Calasiao Plant and Related Companies Employees MPC: Best Practices

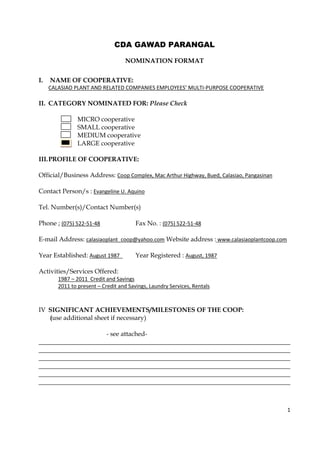

- 1. 1 CDA GAWAD PARANGAL NOMINATION FORMAT I. NAME OF COOPERATIVE: CALASIAO PLANT AND RELATED COMPANIES EMPLOYEES’ MULTI-PURPOSE COOPERATIVE II. CATEGORY NOMINATED FOR: Please Check MICRO cooperative SMALL cooperative MEDIUM cooperative LARGE cooperative III.PROFILE OF COOPERATIVE: Official/Business Address: Coop Complex, Mac Arthur Highway, Bued, Calasiao, Pangasinan Contact Person/s : Evangeline U. Aquino Tel. Number(s)/Contact Number(s) Phone ; (075) 522-51-48 Fax No. : (075) 522-51-48 E-mail Address: calasiaoplant_coop@yahoo.com Website address : www.calasiaoplantcoop.com Year Established: August 1987 Year Registered : August, 1987 Activities/Services Offered: 1987 – 2011 Credit and Savings 2011 to present – Credit and Savings, Laundry Services, Rentals IV SIGNIFICANT ACHIEVEMENTS/MILESTONES OF THE COOP: (use additional sheet if necessary) - see attached- ______________________________________________________________________________ ______________________________________________________________________________ ______________________________________________________________________________ ______________________________________________________________________________ ______________________________________________________________________________ ______________________________________________________________________________

- 2. 2 NOMINATED BY: MUNICIPALITY OF CALASIAO, PANGASINAN (Name of Organization/Institution) Name of Authorized Representative/Position: Hon. Mark Roy Q. Macanlalay Municipal Mayor Address: Calasiao, Pangasinan Telephone: (075) 517-22-33 E-mail(s): _____________________________ Website: ______________________________

- 3. 3 Brief History/Background of Coop Nominee (Organizational and Financial Highlights) The Calasiao Plant and Related Companies Employees’ Multi-purpose Cooperative was born out of necessity at the Calasiao Plant of Coca-Cola Bottlers Philis., Inc.. Employees of the said Plant were then victims of usurious lenders or “lending sharks.” Every payday almost nothing left for their families as the collectors for these usurious lenders were always there demanding payment upto the last centavo. Because of this situation, the concept of cooperative was introduced and everything is history. On August 26, 1987, the Calasiao Plant Employees Credit Cooperative was registered with the Department of Agriculture (DA), Region I under Certificate of Registration No. RI-FF-170. The DA was then the government agency in charge of Cooperatives before the creation of the Cooperative Development Authority. Mr. Marcelino G. Santiago who was then the Plant Personnel Officer of Coca- Cola Calasiao Plant, founded the Cooperative. It took him several attempts to register it because of numerous requirements but Mr. Santiago did not give up. He diligently completed all the requirements, and with his determination to organize the cooperative he eventually succeeded with an initial paid up capital of Php57,242.74 from the 104 founding members. His immediate objective in mind then was to save the employees from being victimized by usurious lenders and to promote the value of saving for the future among the employees. All the pledges made by members for their capital contribution (fixed deposit) and their loan payments were made thru payroll deduction so after a year of operation, the Cooperative reached the million mark and received its first award in 1988 as the Most Outstanding Credit Cooperative – Institutional Category because of its phenomenal growth. Thereafter the Cooperative was a consistent recipient of similar awards year after year. With the enactment of RA 6938 and 6939, the Cooperative Development Authority (CDA) was created. Our cooperative was given a confirmation of registration with confirmation No. 774 on March 19, 1991 by the new Agency. Our cooperative operates solely on credit extension. Different kinds of loans were offered to its members like regular loan, salary loan, special loan, appliance loan, grocery loan and emergency loan. We never had problems on funding and never resorted to borrowing from banks or other lending institutions. We are self-reliant Cooperative. Our members who have extra savings invested the same in the Cooperative in order to help other members and at the same time earned dividends. Our members who were granted loans used them for house acquisition, tuition fees of their children, etc. Mostly however were used as initial capital for their personal business and for those members with existing business, as additional capital.

