The document describes a pairs trading model and software implementation in three parts:

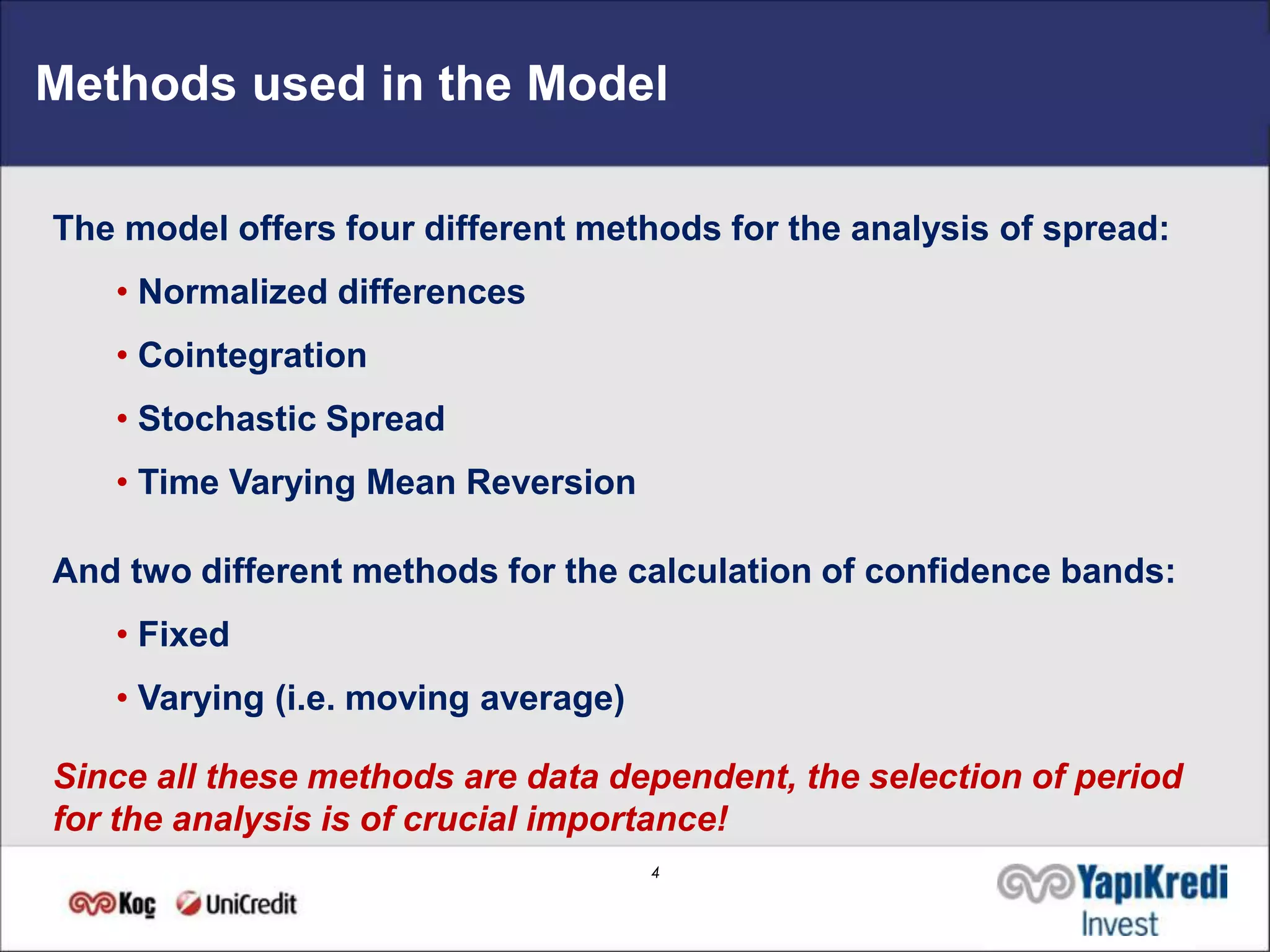

