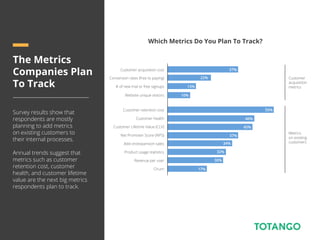

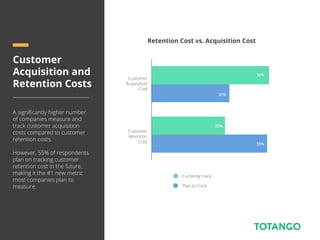

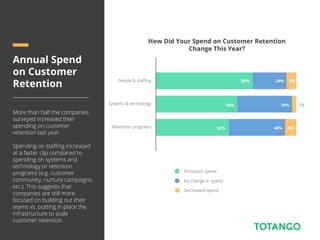

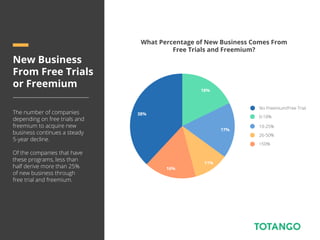

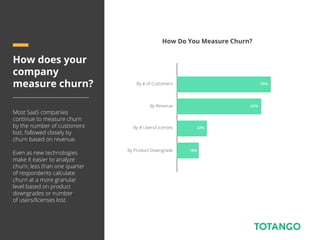

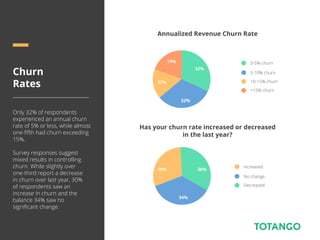

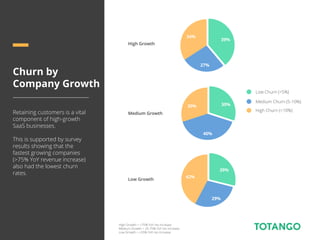

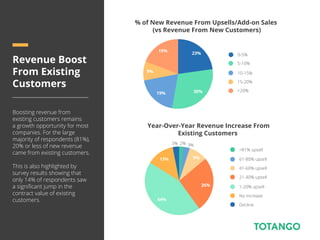

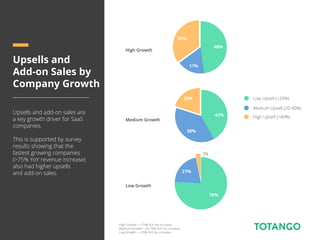

The survey found that SaaS companies are increasingly focused on metrics related to existing customers, such as customer retention cost, health, and lifetime value. While over two-thirds of companies experienced annual churn rates of 5% or higher, spending on customer retention is growing. Fast growing companies tend to have lower churn rates and higher revenue from upsells/add-ons with existing customers. However, for most companies upsells contribute to less than 20% of new revenue, indicating it remains an opportunity area.