- 4. 4 In 1999, the Coop started offering an even lower interest rate for housing loans which is only point fifty five percent (.55%) per month or 12% per annum based on diminishing balance for loan amount below 2 million. Members really benefited from this loan. House renovation and house repairs were also financed thru Multi-purpose loan with a low interest rate of only point eighty three percent (0.83%) per month or 18% per annum based on diminishing balance. This is probably the lowest loan interest rate compared to other lending institutions. More members are encouraged to invest their money in the Cooperative. Even retirees invest their retirement pay in the Cooperative. The Board of Directors decided to offer the Coop services to employees of Coca-Cola outside Calasiao. Members from other Plants and other related Companies such as San Miguel Corporation and Ginebra San Miguel are also accepted. We amended our Articles and By-laws and re-registered it on May 14, 2004 in its new name Calasiao Plant and Related Companies Employees’ Credit Cooperative. We have a total membership of 1,472 as of December 31, 2010. We are now operating nationwide: Luzon, Visayas and Mindanao. With the help of modern technology like e-mail, fax and cellphones, our services to our members were so fast that loans are processed in 1 to 2 days and the proceeds of their loans are deposited in their bank accounts. As practiced, capital contributions (fixed deposit) and loan amortizations are all thru payroll deduction and the Company remits its collections to the Cooperative. Outstanding obligations of separated employees net of their separation pay are automatically deducted from the salary of their co-makers. However, no interest charges and for longer payment term. Hence, we don’t have uncollected principal amounts but only deferred collections. On June, 2011, We constructed our own building with a total cost including land and furnishings of Php29,693,771.49. On August, 2011, We amended our registration from Credit Cooperative to Multi- purpose Cooperative to include our new businesses: the Hotel, 5 door Apartments for rent, Commercial Units for rent and a Function Hall for all occasions. Our total loan releases per month reached the maximum amount of Php31,200,000.00. Our total paid up capital as of December 31, 2012 is Php247,353,520.72 and our Net Surplus for all our business as of December 31, 2012 is Php45,995,288.81. Last year, we were recognized by the CDA as no. 1 in total paid up capital and no. 1 in Net Surplus in Region 1 for 2011 result of operations. Dividend distribution for the year 2012: Interest on Share capital @ 10.77% of the average capital contribution (fixed deposit) and Patronage Refund @23.81% of the total interest payment. This means, 23.81% of the total interest paid in 2012 was refunded, making it in effect the interest rate on loan was only 7.63% per annum. Because of this, members prefer to loan an amount equal to their contribution rather than withdraw their contribution and lose their membership.

- 5. 5 VISION: The Calasiao Plant and Related Companies Employees’ Cooperative is a Model and World-class Cooperative committed to provide excellent financial services to its members for better quality of life. MISSION: In order to carry out its vision, the Cooperative commits: 1. To promote the value of saving for the future 2. To inculcate the culture of thrift and use of money productively. 3. To secure financial stability of the Cooperative thru good governance and prudent management of its financial resources. 4. To show care and concern to its members, employees and the community. VALUES: 1. Integrity 2. Honesty 3. Transparency 4. Responsiveness 5. Cooperation 6. Customer Focus 7. Teamwork BEST PRACTICES: 1. Members of the Board of Directors do not receive any form of compensation not even honorarium. Their services are for free which is their commitment. They are only served “merienda” during the Monthly Board Meeting. Qualification Requirements for Board of Directors” a) Integrity b) Competence c) Willingness to serve without any financial reward or compensation 2. Computerized loan processing, bookkeeping and financial statement preparation to ensure accuracy and speed 3. The Cooperative now has its own website (www.calasiaoplantcoop.com) to keep members updated and to facilitate their availment of services. 4. Interest are not charged in advance.