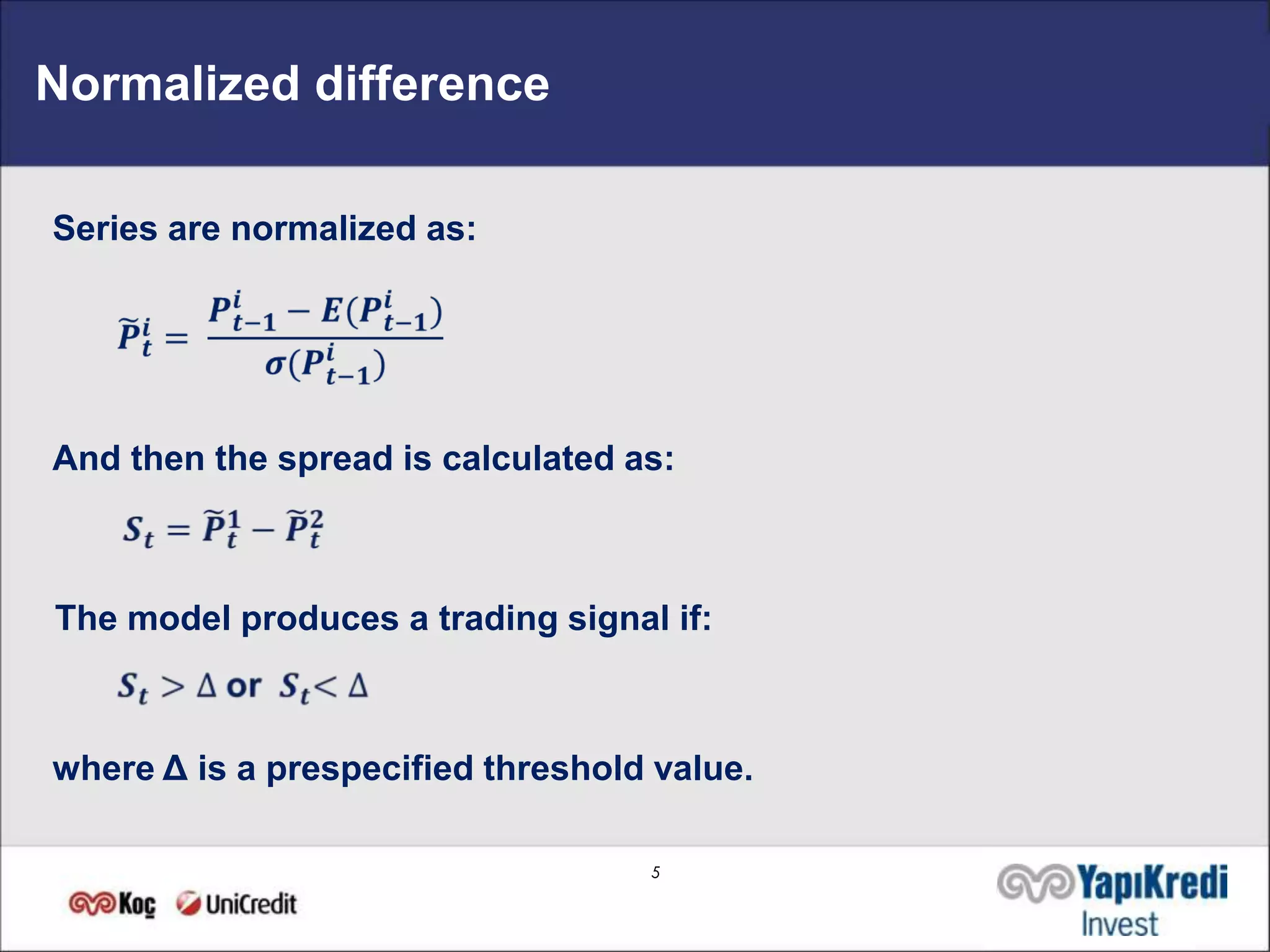

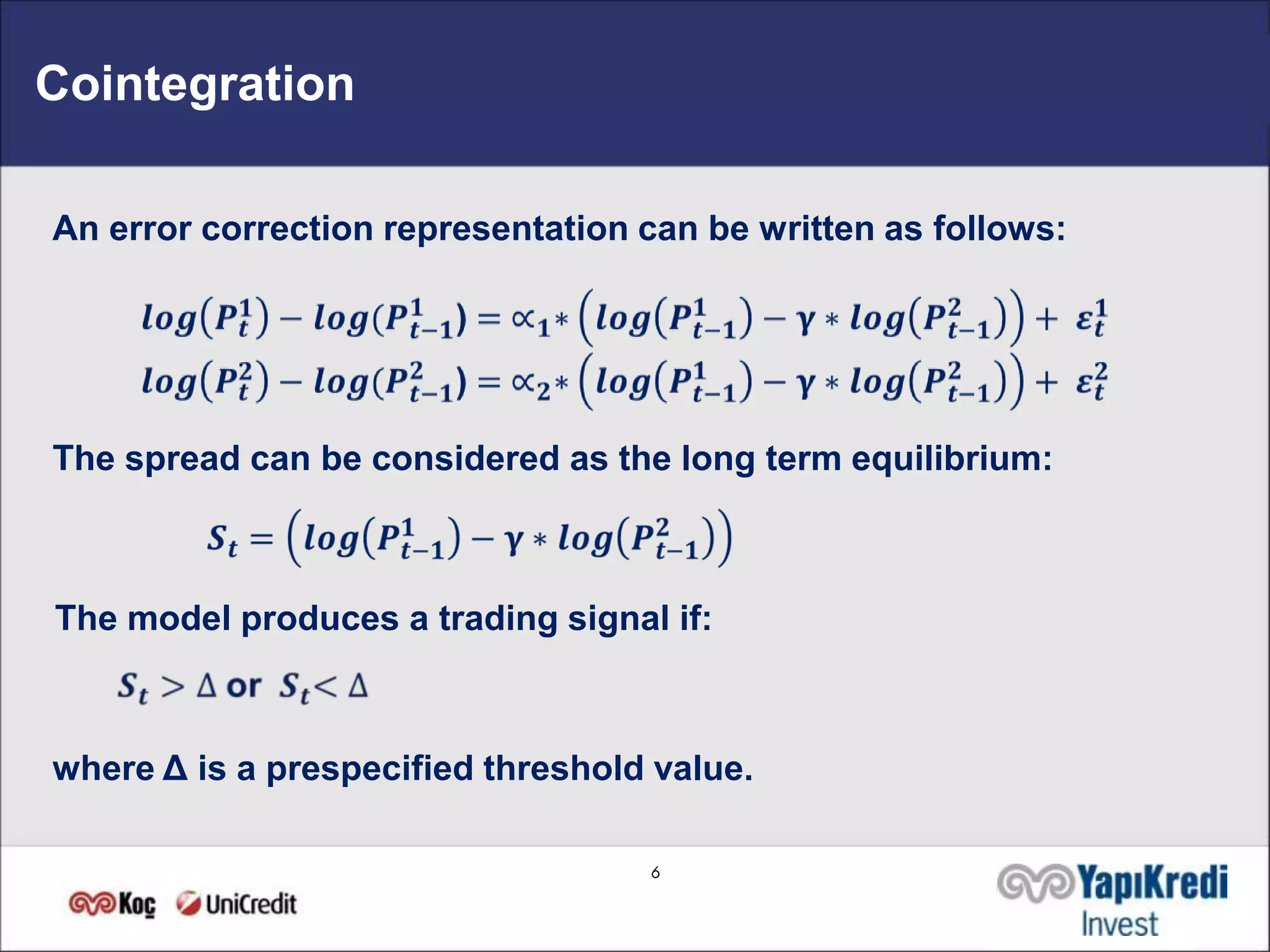

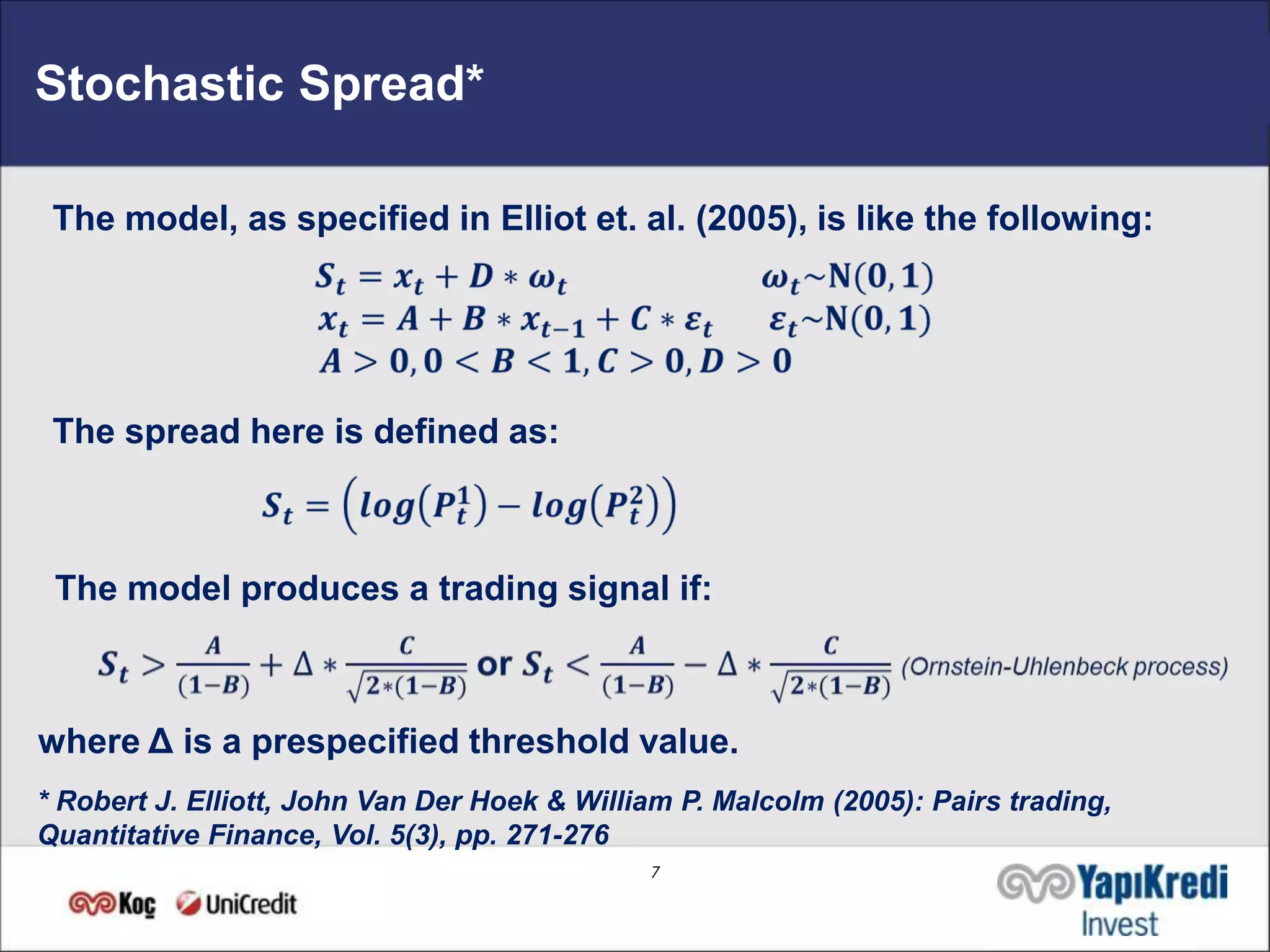

