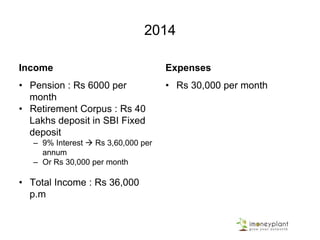

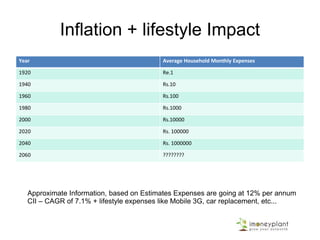

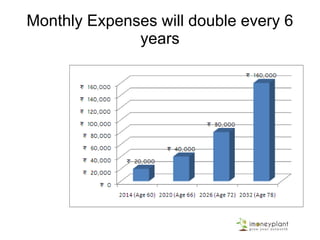

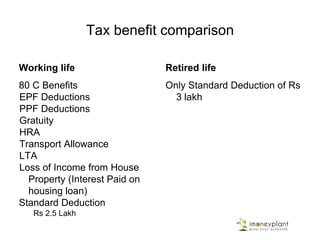

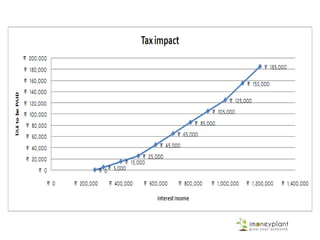

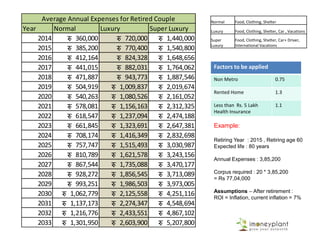

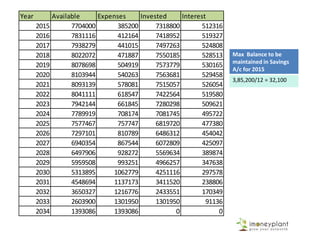

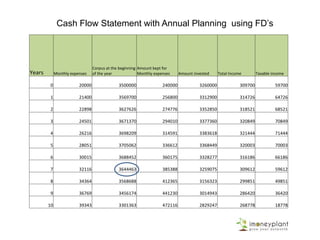

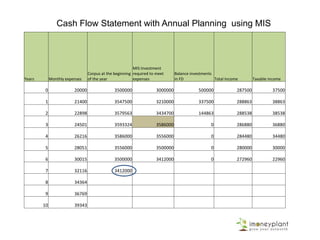

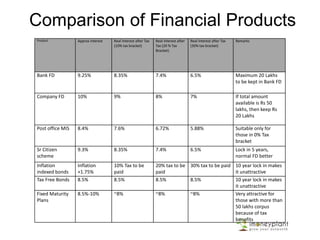

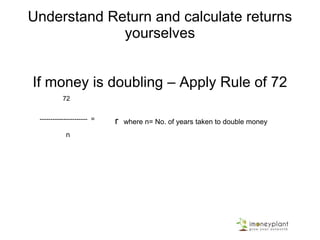

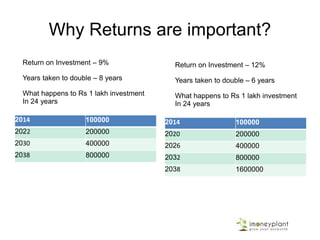

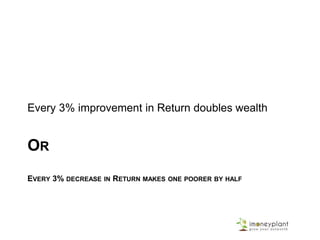

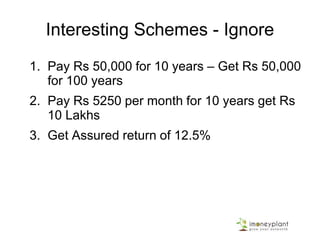

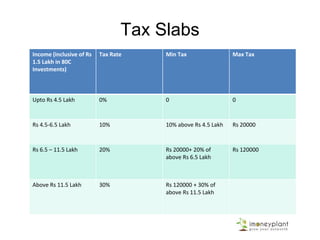

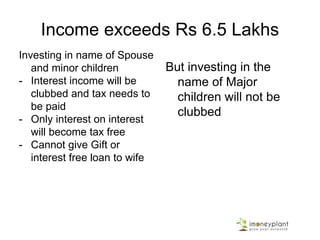

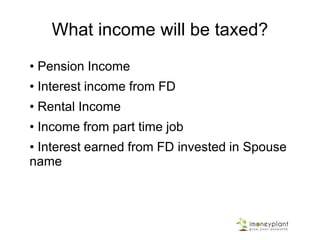

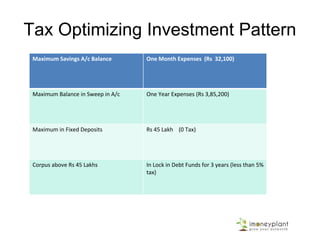

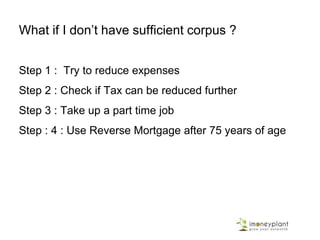

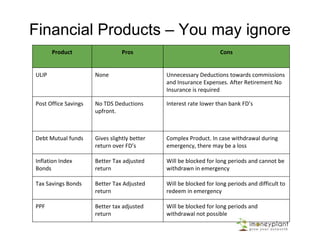

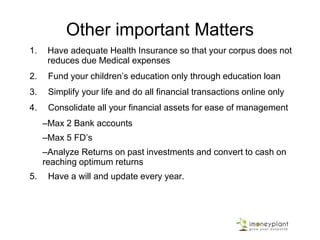