- 6. 6 5. The Cooperative grants Php100,000.00 death benefit to members. This is equivalent to life insurance but members don’t pay any premium contribution and no insurance company involved. 6. The Cooperative grants Christmas gift to qualified members with an amount ranging from Php500.00 – Php1,000.00 each. 7. The Cooperative has remained self-reliant. It has not borrowed any amount from any lending institution since it started operation in 1987. 8. The Cooperative releases its dividends yearly: 1) Interest on share capital; 2) Patronage Refund. Our rate of interest on share capital is higher than our loan rate. COMMUNITY DEVELOPMENT PROJECTS: 1. Livelihood Project: The Coop is lending money (interest-free) to identified individuals in the community to help them finance their small businesses. 2. Donation: The Coop gave donation to support the Church organization, Senior Citizen and government projects. 3. Coop Staff served during election as PPCRV volunteers. 4. Constructed road going to Balicon Subdivision in Bued, Calasiao, Pangasinan 5. Conducted a tree planting program in Bued, Calasiao, Pangasinan AWARDS: We are consistent recipient of awards for Outstanding Performance here in Region I (provincial and regional level). For 2010 result of operations, the CDA no longer give an award but we were recognized by them as No. 1 in the province and in Region I. On their announced reports last year, our Cooperative got the highest total paid up capital and total net surplus in Region I from the result of operation for 2011. We receive our yearly awards from the CDA on the celebration of Cooperative Month: Date Award 1997 Most Outstanding Cooperative of the Philippines (Industrial Category) 2007 Best Performing Cooperative – Regional Level 3rd place 2007 Best Performing Cooperative – Provincial Level 2nd place 2008 Best Performing Cooperative – Regional Level 4th place 2008 Best Performing Cooperative – Provincial Level 3rd place 2009 Best Performing Cooperative – Regional Level 3rd place 2009 Best Performing Cooperative – Provincial Level 2nd place 2010 Best Performing Cooperative – Regional Level 3rd place 2010 Best Performing Cooperative – Provincial Level 1st place 2011 No. 1 in Region 1 based on Total Paid Up Capital and Total Net Surplus

- 7. 7 In 1997, We received our Highest Award as Most Outstanding Cooperative in the Philippines (National - Industrial Category). It was awarded by then President Fidel V. Ramos during the National Cooperative Summit/Conference held at Imus, Cavite. GROWTH AND EXPANSION: The Cooperative which started in Calasiao, Pangasinan with only Php57,242.74 initial fund from 104 members now has grown to 2,812 members and now operating nationwide covering all Plants of Coca-Cola Bottlers Phils., Inc, and related companies like San Miguel Corporation, Ginebra San Miguel, Inc., The Redsystems Company, Inc. and Coca-Cola Bottlers Business Services. We also have is a 3-storey commercial building and 5-door apartment. The commercial building has the following: 1) First Floor – 5 units commercial spaces/offices for rent 2) Second Floor – 5 fully-furnish condotel units (for daily, weekly, monthly rental) 3) Third Floor – fully-furnished Multi-purpose Function Hall and Training Center. The fully furnished five-door apartment units is now fully occupied. We also have a high-tech laundry service business. FIVE-YEAR PLAN (2012-2016) The Cooperative will double its assets and membership. It will engage in other business opportunities since it has already transformed from Credit Cooperative to Multi-purpose Cooperative.