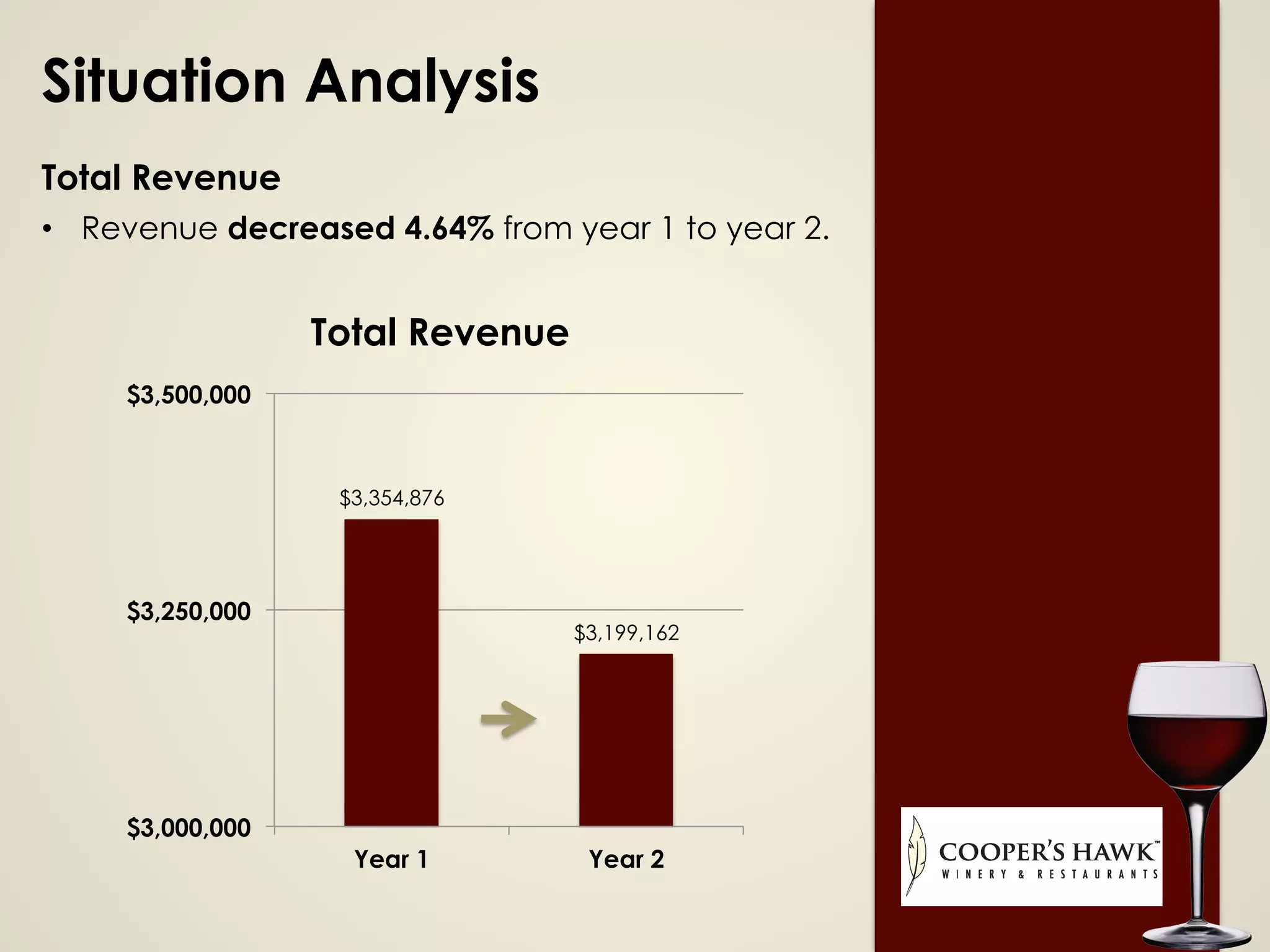

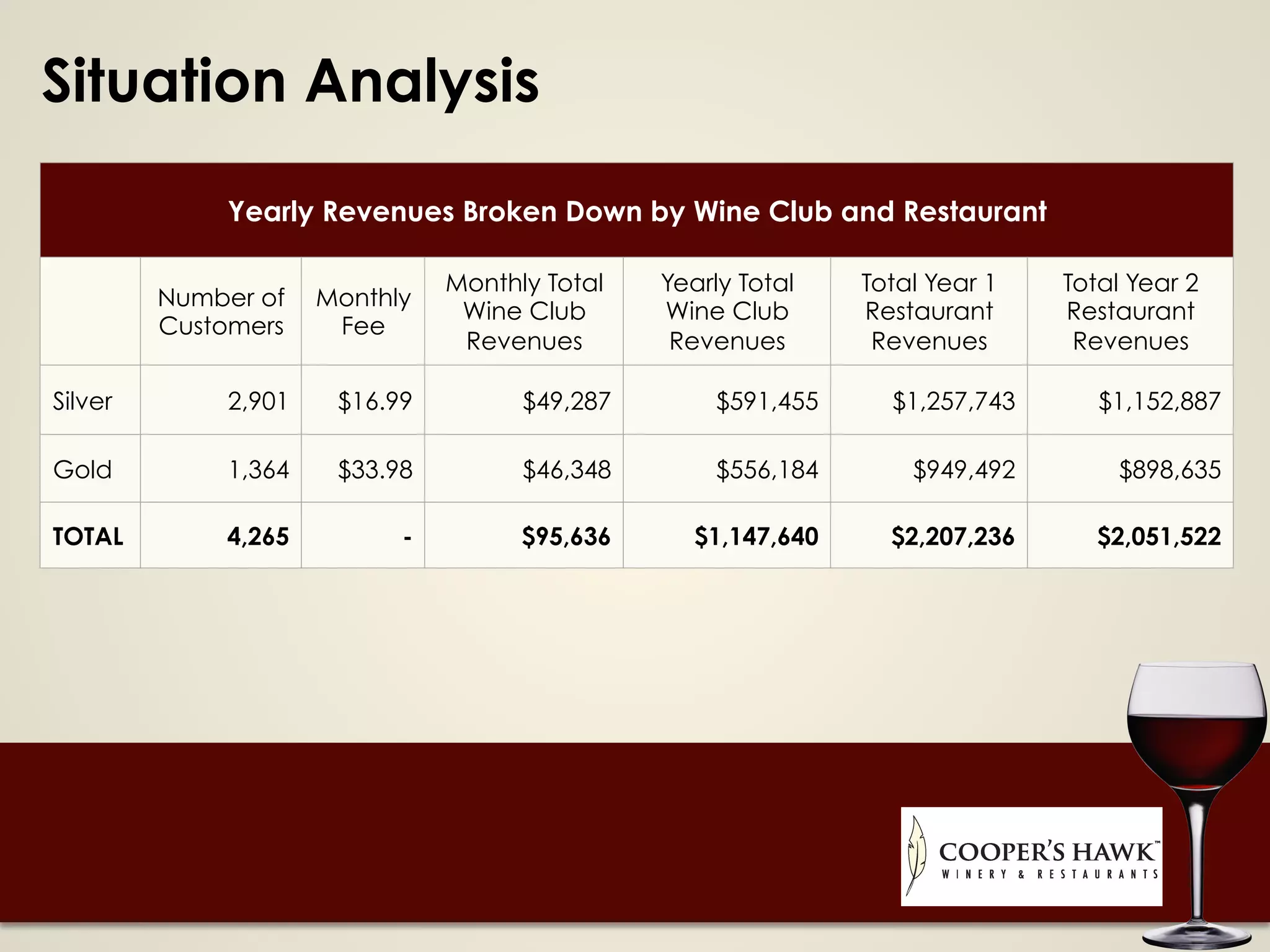

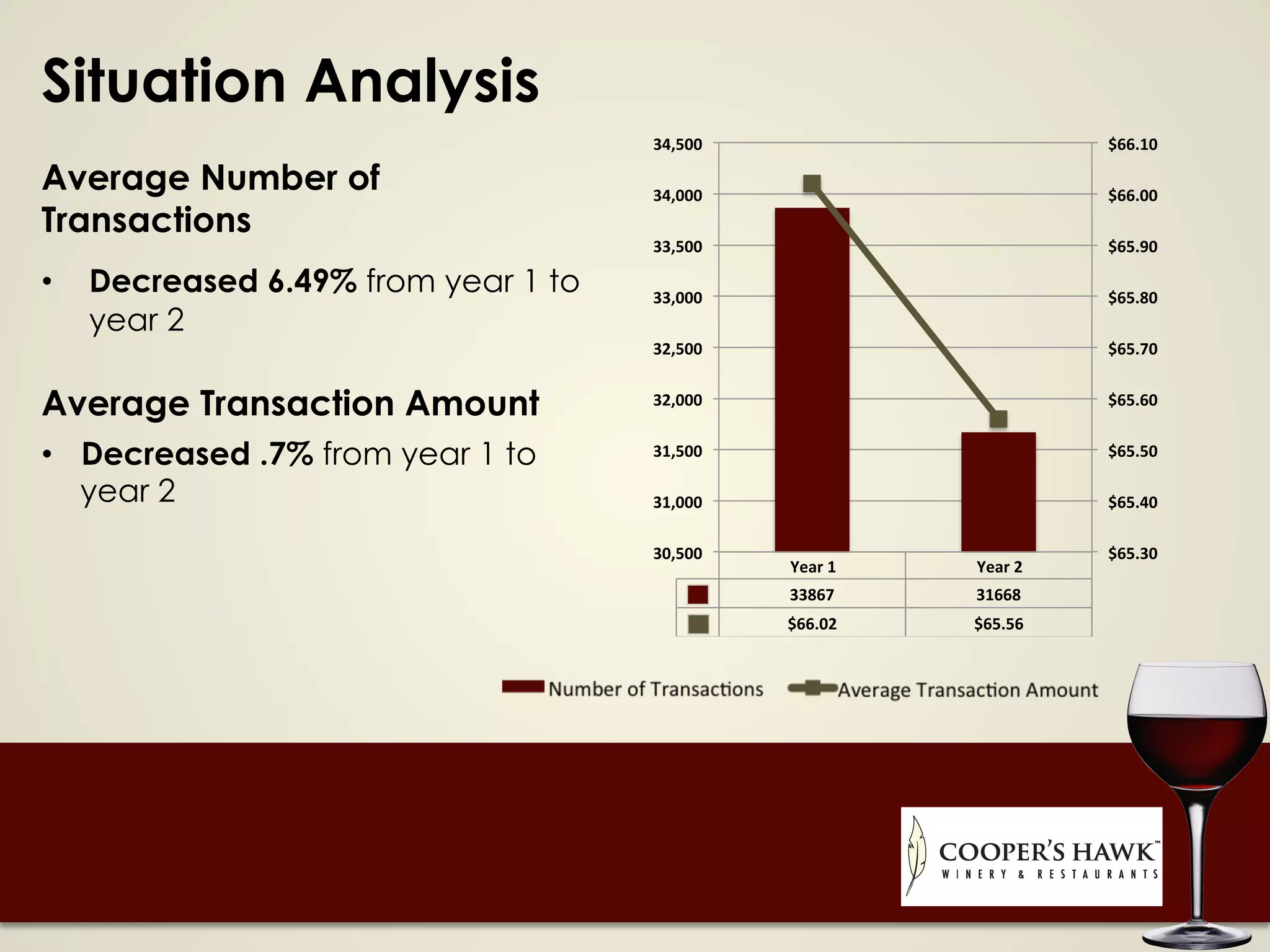

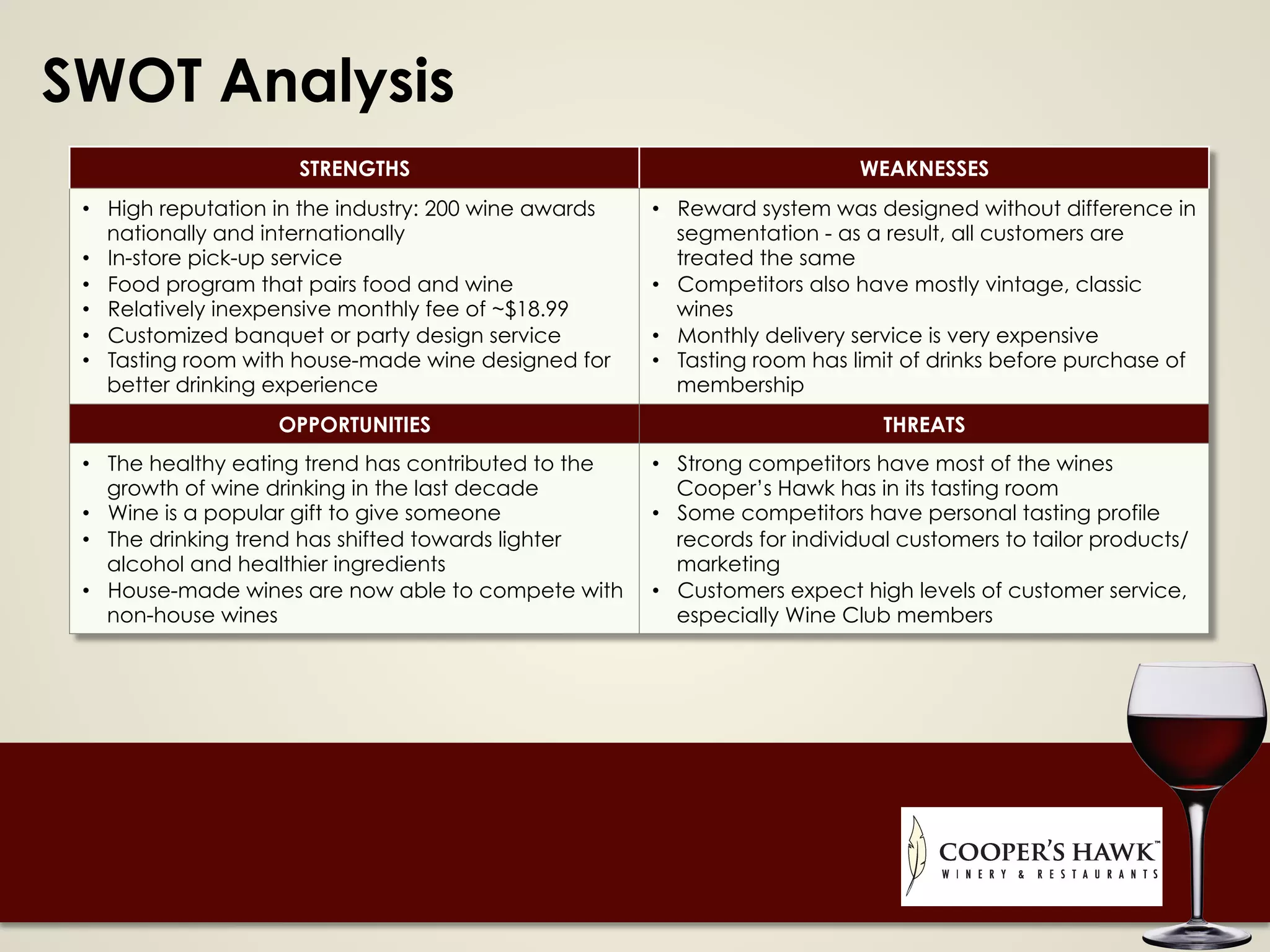

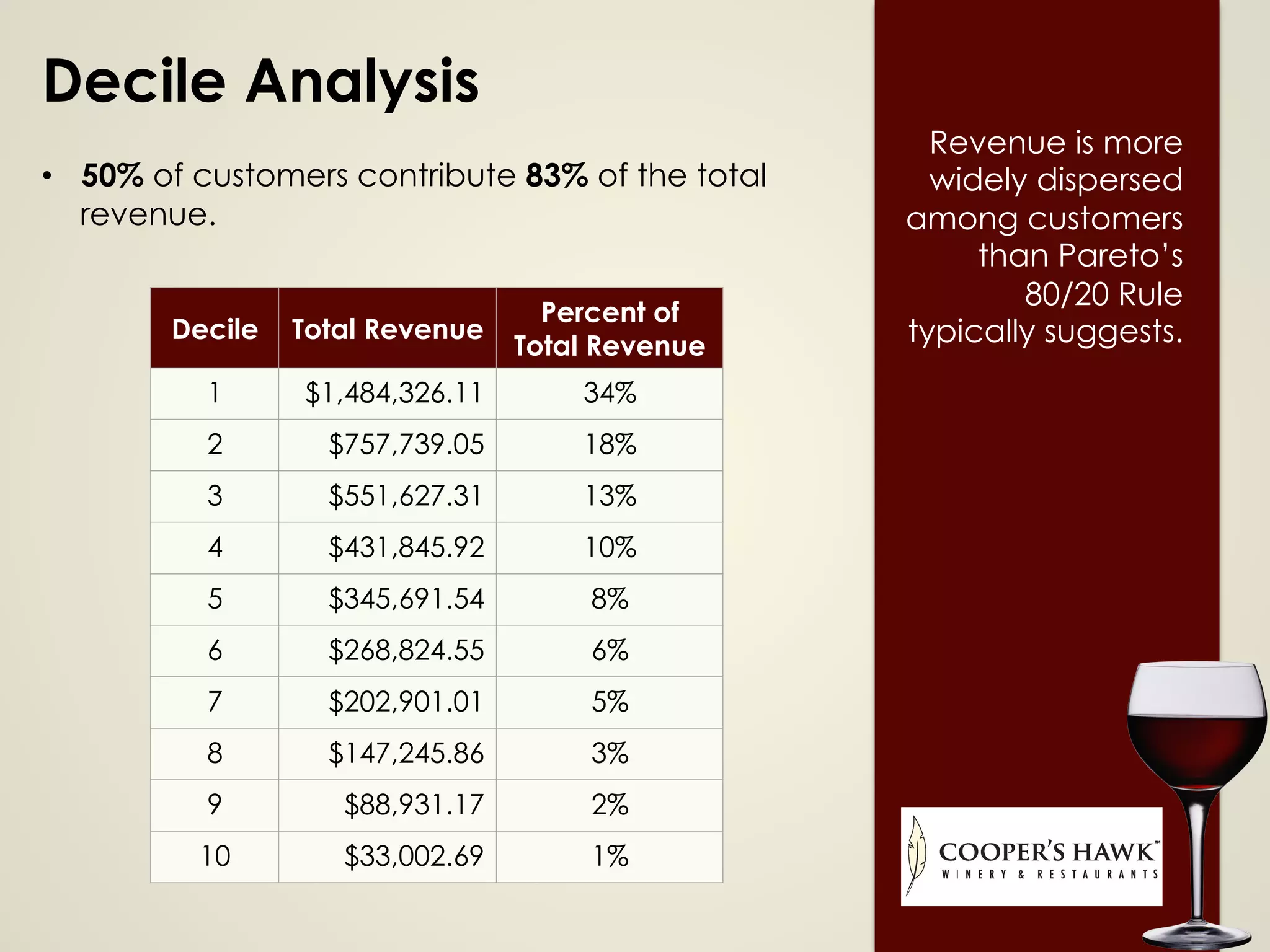