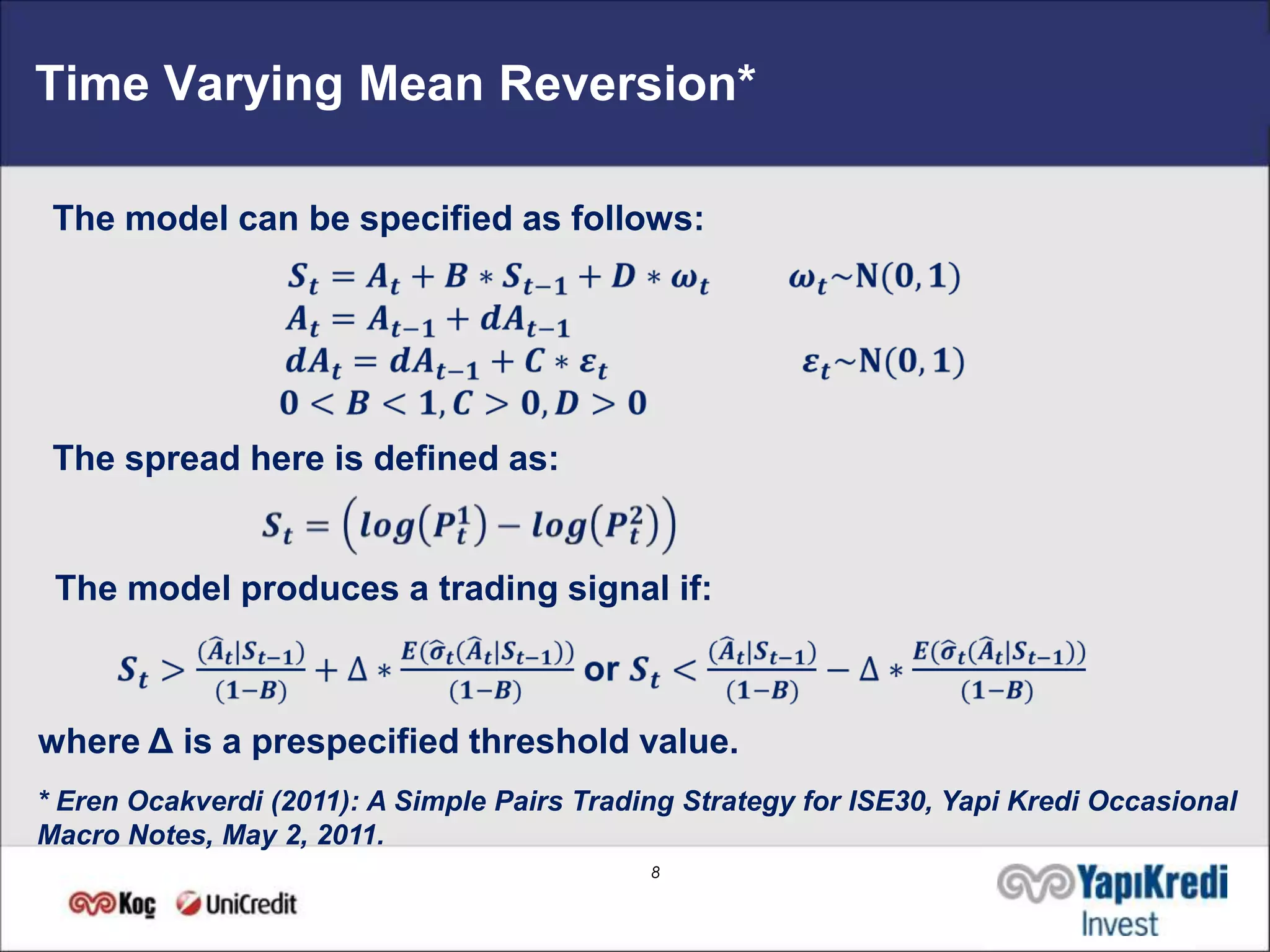

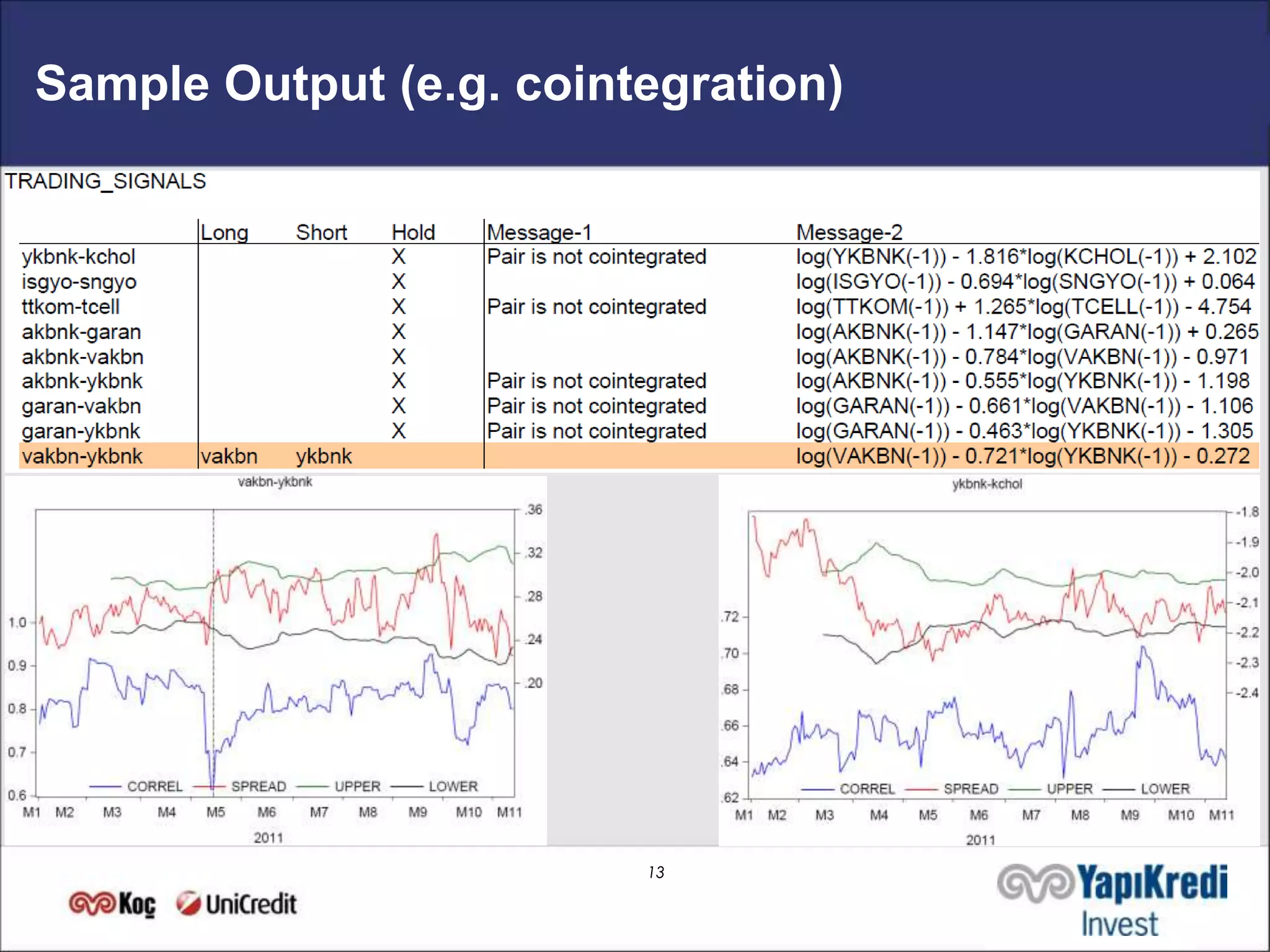

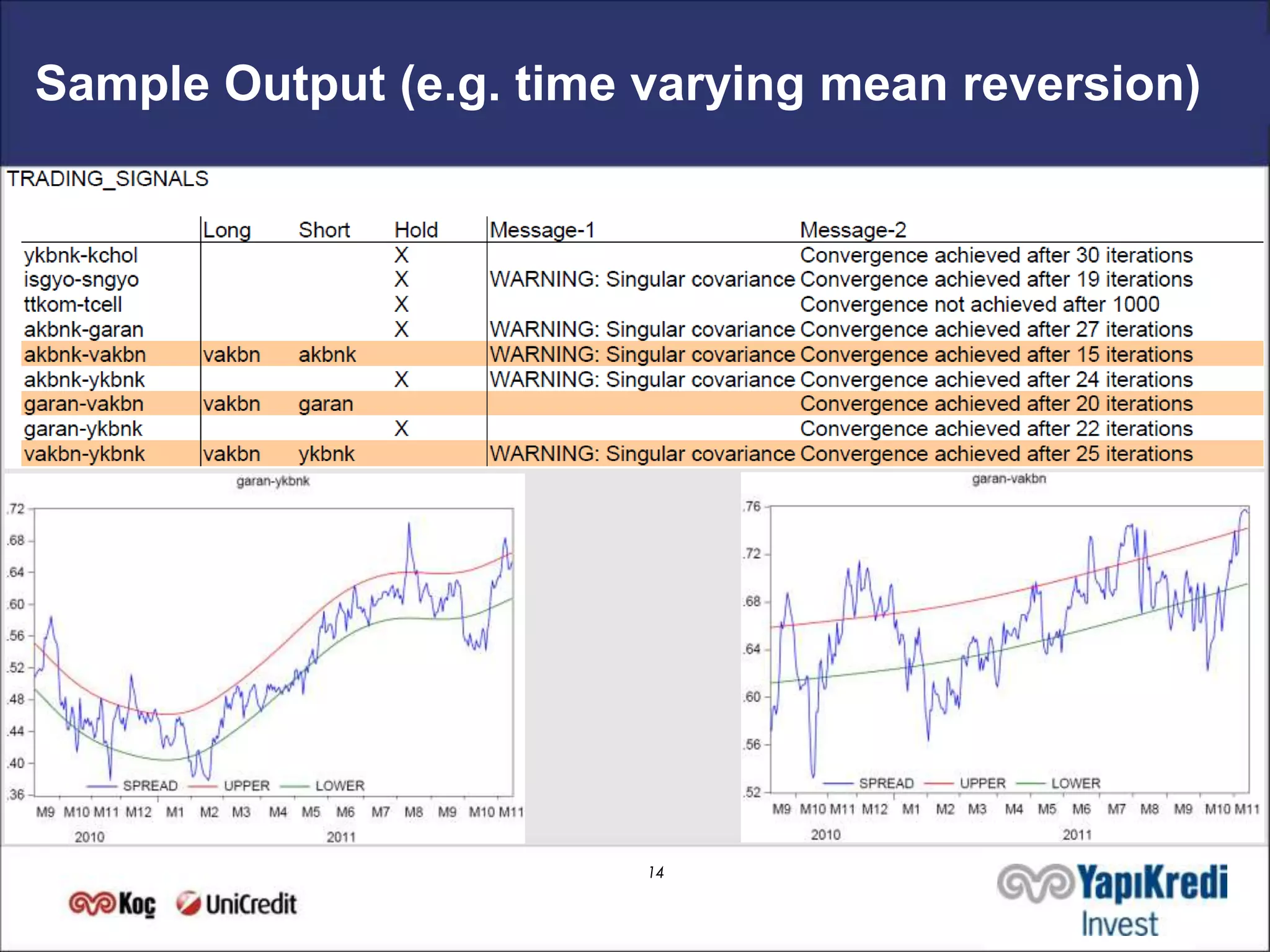

