More Related Content

Similar to Whirlpool case (20)

Whirlpool case

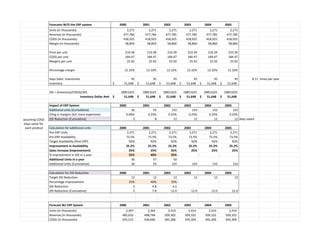

- 1. Forecasts W/O the ERP system 2000 2001 2002 2003 2004 2005

Units (in thousands) 2,271 2,271 2,271 2,271 2,271 2,271

Revenue (in thousands) 477,784 477,784 477,785 477,785 477,785 477,785

COGS (In thousands) 418,925 418,925 418,925 418,925 418,925 418,925

Margin (in thousands) 58,859 58,859 58,860 58,860 58,860 58,860

Price per unit 210.38 210.38 210.39 210.39 210.39 210.39

COGS per unit 184.47 184.47 184.47 184.47 184.47 184.47

Margins per unit 25.92 25.92 25.92 25.92 25.92 25.92

Percentage margin 12.32% 12.32% 12.32% 12.32% 12.32% 12.32%

Days Sales' inventories 45 45 45 45 45 45 8.11 times per year

Inventory ($ 51,648) ($ 51,648) ($ 51,648) ($ 51,648) ($ 51,648) ($ 51,648)

DSI = (Inventory/COGS)/365 18851625 18851625 18851625 18851625 18851625 18851625

Inventory Dollar Amt ($ 51,648) ($ 51,648) ($ 51,648) ($ 51,648) ($ 51,648) ($ 51,648)

Impact of ERP System 2000 2001 2002 2003 2004 2005

Additional units (Cumulative) 36 93 143 143 143 143

assuming COGS

stays same for

each prodcut

Chng in margins (b/c more expensive) 0.06% 0.25% 0.25% 0.25% 0.25% 0.25%

DSI Reduction (Cumulative) 3 8 12 12 12 12 days saved

Calculation for additional units 2000 2001 2002 2003 2004 2005

Pre-ERP Units 2,271 2,271 2,271 2,271 2,271 2,271

Pre-ERP Availability 73.5% 73.5% 73.5% 73.5% 73.5% 73.5%

Target Availability (Post ERP) 92% 92% 92% 92% 92% 92%

Improvement in Availability 25.2% 25.2% 25.2% 25.2% 25.2% 25.2%

Sales Increase (Improvement) 25% 25% 25% 25% 25% 25%

% Improvement in DSI in a year 25% 40% 35% - - -

Additional Units in a year 36 57 50

Additional Units (Cumulative) 36 93 143 143 143 143

Calculation for DSI Reduction 2000 2001 2002 2003 2004 2005

Target DSI Reduction 12 12 12 12 12 12

Percentage Improvement 25% 40% 35% - - -

DSI Reduction 3 4.8 4.2

DSI Reduction (Cumulative) 3 7.8 12.0 12.0 12.0 12.0

Forecast W/ ERP System 2000 2001 2002 2003 2004 2005

Units (in thousands) ( 2,307) ( 2,364) ( 2,414) ( 2,414) ( 2,414) ( 2,414)

Revenue (in thousands) ( 485,632) ( 498,748) ( 509,302) ( 509,322) ( 509,322) ( 509,322)

COGS (In thousands) ( 425,515) ( 436,060) ( 445,286) ( 445,304) ( 445,304) ( 445,304)

- 2. Margin (in thousands) ( 60,117.25) ( 62,688.47) ( 64,015.93) ( 64,018.50) ( 64,018.50) ( 64,018.50)

Price per unit 210.53 210.99 210.99 210.99 210.99 210.99

didn't change COGS per unit 184.47 184.47 184.47 184.47 184.47 184.47

Margins per unit 26.06 26.52 26.52 26.52 26.52 26.52

Percentage margin 12.38% 12.57% 12.57% 12.57% 12.57% 12.57%

Days Sales' inventories 42 37 33 33 33 33

Inventory ( 48,963) ( 44,442) ( 40,259) ( 40,260) ( 40,260) ( 40,260)

DSI = (Inventory/COGS)/365

Price per unit = COGS per unit / (1 - % margin)

- 3. South Forecasts W/O the ERP system 2000 2001 2002 2003 2004 2005

Units (in thousands) 1,416 1,416 1,416 1,416

Revenue (in thousands) 283,549 283,549 283,549 283,549 283,549 283,549

COGS (In thousands) 237,308 237,308 237,308 237,308 237,308 237,308

Margin (in thousands) 46,241 46,241 46,241 46,241

Price per unit 200.25 200.25 200.25 200.25

COGS per unit 167.59 167.59 167.59 167.59

Margins per unit 32.66 32.66 32.66 32.66

Percentage margin 16.31% 16.31% 16.31% 16.31%

Days Sales' inventories 51 51 51 51 7.16

Inventory ($ 33,158) ($ 33,158) ($ 33,158) ($ 33,158)

