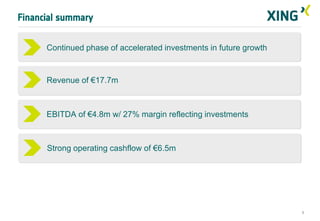

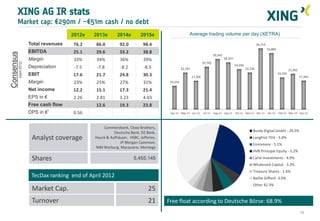

XING reported strong financial results for Q1 2012, in line with expectations. Key highlights included:

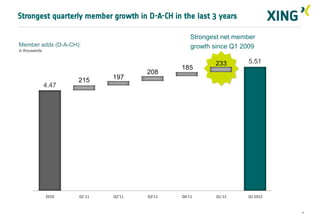

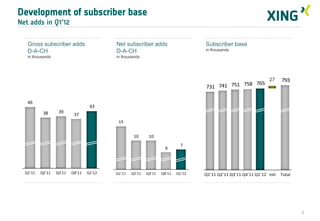

- Highest number of new members in the D-A-CH region in the last 12 quarters.

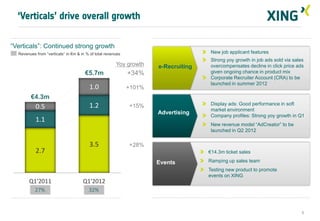

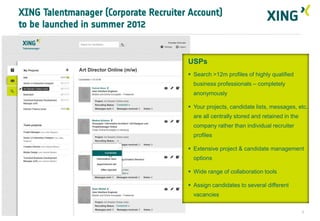

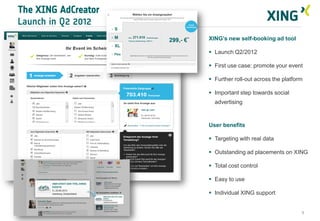

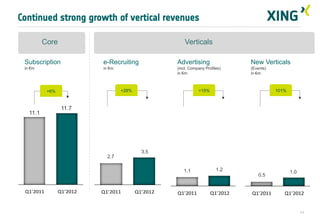

- Important new product launches planned for recruitment and advertising verticals.

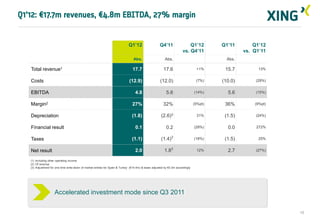

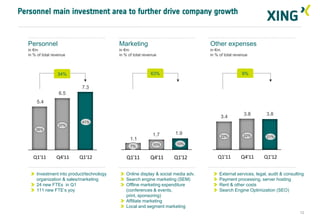

- Revenue of €17.7 million and EBITDA of €4.8 million, reflecting continued investments to drive future growth.

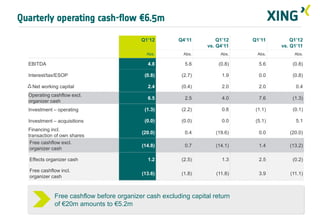

- Strong operating cash flow of €6.5 million despite accelerated investment phase since Q3 2011.