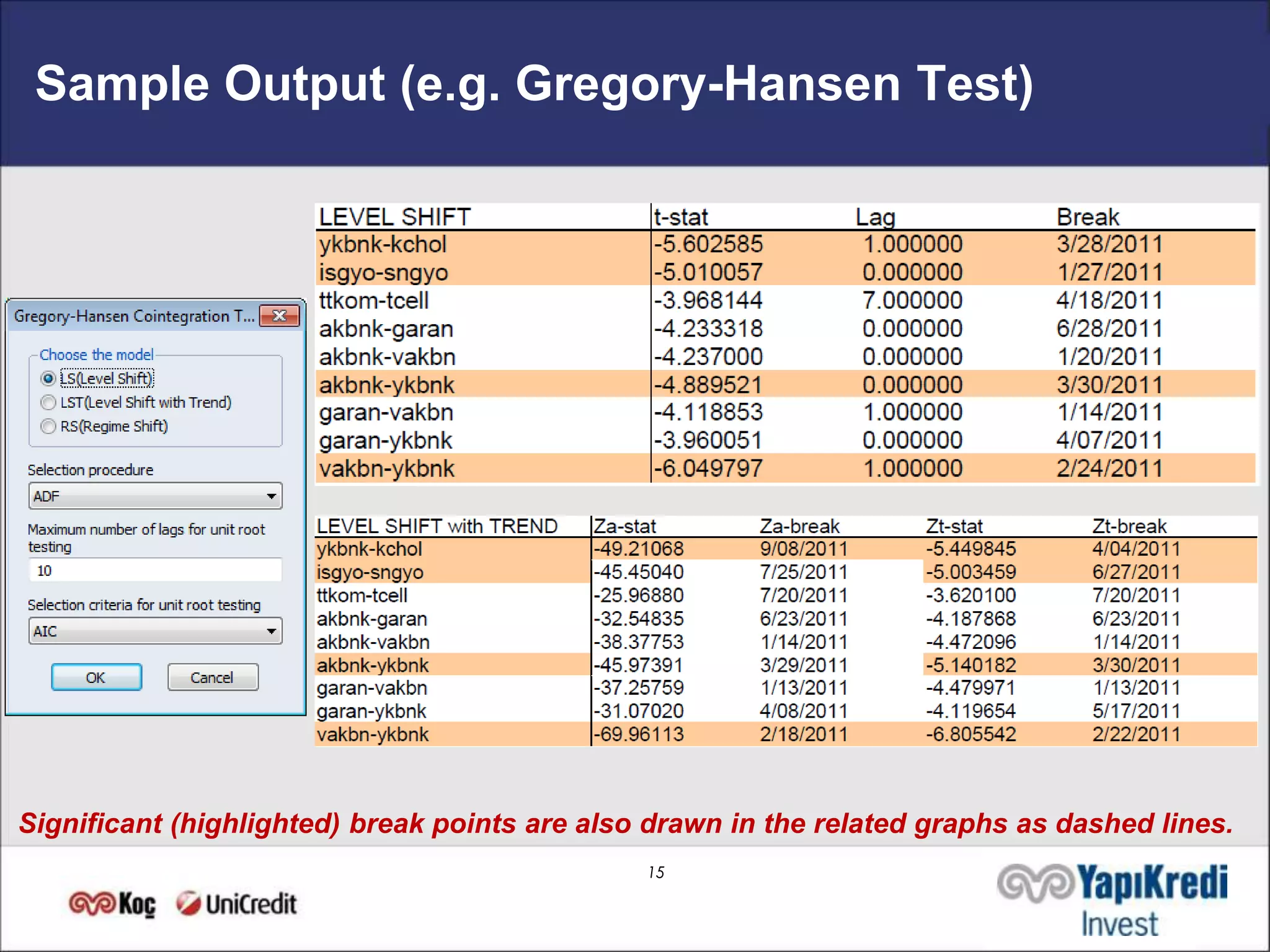

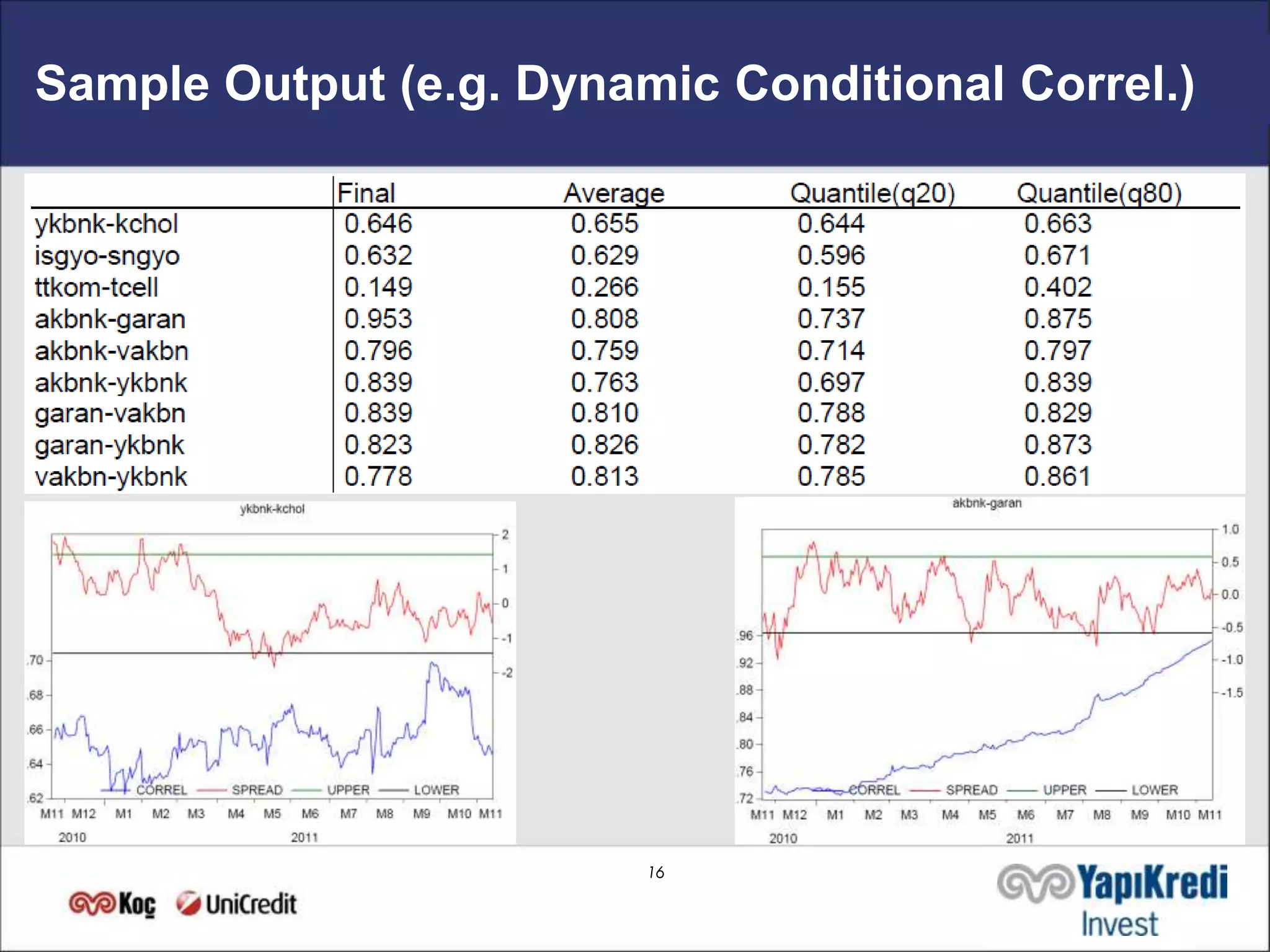

1. It outlines four mathematical