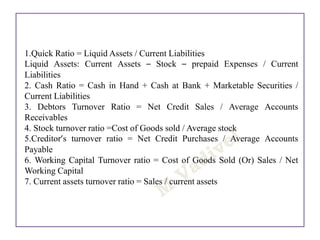

This document discusses working capital management. It defines working capital management as activities to ensure a company has sufficient resources to cover day-to-day operating expenses while keeping resources invested productively. It explains that working capital is the difference between current assets and current liabilities. Current assets include cash, accounts receivable, and inventory, while current liabilities include accounts payable, short-term debt, and accrued expenses. Ensuring adequate working capital protects a company's ability to operate as a going concern. The document then discusses managing liquidity, accounts receivable, inventory, short-term debt, accounts payable, and various working capital ratios.