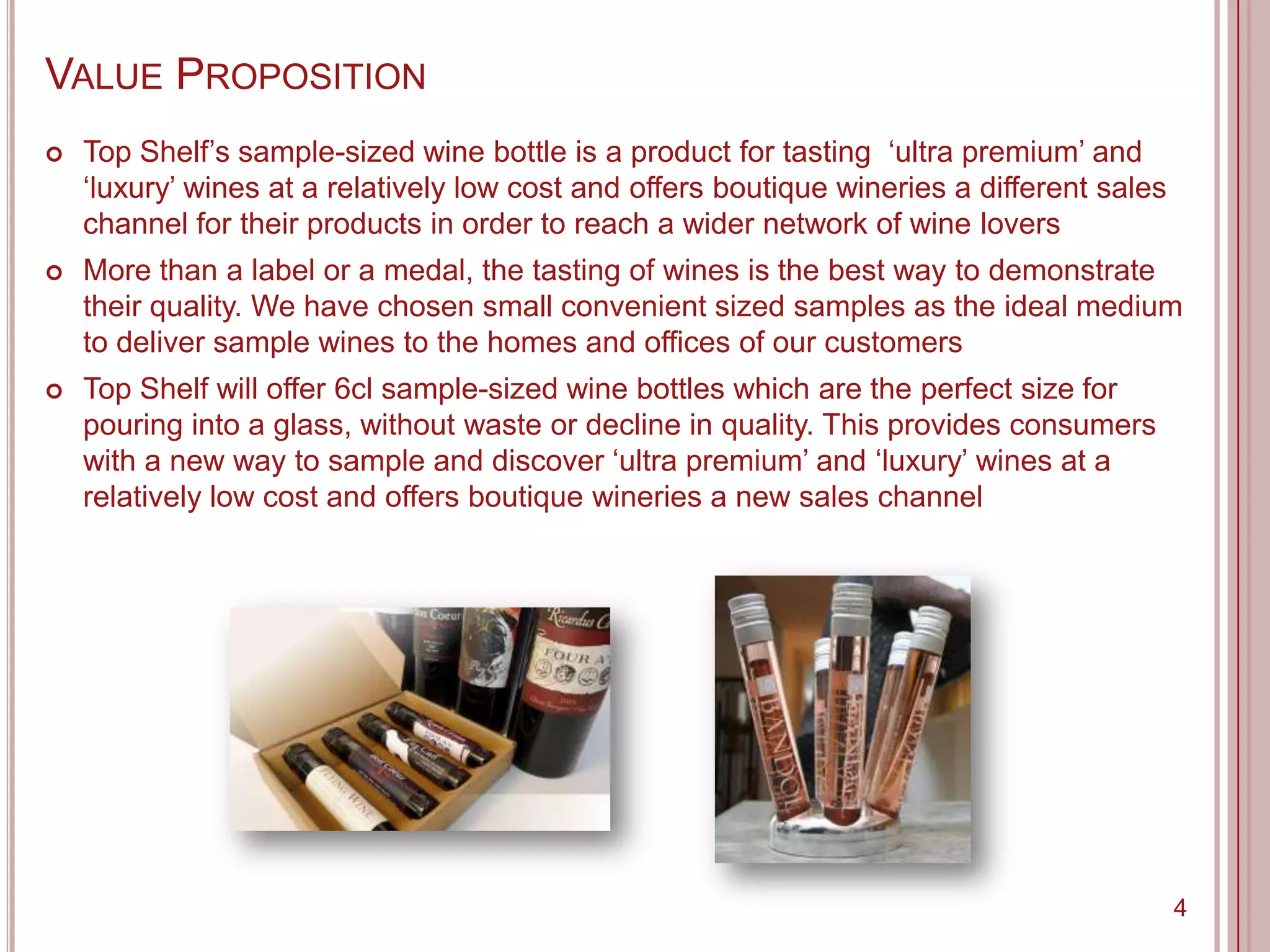

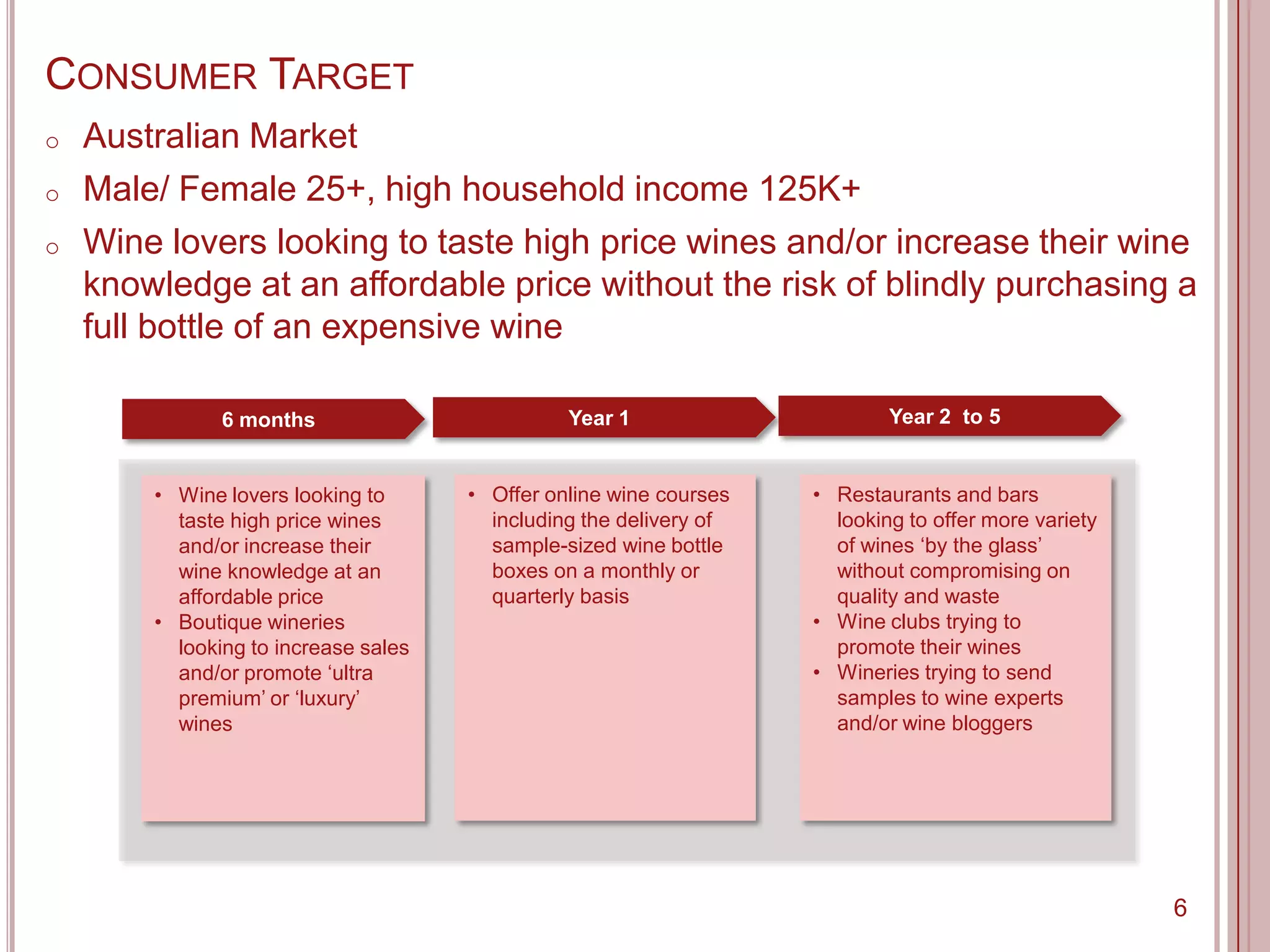

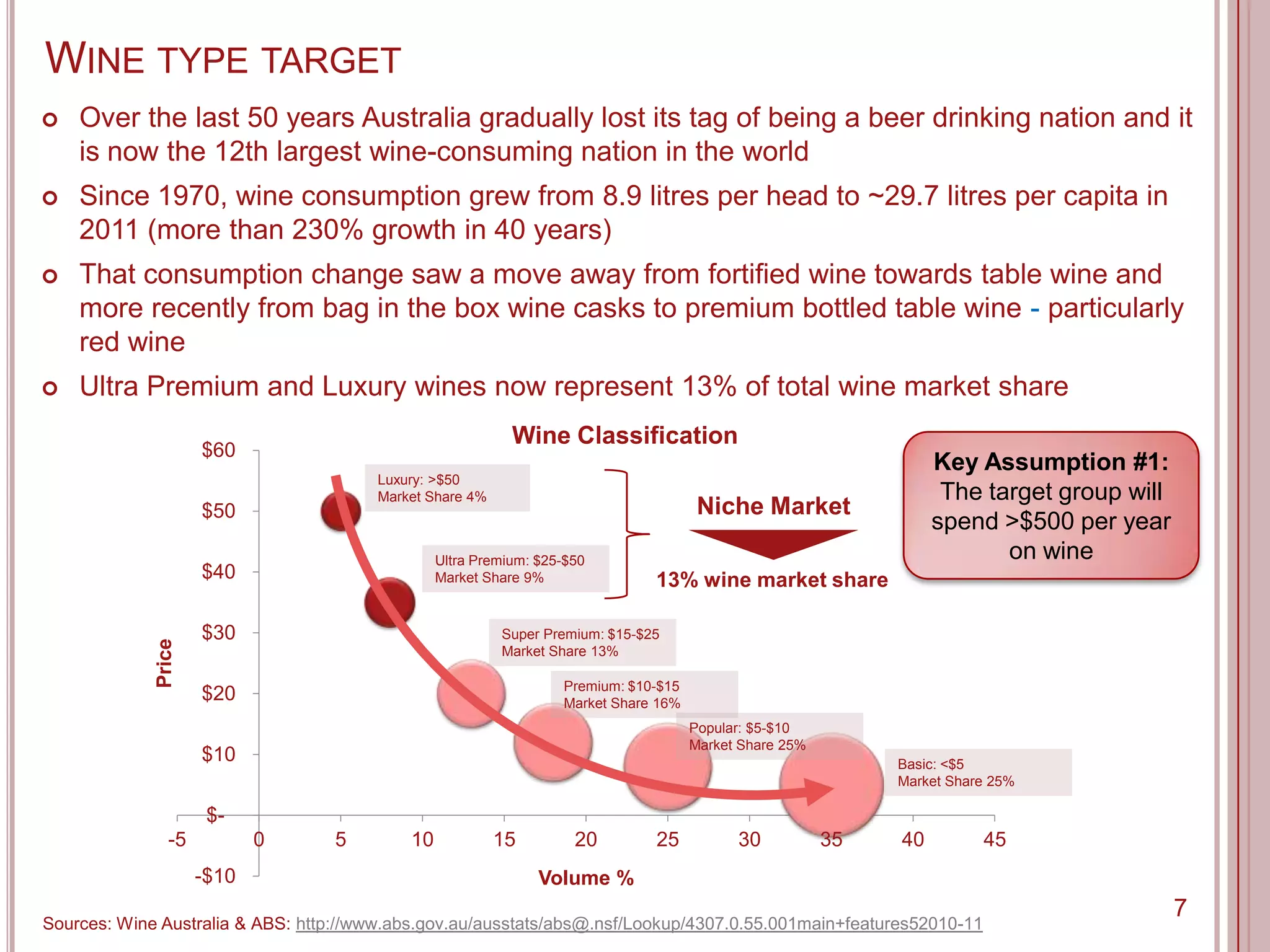

