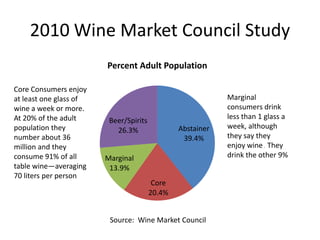

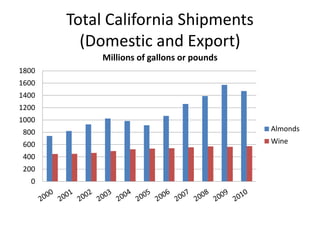

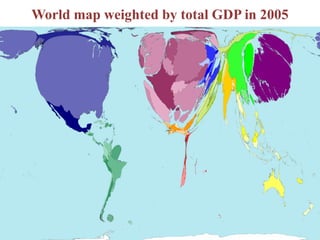

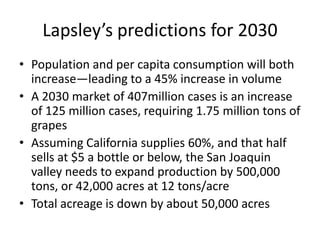

The document summarizes the state of the U.S. wine market from a UC Davis perspective. It notes that the U.S. is the largest wine consuming country but lags in per capita consumption compared to others. California dominates U.S. wine production, supplying 61% of the domestic market. Most wine sold is inexpensive, with 57% retailing under $7 per bottle. The document also examines wine grape production in California's San Joaquin Valley and competition with almonds, finding winegrapes currently less profitable but with potential for increased international demand. It predicts a 45% increase in U.S. wine volume by 2030, requiring 500,000 more tons of grapes primarily from the San Joaqu