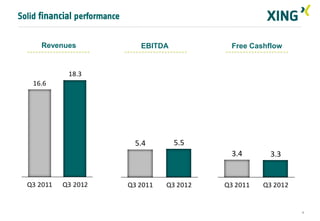

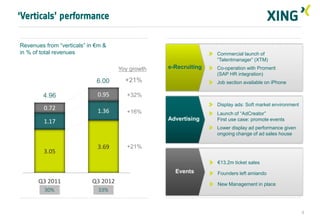

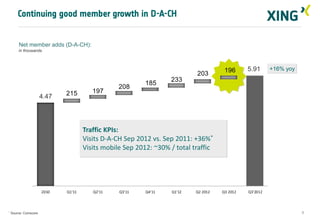

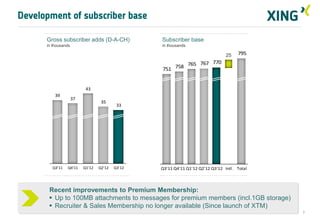

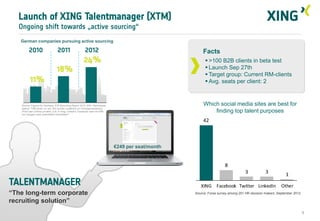

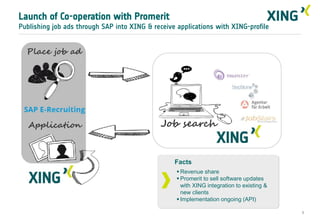

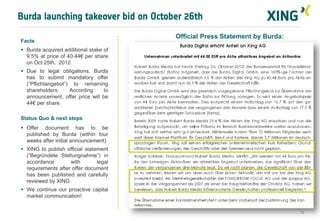

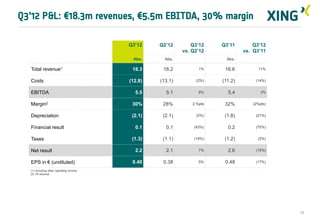

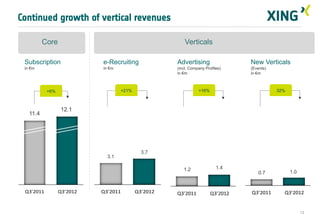

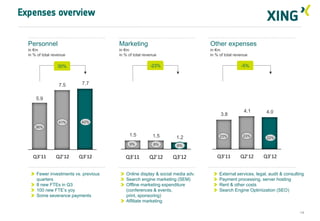

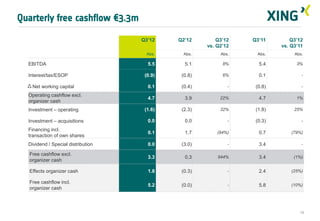

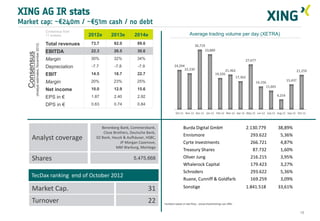

XING reported solid financial results for Q3 2012, with revenues of €18.3 million, up 11% year-over-year, and EBITDA of €5.5 million, resulting in a 30% EBITDA margin. Member growth in Germany, Austria and Switzerland continued with 196,000 net new members added in Q3. XING successfully launched new products and features including XING Talentmanager, integration with SAP HR systems through Promerit, and enhanced premium membership features. In October, Burda announced a takeover bid for XING at €44 per share, intending to maintain XING as a separately listed entity.