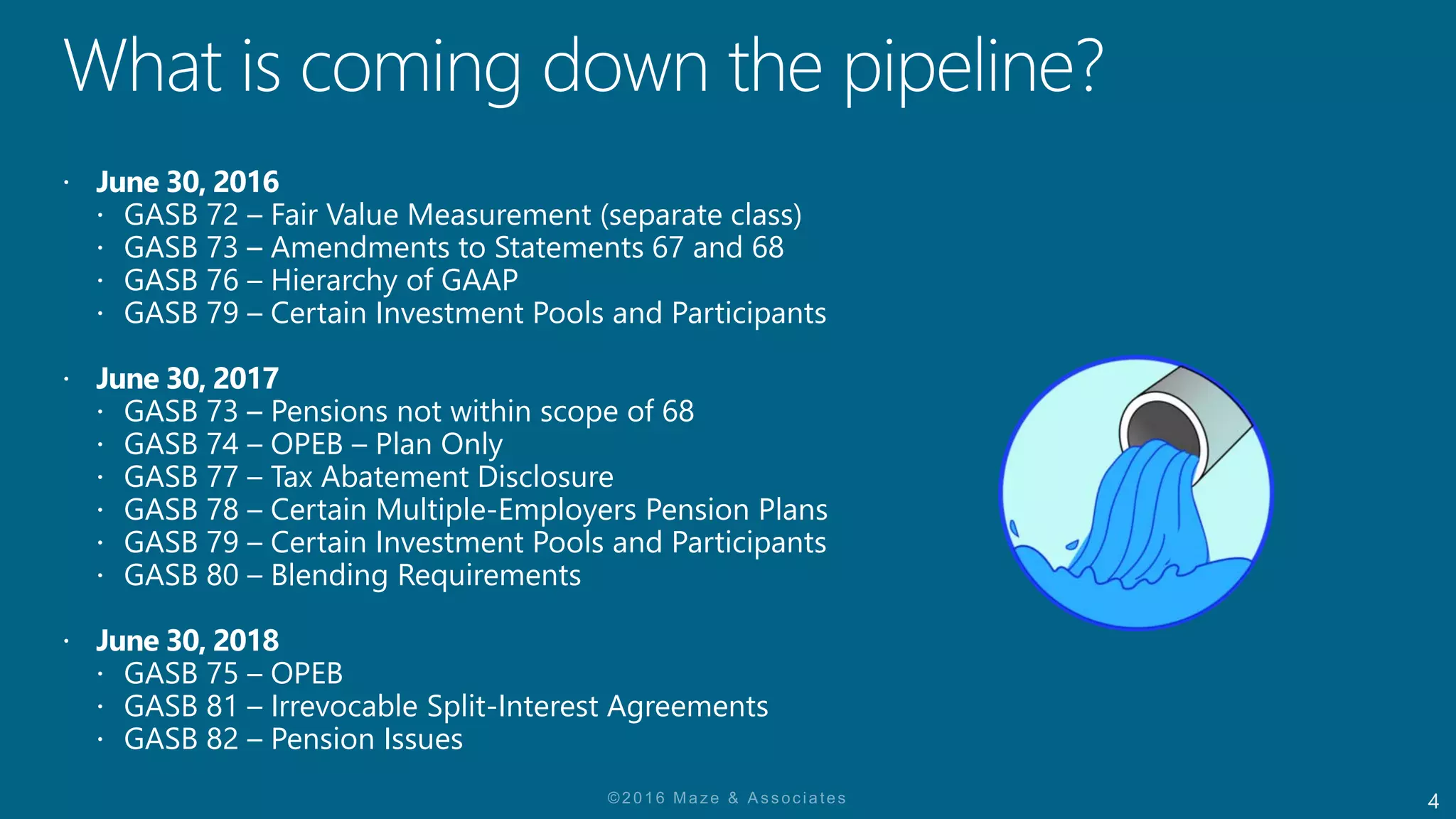

The document discusses various GASB standards related to fair value measurement, government accounting practices, and postemployment benefits. It outlines specific GASB Statements and implementation requirements, including disclosures related to tax abatement agreements and investment policies. Effective dates for compliance and specific criteria for reporting are also specified.