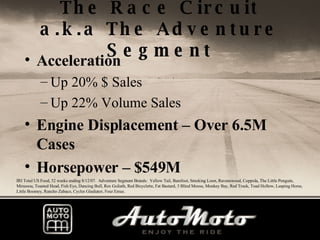

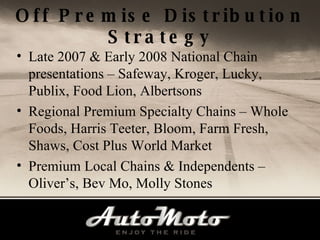

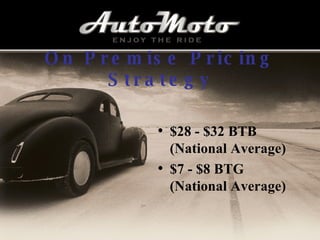

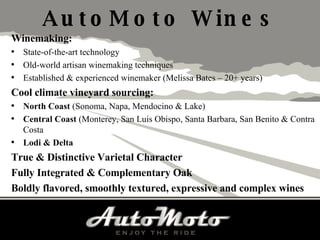

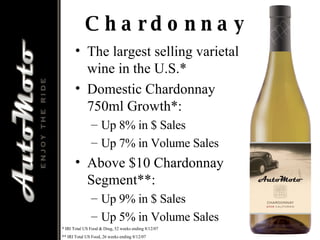

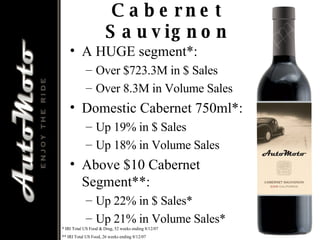

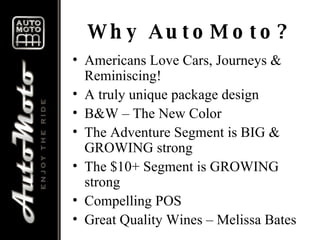

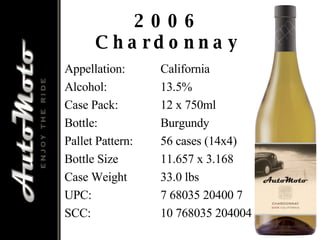

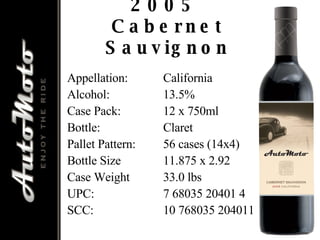

The document discusses the development of a new wine brand called AutoMoto targeted at consumers aged 21-35. It aims to have engaging and premium branding and packaging. The wine variety lineup includes 2005 Merlot, 2007 Riesling, and 2006 Chardonnay. The $10-11.49 price segment is growing, as are the adventure segment brands. The document outlines the branding, winemaking, varietals, pricing, and distribution strategies.