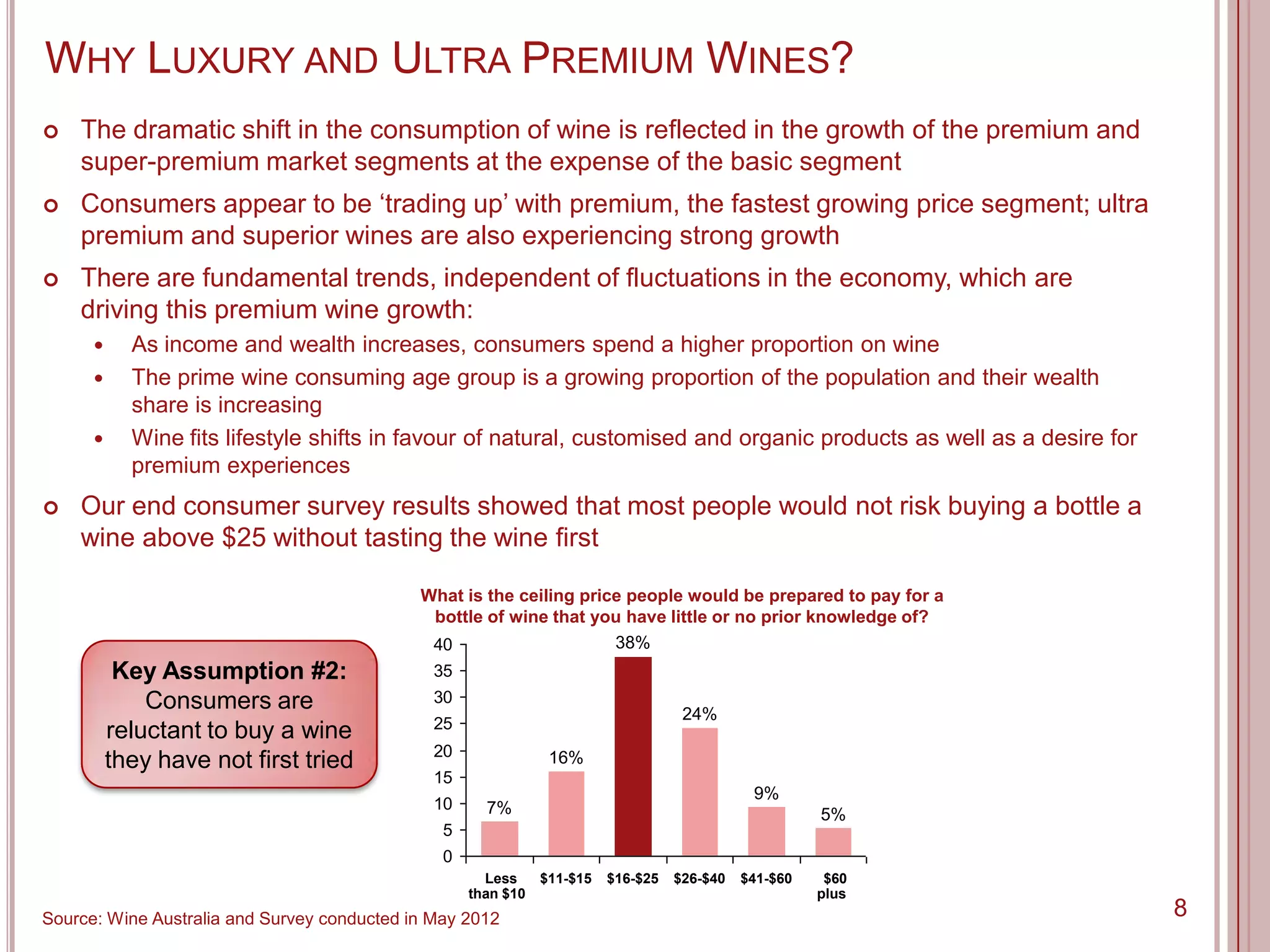

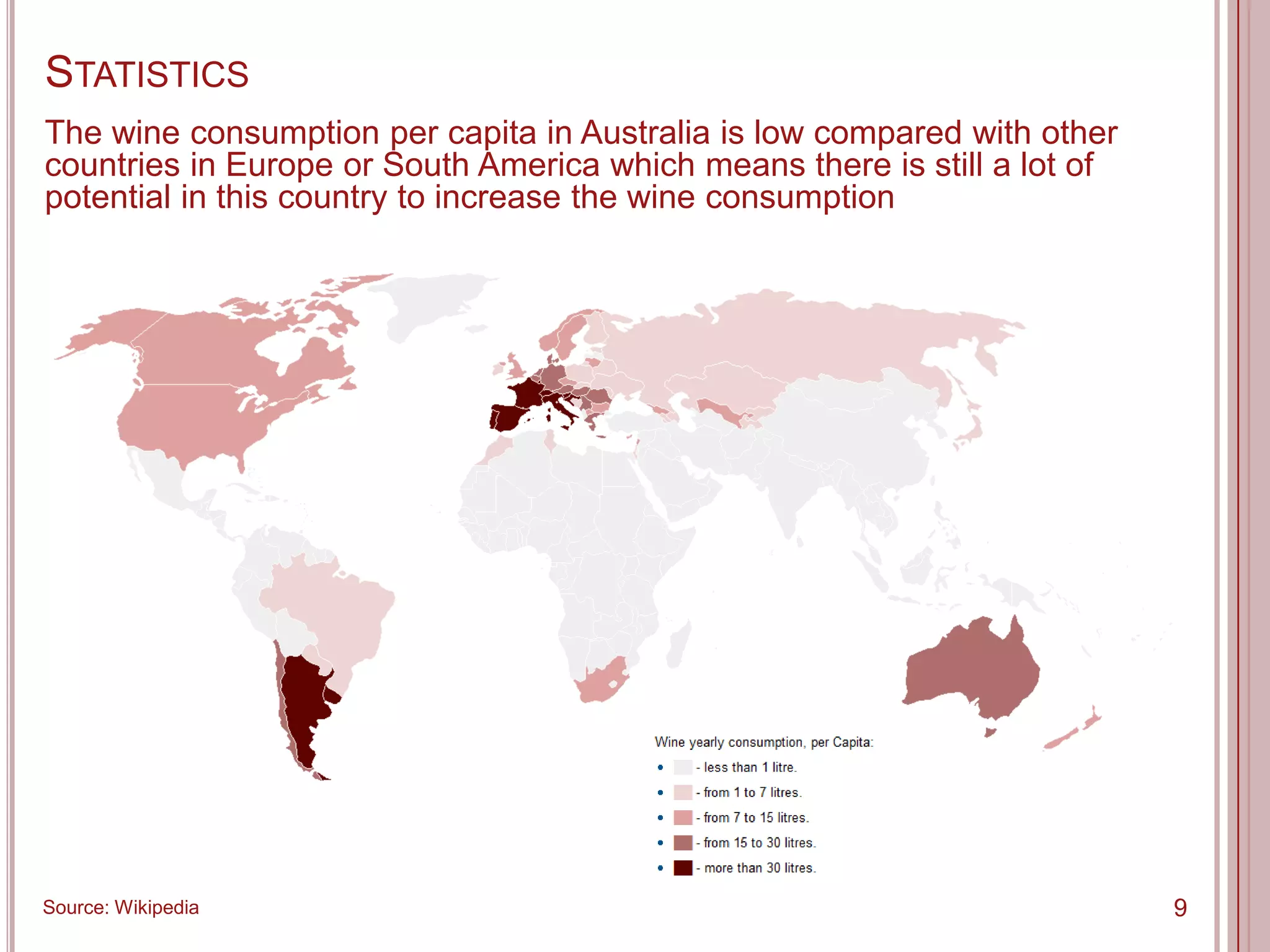

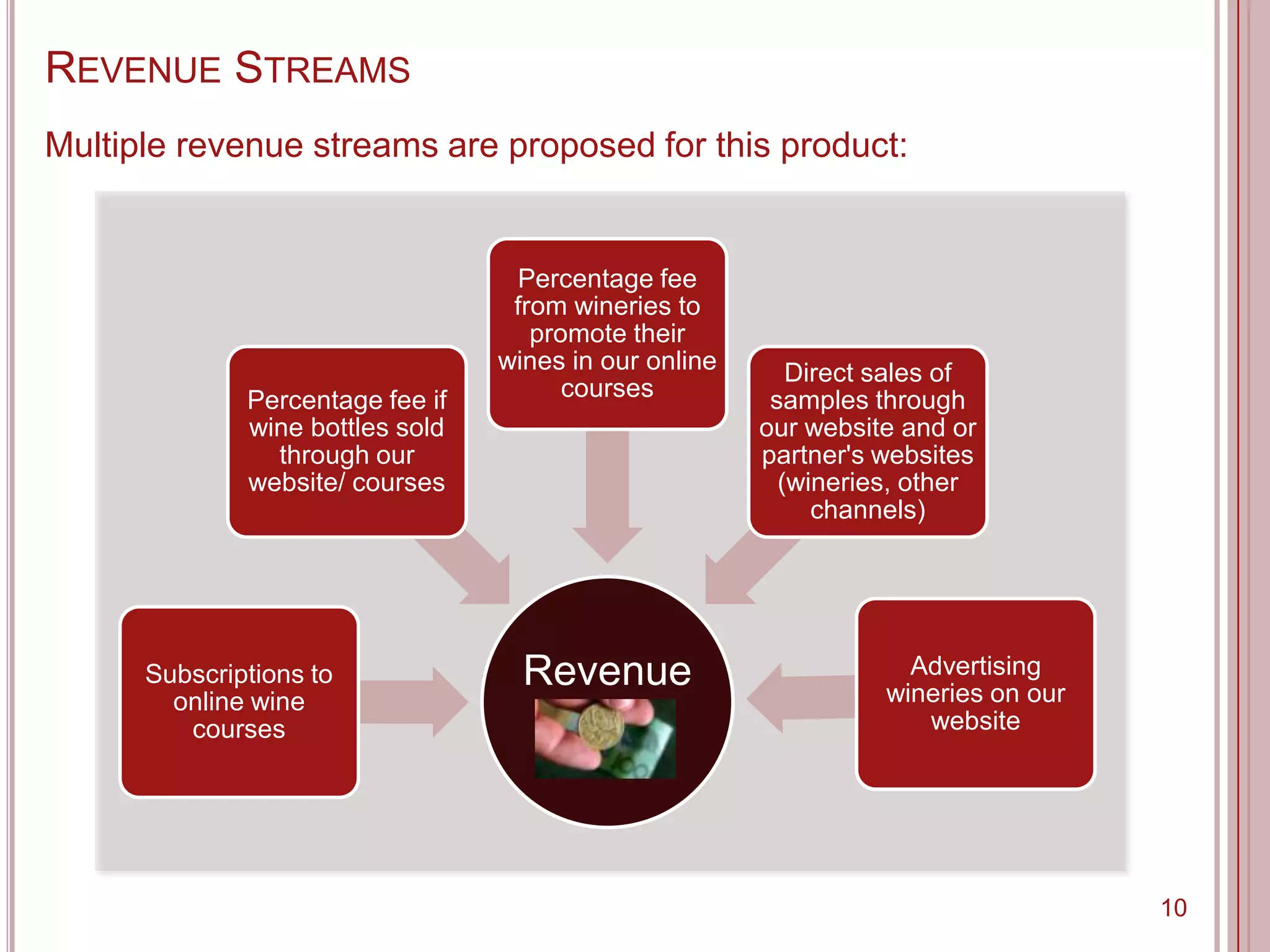

