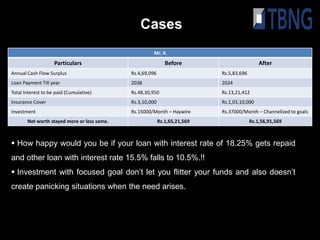

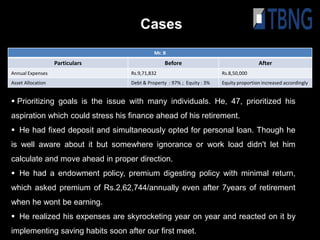

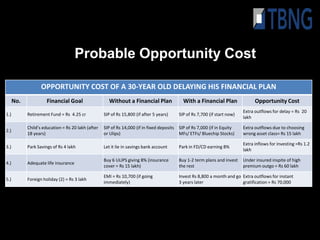

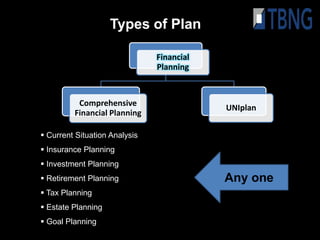

Everyone is busy with professional life and lacks time for personal finance. Decisions about personal finance are often made emotionally rather than professionally. Financial planning is a three-step process of evaluating one's current financial position, setting future goals, and finding ways to achieve those goals through proper cash flow management, risk assessment, insurance needs, and retirement planning. A paid financial plan that is client-centric rather than product-centric can help achieve goals more efficiently compared to free plans that may be influenced by commissions and fees.