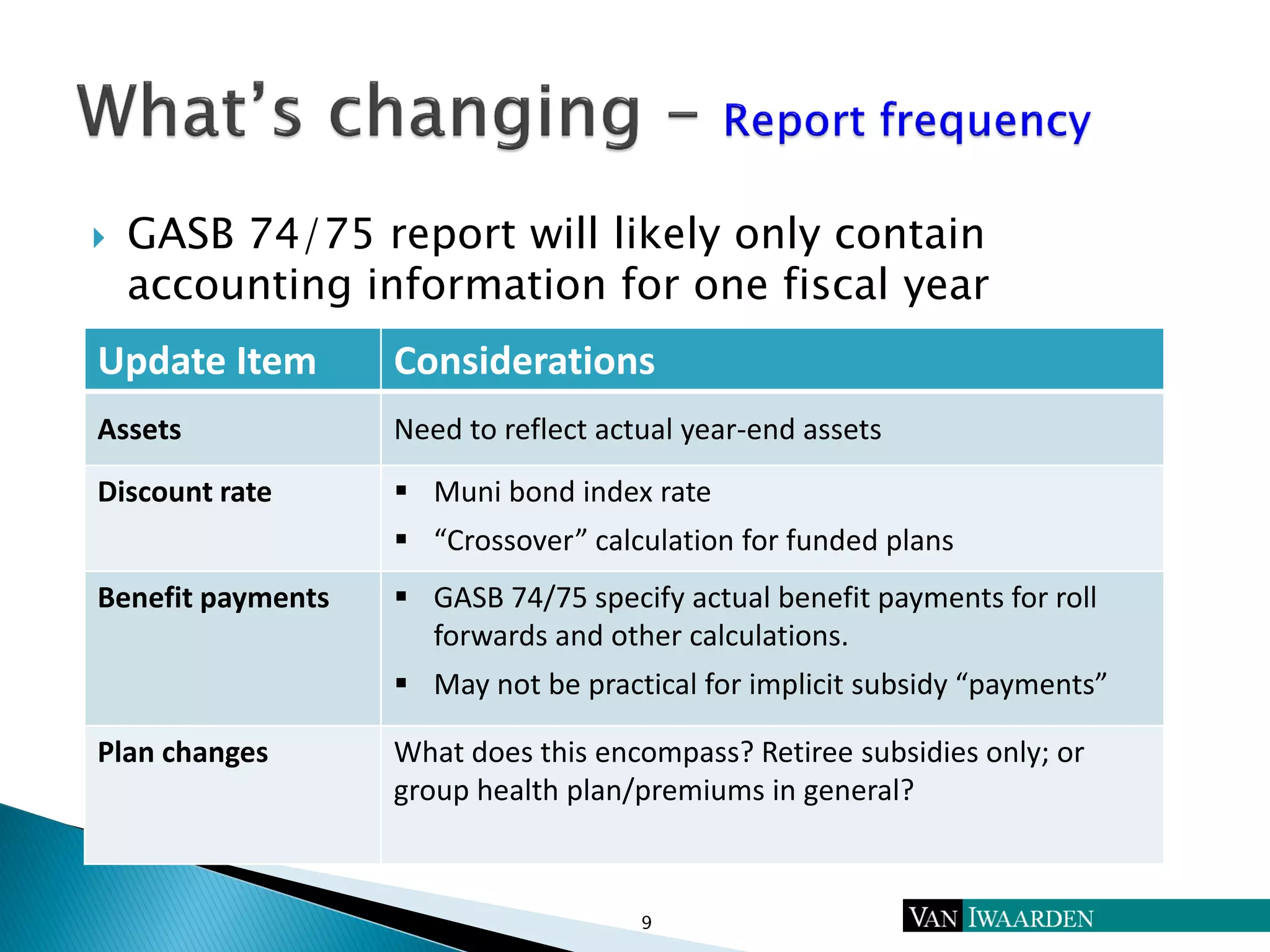

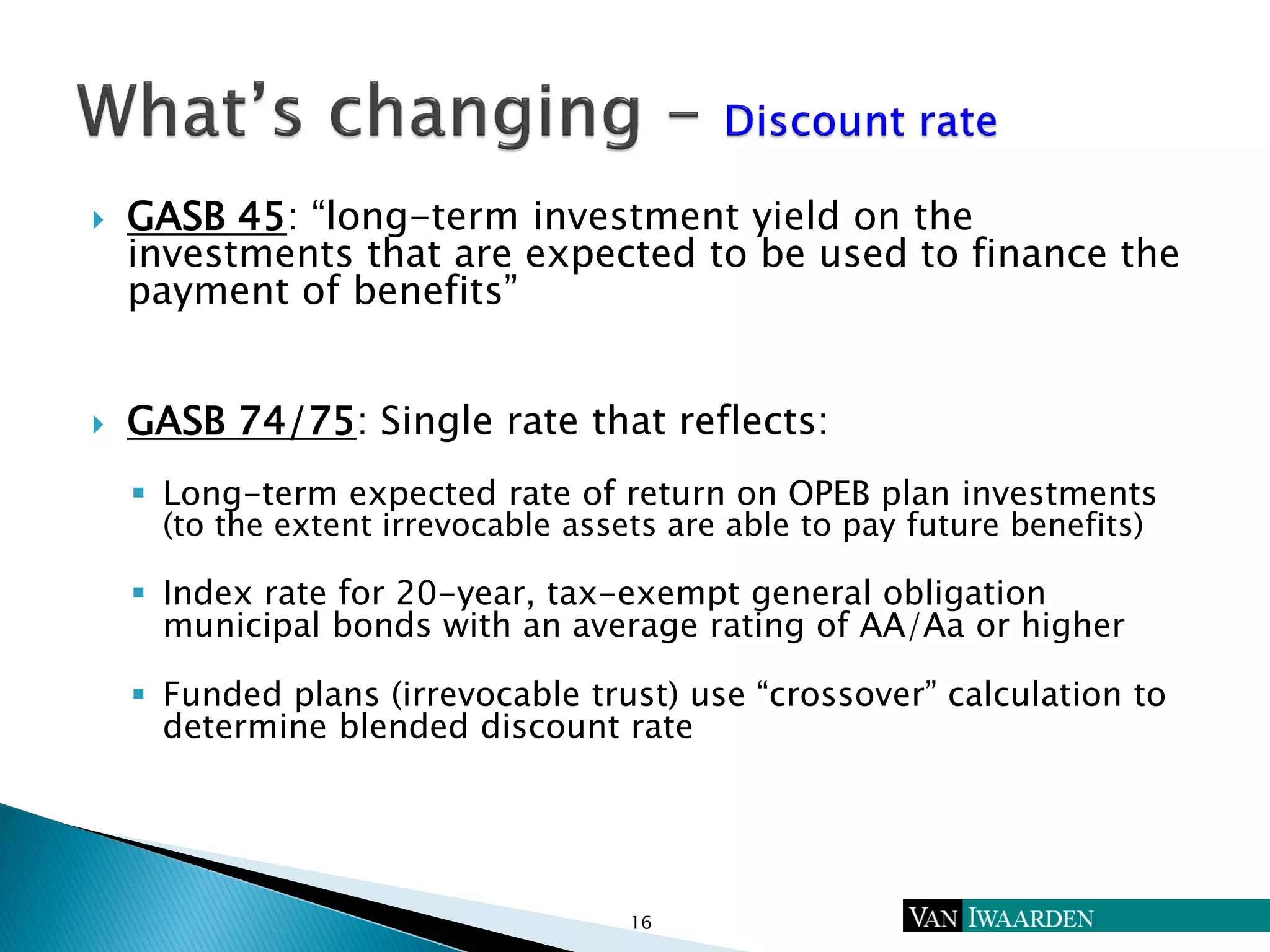

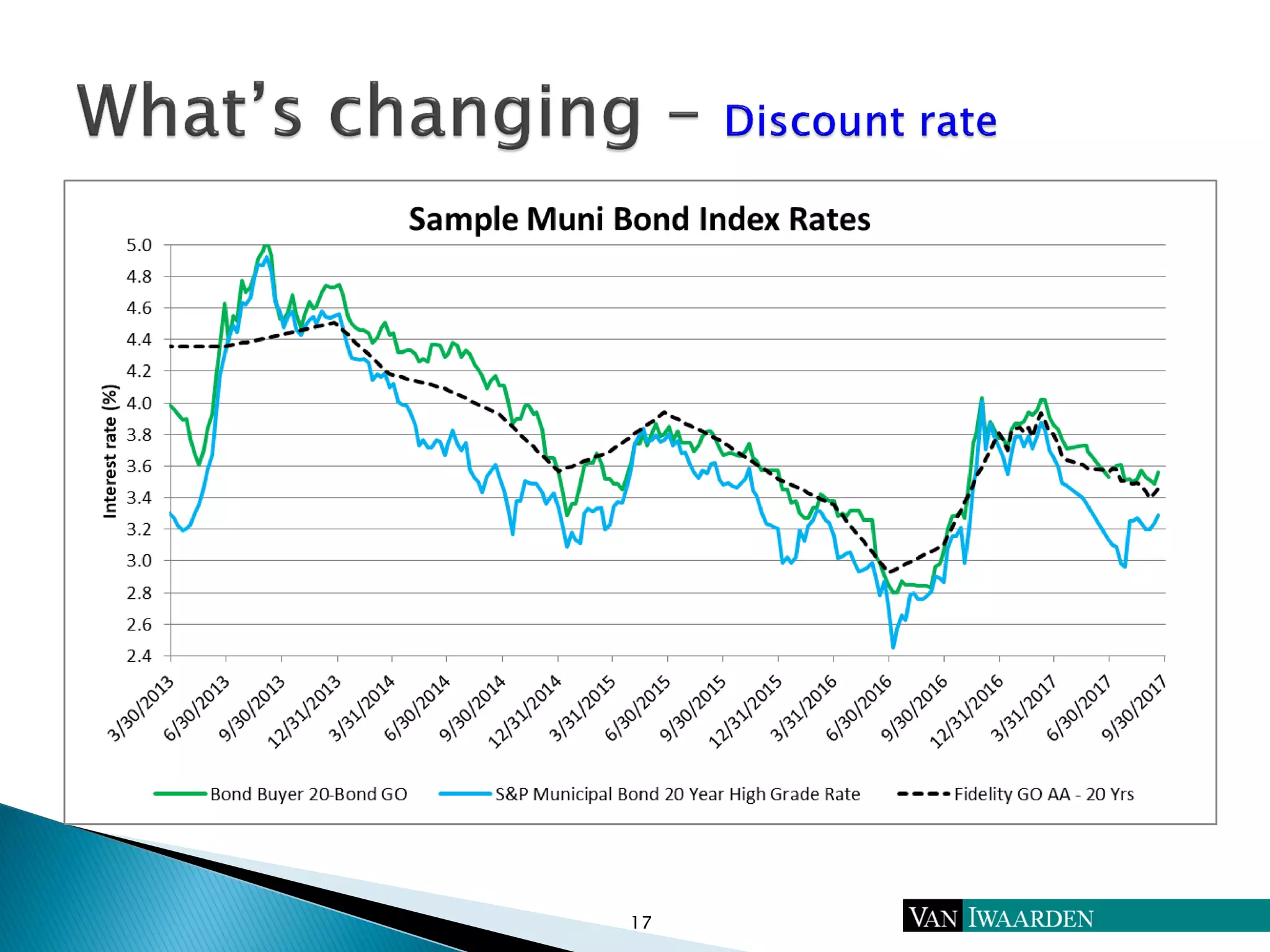