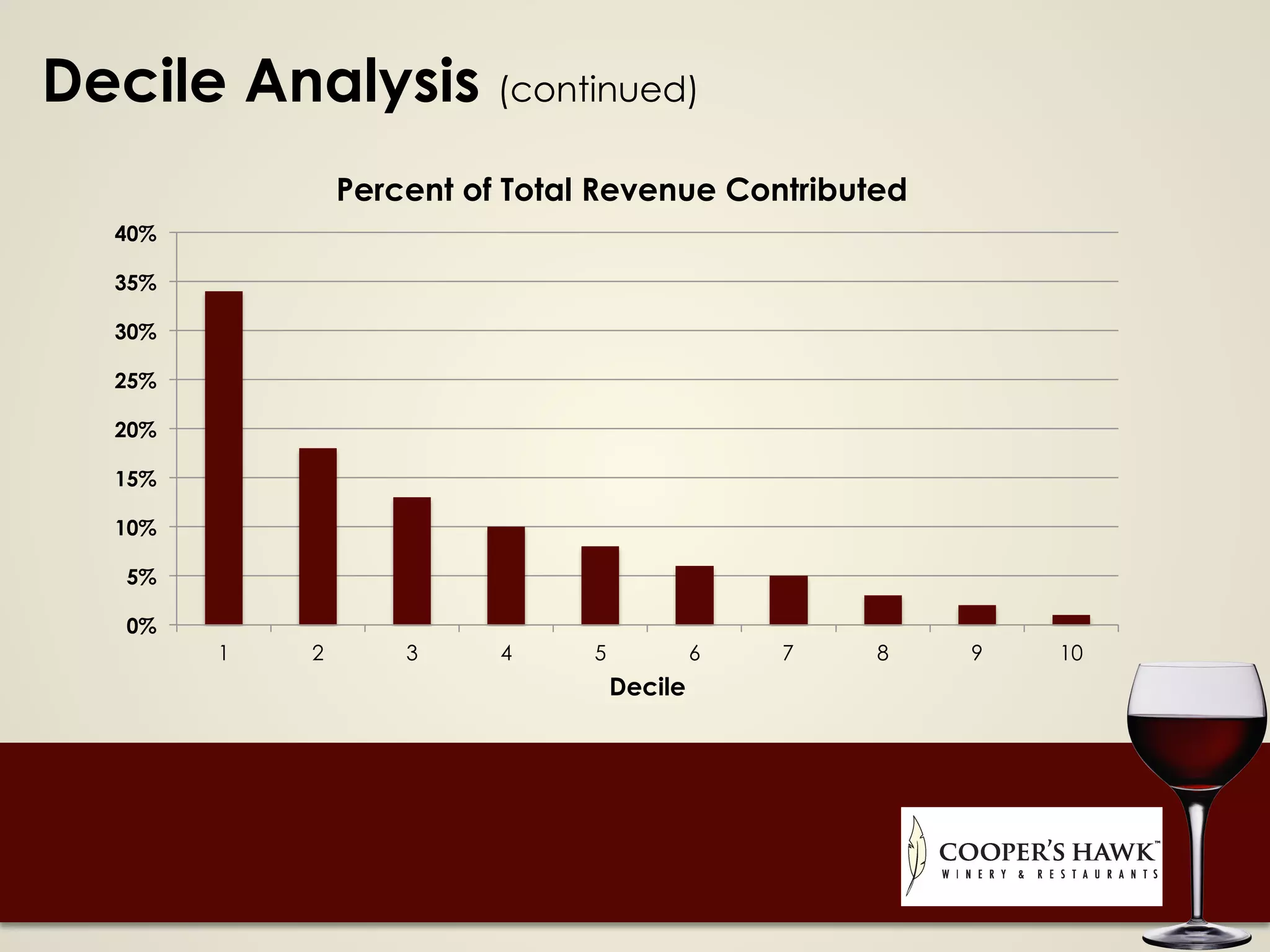

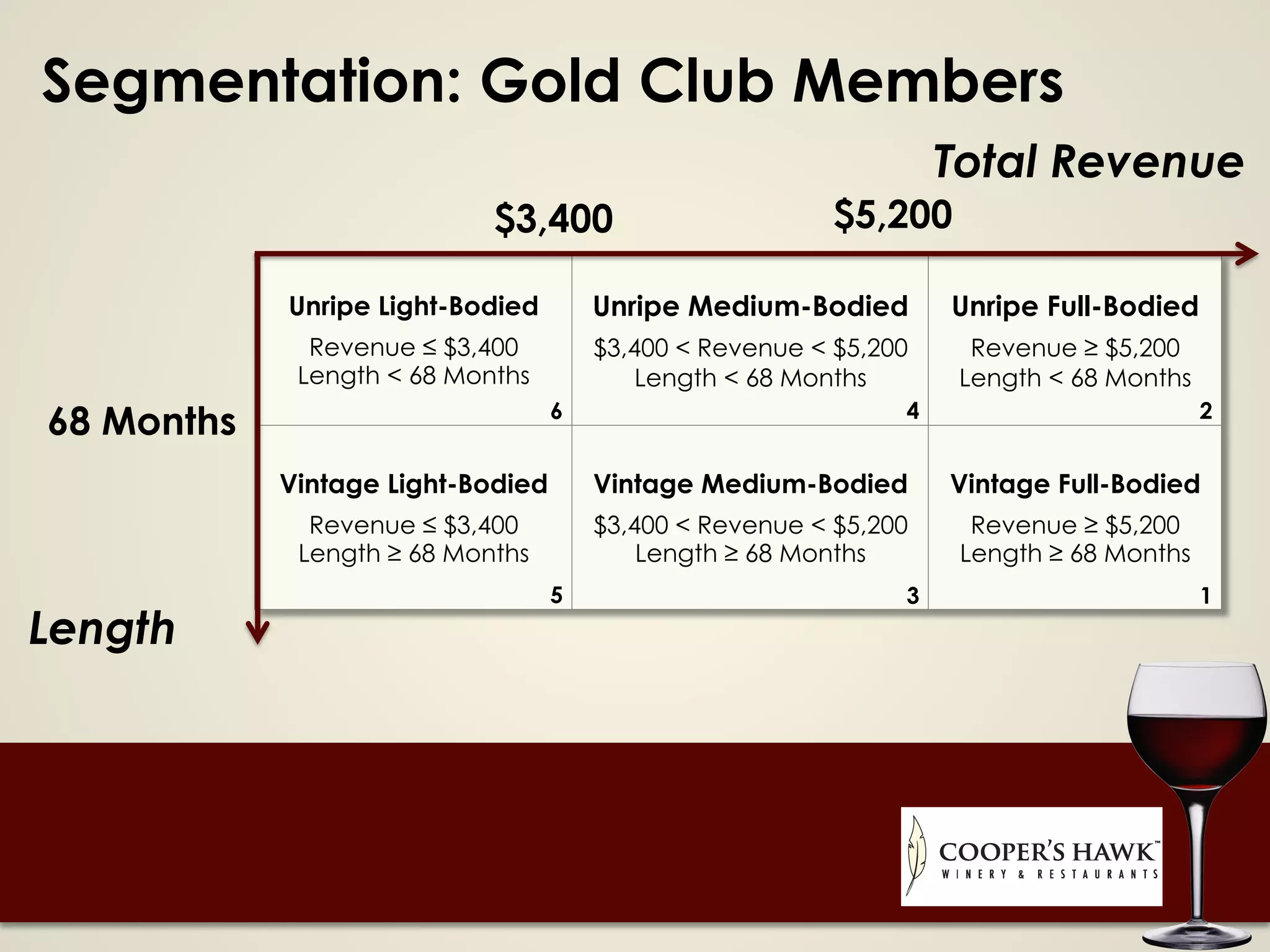

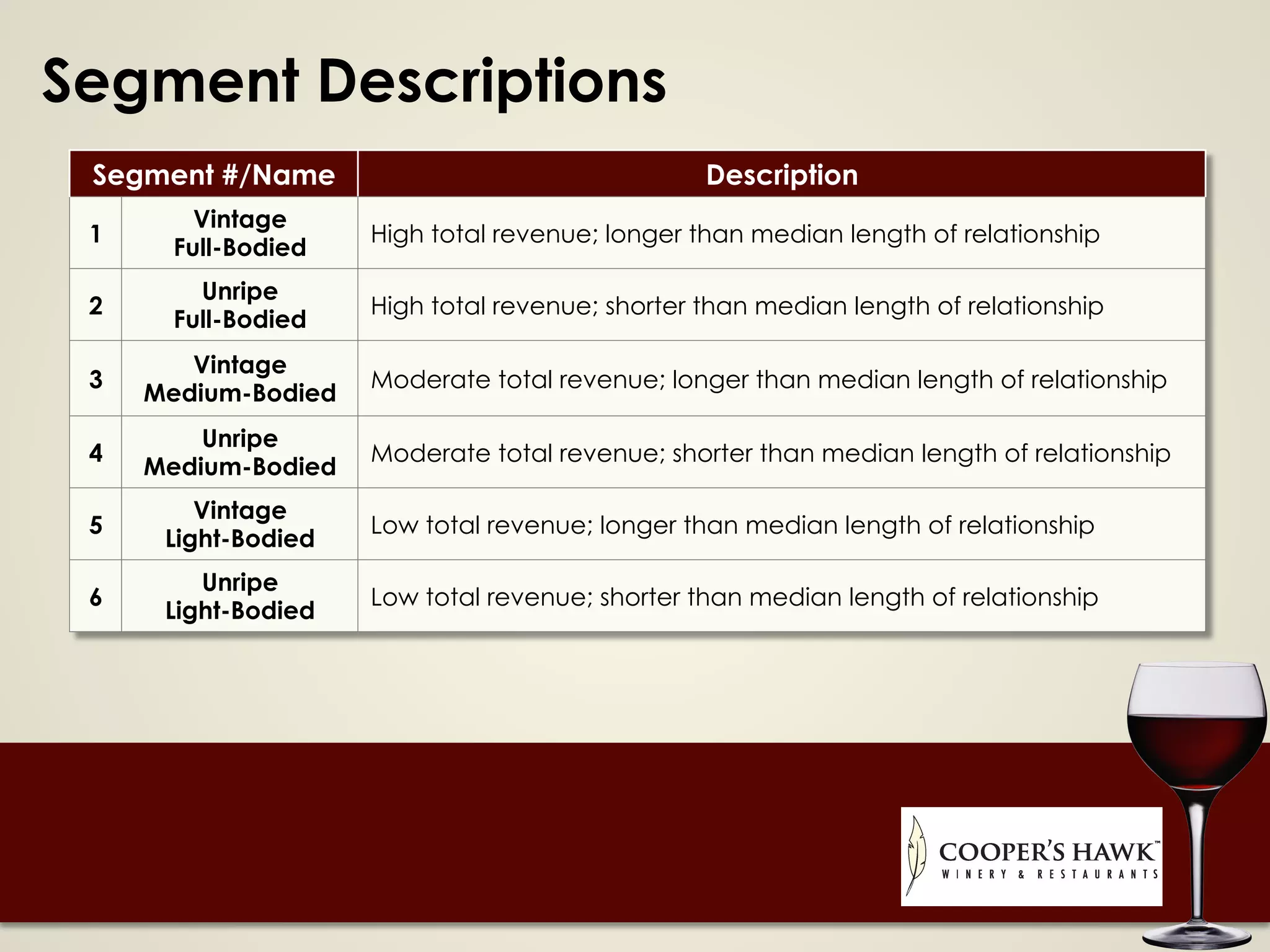

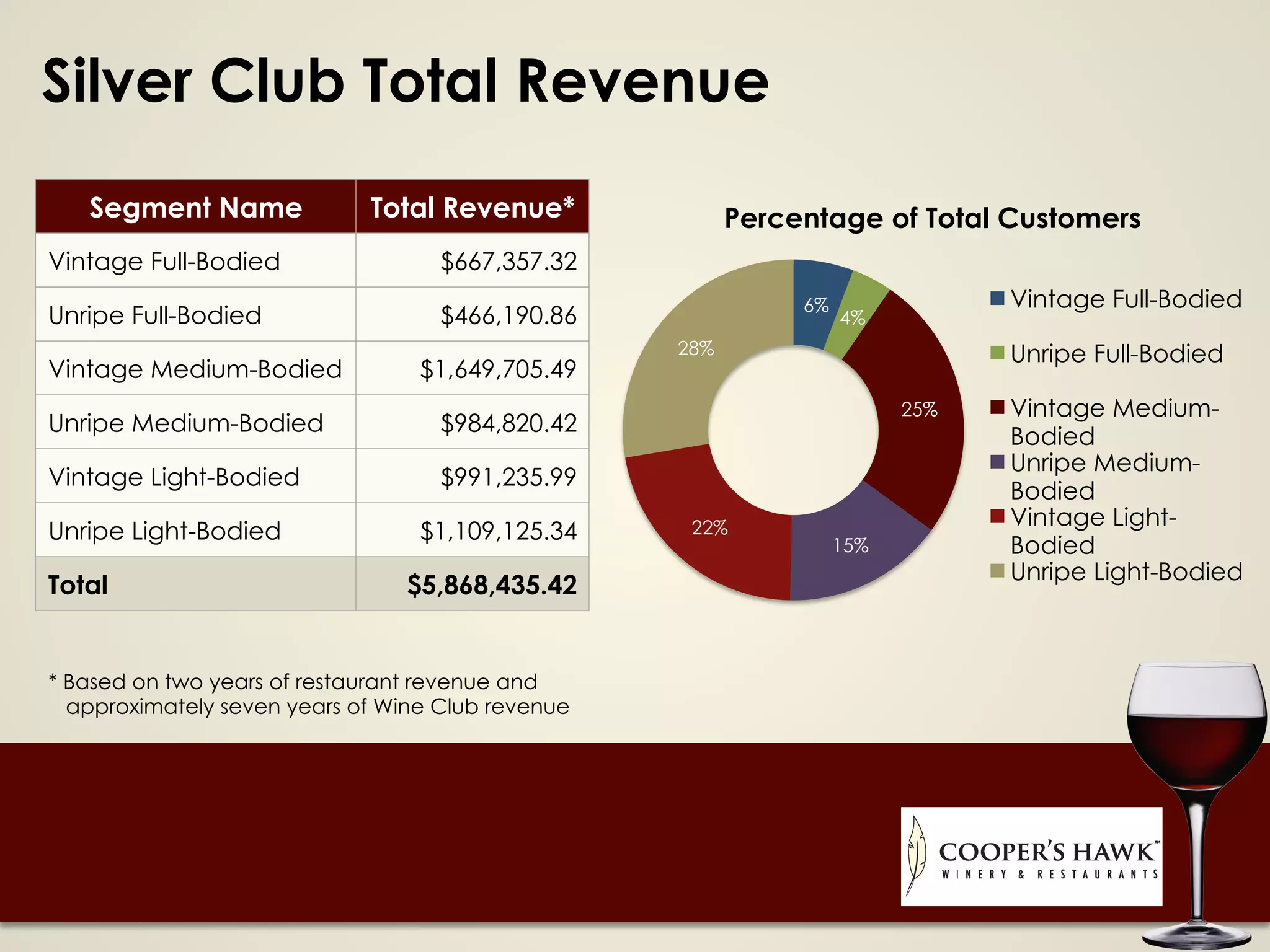

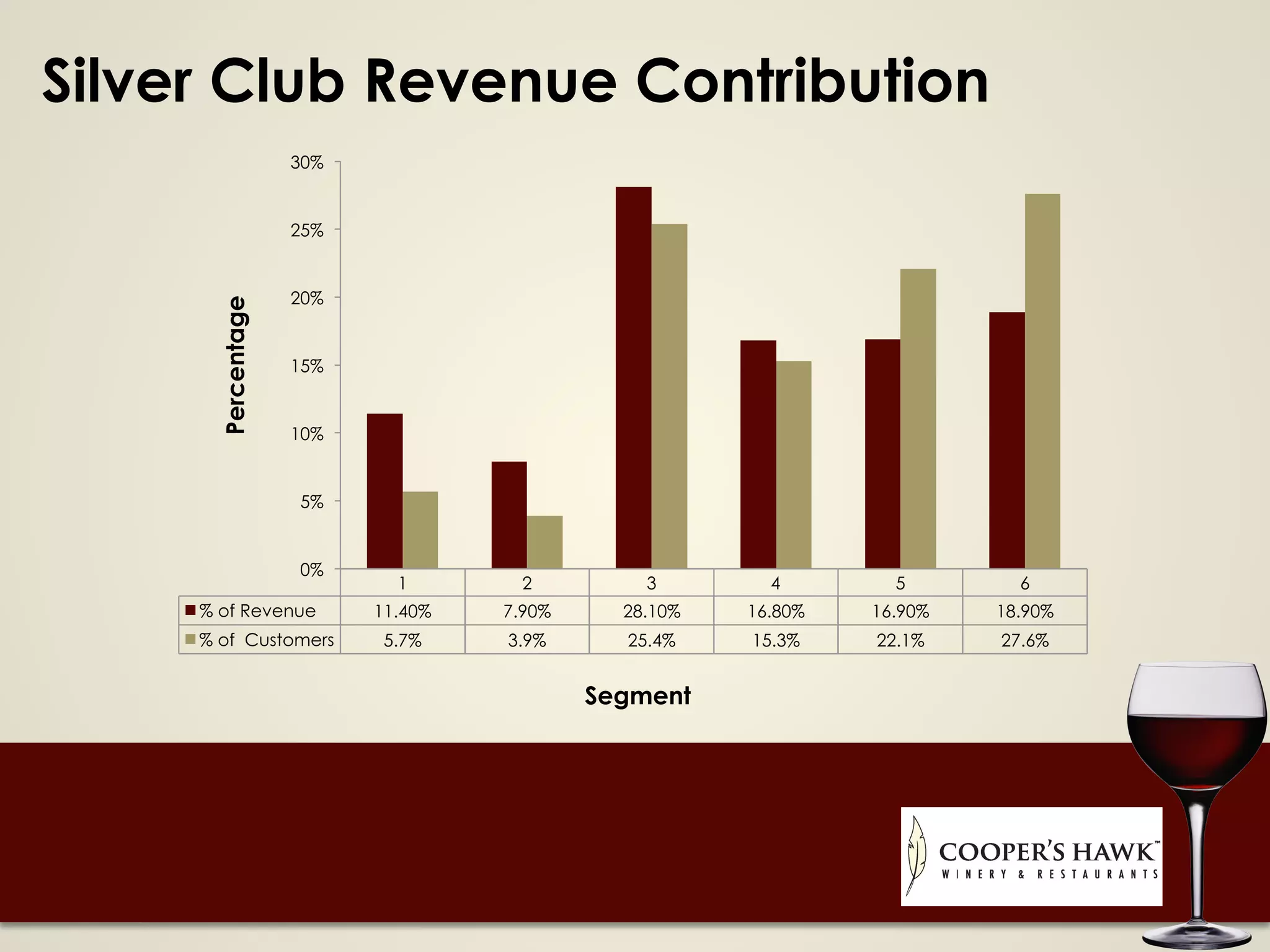