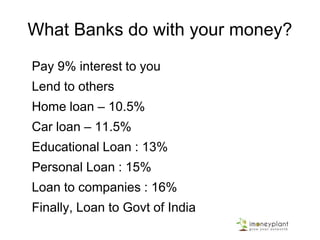

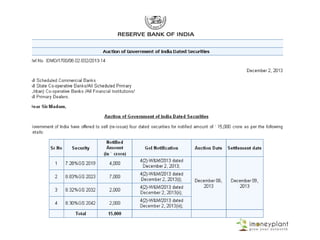

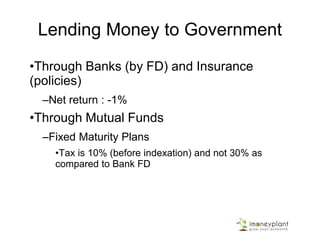

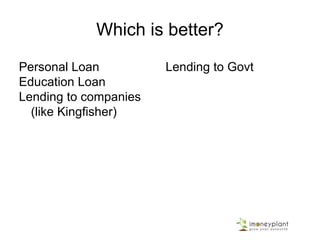

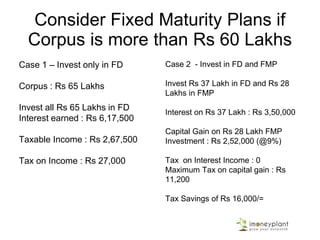

This document discusses financial challenges and strategies for managing finances post-retirement. It identifies three main challenges: 1) inflation will cause expenses to double every 6 years, 2) taxes will be higher with fewer deductions, 3) discretionary spending tends to increase in retirement. To manage these, the strategies proposed are to 1) fix expenses and deposit only what is needed each month, 2) plan finances for 20+ years rather than just 12 months, and 3) select investments with the highest post-tax returns and less than 5-year lock-ins. The document provides tools to project expenses over 20 years and compare returns of different investment options.