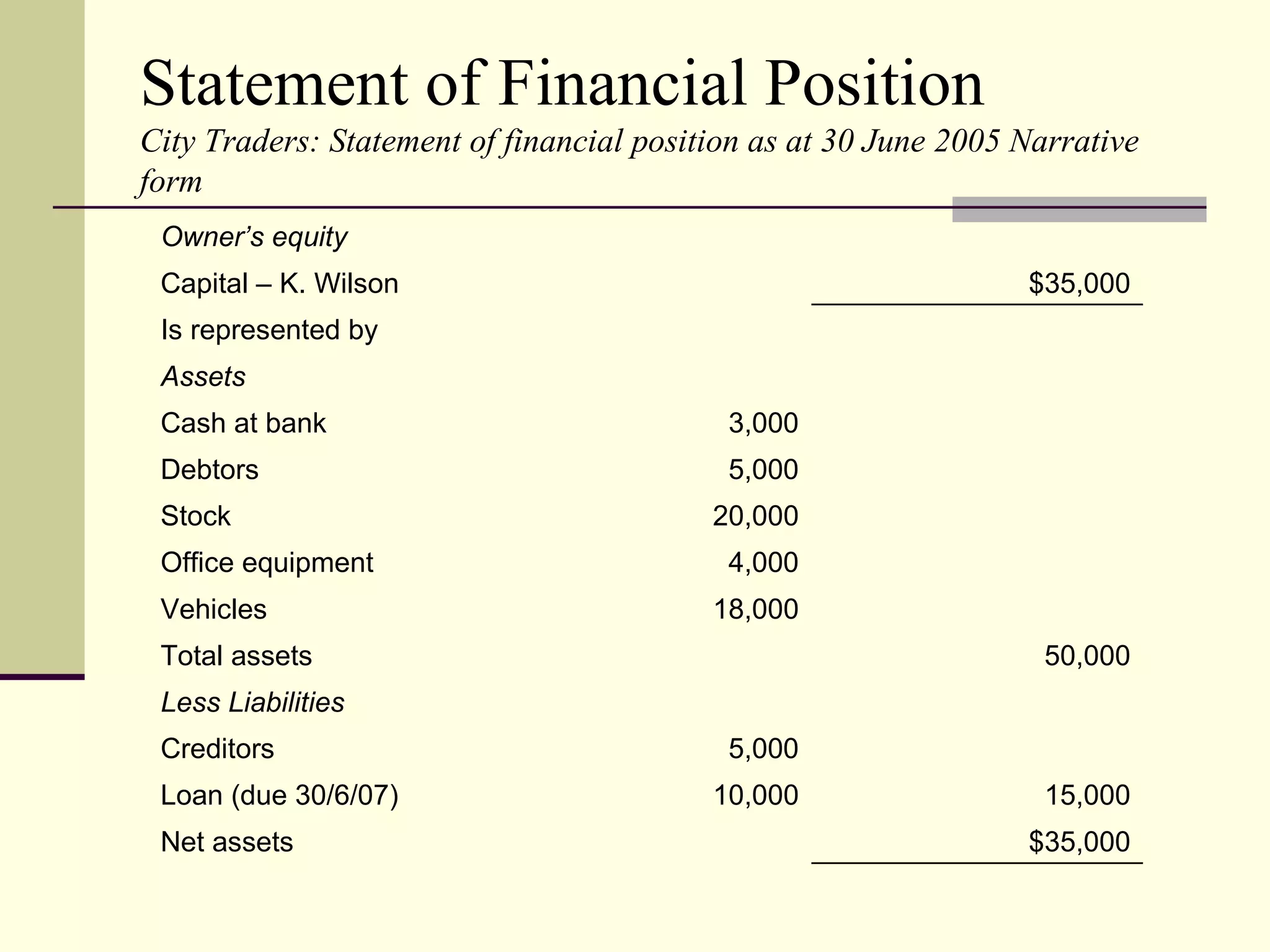

3. The accounting equation is not balanced. Assets should equal the sum of liabilities and capital.

Please let me know if you would like me to review the corrected balance sheet.