The Boulder Group | Q3 2014 Net Lease Research Report2014 q3-net-lease-research-report

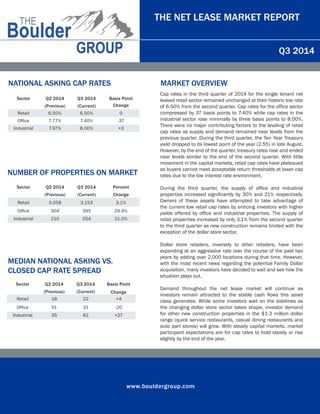

- 1. www.bouldergroup.com THE NET LEASE MARKET REPORT Q3 2014 Sector Q2 2014 Q3 2014 Basis Point (Previous) (Current) Change Retail 6.50% 6.50% 0 Office 7.77% 7.40% -37 Industrial 7.97% 8.00% +3 Sector Q2 2014 Q3 2014 Percent (Previous) (Current) Change Retail 3,058 3,153 3.1% Office 304 395 29.9% Industrial 210 254 21.0% MARKET OVERVIEW Cap rates in the third quarter of 2014 for the single tenant net leased retail sector remained unchanged at their historic low rate of 6.50% from the second quarter. Cap rates for the office sector compressed by 37 basis points to 7.40% while cap rates in the industrial sector rose minimally by three basis points to 8.00%. There were no major contributing factors to the leveling of retail cap rates as supply and demand remained near levels from the previous quarter. During the third quarter, the Ten Year Treasury yield dropped to its lowest point of the year (2.55) in late August. However, by the end of the quarter, treasury rates rose and ended near levels similar to the end of the second quarter. With little movement in the capital markets, retail cap rates have plateaued as buyers cannot meet acceptable return thresholds at lower cap rates due to the low interest rate environment. During the third quarter, the supply of office and industrial properties increased significantly by 30% and 21% respectively. Owners of these assets have attempted to take advantage of the current low retail cap rates by enticing investors with higher yields offered by office and industrial properties. The supply of retail properties increased by only 3.1% from the second quarter to the third quarter as new construction remains limited with the exception of the dollar store sector. Dollar store retailers, inversely to other retailers, have been expanding at an aggressive rate over the course of the past two years by adding over 2,000 locations during that time. However, with the most recent news regarding the potential Family Dollar acquisition, many investors have decided to wait and see how the situation plays out. Demand throughout the net lease market will continue as investors remain attracted to the stable cash flows this asset class generates. While some investors wait on the sidelines as the changing dollar store sector takes shape, investor demand for other new construction properties in the $1-3 million dollar range (quick service restaurants, casual dining restaurants and auto part stores) will grow. With steady capital markets, market participant expectations are for cap rates to hold steady or rise slightly by the end of the year. Sector Q2 2014 Q3 2014 Basis Point (Previous) (Current) Change Retail 18 22 +4 Office 51 31 -20 Industrial 35 62 +27 NATIONAL ASKING CAP RATES NUMBER OF PROPERTIES ON MARKET MEDIAN NATIONAL ASKING VS. CLOSED CAP RATE SPREAD

- 2. www.bouldergroup.com THE NET LEASE MARKET REPORT Q3 2014 SELECTED SINGLE TENANT SALES COMPARABLES Sale Date Sector Tenant City State Price Price Per SF Cap Rate Lease Term Remaining Jul-14 Industrial Nissan Murfreesboro TN $25,837,500 $56 6.40% 15 Jul-14 Retail Lowe's Shippensburg PA $24,400,000 $143 6.05% 18 Jul-14 Retail BJ's Wholesale Jacksonville FL $18,300,000 $150 6.87% 12 Sep-14 Retail Walgreens Chicago IL $16,600,000 $1,034 5.25% 22 Jul-14 Retail Price Chopper Worcester MA $16,000,000 $232 7.39% 14 Sep-14 Retail Pick N Save Kenosha WI $9,250,000 163 6.78% 13 Aug-14 Retail Kohl's Sherwood OR $7,490,000 $129 5.70% 19 Aug-14 Retail McDonald's (Ground Lease) Arlington VA $7,350,000 N/A 3.95% 12 Jul-14 Retail Bank of America Chicago IL $7,150,000 $1,788 6.15% 12 Jul-14 Retail Chase Bank (Ground Lease) Lombard IL $6,500,000 N/A 5.00% 18 Jul-14 Retail CVS Riverton NJ $6,080,000 $471 6.20% 18 Jul-14 Retail Walgreens Raytown MO $5,862,250 $404 6.00% 15 Jul-14 Office Shearer's Corporation Massillon OH $5,600,000 $140 8.39% 15 NET LEASED CAP RATE TRENDS Retail Office Industrial 6.25% 6.75% 7.25% 7.75% 8.25% 8.75% Q1 2007 Q1 2008 Q1 2009 Q1 2010 Q1 2011 Q1 2012 Q1 2013 Q1 2014

- 3. www.bouldergroup.com THE NET LEASE MARKET REPORT Q3 2014 Tenant 2010-2014 2005-2009 2000-2004 Pre 2000 Walgreens 5.30% 5.60% 6.00% 7.25% CVS 5.25% 5.63% 6.13% 7.04% Rite Aid N/A 6.75% 7.63% 8.00% Advance Auto Parts 6.00% 6.83% 7.25% 7.75% AutoZone 5.40% 6.45% 6.75% 7.53% O'Reilly Auto Parts 5.86% 6.17% 6.35% 7.00% Dollar General 6.45% 7.25% 7.90% 8.65% Family Dollar 6.75% 7.40% 8.15% 8.75% McDonald's (GL) 4.00% 4.19% 4.60% 5.00% FedEx 6.58% 7.00% 8.00% 8.45% GSA 7.64% 7.55% 8.38% 9.10% Chase (GL) 4.00% 4.35% 4.63% N/A Bank of America (GL) 4.25% 4.88% 5.00% 5.10% PNC (GL) 4.33% 4.88% 5.25% N/A Wells Fargo (GL) 4.15% 4.65% 4.85% 5.25% 7-Eleven 5.13% 5.50% 6.05% 6.25% DaVita 6.43% 6.84% 7.15% 8.00% Fresenius 6.25% 6.90% 7.85% 8.00% FOR MORE INFORMATION AUTHOR John Feeney | Vice President john@bouldergroup.com CONTRIBUTORS Randy Blankstein | President randy@bouldergroup.com Jimmy Goodman | Partner jimmy@bouldergroup.com Zach Wright | Research Analyst zach@bouldergroup.com © 2014. The Boulder Group. Information herein has been obtained from databases owned and maintained by The Boulder Group as well as third party sources. We have not verified the information and we make no guarantee, warranty or representation about it. This information is provided for general illustrative purposes and not for any specific recommendation or purpose nor under any circumstances shall any of the above information be deemed legal advice or counsel. Reliance on this information is at the risk of the reader and The Boulder Group expressly disclaims any liability arising from the use of such information. This information is designed exclusively for use by The Boulder Group clients and cannot be reproduced, retransmitted or distributed without the express written consent of The Boulder Group. MEDIAN ASKING CAP RATES BY YEAR BUILT GL = Ground Lease Jordan Kaufman | Vice President jordan@bouldergroup.com