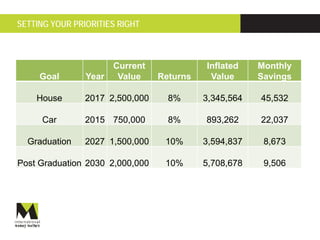

This document outlines an agenda for a presentation on personal financial planning. The presentation covers building a strong financial foundation through health and life insurance. It emphasizes the importance of setting goals and priorities to guide investment decisions. Short term goals are suited for low risk debt funds and FDs, while long term goals require higher risk equity funds. Professional financial advisors can help due to the complexity of products and lack of time and expertise for individuals. The presentation provides a framework for financial planning focused on protection, goals, asset allocation, and using advisors.