methods - normalized differences, cointegration, stochastic spread, and time varying mean reversion - to analyze pair spreads and generate trading signals.

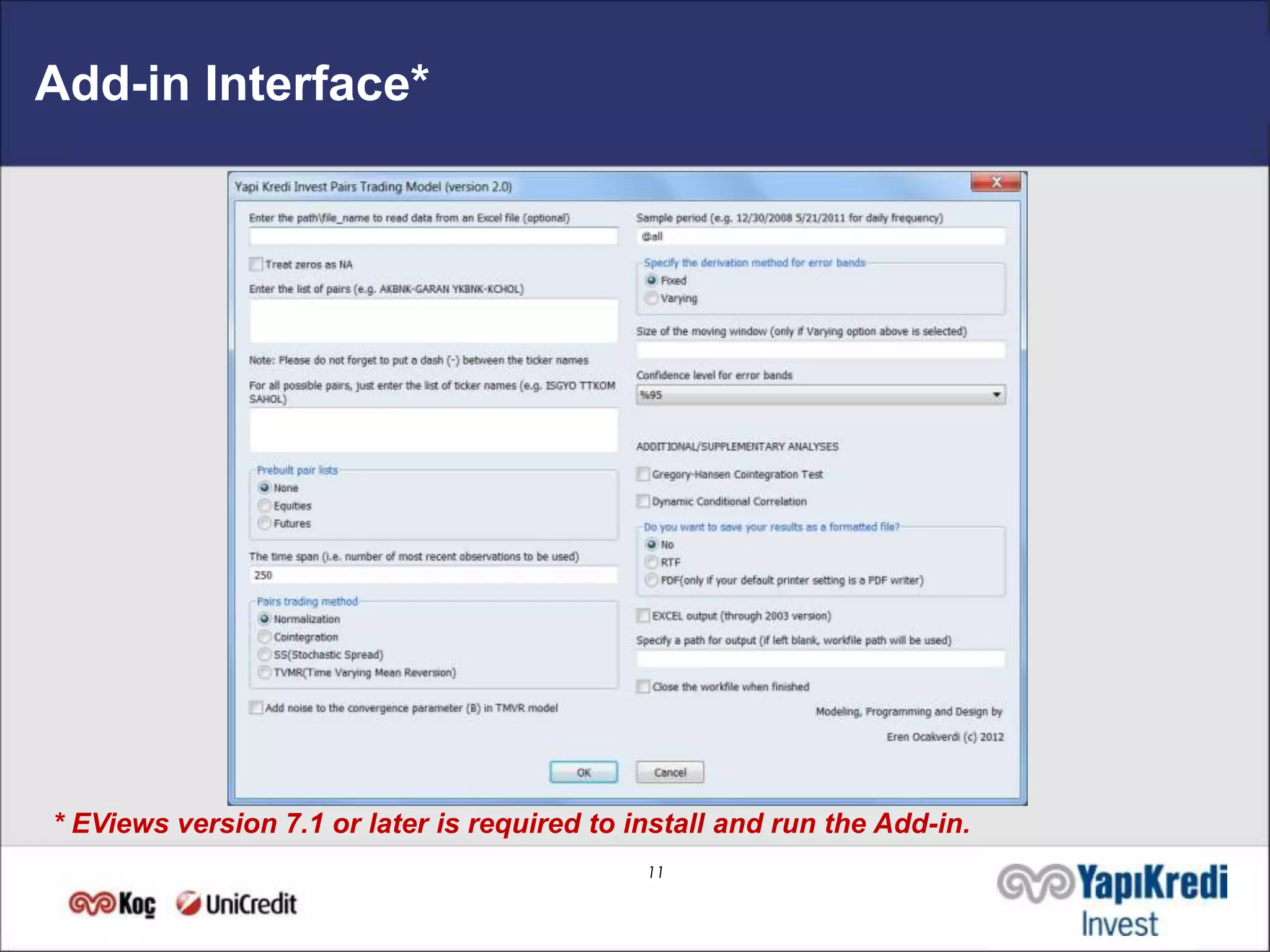

2. It discusses how the accompanying software add-in allows running the computationally intensive methods in EViews and producing summary outputs, charts, and test results.

