net lease research report q1 2018 | The Boulder Group

•

1 like•192 views

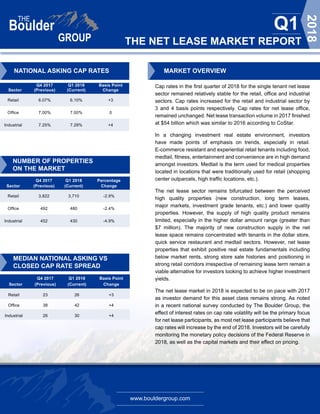

This report summarizes key metrics and trends in the net lease market in Q1 2018: - Cap rates remained stable for retail (6.1%) and office (7%), and increased slightly for industrial (7.29%). - Transaction volume in 2017 was similar to 2016 at $54 billion. Demand remains high for e-commerce resistant and experiential retail tenants. - The market remains bifurcated between high and lower quality properties. New construction supply is concentrated in dollar stores, restaurants, and medical properties.

Report

Share

Report

Share

Download to read offline

Recommended

Recommended

More Related Content

What's hot

What's hot (20)

net lease casual dining report | The Boulder Group

net lease casual dining report | The Boulder Group

The Boulder Group Publishes 4th Quarter Net Lease Market Research Report

The Boulder Group Publishes 4th Quarter Net Lease Market Research Report

Net Lease Big Box Research Report | The Boulder Group

Net Lease Big Box Research Report | The Boulder Group

3rd Quarter Net Lease Market Research Report | The Boulder Group

3rd Quarter Net Lease Market Research Report | The Boulder Group

The Boulder Group | Q3 2014 Net Lease Research Report2014 q3-net-lease-resear...

The Boulder Group | Q3 2014 Net Lease Research Report2014 q3-net-lease-resear...

JPM Global High Yield & Leveraged Finance Conference

JPM Global High Yield & Leveraged Finance Conference

Mercer Capital's Value Focus: Convenience Store Industry | Q2 2015 | Segment:...

Mercer Capital's Value Focus: Convenience Store Industry | Q2 2015 | Segment:...

Chicago_AMERICAS_MarketBeat_Industrial_2page_Q42012

Chicago_AMERICAS_MarketBeat_Industrial_2page_Q42012

Similar to net lease research report q1 2018 | The Boulder Group

Presented by Eric Duffee and Michael Shaw, Copper Run Capital, on 10/17 as part of a Four Part Series. This segment of the series offered 8 clear steps to follow in pursuit of facilitating a successful transaction. It covered areas such as securing your assets, awareness of current market trends, a visual analysis of our current market update, and surrounding yourself with the right team. Grow + Sell Your Business Part Three: Practical Tips To Facilitate a Transaction

Grow + Sell Your Business Part Three: Practical Tips To Facilitate a TransactionKegler Brown Hill + Ritter

Similar to net lease research report q1 2018 | The Boulder Group (19)

2016 q3 net lease research report | The Boulder Group

2016 q3 net lease research report | The Boulder Group

Net Lease Market Research Report Published by The Boulder Group

Net Lease Market Research Report Published by The Boulder Group

Mercer Capital's Bank Watch | July 2019 | Bank M&A Mid-Year Update

Mercer Capital's Bank Watch | July 2019 | Bank M&A Mid-Year Update

Grow + Sell Your Business Part Three: Practical Tips To Facilitate a Transaction

Grow + Sell Your Business Part Three: Practical Tips To Facilitate a Transaction

High Real Estate C&I Market presentation feb. 2018

High Real Estate C&I Market presentation feb. 2018

Cushman & Wakefield's Americas Market Beat~ Industrial Philadelphia q32016

Cushman & Wakefield's Americas Market Beat~ Industrial Philadelphia q32016

The Blue Sky Report® - A Kerrigan Quarterly - Q3 2018 Preview

The Blue Sky Report® - A Kerrigan Quarterly - Q3 2018 Preview

More from The Boulder Group

More from The Boulder Group (20)

The Boulder Group Net Lease Tenant Profile Report 2020

The Boulder Group Net Lease Tenant Profile Report 2020

Net Lease Tenant Profile Report 2019 | The Boulder Group

Net Lease Tenant Profile Report 2019 | The Boulder Group

Net Lease Casual Dining Report 2018 | The Boulder Group

Net Lease Casual Dining Report 2018 | The Boulder Group

Sale Leaseback Property For Sale - The Boulder Group

Sale Leaseback Property For Sale - The Boulder Group

Net Lease Casual Dining Research Report | The Boulder Group

Net Lease Casual Dining Research Report | The Boulder Group

Net Lease Bakers Square Property For Sale by The Boulder Group

Net Lease Bakers Square Property For Sale by The Boulder Group

Recently uploaded

Recently uploaded (20)

Bptp The Amaario Launch Luxury Project Sector 37D Gurgaon Dwarka Expressway...

Bptp The Amaario Launch Luxury Project Sector 37D Gurgaon Dwarka Expressway...

