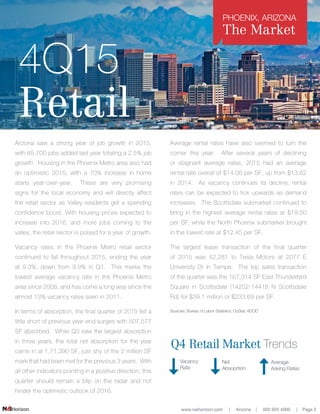

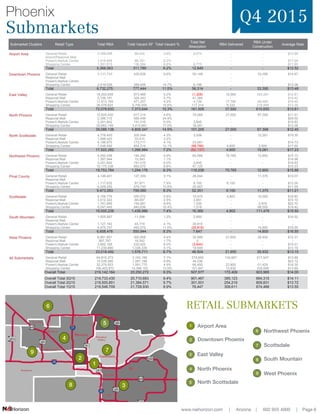

The retail market report summarizes 2015 trends in the Phoenix metro area. It notes that 65,700 jobs were added in 2015, home starts increased 70% year-over-year, and these economic gains are boosting consumer confidence. Retail vacancy rates declined to 9.3% while net absorption was 1.77 million square feet. Average rental rates increased to $14/sqft, up from $13.62/sqft in 2014. The report concludes that with continued job and housing growth, the retail sector is poised for growth in 2016.