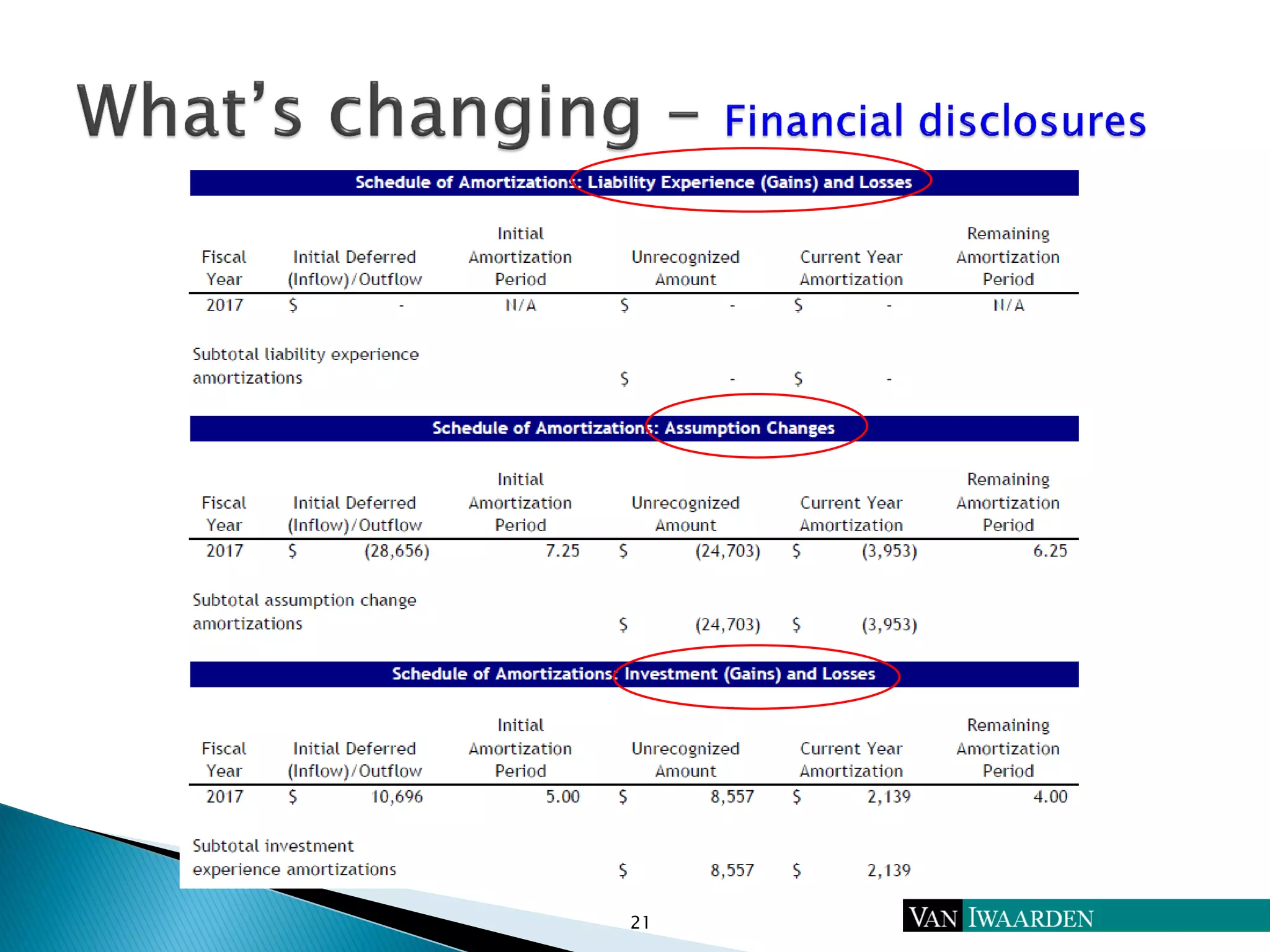

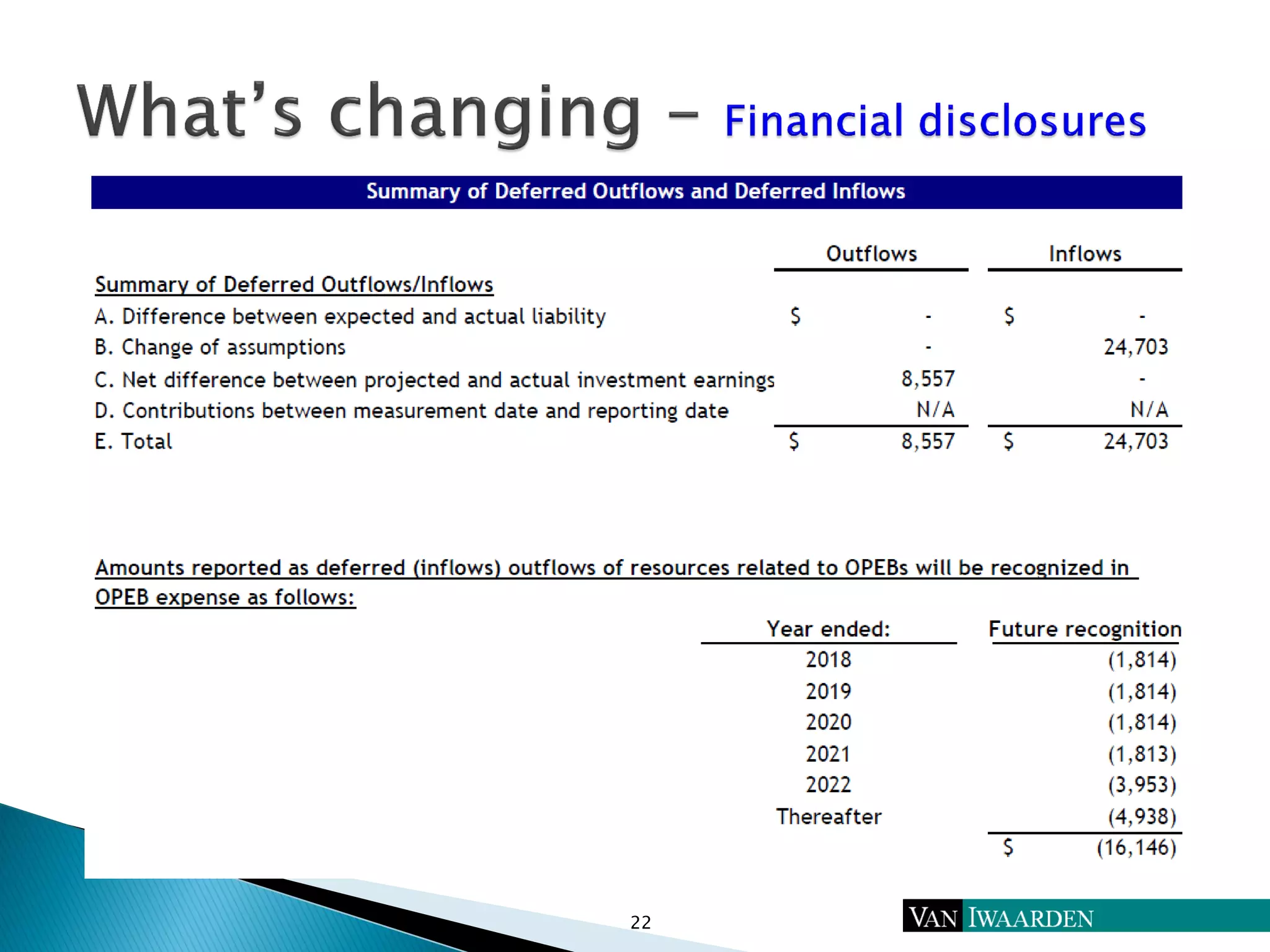

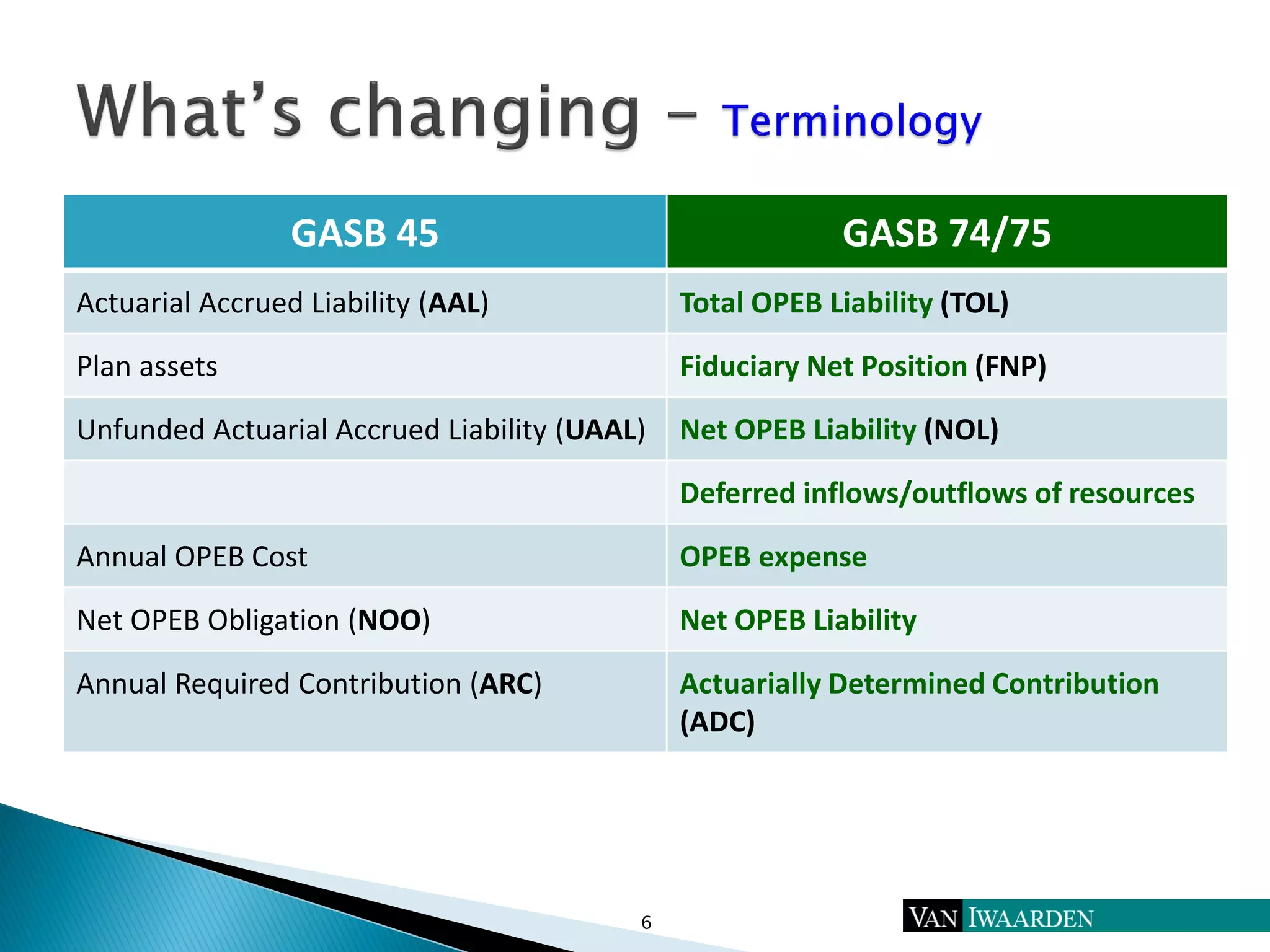

The document discusses essential changes in accounting standards for Other Post-Employment Benefits (OPEB) under GASB 74 and 75, highlighting the transition from GASB 45. It emphasizes updated reporting requirements, including more frequent actuarial evaluations and new terminologies, which impact local governments' financial disclosures and liability recognition. The author suggests a strategic approach for compliance, including early adoption of the new standards to improve clarity and accuracy in financial reporting.