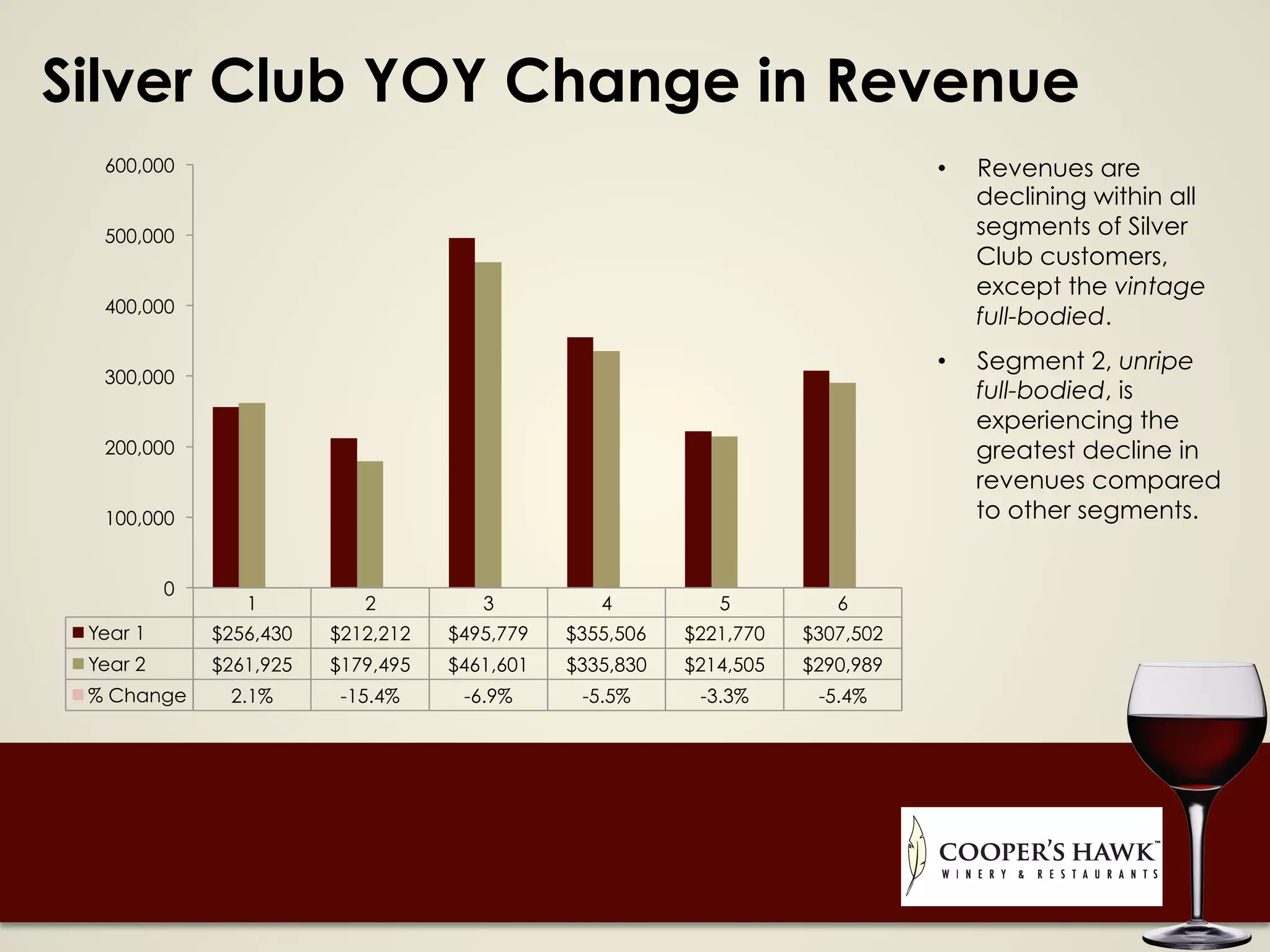

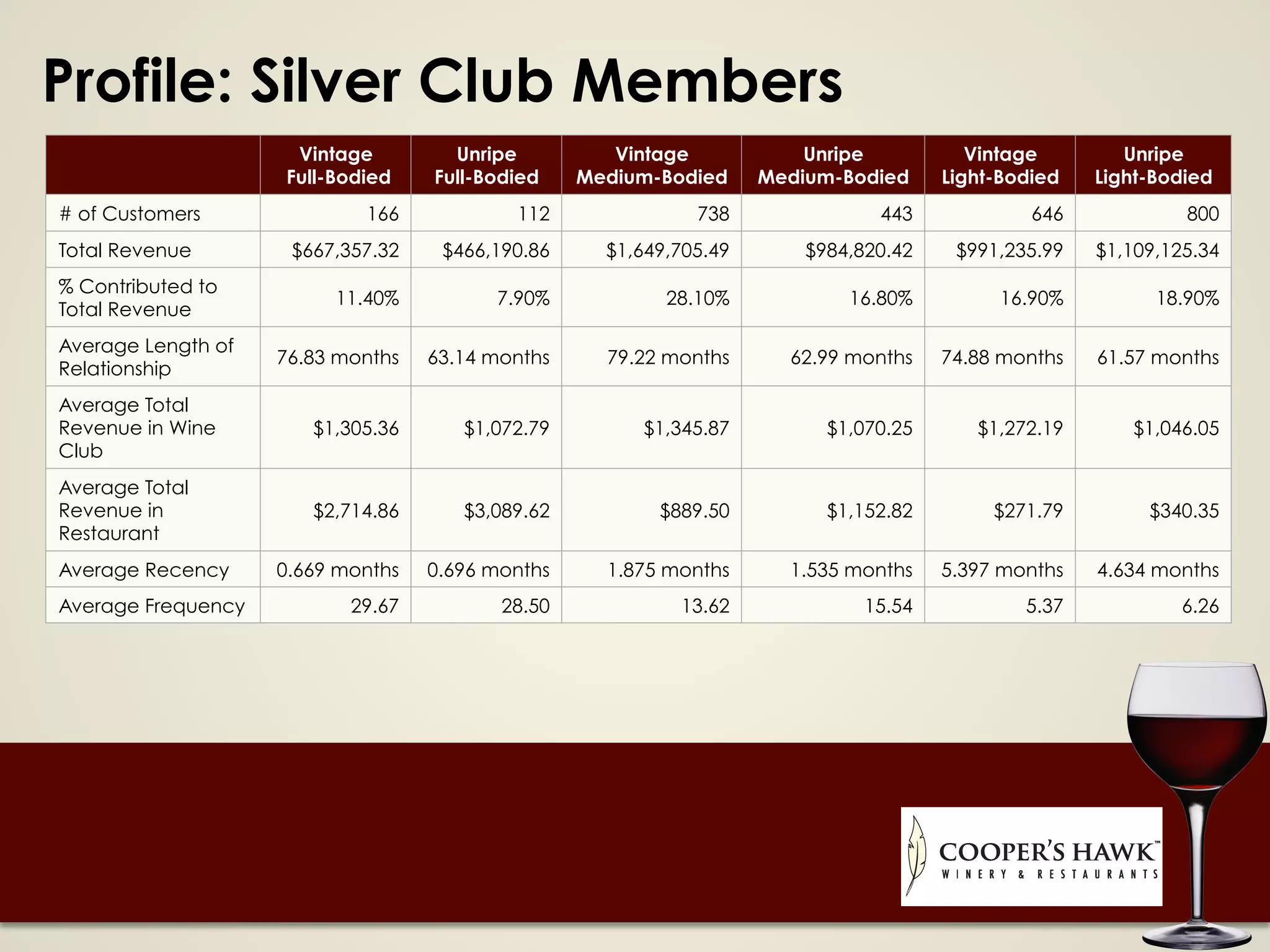

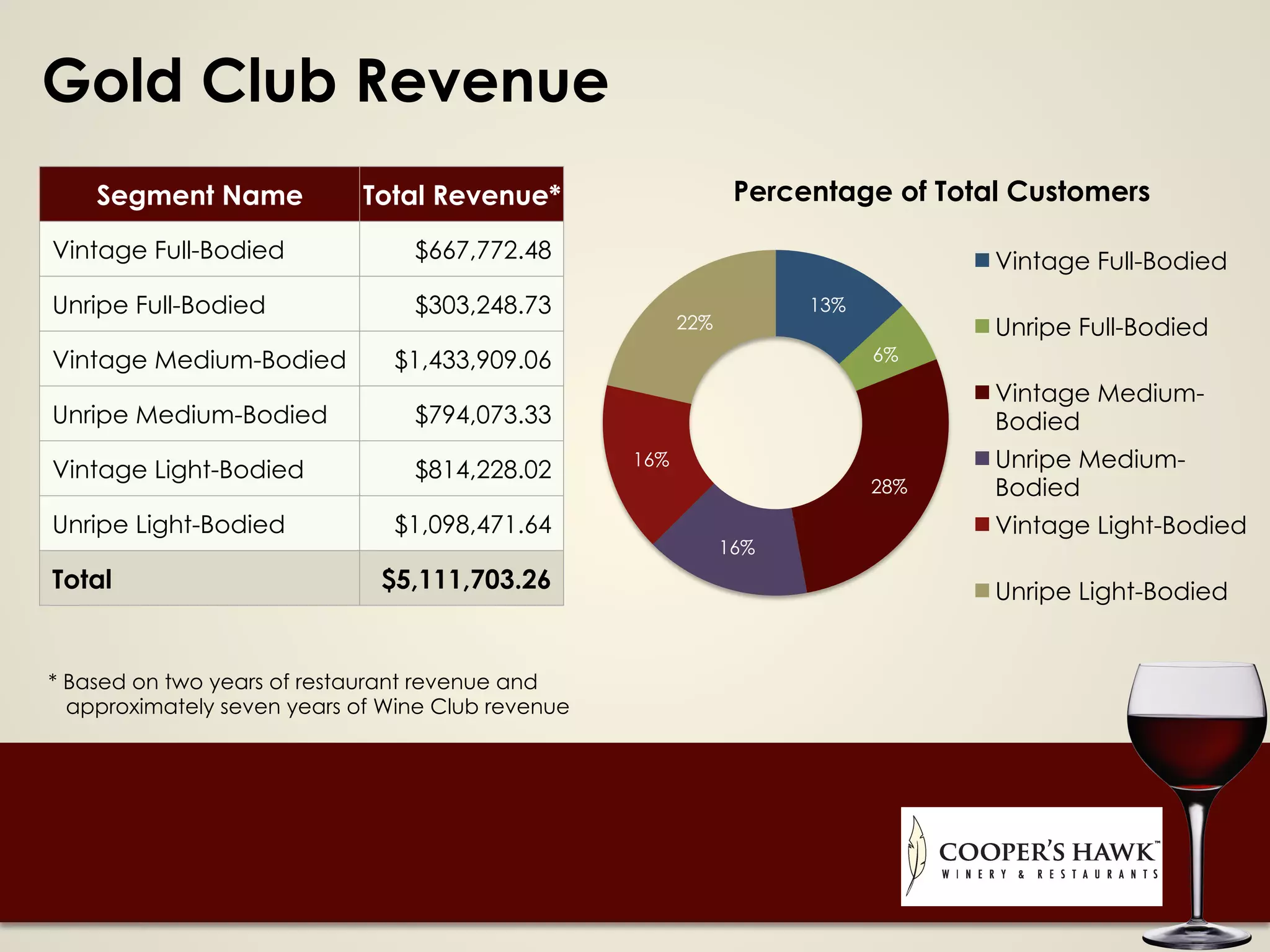

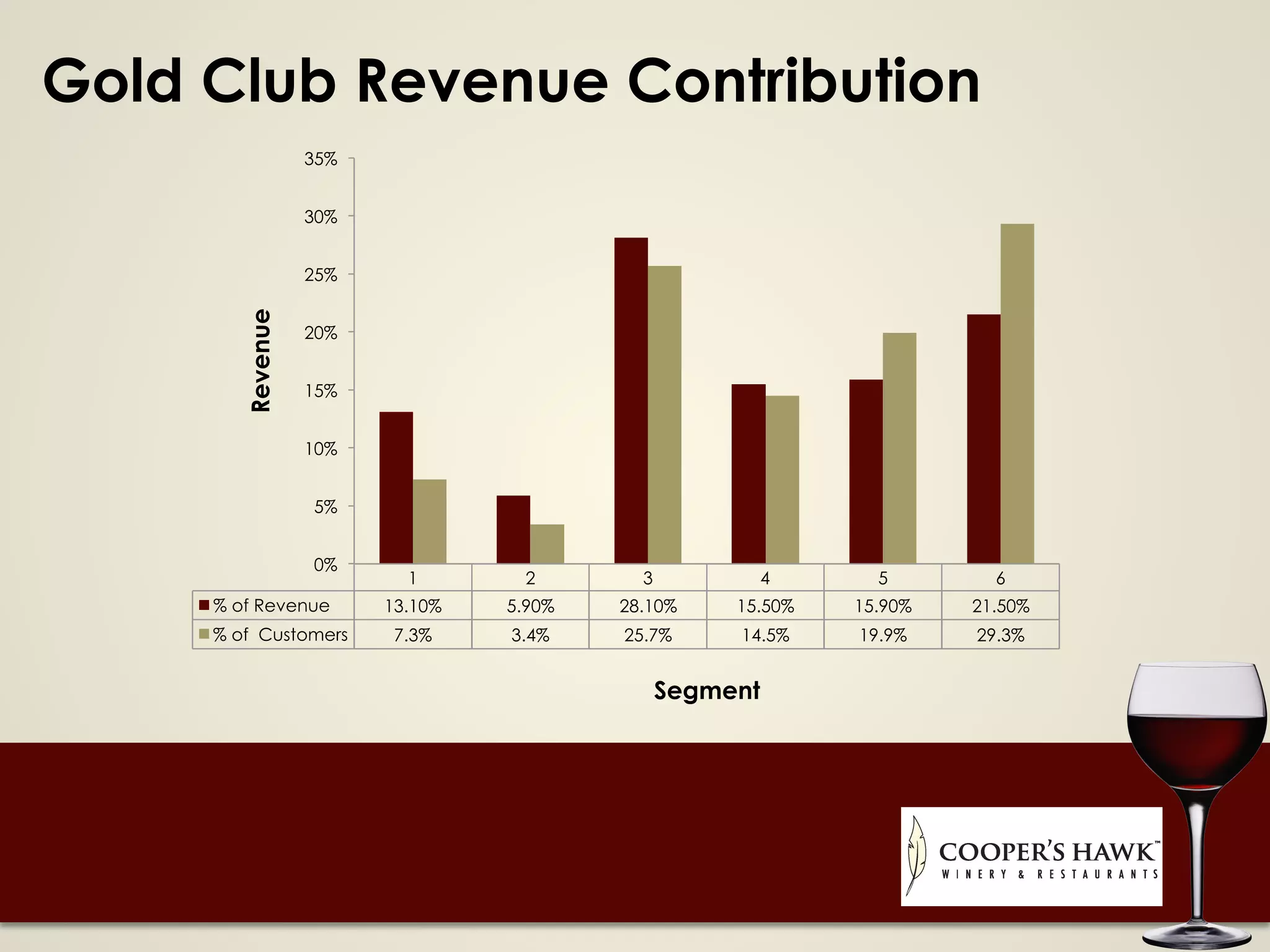

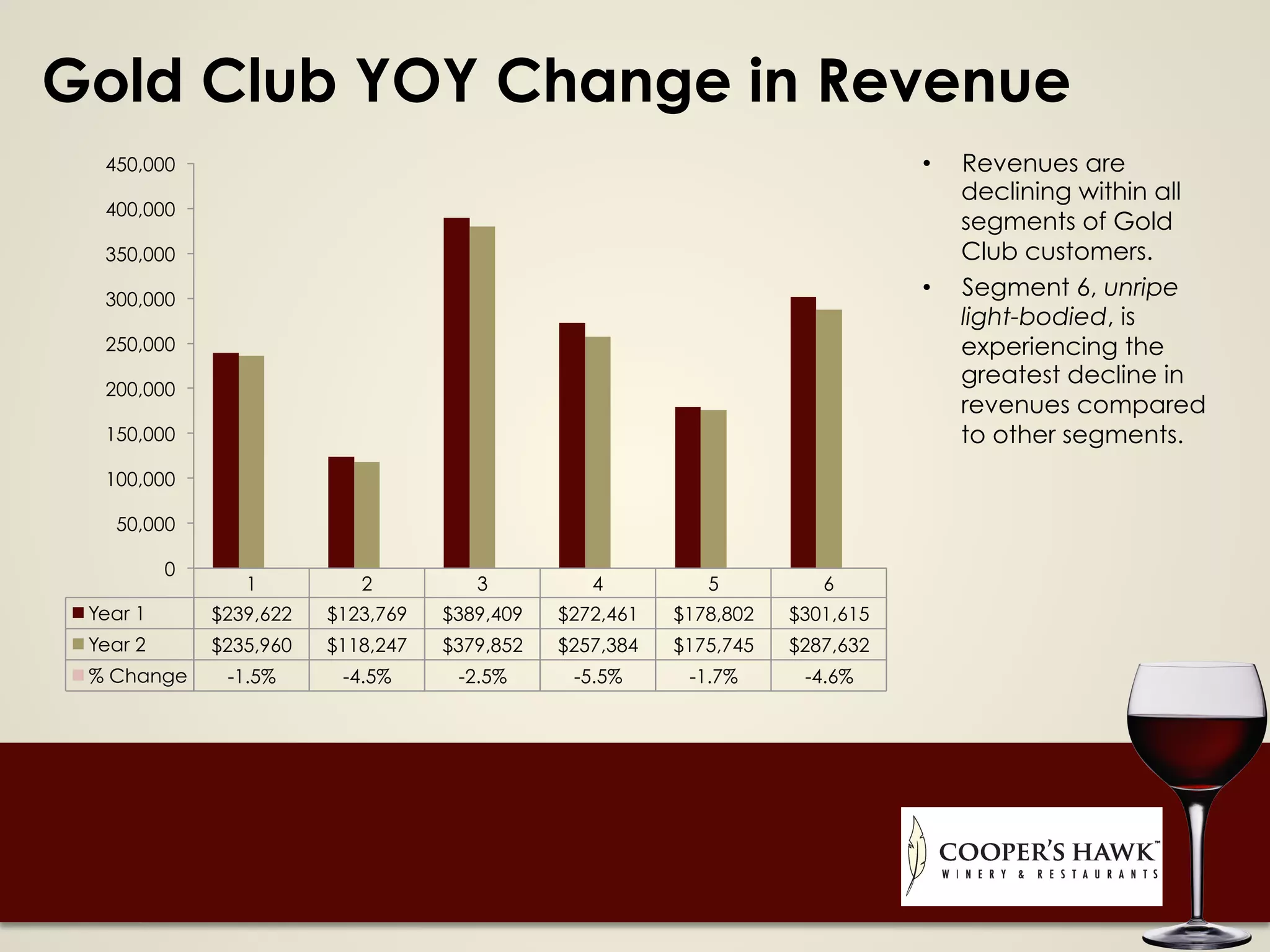

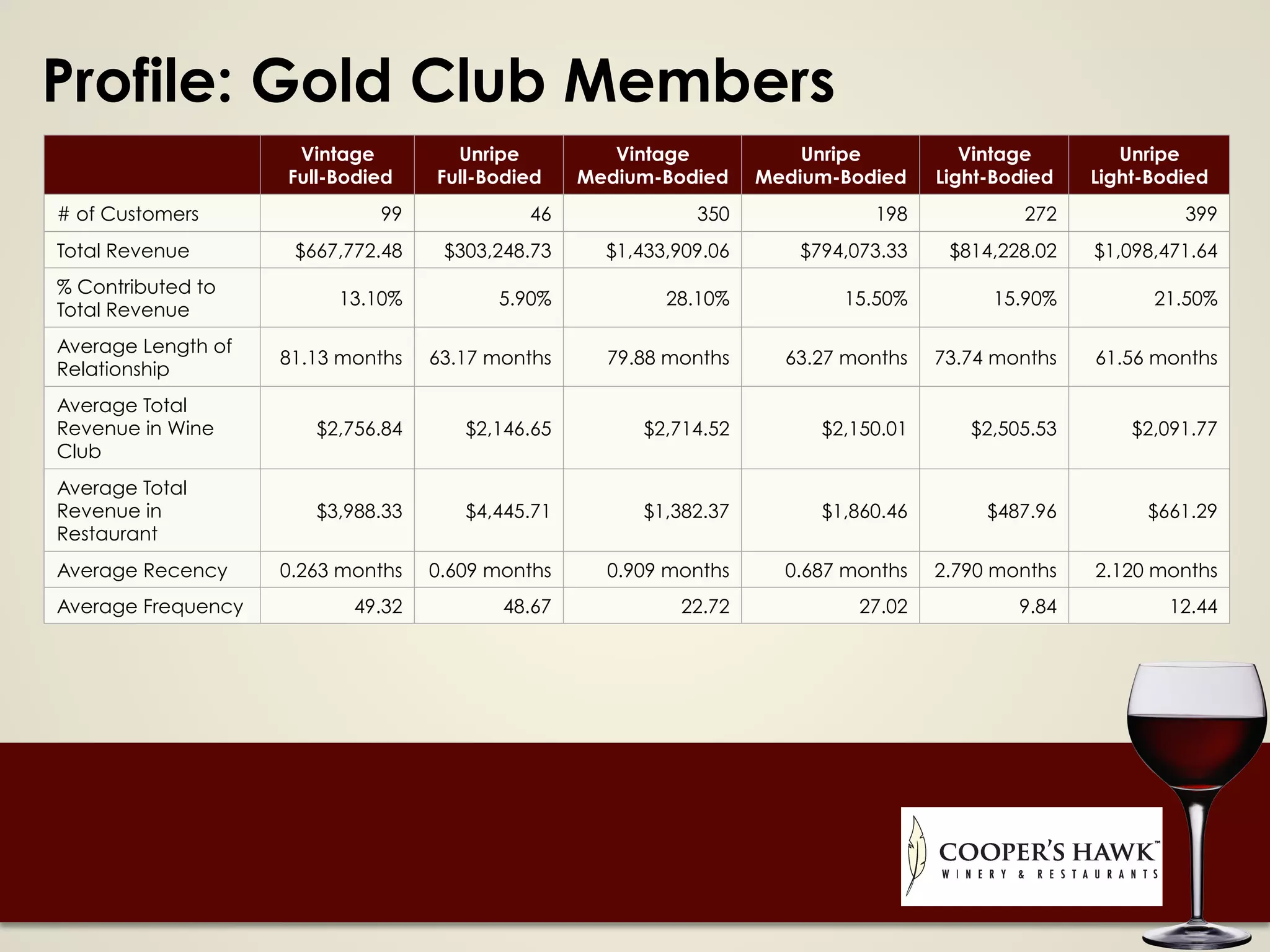

