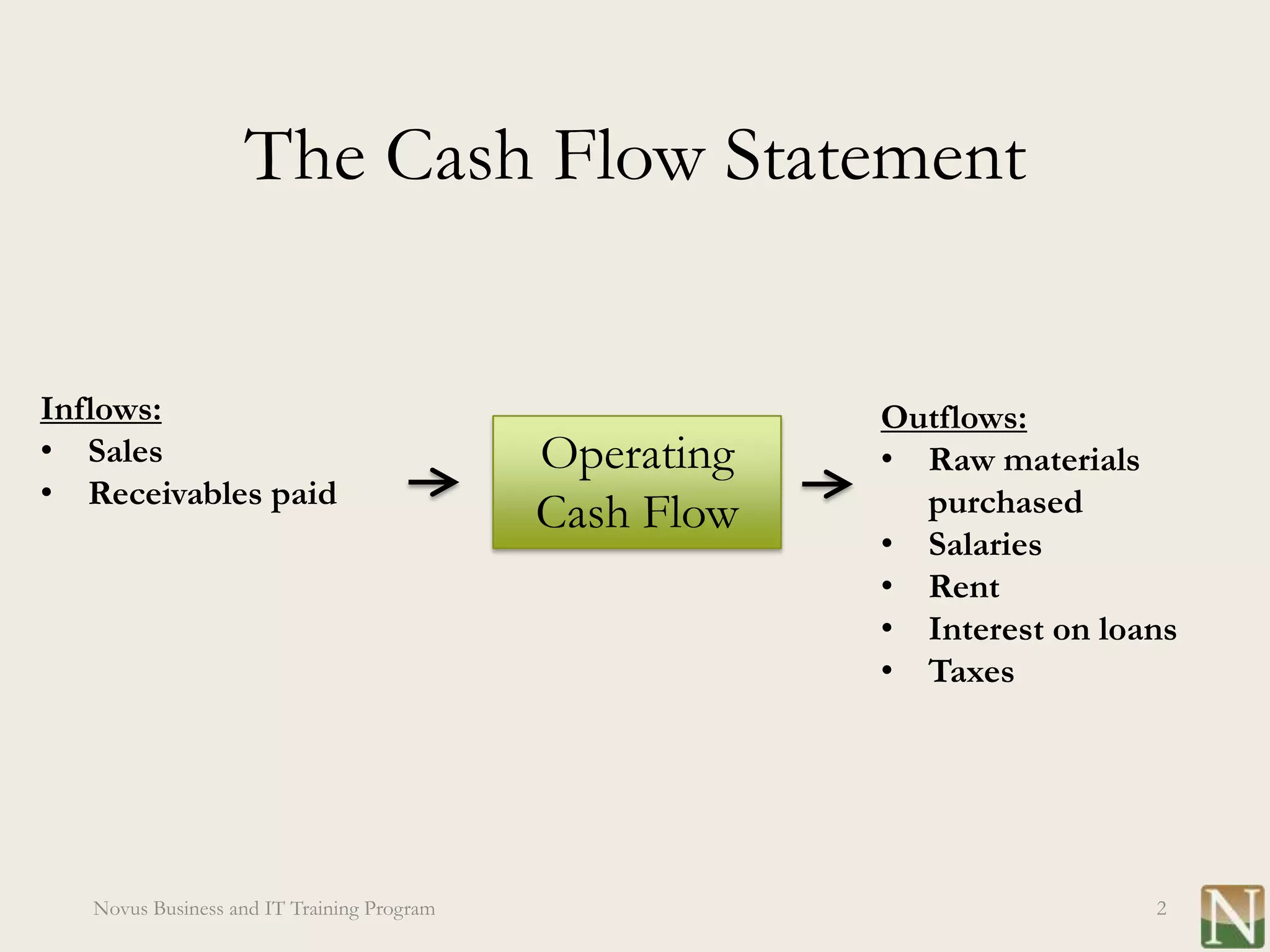

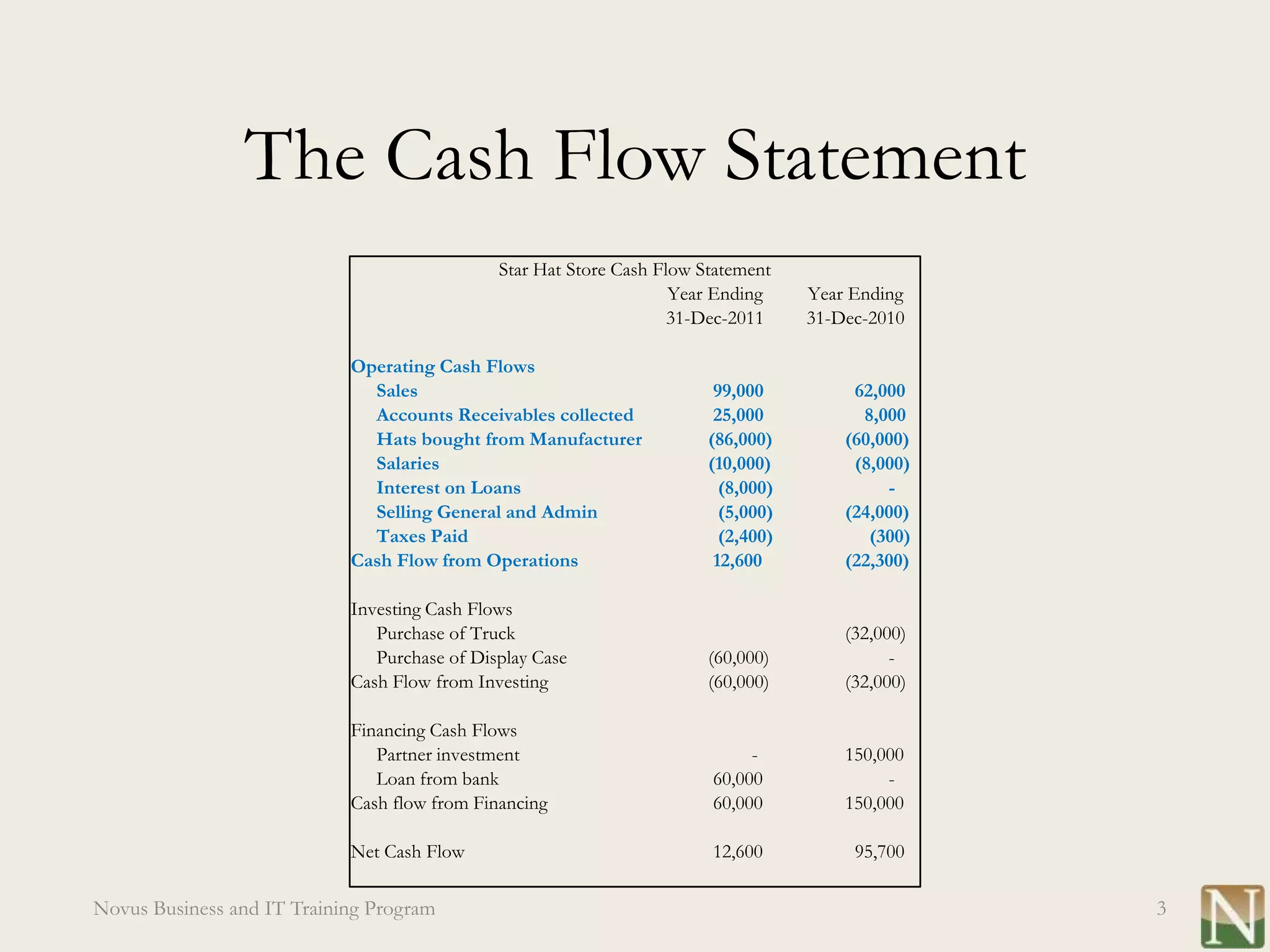