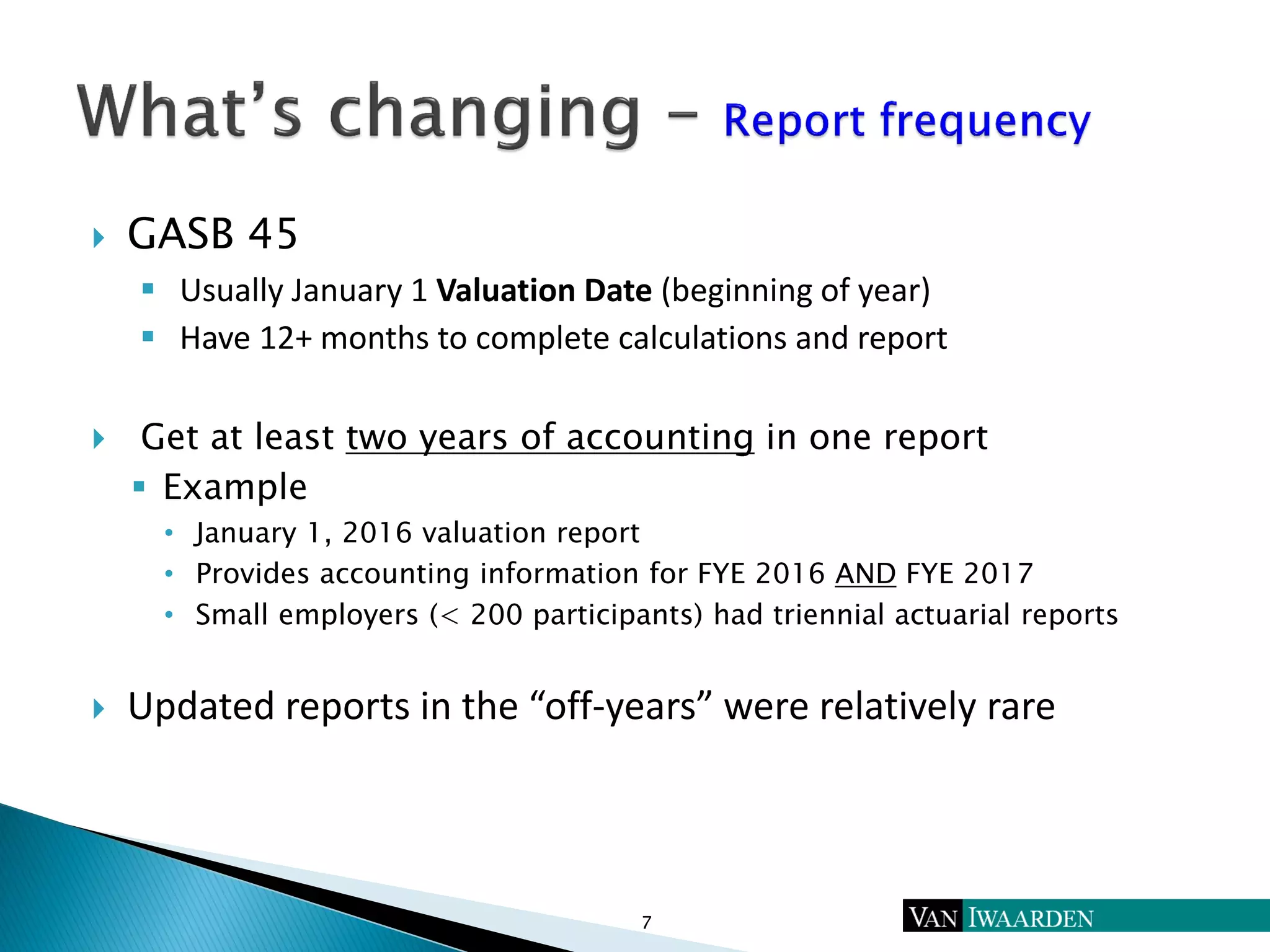

![ GASB 74/75 require full actuarial reports every two

years for all employers

“Update procedures” to reflect any changes since

the actuarial valuation date [GASB 74 Q&A #4.104]

In most cases, employers will need an updated

“off-year” report to reflect certain changes

Movement towards annual valuations because of

OPEB volatility

8](https://image.slidesharecdn.com/gasb75preparingforopeboverhaul-180629211156/75/GASB-74-75-Preparing-for-the-New-World-of-OPEB-Accounting-9-2048.jpg)