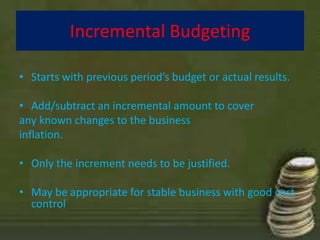

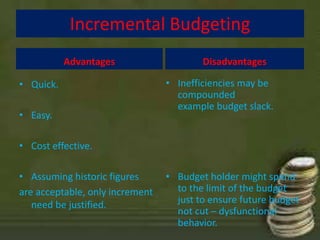

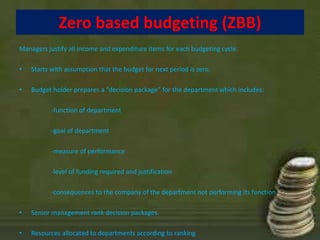

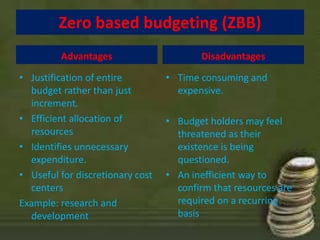

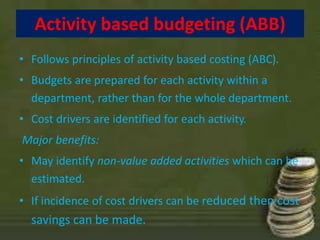

The document discusses four main forms of budgeting: incremental budgeting, zero-based budgeting, and activity-based budgeting. Incremental budgeting starts with the previous period's budget and makes incremental adjustments. It is quick and easy but may compound inefficiencies. Zero-based budgeting requires justifying all budget items annually. It efficiently allocates resources but is time-consuming. Activity-based budgeting budgets at the activity level based on cost drivers to identify non-value added activities and potential cost savings.