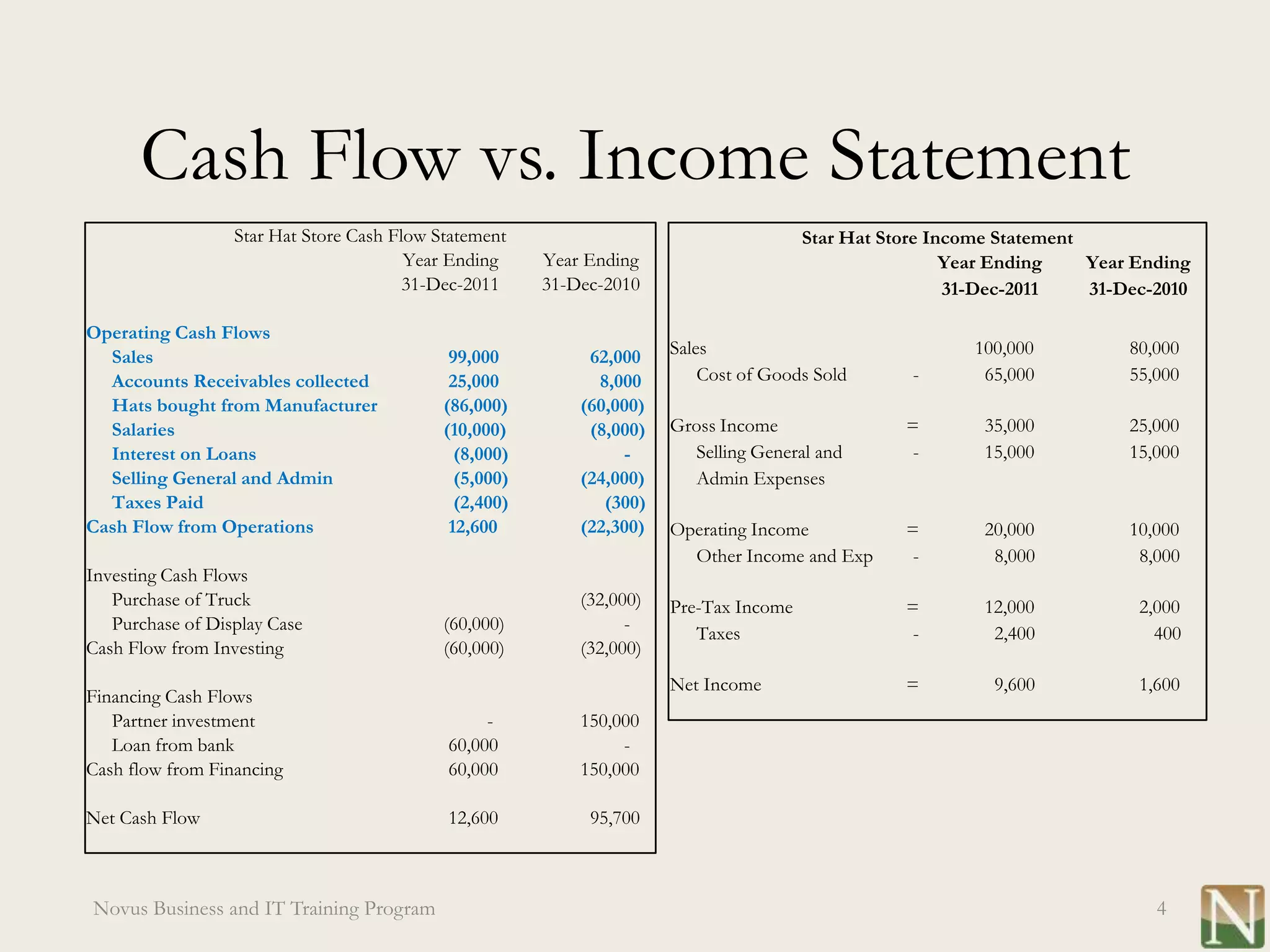

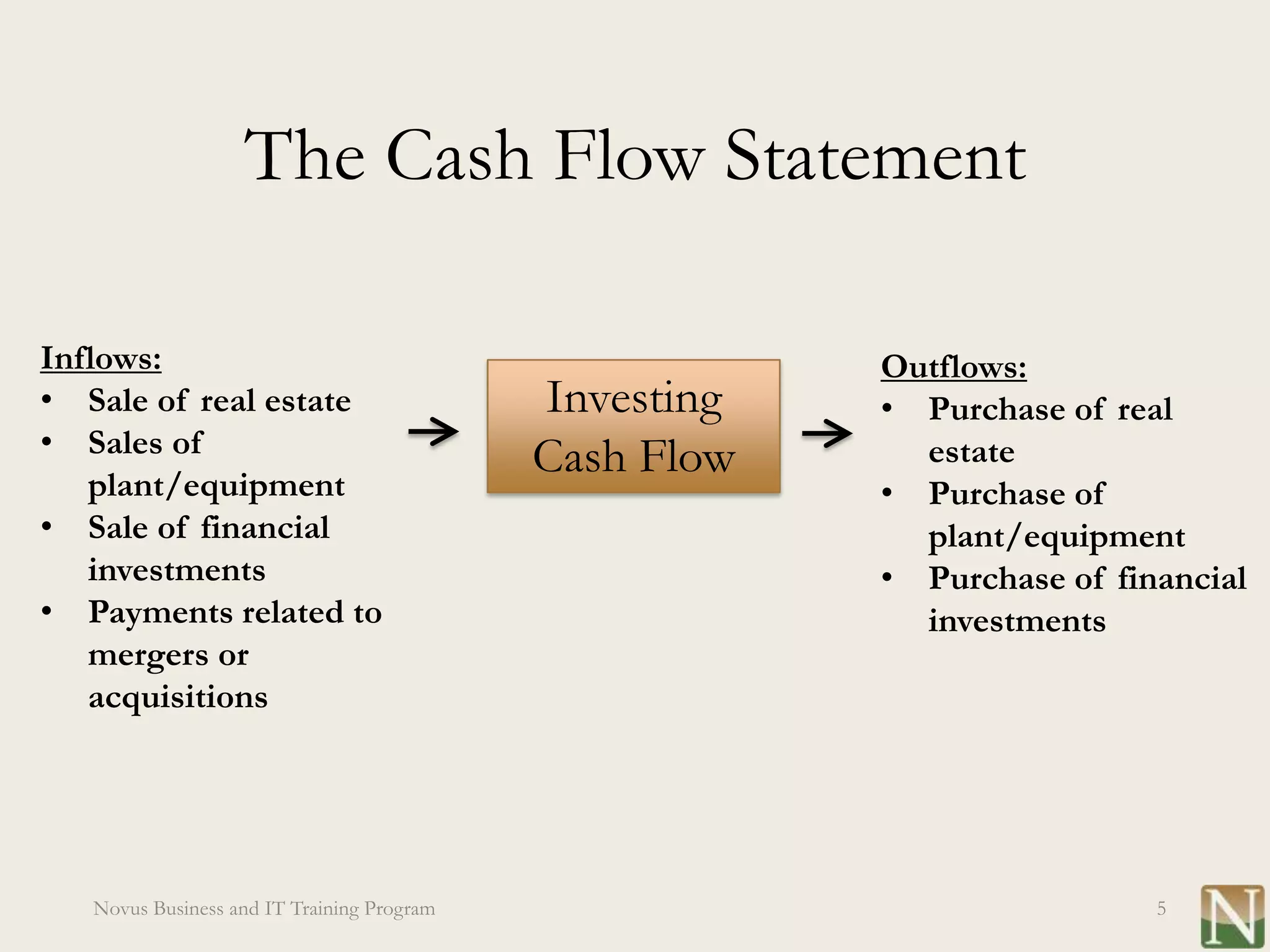

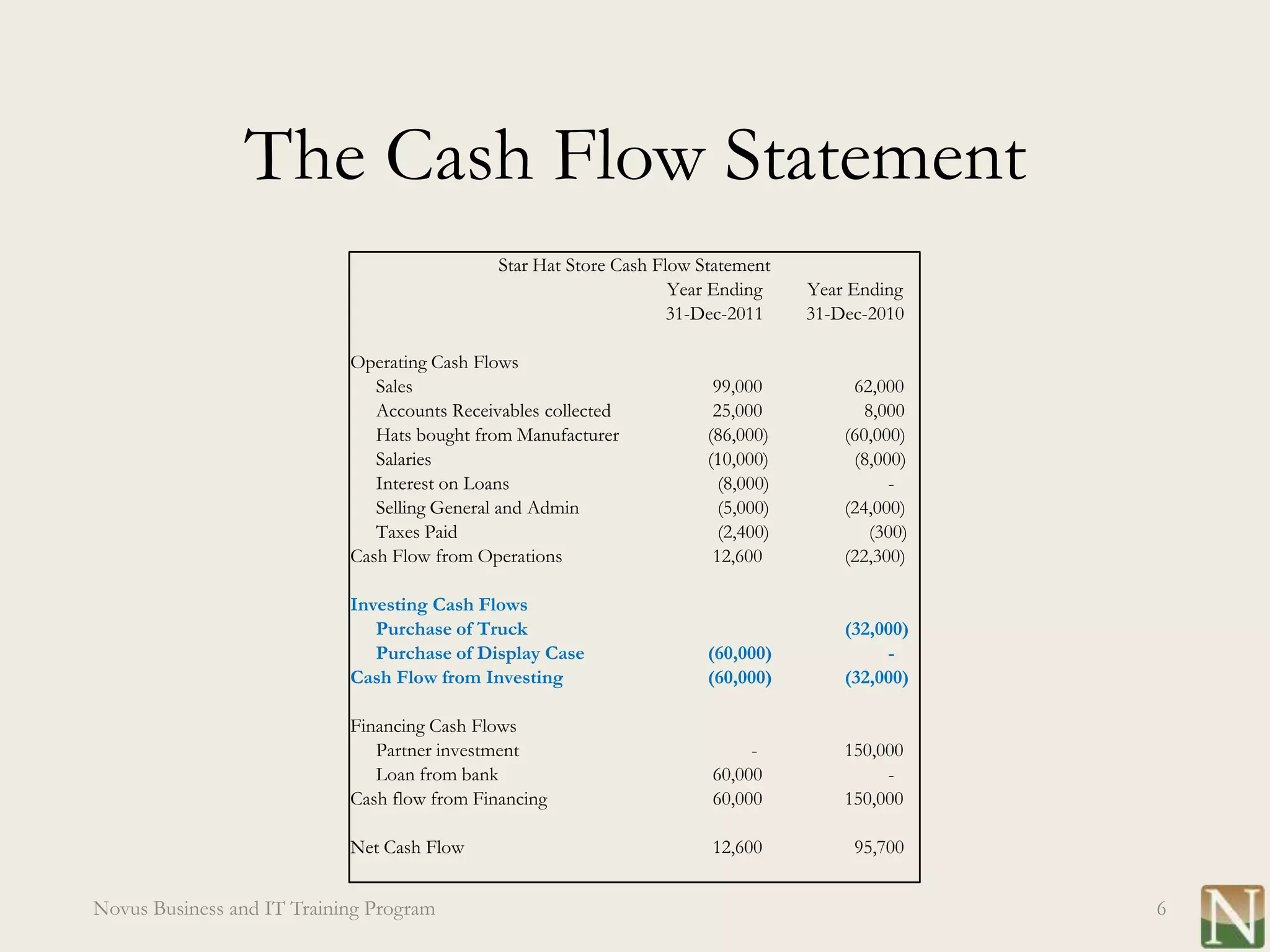