9990771857 Call Girls in Dwarka Sector 7 Delhi (Call Girls) Delhi

9990771857 Call Girls in Dwarka Sector 7 Delhi (Call Girls) Delhi

The Gale at Godrej Park World Hinjewadi Pune Brochure.pdf

The Gale at Godrej Park World Hinjewadi Pune Brochure.pdf

Enjoy Night ≽ 8448380779 ≼ Call Girls In Iffco Chowk (Gurgaon)

Enjoy Night ≽ 8448380779 ≼ Call Girls In Iffco Chowk (Gurgaon)

9990771857 Call Girls in Dwarka Sector 6 Delhi (Call Girls) Delhi

9990771857 Call Girls in Dwarka Sector 6 Delhi (Call Girls) Delhi

Best Deal Virtual Space in Satya The Hive Tata Zudio 750 Sqft 1.89 Cr All inc...

Best Deal Virtual Space in Satya The Hive Tata Zudio 750 Sqft 1.89 Cr All inc...

Call Girls in Karkardooma Delhi +91 84487779280}Woman Seeking Man in Delhi NCR

Call Girls in Karkardooma Delhi +91 84487779280}Woman Seeking Man in Delhi NCR

9990771857 Call Girls in Dwarka Sector 3 Delhi (Call Girls) Delhi

9990771857 Call Girls in Dwarka Sector 3 Delhi (Call Girls) Delhi

Enjoy Night ≽ 8448380779 ≼ Call Girls In Huda City Centre (Gurgaon)

Enjoy Night ≽ 8448380779 ≼ Call Girls In Huda City Centre (Gurgaon)

BDSM⚡Call Girls in Sector 57 Noida Escorts >༒8448380779 Escort Service

BDSM⚡Call Girls in Sector 57 Noida Escorts >༒8448380779 Escort Service

Call Girls In Vasant Vihar Delhi 💯Call Us 🔝8264348440🔝

Call Girls In Vasant Vihar Delhi 💯Call Us 🔝8264348440🔝

Greater Vancouver Realtors Statistics Package April 2024

Greater Vancouver Realtors Statistics Package April 2024

9990771857 Call Girls Dwarka Sector 9 Delhi (Call Girls ) Delhi

9990771857 Call Girls Dwarka Sector 9 Delhi (Call Girls ) Delhi

9990771857 Call Girls in Dwarka Sector 2 Delhi (Call Girls) Delhi

9990771857 Call Girls in Dwarka Sector 2 Delhi (Call Girls) Delhi

2k Shots ≽ 9205541914 ≼ Call Girls In Sainik Farm (Delhi)

2k Shots ≽ 9205541914 ≼ Call Girls In Sainik Farm (Delhi)

9990771857 Call Girls in Dwarka Sector 137 Noida (Call Girls) Delhi

9990771857 Call Girls in Dwarka Sector 137 Noida (Call Girls) Delhi

net lease research report q1 2018 | The Boulder Group

- 1. www.bouldergroup.com THE NET LEASE MARKET REPORT Q1 2018 Q4 2017 Q1 2018 Basis Point Sector (Previous) (Current) Change Retail 6.07% 6.10% +3 Office 7.00% 7.00% 0 Industrial 7.25% 7.29% +4 NUMBER OF PROPERTIES ON THE MARKET Q4 2017 Q1 2018 Percentage Sector (Previous) (Current) Change Retail 3,822 3,710 -2.9% Office 492 480 -2.4% Industrial 452 430 -4.9% MEDIAN NATIONAL ASKING VS CLOSED CAP RATE SPREAD MARKET OVERVIEW Cap rates in the first quarter of 2018 for the single tenant net lease sector remained relatively stable for the retail, office and industrial sectors. Cap rates increased for the retail and industrial sector by 3 and 4 basis points respectively. Cap rates for net lease office, remained unchanged. Net lease transaction volume in 2017 finished at $54 billion which was similar to 2016 according to CoStar. In a changing investment real estate environment, investors have made points of emphasis on trends, especially in retail. E-commerce resistant and experiential retail tenants including food, medtail, fitness, entertainment and convenience are in high demand amongst investors. Medtail is the term used for medical properties located in locations that were traditionally used for retail (shopping center outparcels, high traffic locations, etc.). The net lease sector remains bifurcated between the perceived high quality properties (new construction, long term leases, major markets, investment grade tenants, etc.) and lower quality properties. However, the supply of high quality product remains limited, especially in the higher dollar amount range (greater than $7 million). The majority of new construction supply in the net lease space remains concentrated with tenants in the dollar store, quick service restaurant and medtail sectors. However, net lease properties that exhibit positive real estate fundamentals including below market rents, strong store sale histories and positioning in strong retail corridors irrespective of remaining lease term remain a viable alternative for investors looking to achieve higher investment yields. The net lease market in 2018 is expected to be on pace with 2017 as investor demand for this asset class remains strong. As noted in a recent national survey conducted by The Boulder Group, the effect of interest rates on cap rate volatility will be the primary focus for net lease participants, as most net lease participants believe that cap rates will increase by the end of 2018. Investors will be carefully monitoring the monetary policy decisions of the Federal Reserve in 2018, as well as the capital markets and their effect on pricing. Q4 2017 Q1 2018 Basis Point Sector (Previous) (Current) Change Retail 23 26 +3 Office 38 42 +4 Industrial 26 30 +4 NATIONAL ASKING CAP RATES

