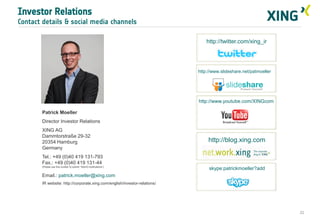

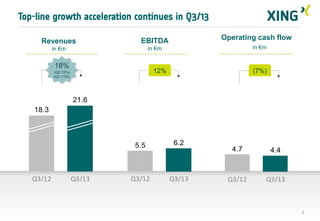

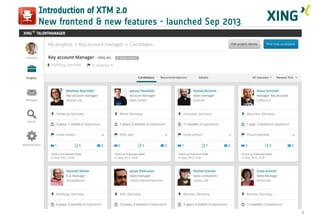

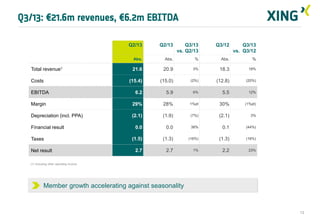

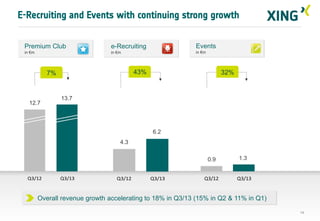

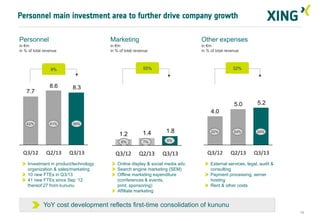

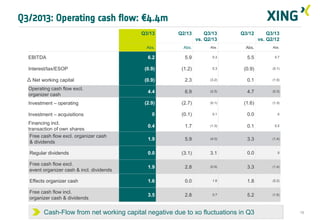

XING, the largest professional social network in German-speaking Europe, reported strong growth in members and revenues for Q3 2013. Member growth was the highest in the last 18 months, with 214,000 new members. Revenues grew 18% year-over-year to €21.6 million, driven by accelerating growth in e-recruiting, events, and premium memberships. EBITDA increased 12% to €6.2 million. The company launched new versions of its talent management platform and premium services, and saw positive customer feedback. XING remains on track to meet its full-year objectives.

![Strongest member growth during last 18 months

Lot of scope still available for further growth in D-A-CH

Member base [millions] & net adds [thousands]

~20m

6.72

184

196

205

211

214

5.28

Mobile traffic growing nicely.

38% of total traffic is mobile already.

June '12

Q3/12

Rounding differences are possible

Q4/12

Q1/13

Q2/13

Q3/13

Sep '13

Addressable market

in D-A-CH

3](https://image.slidesharecdn.com/xingagq32013-140116085041-phpapp02/85/XING-AG-Q3-2013-conference-call-presentation-3-320.jpg)

![Paying subscriber base growing

Paying member base & net adds in D-A-CH

[thousands]

829

805

4

15

3

767

13

4

New pricing effective since June 2013

3-month membership: €9.95 p.m. (+€2)

12-month membership: €7.95 p.m. (+€1)

June '12

Q3/12

Rounding differences are possible

Q4/12

Q1/13

Q2/13

Q3/13

Sep '13

Worldwide

4](https://image.slidesharecdn.com/xingagq32013-140116085041-phpapp02/85/XING-AG-Q3-2013-conference-call-presentation-4-320.jpg)

![Negative invested capital from shareholders’ perspective

in €m

[Excl. event organizer cash and NWC]

As of Sep

2013

Abs.

Assets

107.1

Operating assets

26.9

Acquisitions / international

Operating assets

€26.9m

Deferred income

(€30.2m)

Liabilities

(€15.1m)

Invested capital

w/o cash

(€18.4m)

16.3

TAX A/R

Cash

Equity/Liabilities

1.3

62.6

107.1

Equity

58.3

Deferred income

30.2

Liabilities

15.1

Tax liabilities

3.5

Other

0.0

18](https://image.slidesharecdn.com/xingagq32013-140116085041-phpapp02/85/XING-AG-Q3-2013-conference-call-presentation-18-320.jpg)

![XING AG IR stats

Market cap: ~€440m / >€60m cash / no debt

Consensus

(Analyst estimates as of November, 2013)

Consensus from

9 brokers

2013e

2014e

Total revenues

82.7

93.2

102.1

EBITDA

23.9

29.9

35.5

Margin

29%

32%

35%

Depreciation

-8.4

-8.6

-8.5

EBIT

15.5

21.3

Average trading volume per day (XETRA)

2015e

27.0

Margin

19%

23%

10.9

15.0

1.98

2.72

0.70

0.87

12

12

10

1.33

9

7

7

7

3.48

DPS in €

15

19.3

EPS in €

20

26%

Net income

[in thousand]

21

Analyst coverage

6

4

Oct-12

Berenberg Bank, Commerzbank,

Close Brothers, Deutsche Bank,

Hauck & Aufhäuser,

JP Morgan Cazenove,

MM Warburg, Montega

Shares

Dec - 12

3

Feb-13

Jun-13

Aug-13

TecDax ranking end of Oct 2013

2,922,244

Deutsche Asset &

Wealth Management

358,800

6.42%

Ennismore

277,848

4.97%

282,421

5.05%

37,832

0.68%

1,712,992

30.63%

Treasury Shares

Market Cap.

27

Turnover

30

Oct-13

52.26%

Schroders

5,592,137

Burda Digital GmbH

Apr-13

Sonstige

Numbers based on last filing – actual shareholdings can differ

20](https://image.slidesharecdn.com/xingagq32013-140116085041-phpapp02/85/XING-AG-Q3-2013-conference-call-presentation-20-320.jpg)