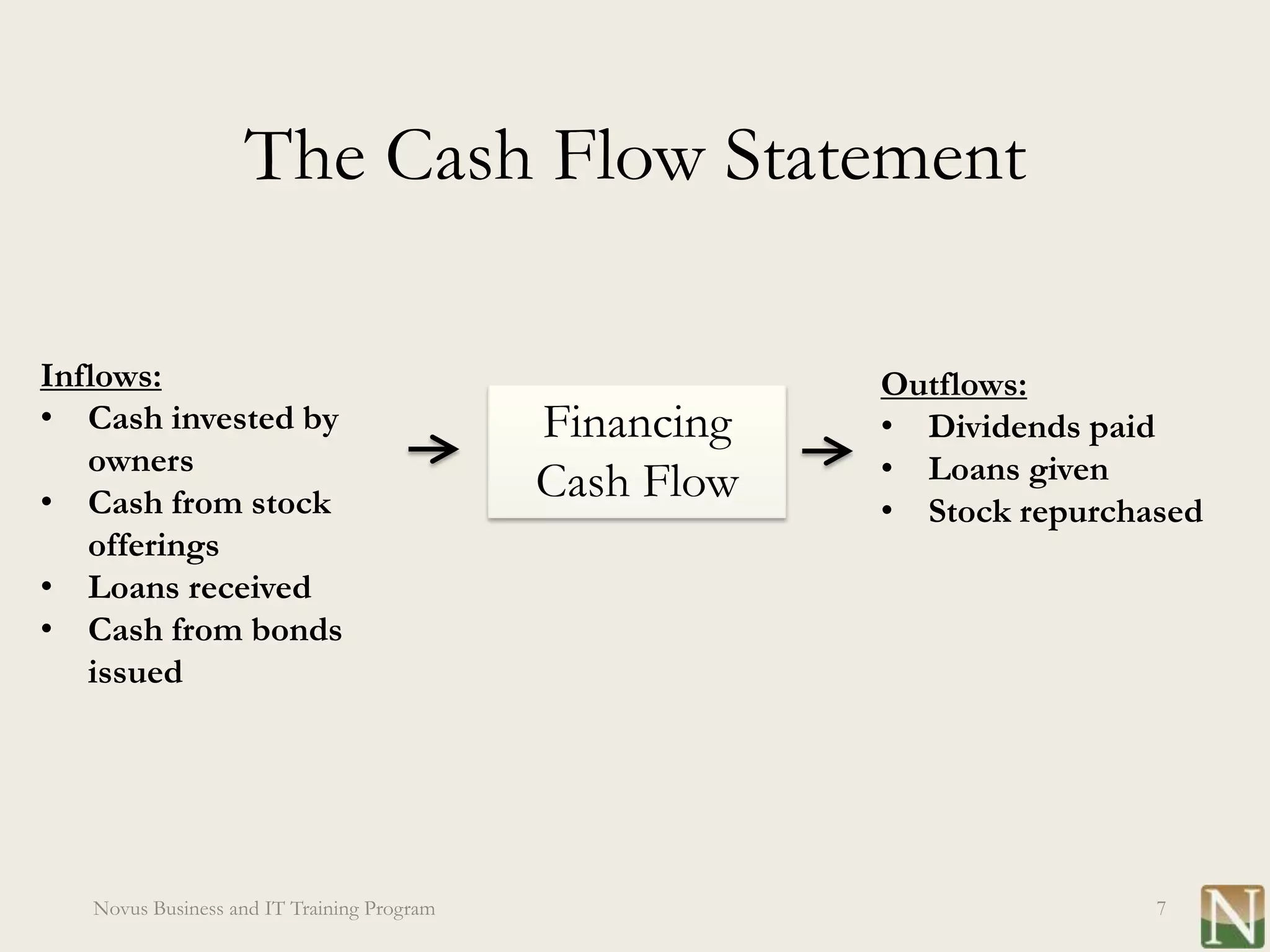

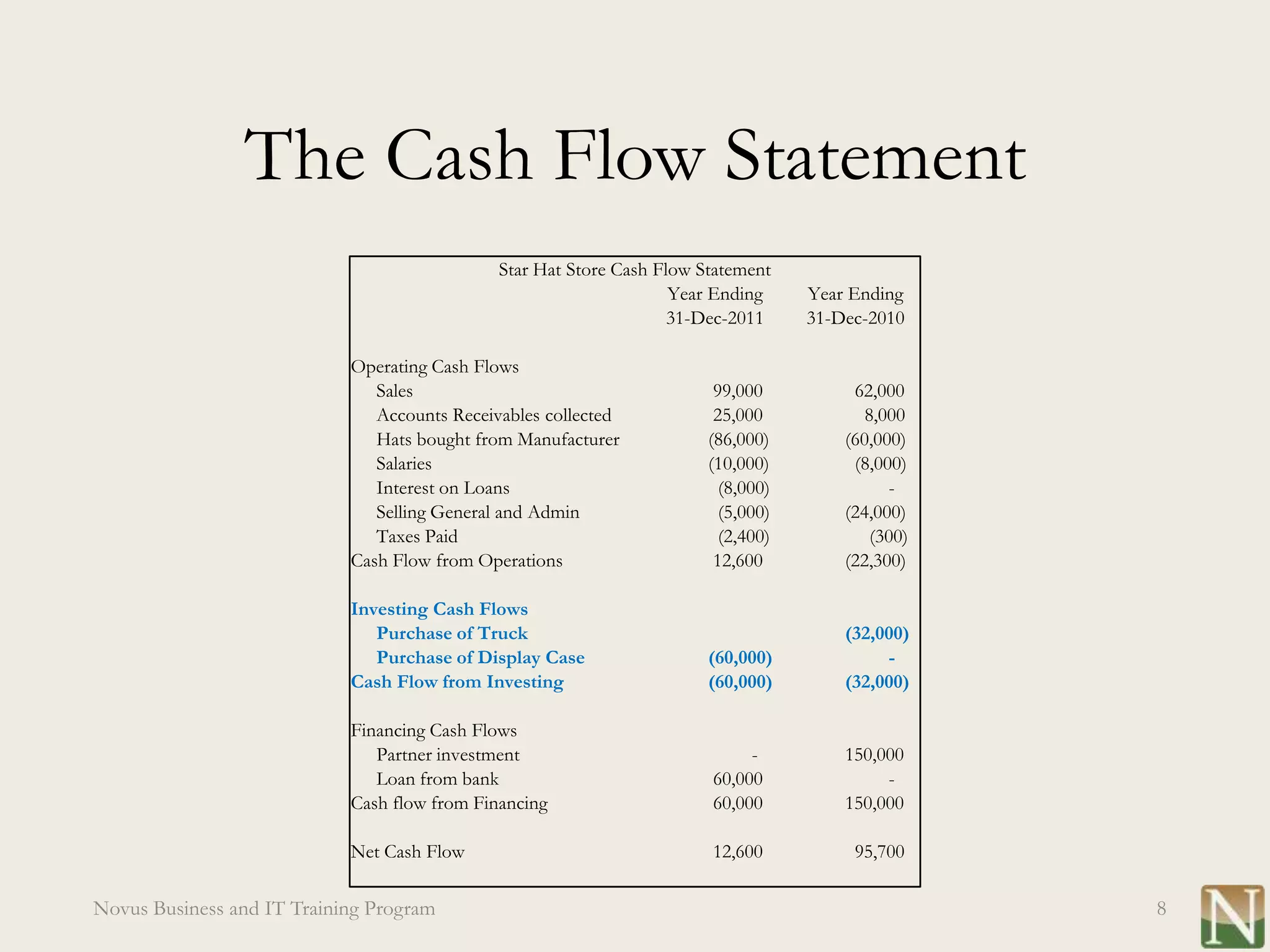

