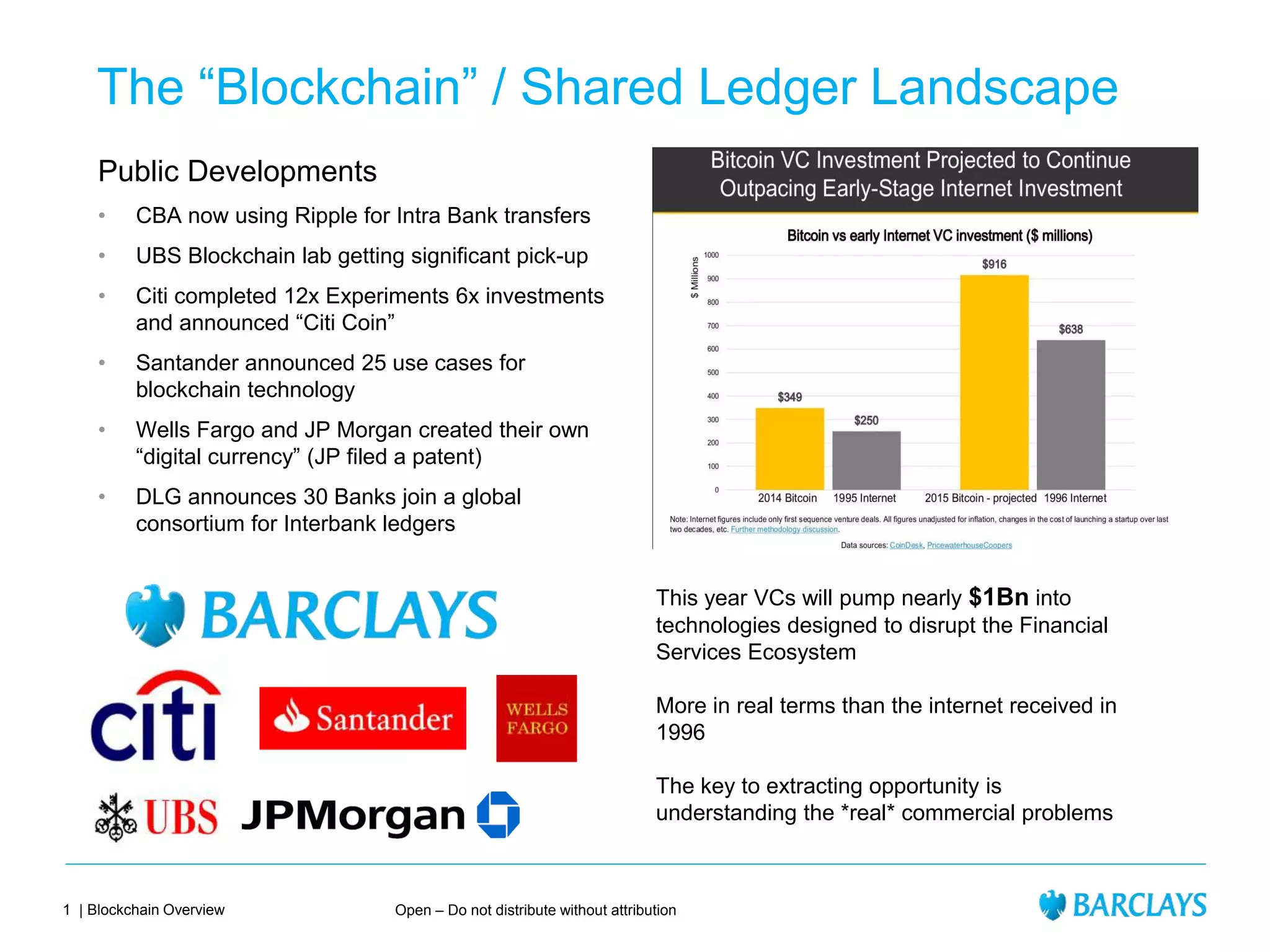

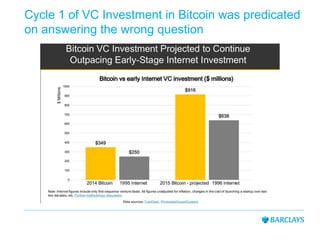

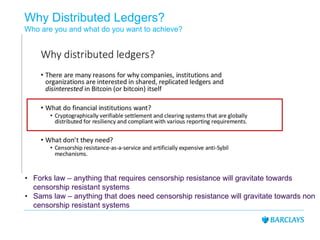

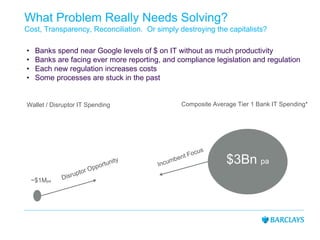

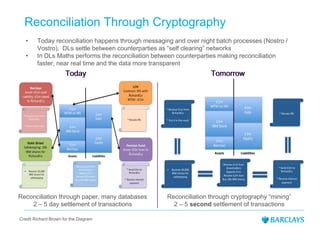

This document discusses the growing adoption of blockchain technology in the banking sector. It notes that major banks like Citi, UBS, and Santander are experimenting with and investing in blockchain. Venture capital funding for blockchain startups is projected to reach $1 billion this year. The document examines why distributed ledgers are useful for solving problems like reconciliation, transparency, and compliance costs. It provides examples of how blockchain could address issues like blood diamonds, proof of ownership, and operational risk in trade finance. Overall, the document advocates an open source and collaborative approach to solving big challenges through blockchain.