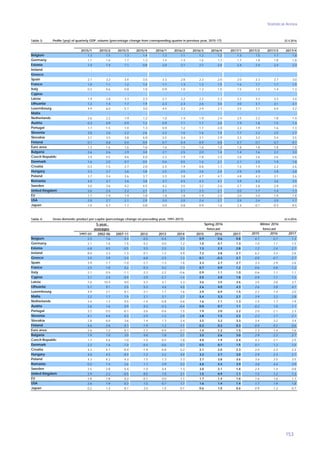

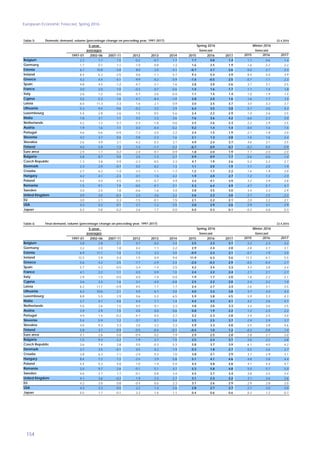

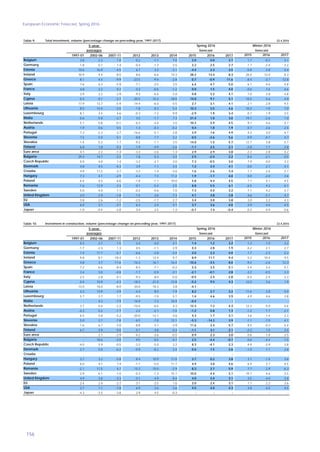

The European economy is projected to continue growing modestly over the forecast period, driven by domestic demand. Growth is expected to be supported by low oil prices, low interest rates, and a slightly expansionary fiscal stance. However, the boost from cheaper oil and the lagged effects of the weaker euro will fade. As a result, private consumption growth is expected to slow somewhat. Risks to the outlook remain high, mainly on the downside, including political uncertainty in Europe and globally. Economic policy needs to support growth while also standing ready to react to potential downside risks.