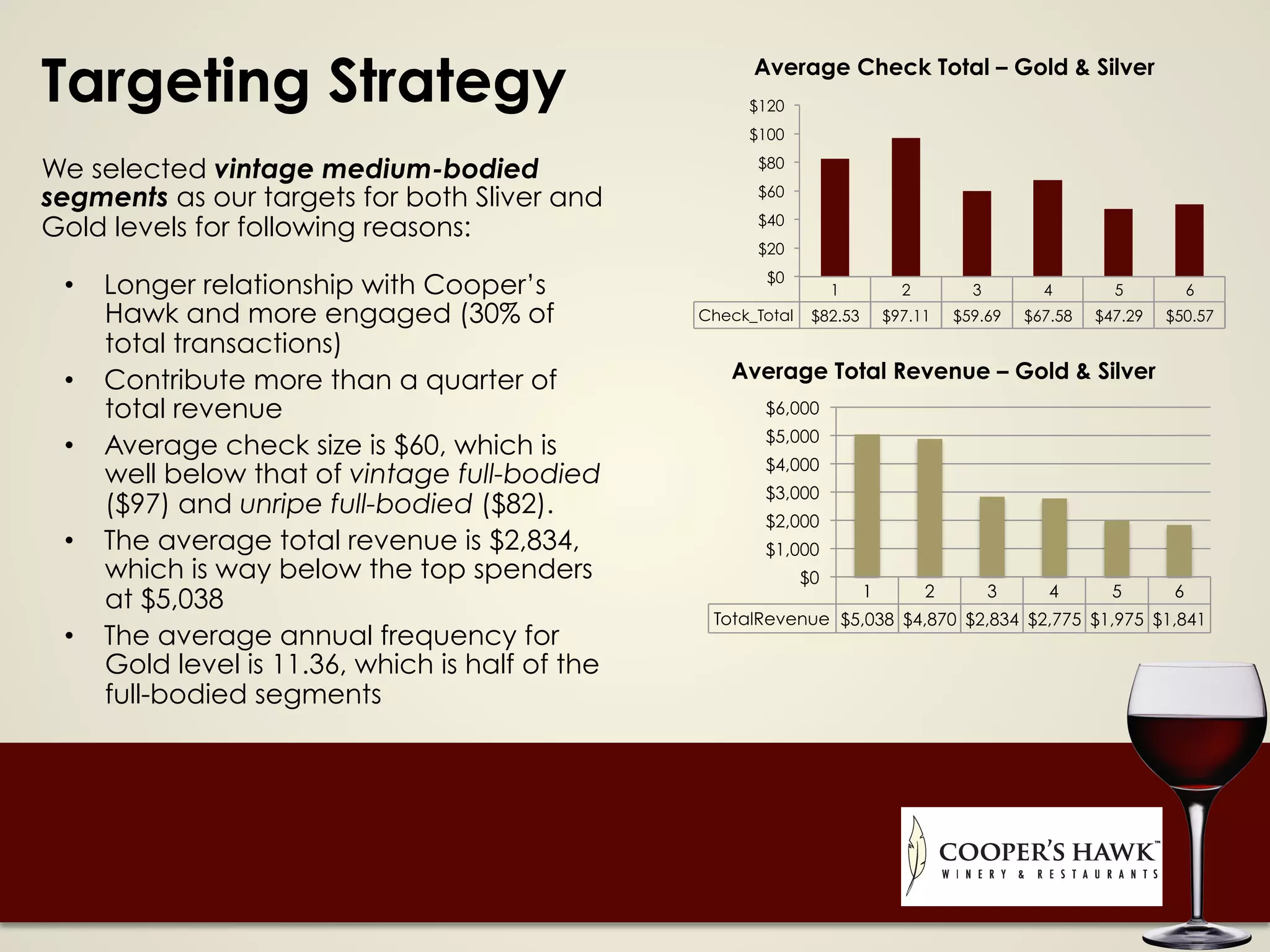

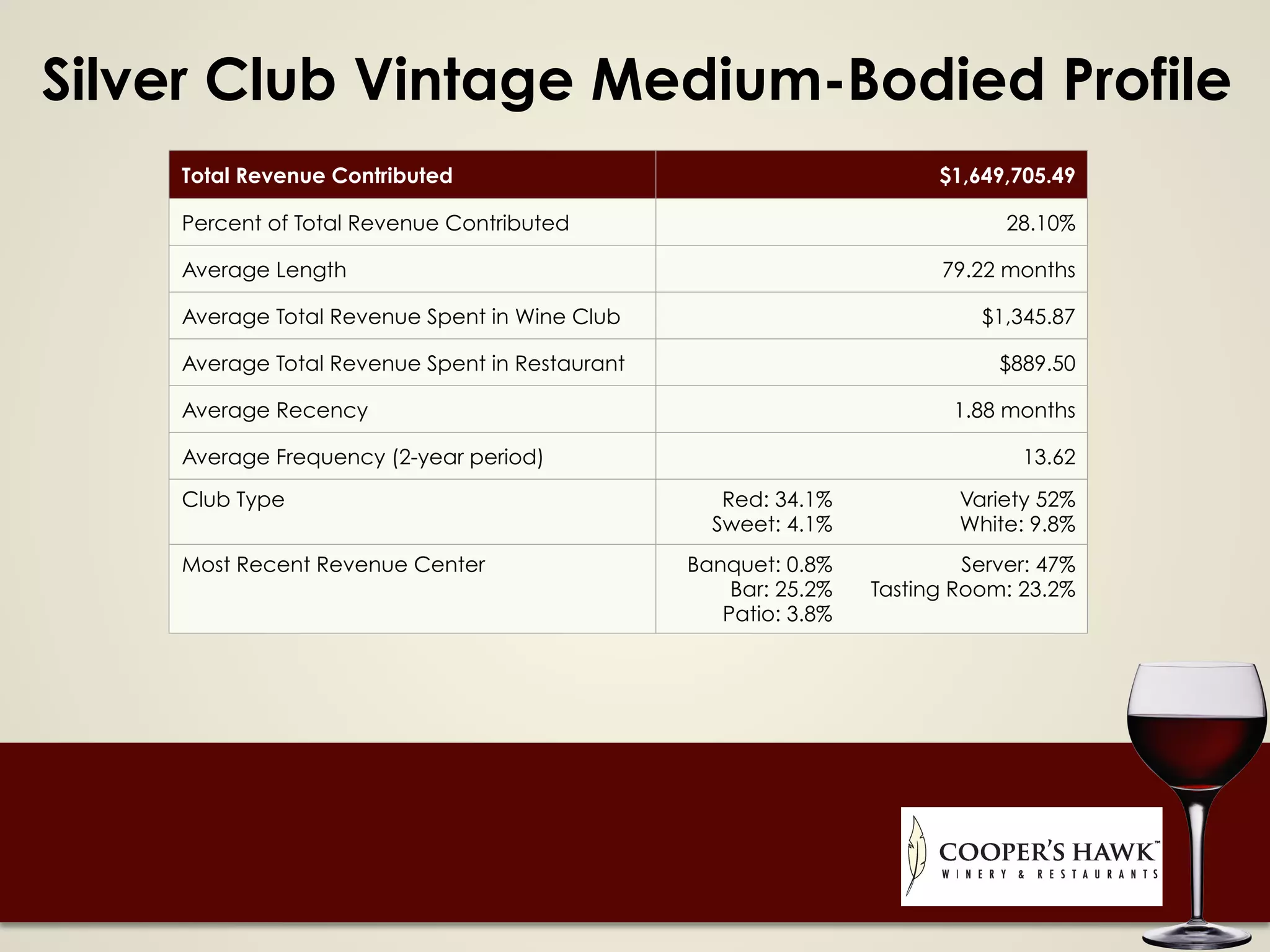

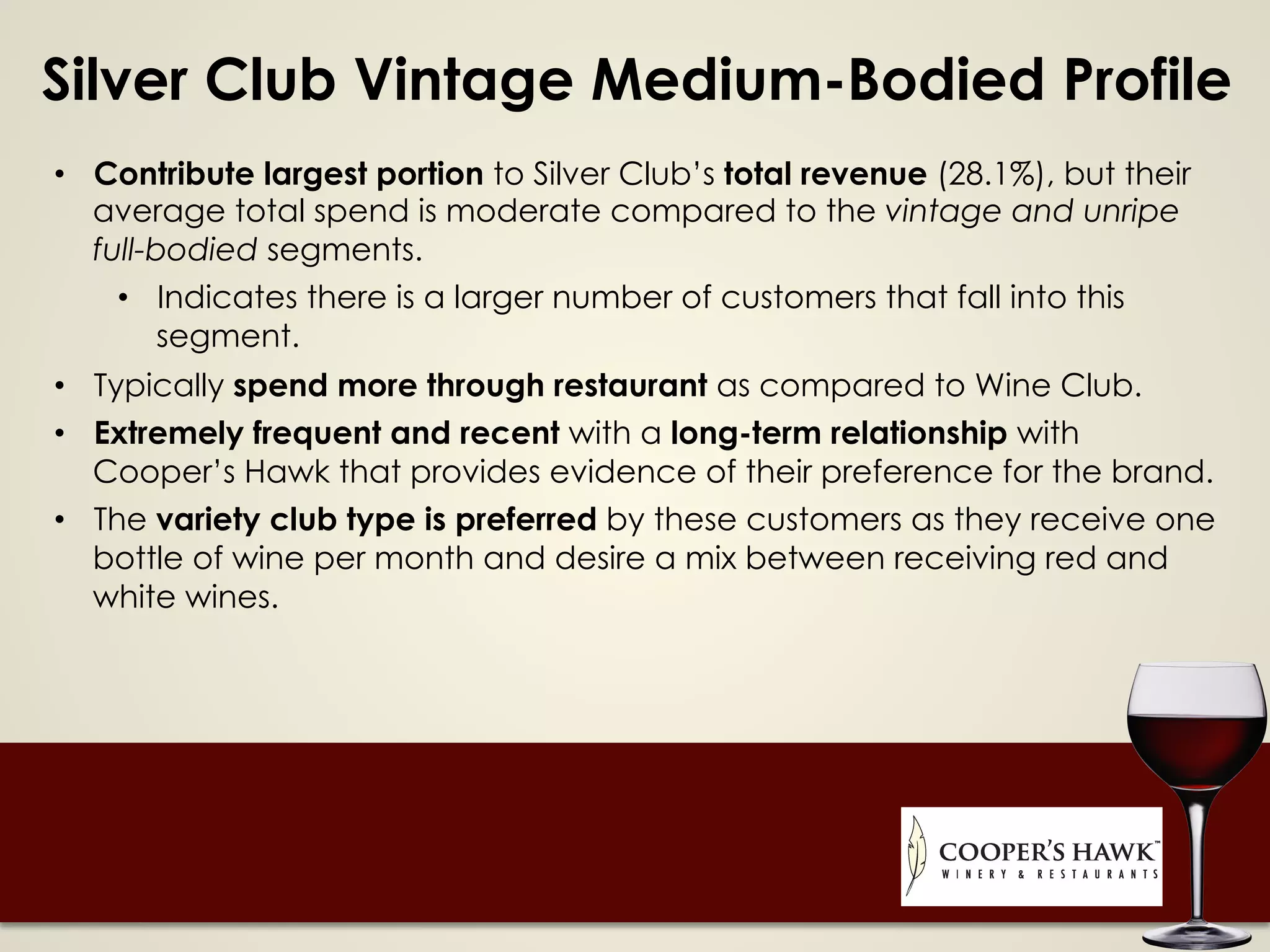

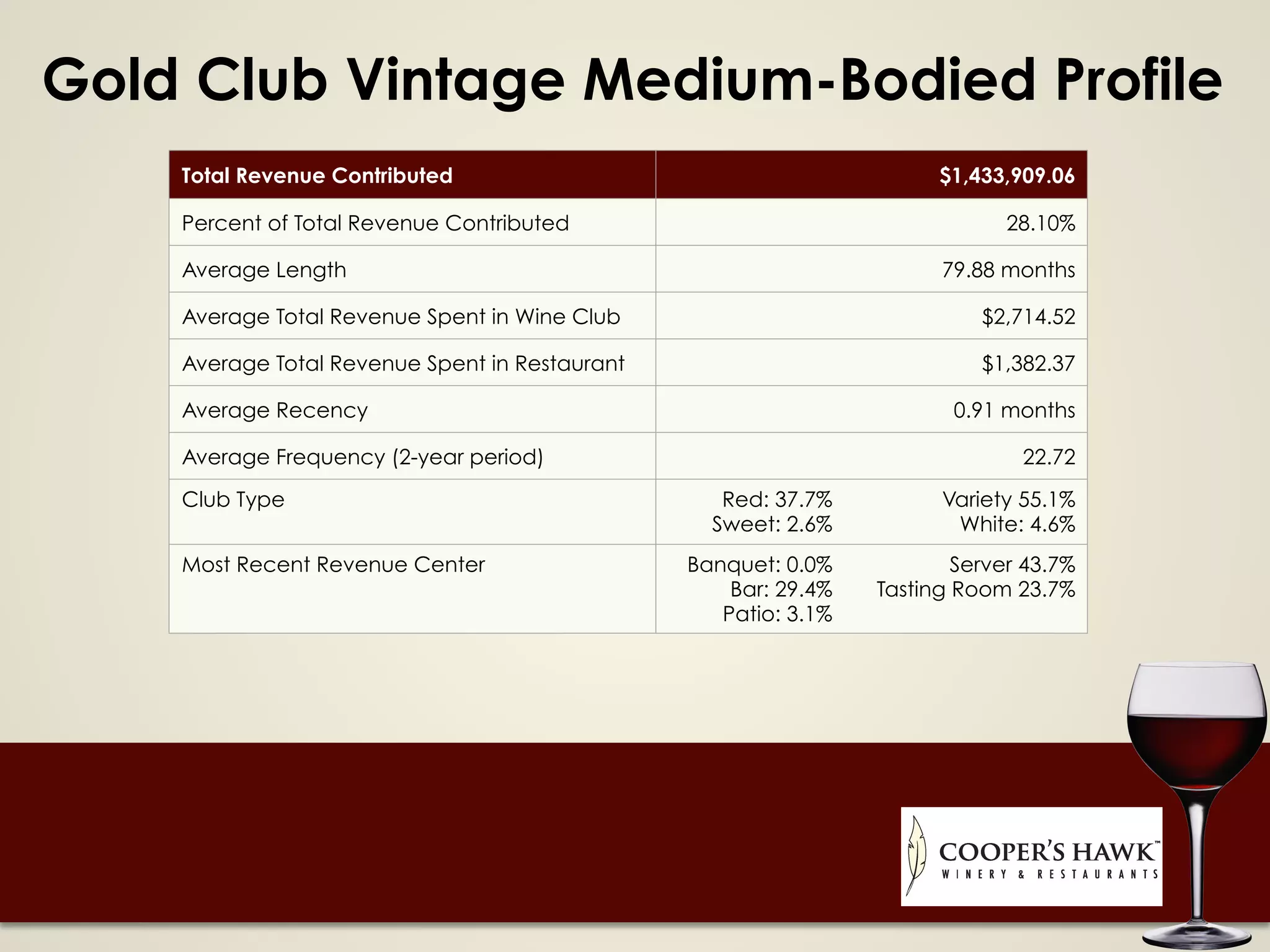

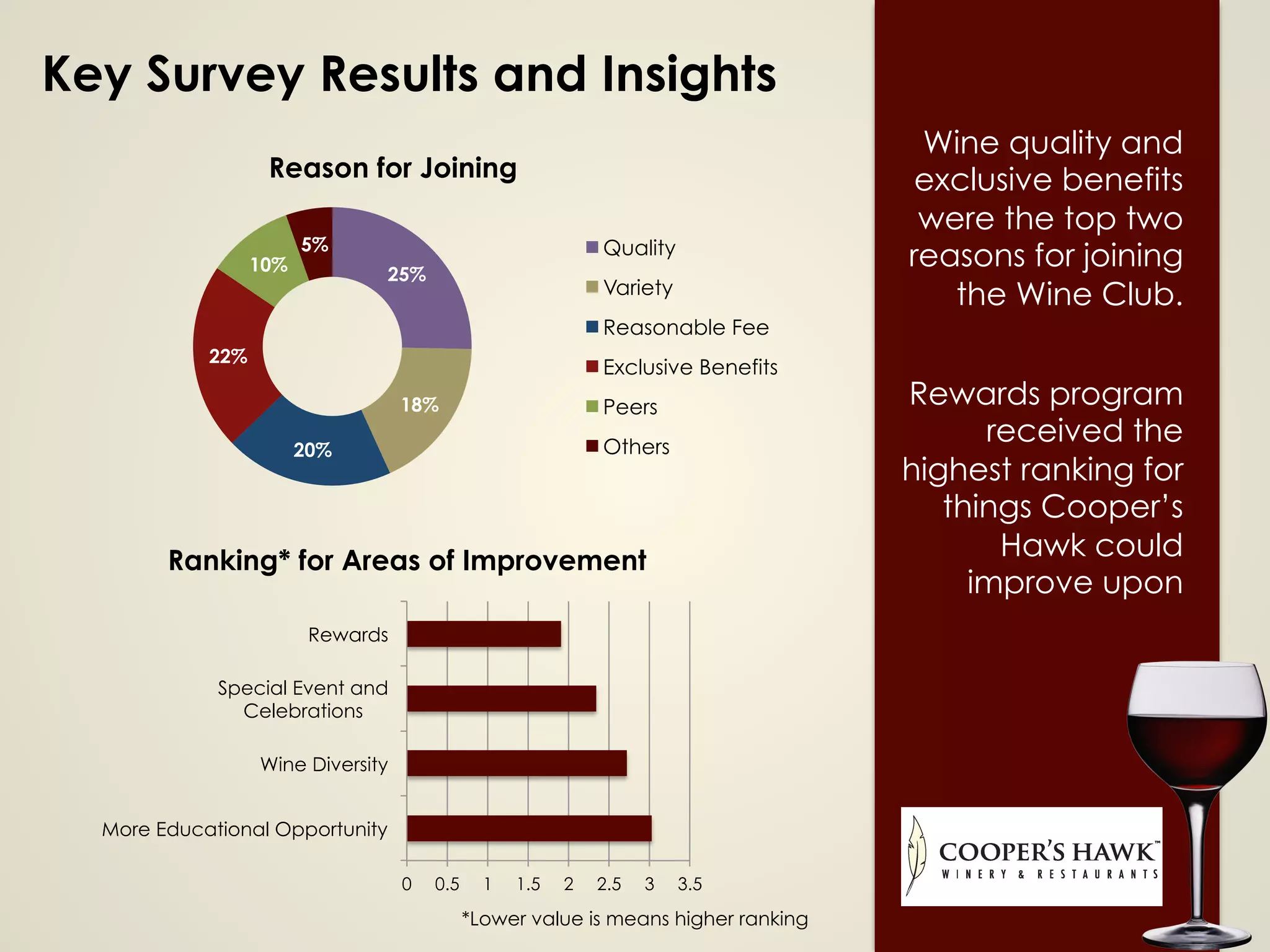