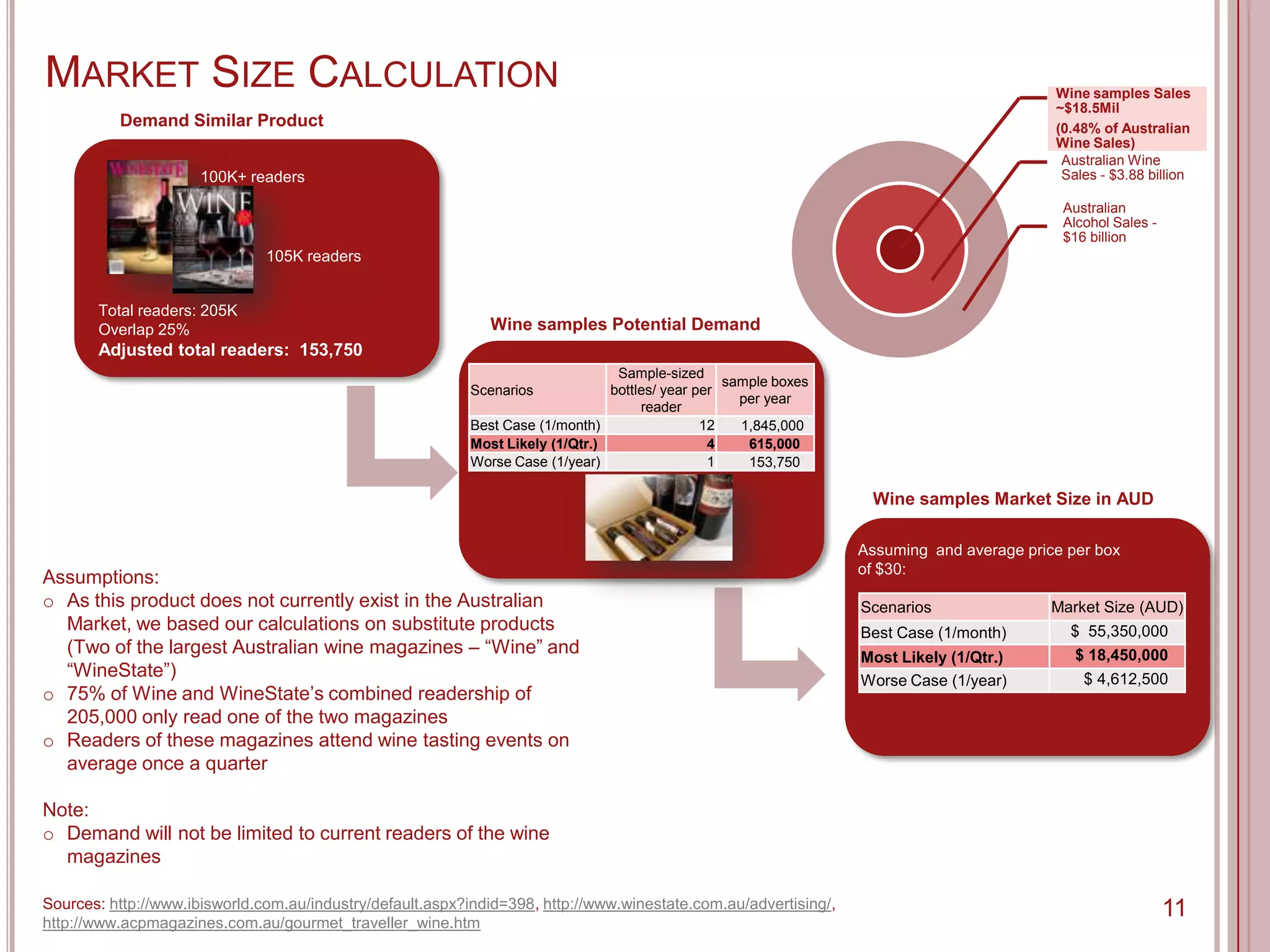

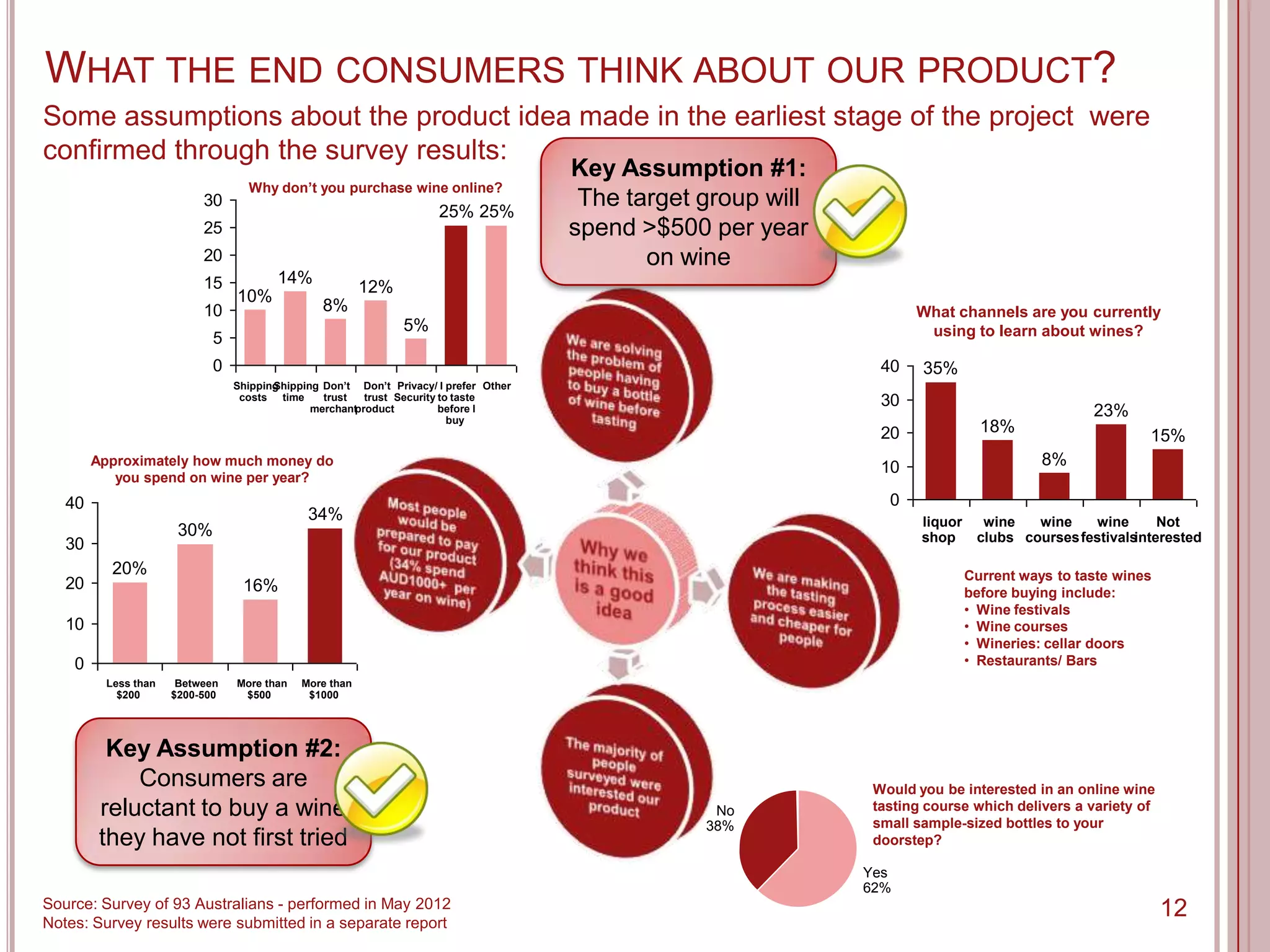

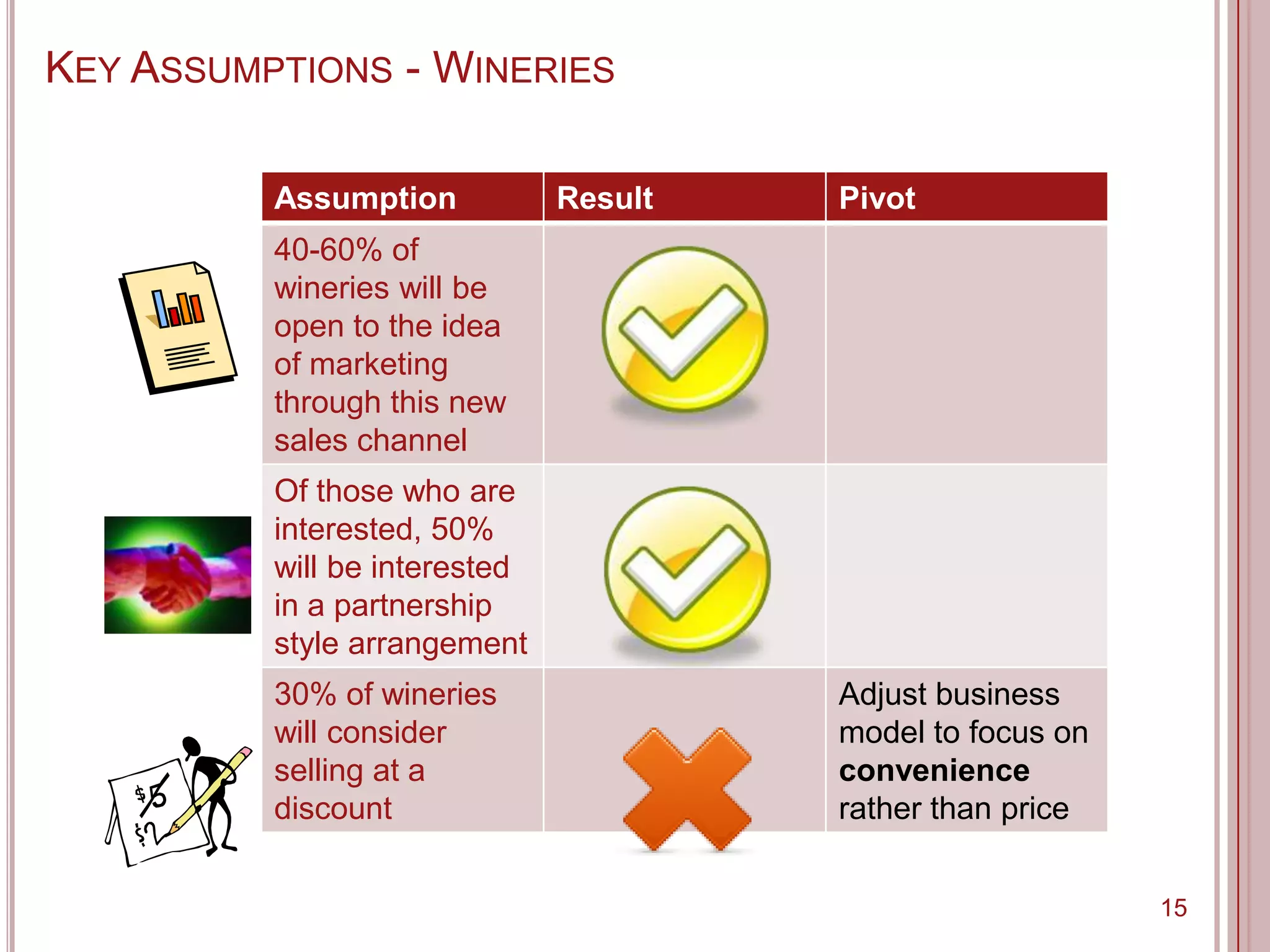

The document summarizes market validation research for a business selling small sample-sized wine bottles in Australia. Survey results found consumers were open to trying new wines in small samples and spending over $500 annually on wine. While wineries were generally supportive, some had concerns about branding control. The market size for sample wines was estimated at $18.5 million annually based on wine magazine readership and consumption habits. Next steps proposed adjusting the business model, conducting a pilot program with initial wineries, and preparing full business plans.