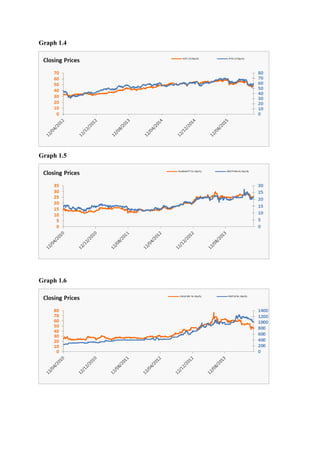

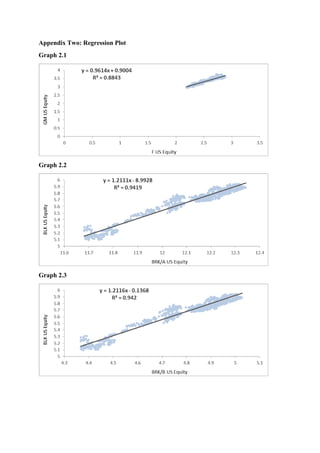

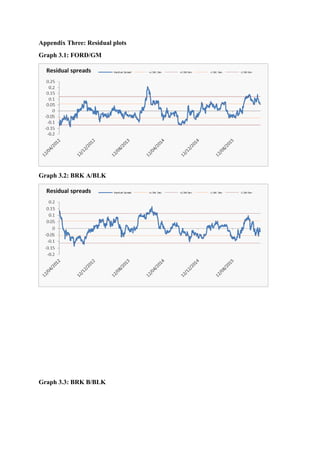

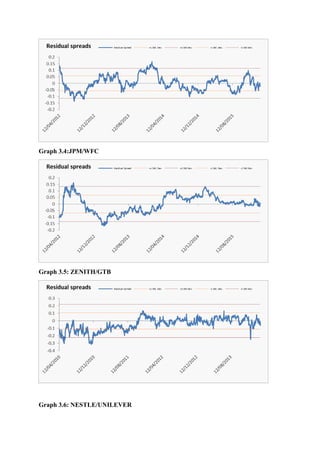

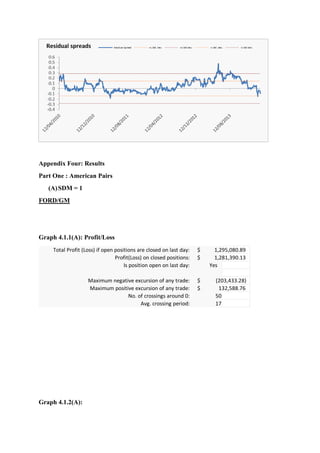

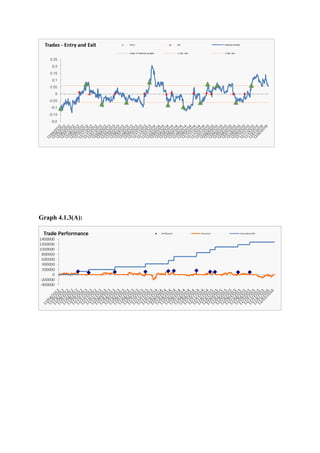

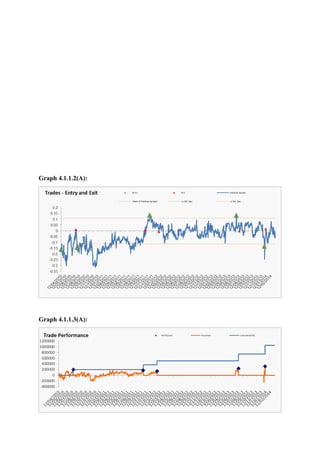

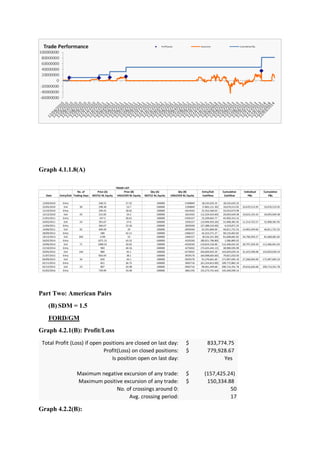

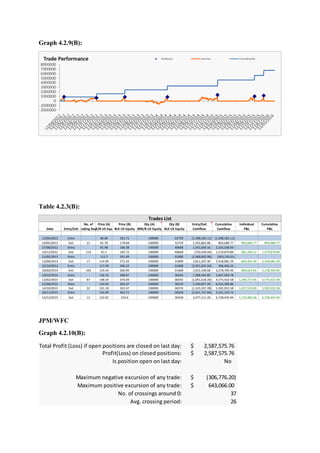

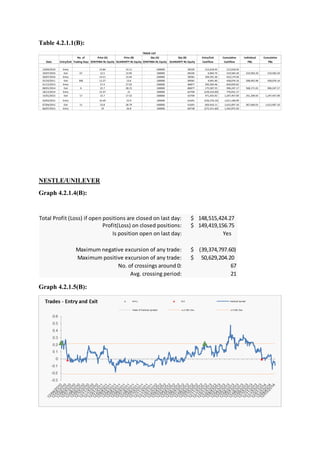

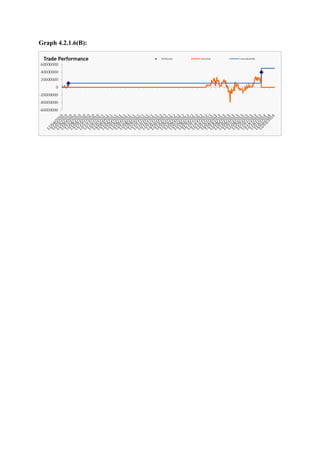

The document summarizes an investigation into pairs trading to profit from arbitrage opportunities. The author selects pairs of securities from the US and Nigerian markets, tests for cointegration using the Engle-Granger approach, and develops a pairs trading strategy based on the residual plot. Using standard deviation thresholds of 1.0 and 1.5, the strategy is applied to the selected pairs and performance is analyzed, finding profits from 109-809% for the Nigerian pairs and 45-106% for the US pairs. The author concludes pairs trading can be profitable in both advanced and developing markets but notes future research could incorporate transaction costs and more fully examine excursion effects.