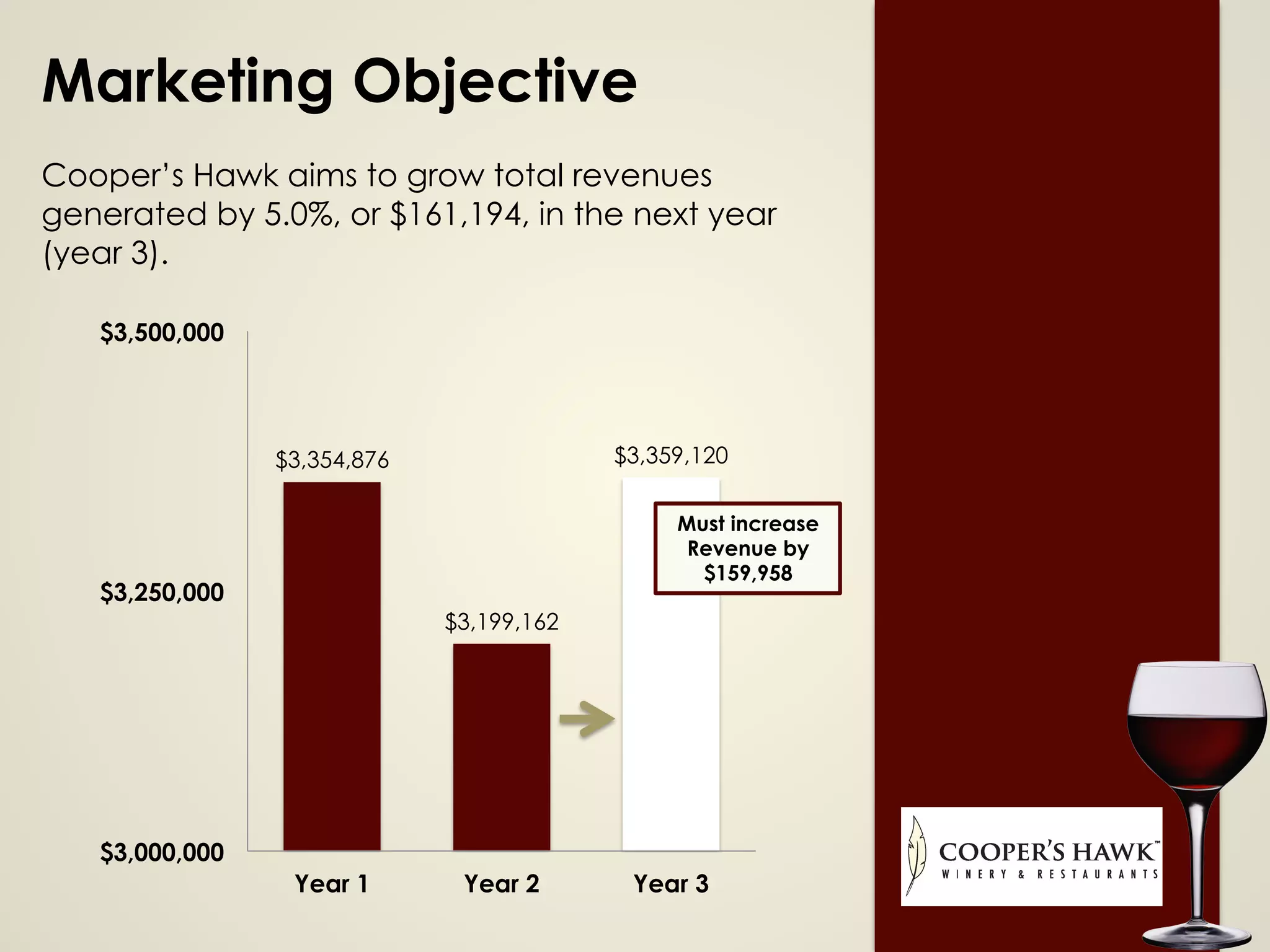

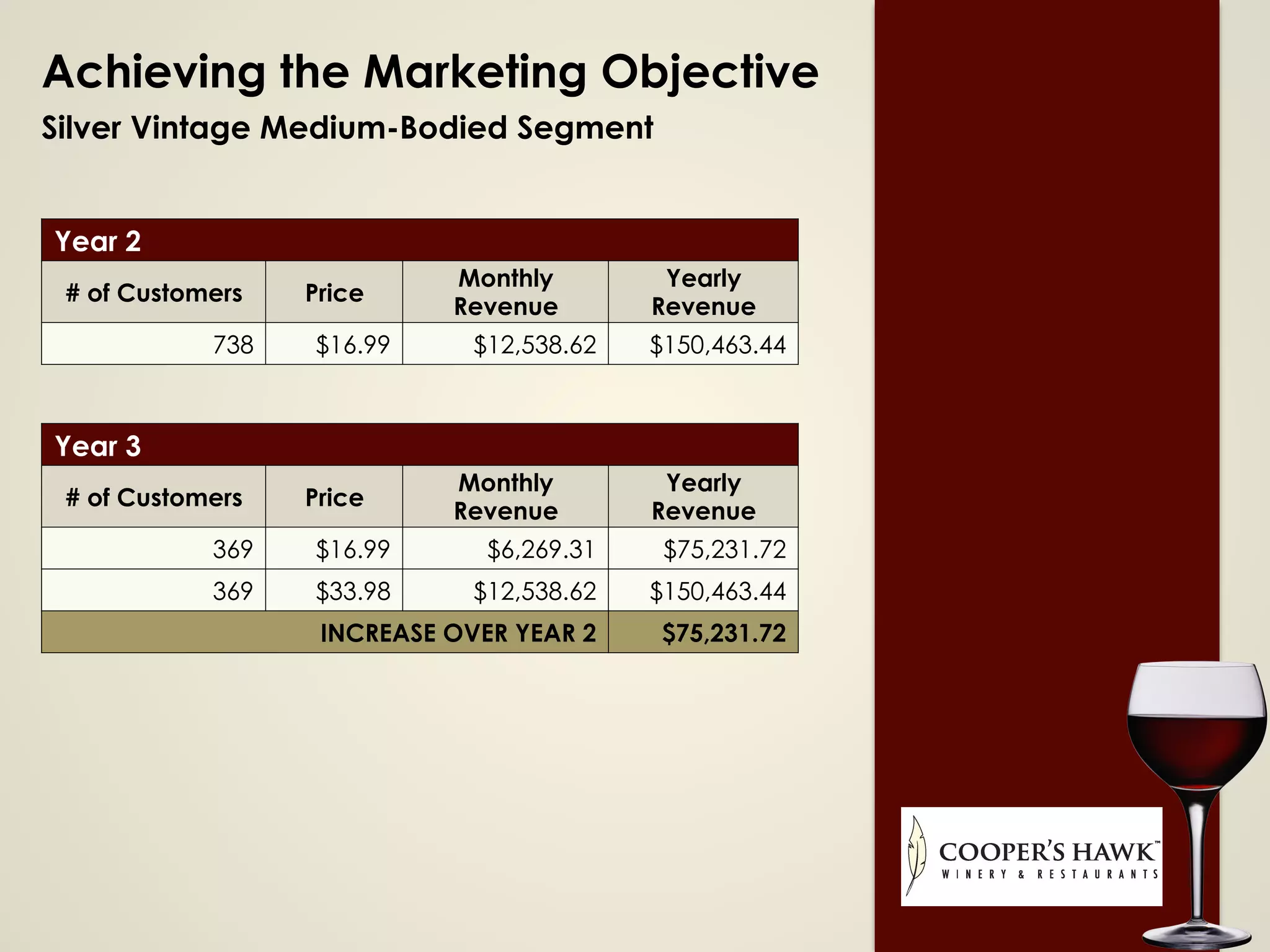

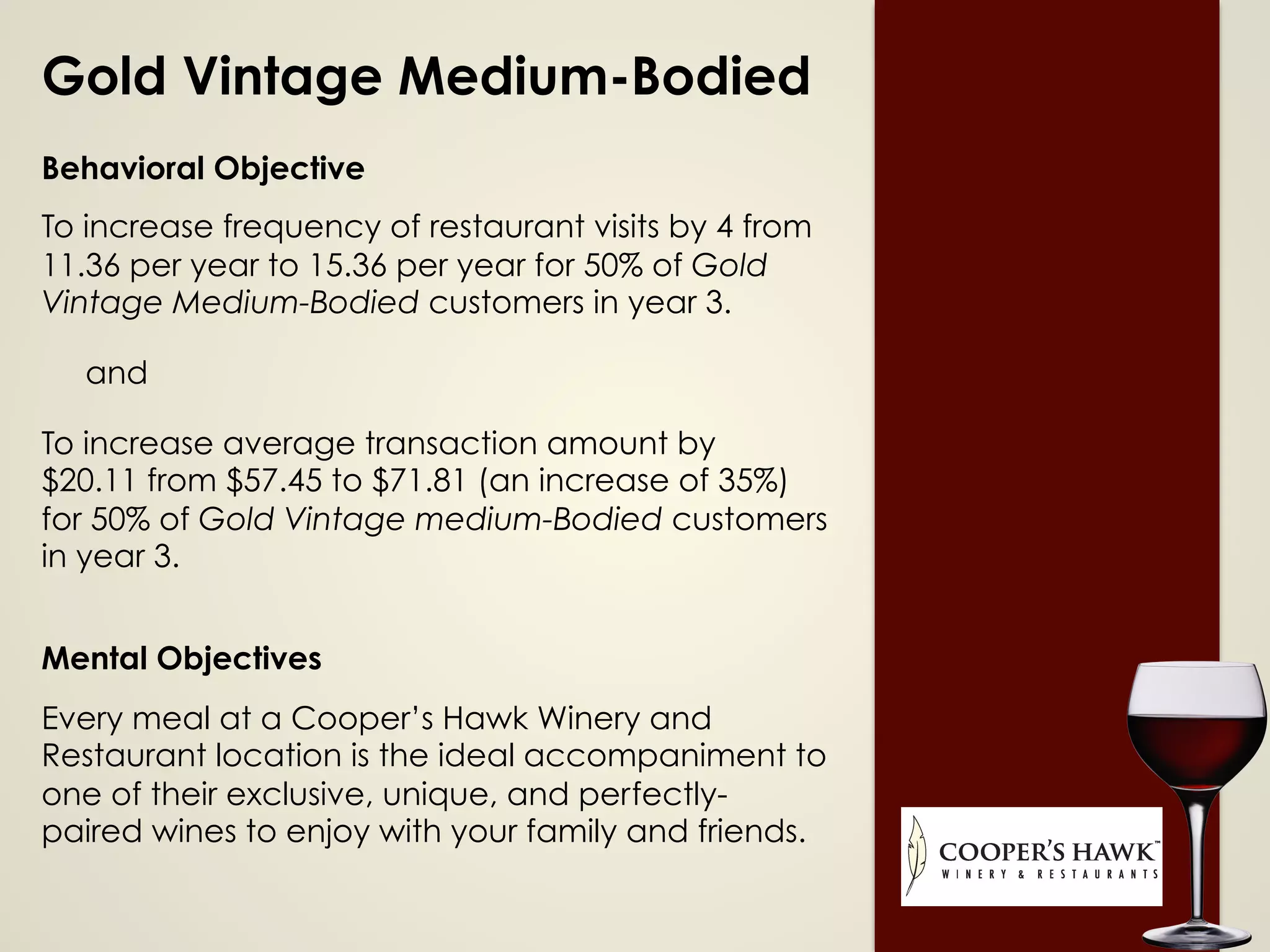

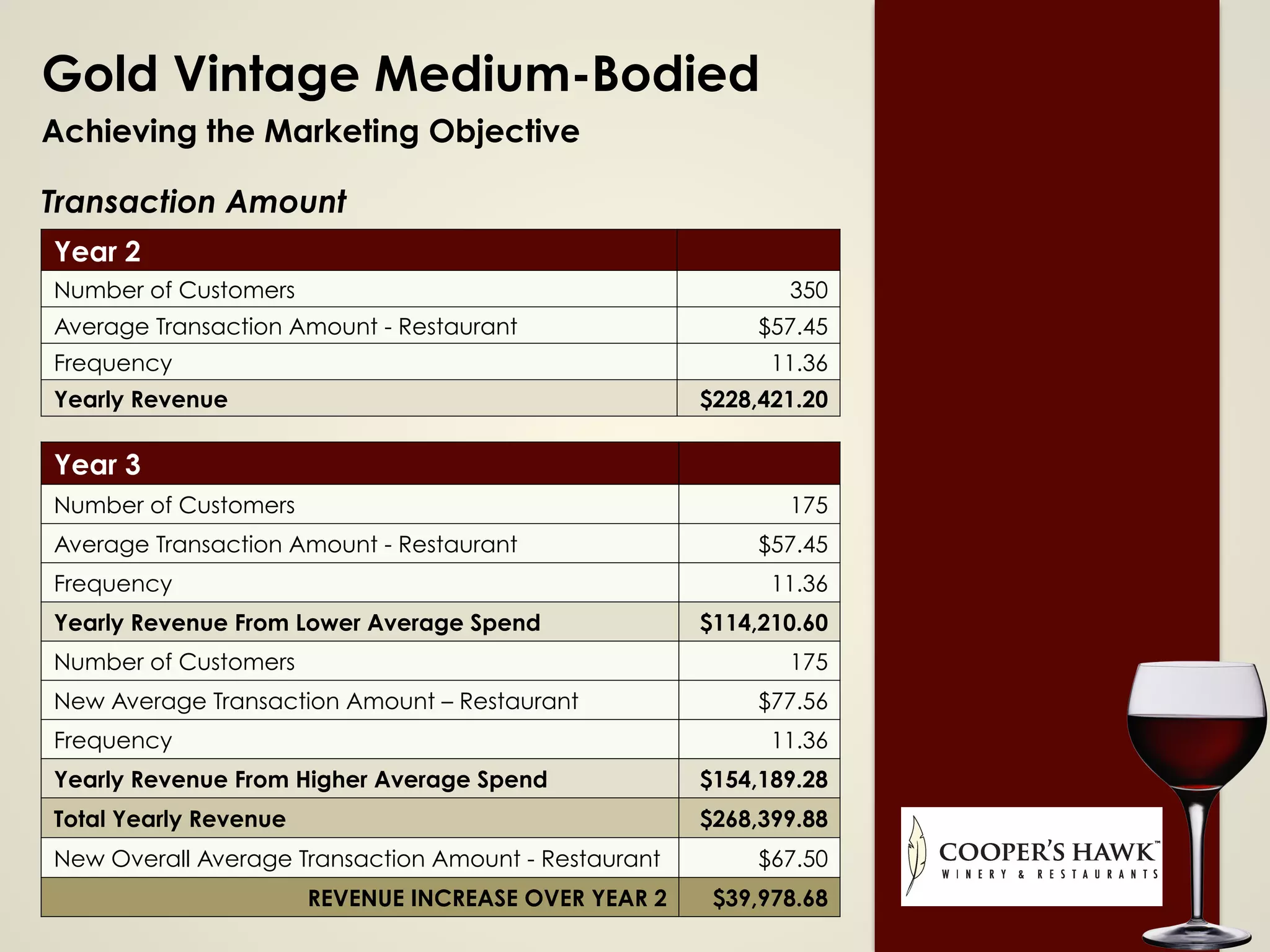

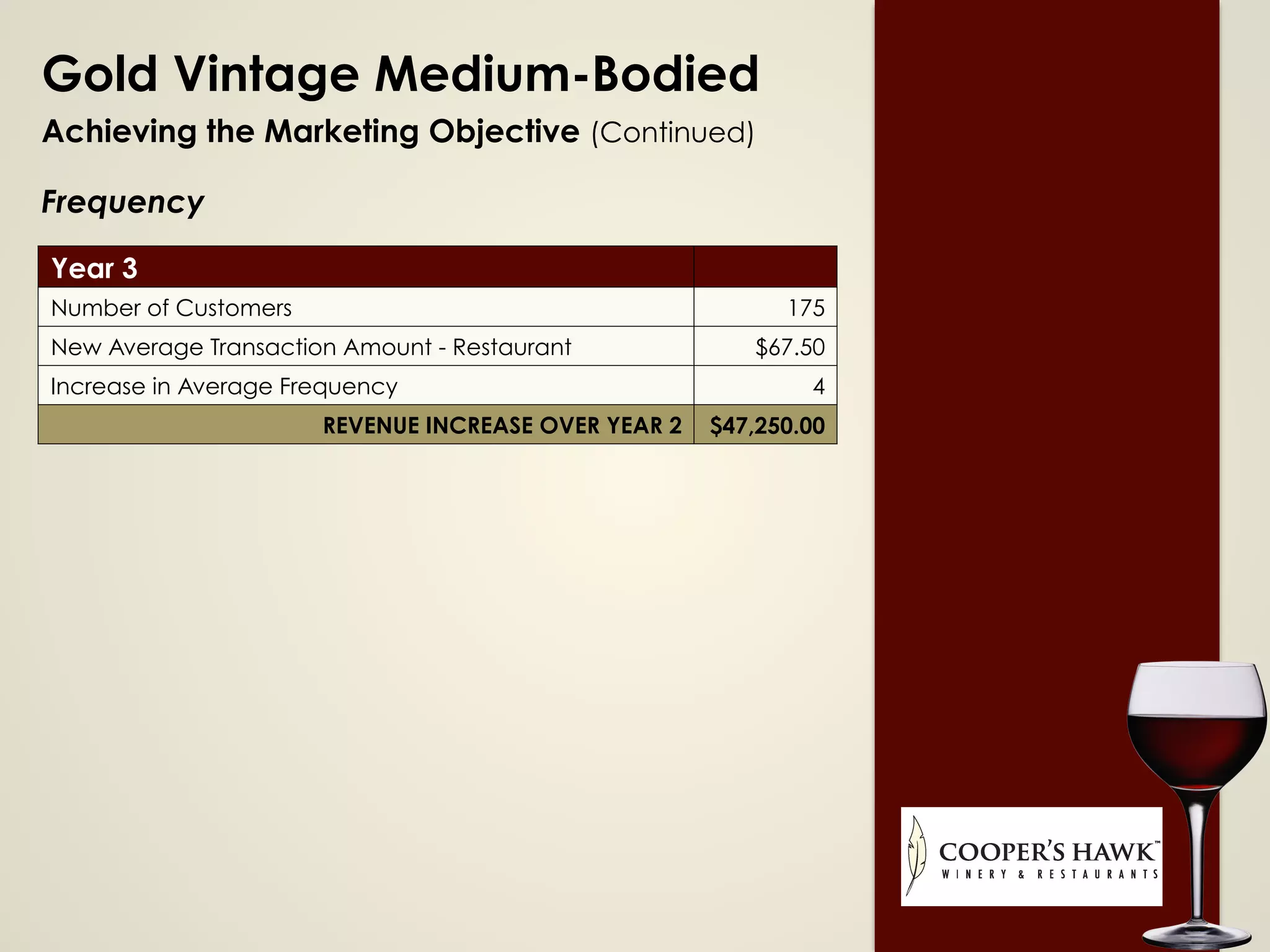

