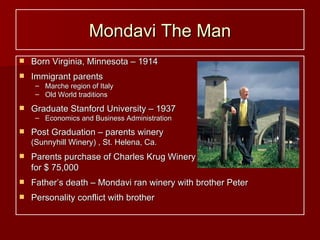

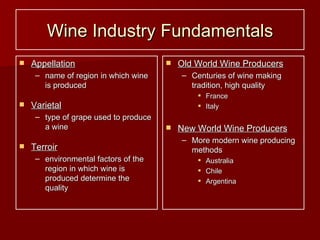

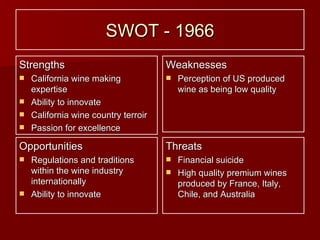

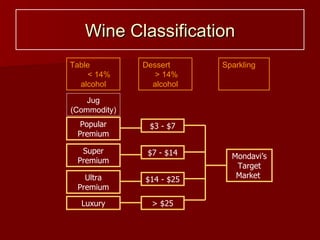

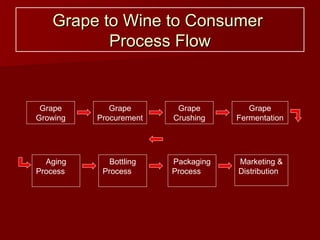

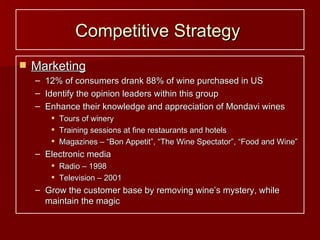

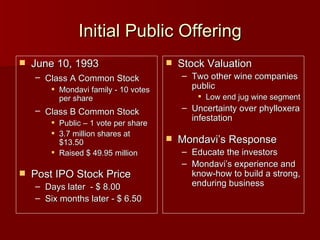

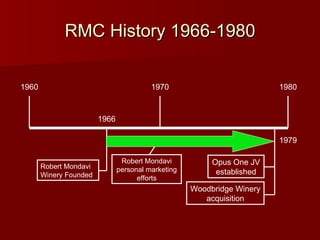

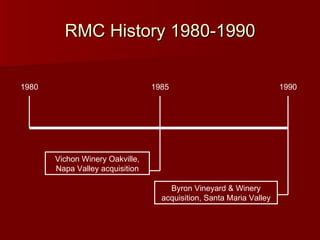

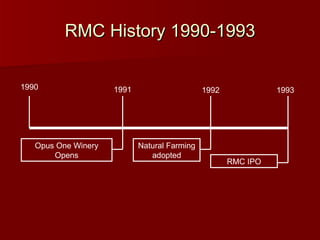

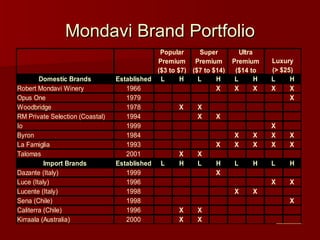

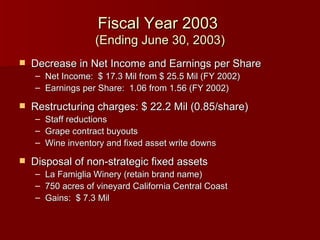

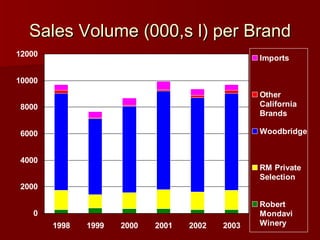

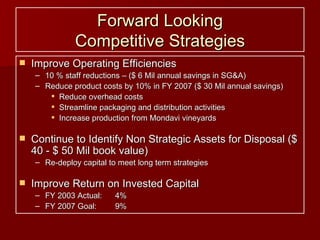

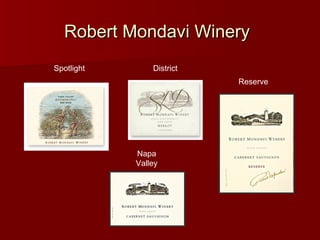

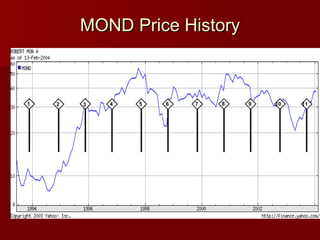

The document summarizes the 2003 annual shareholders meeting of Robert Mondavi Company. It discusses Mondavi's vision and history, competitive strategies, brand portfolio, financial report, and future outlook. Key points included global partnerships, innovations in grape growing and winemaking, diversifying the brand portfolio, and goals to improve operating efficiencies and returns.