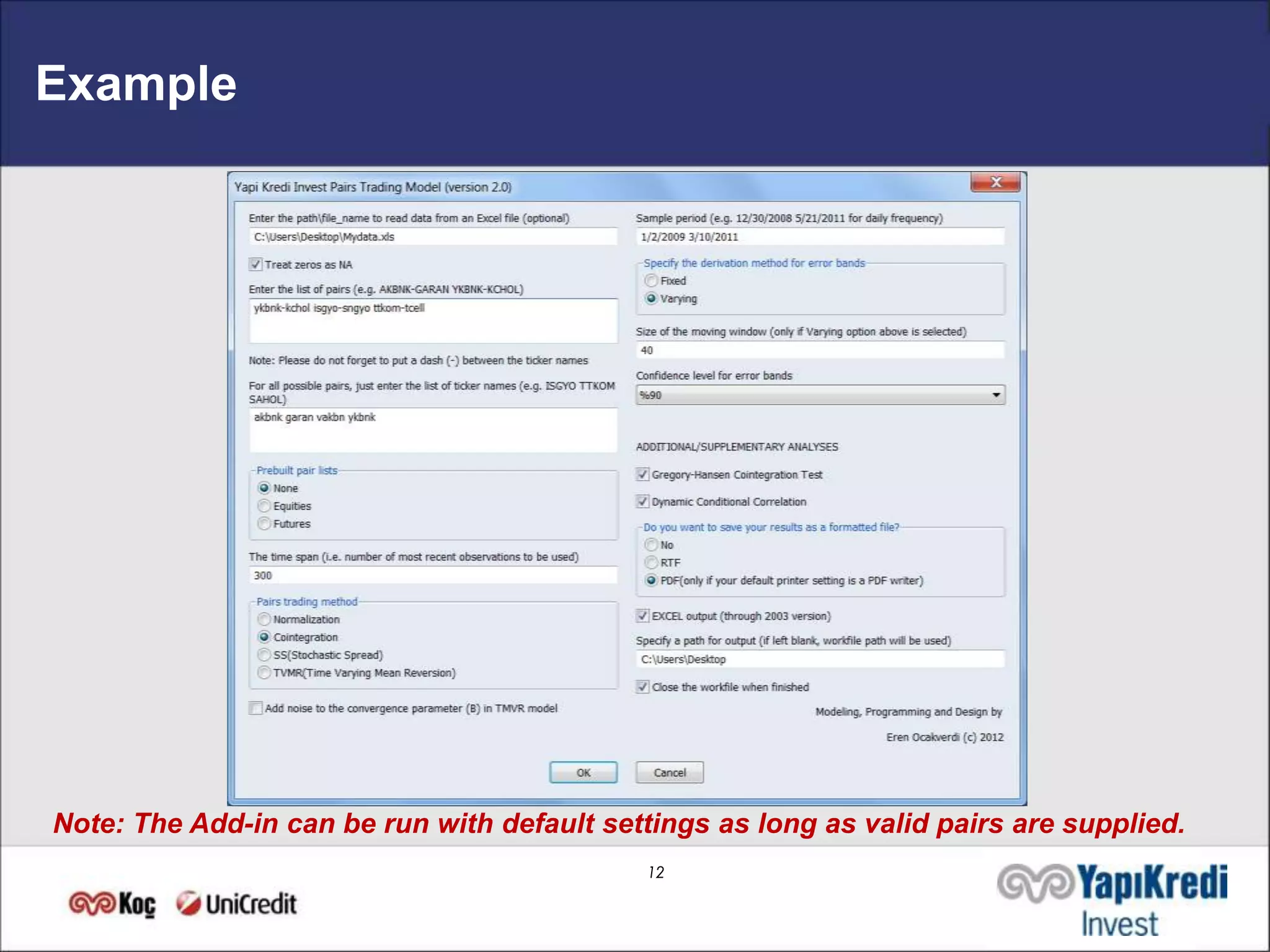

3. It provides examples of the add-in interface and sample trading signal and statistical output to demonstrate the model's application and usefulness for financial decision making despite some limitations.