- 2. www.bouldergroup.com THE NET LEASE MARKET REPORT Q1 2018 SELECTED SINGLE TENANT SALES COMPARABLES Sale Date Sector Tenant City State Price Price Per SF Cap Rate Lease Term Remaining Feb-18 Office Amazon Herndon VA $226,000,000 $560 5.46% 11 Years Mar-18 Industrial Quaker Sales & Distribution (Pepsi) Lakeland FL $59,600,000 $98 4.85% 10 Years Jan-18 Office Daimler Fort Mill SC $40,000,000 $266 5.91% 11 Years Jan-18 Office Go Daddy Gilbert AZ $39,000,000 $216 6.67% 10 Years Feb-18 Industrial FedEx Atlanta GA $32,250,000 $110 5.56% 5 Years Feb-18 Office PayPal Scottsdale AZ $30,500,000 $330 5.95% 10 Years Feb-18 Office Four Winds Interactive Denver CO $17,100,000 $329 7.75% 13 Years Feb-18 Retail Walmart Youngstown OH $13,575,000 $88 6.80% 4 Years Feb-18 Retail Walmart Neighborhood Market Kansas City OH $12,617,500 $307 5.75% 16 Years Jan-18 Retail AMC Springfield MO $11,138,000 $230 7.40% 17 Years Feb-18 Retail Walgreens Ewing NJ $10,645,000 $725 5.33% 20 Years Feb-18 Retail CVS Tujunga CA $10,400,000 $705 4.82% 10 Years Mar-18 Retail Walgreens Port Saint Lucie FL $8,400,000 $619 5.55% 17 Years Feb-18 Retail CVS Lawton OK $6,493,000 $481 5.40% 23 Years Mar-18 Retail Wawa (GL) Deerfield Beach FL $6,125,000 -- 4.57% 20 Years Jan-18 Retail Goodwill Fort Myers FL $6,077,000 $304 6.50% 15 Years Jan-18 Industrial Effox, INC West Chester OH $5,300,000 $55 8.20% 10 Years NET LEASE CAP RATE TRENDS Retail Office Industrial 5.75% 6.25% 6.75% 7.25% 7.75% 8.25% 8.75% Q3 2004 Q1 2005 Q3 2005 Q1 2006 Q3 2006 Q1 2007 Q3 2007 Q1 2008 Q3 2008 Q1 2009 Q3 2009 Q1 2010 Q3 2010 Q1 2011 Q3 2011 Q1 2012 Q3 2012 Q1 2013 Q3 2013 Q1 2014 Q3 2014 Q1 2015 Q3 2015 Q1 2016 Q3 2016 Q1 2017 Q3 2017 Q1 2018 Q1 2004

- 3. www.bouldergroup.com THE NET LEASE MARKET REPORT Q1 2018 © 2018. The Boulder Group. Information herein has been obtained from databases owned and maintained by The Boulder Group as well as third party sources. We have not verified the information and we make no guarantee, warranty or representation about it. This information is provided for general illustrative purposes and not for any specific recommendation or purpose nor under any circumstances shall any of the above information be deemed legal advice or counsel. Reliance on this information is at the risk of the reader and The Boulder Group expressly disclaims any liability arising from the use of such information. This information is designed exclusively for use by The Boulder Group clients and cannot be reproduced, retransmitted or distributed without the express written consent of The Boulder Group. FOR MORE INFORMATION John Feeney | Senior Vice President john@bouldergroup.com Asher Wenig | Vice President asher@bouldergroup.com Scott Harris | Senior Analyst scott@bouldergroup.com Jeff Weil | Analyst jeff@bouldergroup.com Tenant 2012-2018 2005-2011 2000-2005 Pre 2000 7-Eleven 4.83% 5.25% 5.85% 6.25% Advance Auto Parts 6.05% 6.50% 7.35% 7.75% AutoZone 5.25% 5.70% 6.30% 7.00% Bank of America N/A 5.00% 5.90% 6.35% Chase Bank N/A 4.70% 5.05% 5.75% CVS Pharmacy 5.00% 5.85% 6.00% 7.10% DaVita Dialysis Center 5.65% 6.20% 6.55% 7.00% Dollar General 6.90% 7.60% 8.00% 8.35% Family Dollar 7.30% 7.65% 8.15% 8.70% FedEx 6.00% 6.70% 7.00% 7.65% Fresenius 5.85% 6.50% 6.75% 7.60% McDonald's (GL) 4.00% 4.25% 4.70% 5.00% O'Reilly Auto Parts 5.65% 6.00% 6.15% 6.93% Rite Aid N/A 7.00% 7.75% 8.45% Starbucks 5.00% 5.40% 5.90% 6.40% Walgreens 5.40% 5.85% 6.70% 7.20% MEDIAN ASKING CAP RATES BY YEAR BUILT CONTRIBUTORS Randy Blankstein | President randy@bouldergroup.com Jimmy Goodman | Partner jimmy@bouldergroup.com AUTHOR