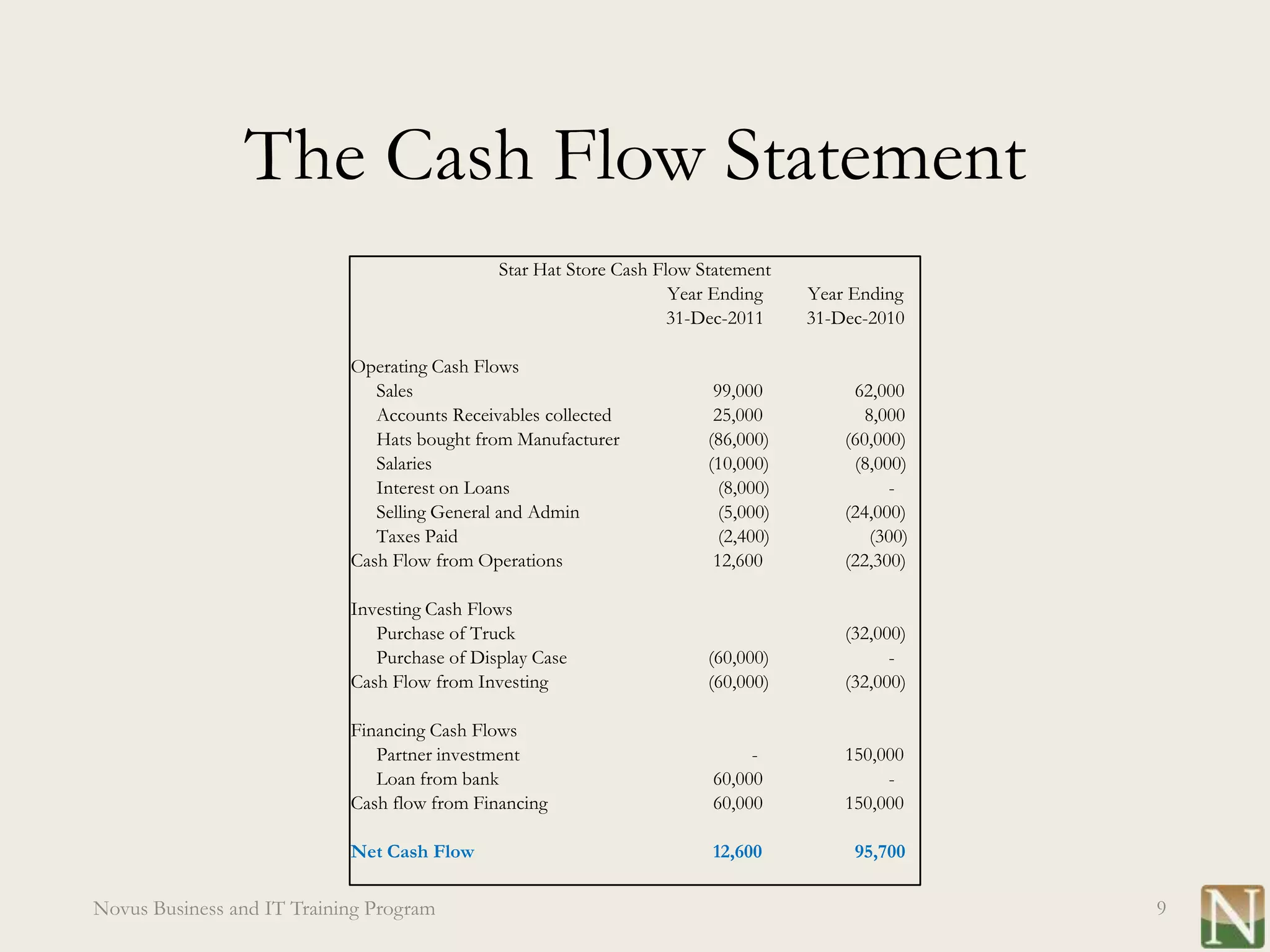

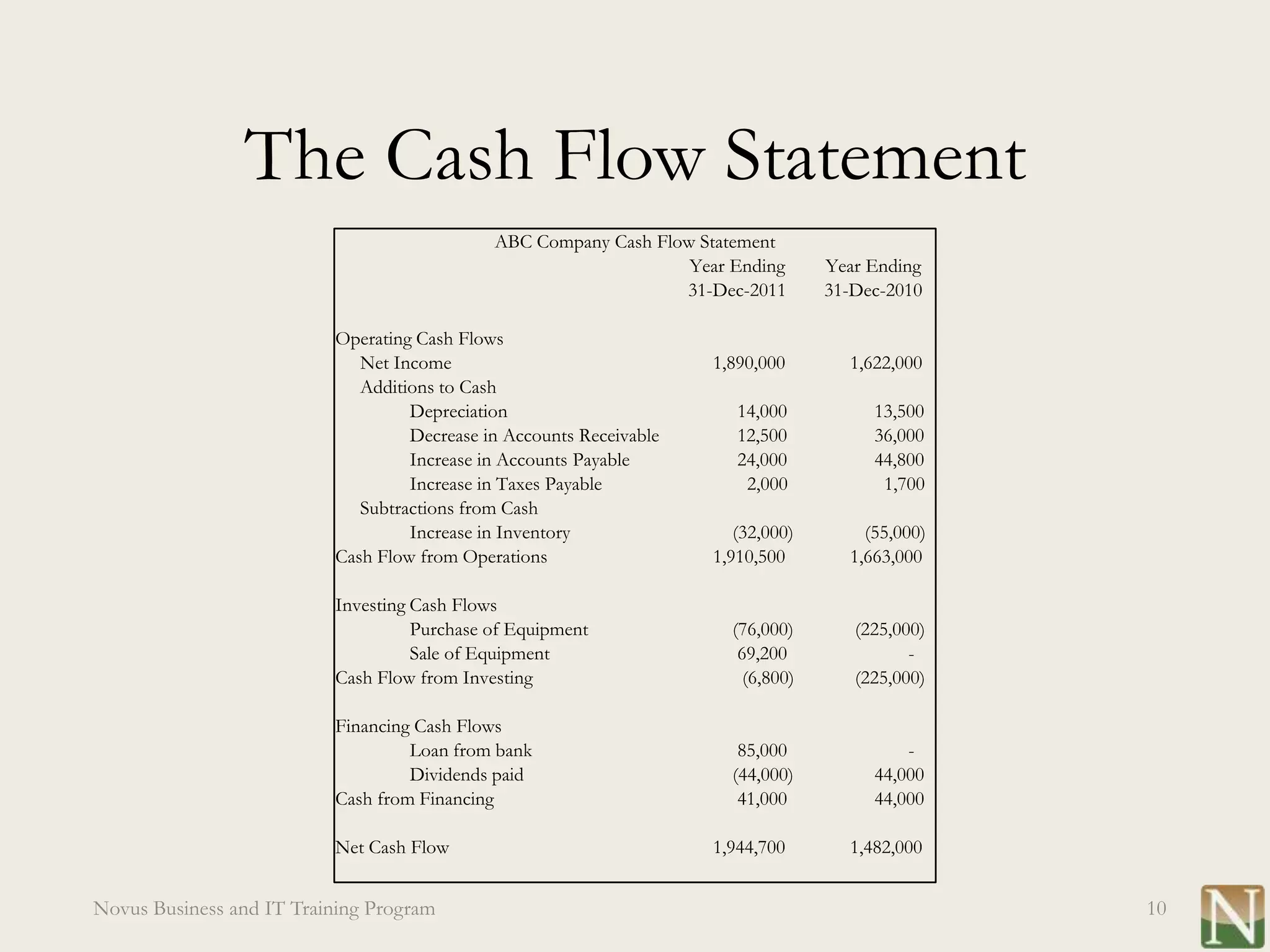

The document analyzes cash flow statements and how they segregate cash flows from operating, investing, and financing activities. It provides examples of inflows and outflows for each category on a cash flow statement, including sales and expenses for operating cash flows, purchases and sales of property for investing cash flows, and loans and dividends for financing cash flows. It demonstrates how to analyze a sample cash flow statement for a company.