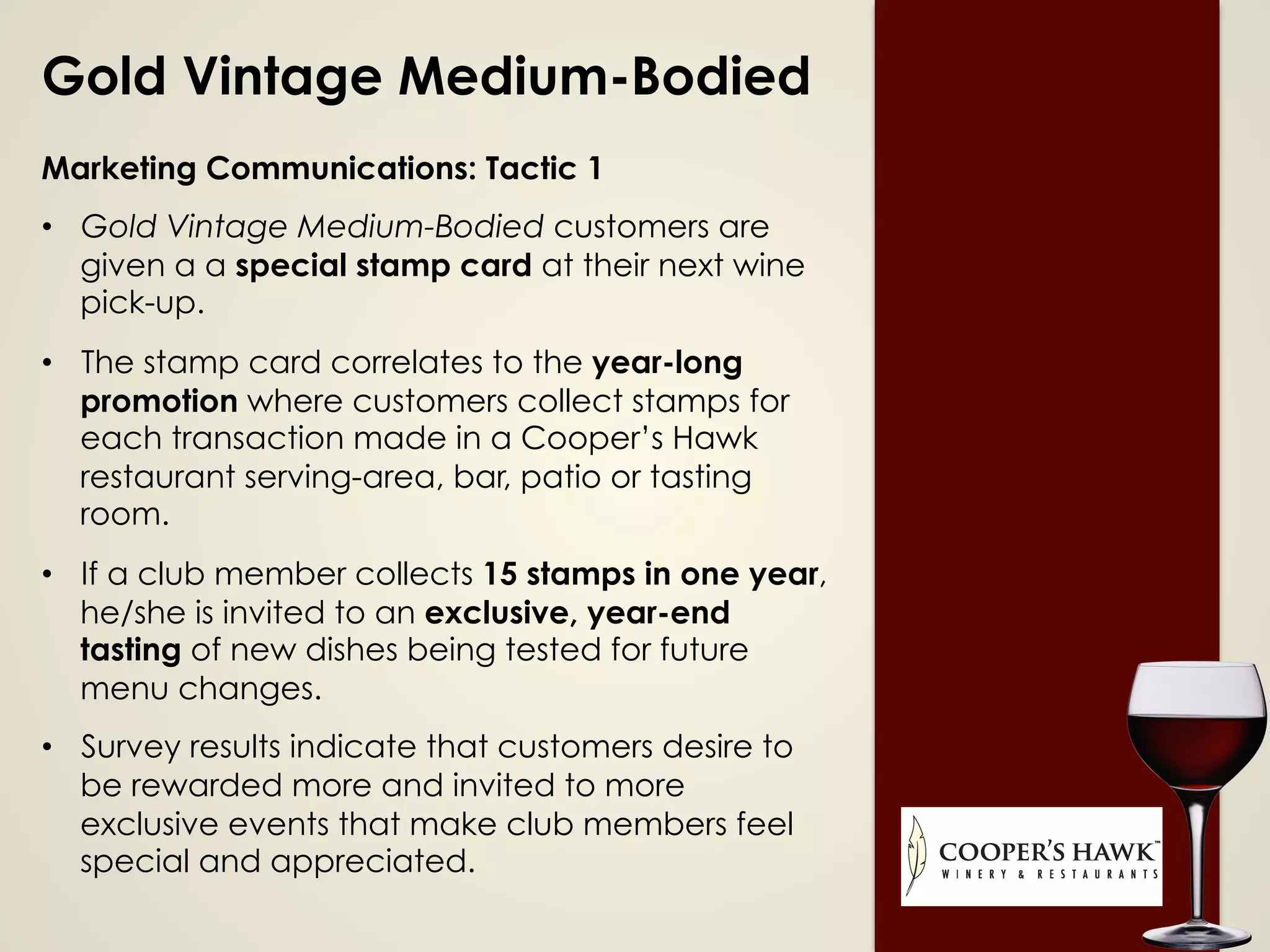

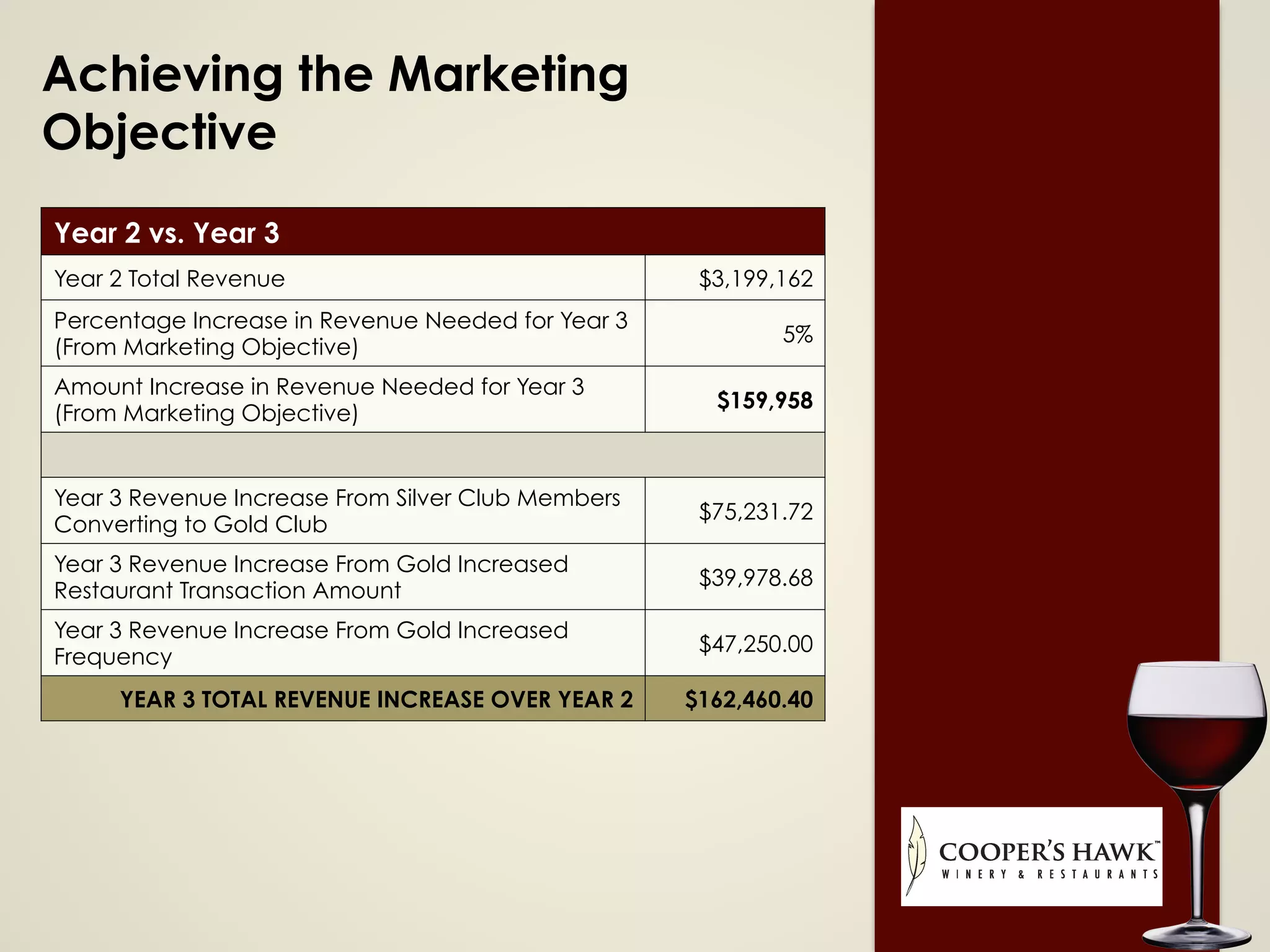

Cooper's Hawk, a wine and dining restaurant chain, saw a 4.64% decrease in total revenue from year 1 to year 2. Their wine club revenues decreased slightly while restaurant revenues decreased more. They have many competitors both direct and indirect. A segmentation analysis divided customers into 6 segments based on their total revenue and length of membership. The highest spending "Vintage Full-Bodied" segments contributed the most revenue and saw a small revenue increase, while the second highest spending "Unripe Full-Bodied" segment saw the largest revenue decrease.