DSI = (Inventory/COGS)/365 12102708 12102708 12102708 12102708

Inventory Dollar Amt ($ 33,158) ($ 33,158) ($ 33,158) ($ 33,158)

Impact of ERP System 2000 2001 2002 2003 2004 2005

Additional units (Cumulative) 13 28 38 38 38

Chng in margins (b/c more expensive) 0.10% 0.25% 0.25%

DSI Reduction (Cumulative) 4 9 12 days saved

Calculation for additional units 2000 2001 2002 2003 2004 2005

Pre-ERP Units 1,416 1,416 1,416 1,416

Pre-ERP Availability 83.1% 83.1% 83.1% 83.1%

Target Availability (Post ERP) 92% 92% 92% 92%

Improvement in Availability 10.7% 10.7% 10.7% 10.7%

Sales Increase (Improvement) 25% 25% 25% 25%

% Improvement in DSI in a year 35% 40% 25%

Additional Units in a year 13 15 9

Additional Units (Cumulative) 13 28 38

Calculation for DSI Reduction 2000 2001 2002 2003 2004 2005

Target DSI Reduction 12 12 12

Percentage Improvement 35% 40% 25%

- 4. DSI Reduction 4.2 4.8 3.0

DSI Reduction (Cumulative) 4.2 9.0 12.0

Forecast W/ ERP System 2000 2001 2002 2003 2004 2005

Units (in thousands) ( 1,416) ( 1,429) ( 1,444) ( 1,454)

Revenue (in thousands) ( 283,752) ( 286,549) ( 290,110) ( 292,013) ( 292,013) ( 292,013)

COGS (In thousands) ( 237,308) ( 239,532) ( 242,073) ( 243,662) ( 243,662) ( 243,662)

Margin (in thousands) ( 46,444.43) ( 47,016.72) ( 48,036.17) ( 48,351.39)

Price per unit 200.39 200.49 200.85 200.85

COGS per unit 167.59 167.59 167.59 167.59

Margins per unit 32.80 32.90 33.26 33.26

Percentage margin 16.37% 16.41% 16.56% 16.56%

Days Sales' inventories 51 47 42 39

Inventory ( 33,158) ( 30,713) ( 27,855) ( 26,035)

DSI = (Inventory/COGS)/365

Price per unit = COGS per unit / (1 - % margin)

- 5. Central Forecasts W/O the ERP system 2000 2001 2002 2003 2004 2005

Units (in thousands) 978 978 978 978 978 978

Revenue (in thousands) 185,625 185,625 185,625 185,625 185,625 185,625

COGS (In thousands) 141,947 141,947 141,947 141,947 141,947 141,947

Margin (in thousands) 43,678 43,678 43,678 43,678 43,678 43,678

Price per unit 189.80 189.80 189.80 189.80 189.80 189.80

COGS per unit 145.14 145.14 145.14 145.14 145.14 145.14

Margins per unit 44.66 44.66 44.66 44.66 44.66 44.66

Percentage margin 23.53% 23.53% 23.53% 23.53% 23.53% 23.53%

Days Sales' inventories 67 67 67 67 67 67 5.45

Inventory ($ 26,056) ($ 26,056) ($ 26,056) ($ 26,056) ($ 26,056) ($ 26,056)

DSI = (Inventory/COGS)/365 9510449 9510449 9510449 9510449 9510449 9510449

Inventory Dollar Amt ($ 26,056) ($ 26,056) ($ 26,056) ($ 26,056) ($ 26,056) ($ 26,056)

Impact of ERP System 2000 2001 2002 2003 2004 2005

Additional units (Cumulative) 0 0 19 39 48 48

Chng in margins (b/c more expensive) 0.13% 0.25% 0.25% 0.25%

DSI Reduction (Cumulative) 4.8 9.6 12.0 12 days saved

Calculation for additional units 2000 2001 2002 2003 2004 2005

Pre-ERP Units 978 978 978 978 978 978

Pre-ERP Availability 76.8% 76.8% 76.8% 76.8% 76.8% 76.8%

Target Availability (Post ERP) 92% 92% 92% 92% 92% 92%

Improvement in Availability 19.8% 19.8% 19.8% 19.8% 19.8% 19.8%

Sales Increase (Improvement) 25% 25% 25% 25% 25% 25%

% Improvement in DSI in a year 40% 40% 20%

Additional Units in a year 0 0 19 19 10 0

Additional Units (Cumulative) 0 0 19 39 48 48

Calculation for DSI Reduction 2000 2001 2002 2003 2004 2005

Target DSI Reduction 12 12 12 12 12 12

Percentage Improvement 40% 40% 20%

- 6. DSI Reduction 0 0.0 4.8 4.8 2.4

DSI Reduction (Cumulative) 0 0.0 4.8 9.6 12.0 12

Forecast W/ ERP System 2000 2001 2002 2003 2004 2005

Units (in thousands) ( 978) ( 978) ( 997) ( 1,017) ( 1,026) ( 1,026)

