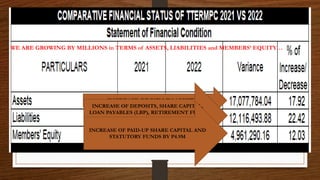

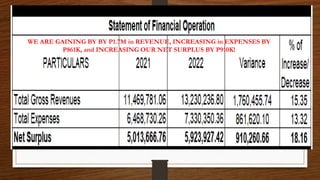

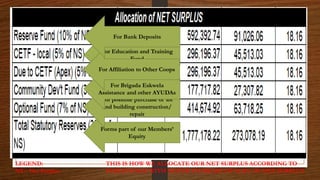

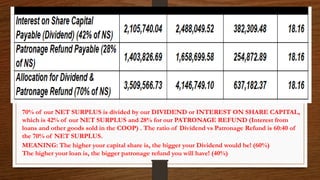

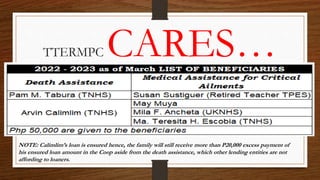

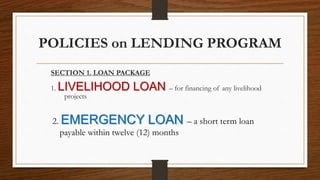

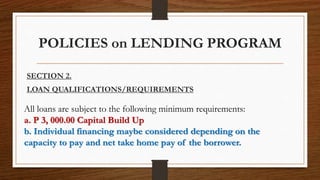

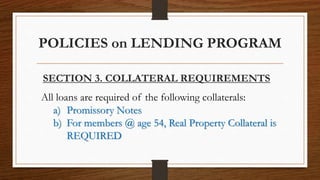

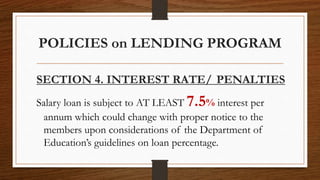

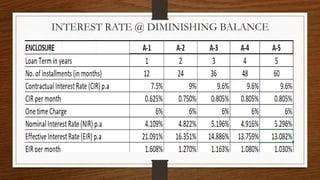

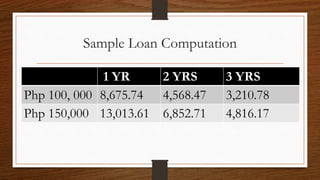

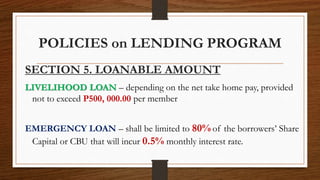

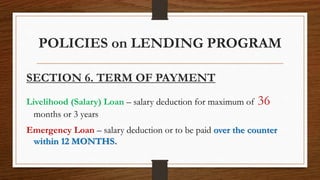

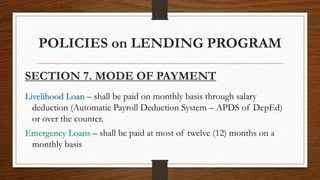

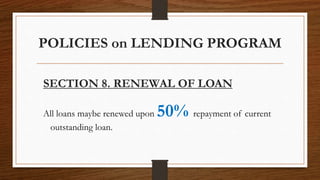

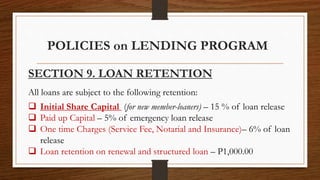

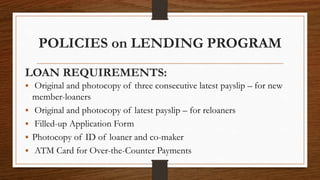

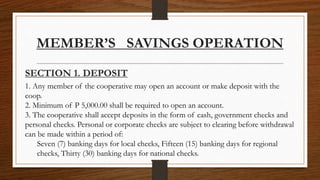

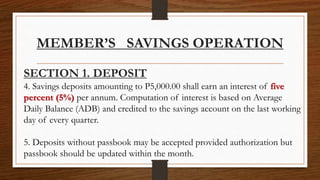

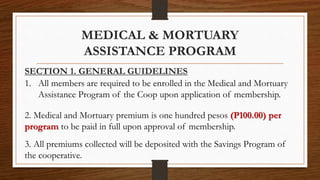

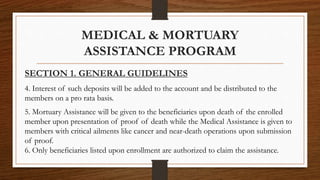

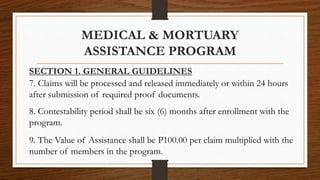

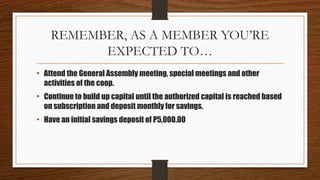

The document provides information about the Tacurong Teachers, Employees and Retirees Multi-purpose Cooperative (TTERMPC). It discusses the cooperative's profile, core values, definition of a cooperative, and the seven cooperative principles it upholds related to voluntary membership, democratic control, member economic participation, autonomy, education/training, cooperation among cooperatives, and concern for community. It also summarizes the cooperative's operations including assets, net surplus, equity, and revenues which have all increased in recent years. The document outlines the cooperative's lending, savings, and medical/mortuary assistance policies and programs.