Resume

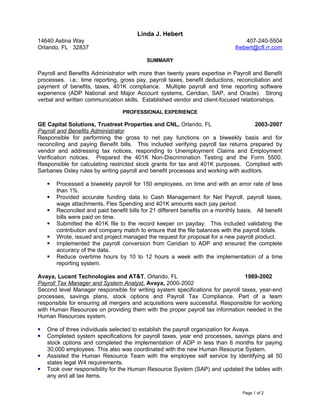

- 1. Linda J. Hebert 14640 Astina Way 407-240-5504 Orlando, FL 32837 lhebert@cfl.rr.com SUMMARY Payroll and Benefits Administrator with more than twenty years expertise in Payroll and Benefit processes. i.e.: time reporting, gross pay, payroll taxes, benefit deductions, reconciliation and payment of benefits, taxes, 401K compliance. Multiple payroll and time reporting software experience (ADP National and Major Account systems, Ceridian, SAP, and Oracle). Strong verbal and written communication skills. Established vendor and client-focused relationships. PROFESSIONAL EXPERIENCE GE Capital Solutions, Trustreet Properties and CNL, Orlando, FL 2003-2007 Payroll and Benefits Administrator Responsible for performing the gross to net pay functions on a biweekly basis and for reconciling and paying Benefit bills. This included verifying payroll tax returns prepared by vendor and addressing tax notices, responding to Unemployment Claims and Employment Verification notices. Prepared the 401K Non-Discrimination Testing and the Form 5500. Responsible for calculating restricted stock grants for tax and 401K purposes. Complied with Sarbanes Oxley rules by writing payroll and benefit processes and working with auditors. Processed a biweekly payroll for 150 employees, on time and with an error rate of less than 1%. Provided accurate funding data to Cash Management for Net Payroll, payroll taxes, wage attachments, Flex Spending and 401K amounts each pay period. Reconciled and paid benefit bills for 21 different benefits on a monthly basis. All benefit bills were paid on time. Submitted the 401K file to the record keeper on payday. This included validating the contribution and company match to ensure that the file balances with the payroll totals. Wrote, issued and project managed the request for proposal for a new payroll product. Implemented the payroll conversion from Ceridian to ADP and ensured the complete accuracy of the data. Reduce overtime hours by 10 to 12 hours a week with the implementation of a time reporting system. Avaya, Lucent Technologies and AT&T, Orlando, FL 1989-2002 Payroll Tax Manager and System Analyst, Avaya, 2000-2002 Second level Manager responsible for writing system specifications for payroll taxes, year-end processes, savings plans, stock options and Payroll Tax Compliance. Part of a team responsible for ensuring all mergers and acquisitions were successful. Responsible for working with Human Resources on providing them with the proper payroll tax information needed in the Human Resources system. One of three individuals selected to establish the payroll organization for Avaya. Completed system specifications for payroll taxes, year end processes, savings plans and stock options and completed the implementation of ADP in less than 6 months for paying 30,000 employees. This also was coordinated with the new Human Resource System. Assisted the Human Resource Team with the employee self service by identifying all 50 states legal W4 requirements. Took over responsibility for the Human Resource System (SAP) and updated the tables with any and all tax items. Page 1 of 2

- 2. Linda J. Hebert Applied for state income tax, unemployment tax and local tax employer identification number for over a 100 taxing jurisdictions. Validated all 50 states tax returns prepared by ADP, for accuracy. Issued over 30,000 W2s and investigated and resolved hundreds of W2 inquires within three days of receiving each inquiry. Hired and managed six additional temporary employees to help with these, in addition to, managing two first level managers. System Analyst and Project Manager, Lucent Technologies, 1997-2000 Responsible for configuring the payroll tax tables for Lucent’s new payroll system. Project managed all Mergers and Acquisitions and payroll taxes through implementation. One of ten individuals selected to establish the payroll organization for Lucent Technologies. Configured, tested and implemented all the payroll tax tables for the SAP-HR payroll tax specifications in order to correctly tax 150,000 employees. Established and managed a team consisting of 20 representatives from Payroll, Accounting and Human Resources to ensure a successful implementation of the SAP- HR system. Wrote and implemented the Lucent Technologies Mergers and Acquisition Procedure Document. This was a successful tool and was followed by the numerous teams involved. Project Manager, Account Manager and Communications Team Leader, AT&T, 1989-1996 Responsible for project managing, a team that represented all payroll functions, the process of requesting a system enhancement through time and cost estimates to implementation. Coordinated overall responsibility for activities associated with time reporting and payroll for Business Units. Managed teams whose responsibility was to develop better ways of performing functions and measuring results. Participated and managed a team of 24 employees to develop a customer request process for system requests. This resulted in a defined process where a customer would be given time and cost estimates and implementation dates within 16 days from request. These system requests, once implemented, impacted 300,000 employees. Wrote the Customer Request Process and forwarded it to all 16 Business Units. Developed and implemented a tax reconciliation process for reconciling one hundred plus tax jurisdictions. Established a dedicated team from payroll, time reporting and operations to work successfully on implementing all Mergers and Acquisitions (M&A) on time and accurately. PROFESSIONAL DEVELOPMENT AND TRAINING ADP Payxpert and ADP EzlaborManager Training Ceridian Training CERTIFICATION Certified Payroll Professional – (CPP) Page 2 of 2