Revenue (in thousands) ( 185,771) ( 185,625) ( 189,621) ( 193,606) ( 195,449) ( 195,449)

COGS (In thousands) ( 141,947) ( 141,947) ( 144,756) ( 147,566) ( 148,970) ( 148,970)

Margin (in thousands) ( 43,823.76) ( 43,678.00) ( 44,864.82) ( 46,039.87) ( 46,478.12) ( 46,478.12)

Price per unit 189.95 189.80 190.12 190.42 190.42 190.42

COGS per unit 145.14 145.14 145.14 145.14 145.14 145.14

Margins per unit 44.81 44.66 44.98 45.28 45.28 45.28

Percentage margin 23.59% 23.53% 23.66% 23.78% 23.78% 23.78%

Days Sales' inventories 67 67 62 57 55 55

Inventory ( 26,056) ( 26,056) ( 24,668) ( 23,206) ( 22,448) ( 22,448)

DSI = (Inventory/COGS)/365

Price per unit = COGS per unit / (1 - % margin)

- 7. North Forecasts W/O the ERP system 2000 2001 2002 2003 2004 2005

Units (in thousands) 1,443 1,443 1,443 1,443 1,443 1,443

Revenue (in thousands) 280,901 280,901 280,901 280,901 280,901 280,901

COGS (In thousands) 251,083 251,083 251,083 251,083 251,083 251,083

Margin (in thousands) 29,818 29,818 29,818 29,818 29,818 29,818

Price per unit 194.66 194.66 194.66 194.66 194.66 194.66

COGS per unit 174.00 174.00 174.00 174.00 174.00 174.00

Margins per unit 20.66 20.66 20.66 20.66 20.66 20.66

Percentage margin 10.62% 10.62% 10.62% 10.62% 10.62% 10.62%

Days Sales' inventories 55 55 55 55 55 55 6.64

Inventory ($ 37,834) ($ 37,834) ($ 37,834) ($ 37,834) ($ 37,834) ($ 37,834)

DSI = (Inventory/COGS)/365 13809565 13809565 13809565 13809565 13809565 13809565

Inventory Dollar Amt ($ 37,834) ($ 37,834) ($ 37,834) ($ 37,834) ($ 37,834) ($ 37,834)

Impact of ERP System 2000 2001 2002 2003 2004 2005

Additional units (Cumulative) 0 0 0 15 31 38

Chng in margins (b/c more expensive) 0.13% 0.25% 0.25%

DSI Reduction (Cumulative) 0 0 0 5 10 12 days saved

Calculation for additional units 2000 2001 2002 2003 2004 2005

Pre-ERP Units 1,443 1,443 1,443 1,443 1,443 1,443

Pre-ERP Availability 83.2% 83.2% 83.2% 83.2% 83.2% 83.2%

Target Availability (Post ERP) 92% 92% 92% 92% 92% 92%

Improvement in Availability 10.6% 10.6% 10.6% 10.6% 10.6% 10.6%

Sales Increase (Improvement) 25% 25% 25% 25% 25% 25%

% Improvement in DSI in a year 40% 40% 20%

Additional Units in a year 0 0 0 15 15 8

Additional Units (Cumulative) 0 0 0 15 31 38

Calculation for DSI Reduction 2000 2001 2002 2003 2004 2005

Target DSI Reduction 12 12 12 12 12 12

Percentage Improvement 40% 40% 20%

DSI Reduction 0 0.0 0.0 5 4.8 2.4

DSI Reduction (Cumulative) 0 0.0 0.0 5 9.6 12.0

- 8. Forecast W/ ERP System 2000 2001 2002 2003 2004 2005

Units (in thousands) ( 1,443) ( 1,443) ( 1,443) ( 1,458) ( 1,474) ( 1,481)

Revenue (in thousands) ( 280,901) ( 280,901) ( 280,901) ( 284,286) ( 287,648) ( 289,137)

COGS (In thousands) ( 251,083) ( 251,083) ( 251,083) ( 253,739) ( 256,394) ( 257,722)

Margin (in thousands) ( 29,818.00) ( 29,818.00) ( 29,818.00) ( 30,546.84) ( 31,253.29) ( 31,415.14)

Price per unit 194.66 194.66 194.66 194.95 195.21 195.21

COGS per unit 174.00 174.00 174.00 174.00 174.00 174.00

Margins per unit 20.66 20.66 20.66 20.95 21.21 21.21

Percentage margin 10.62% 10.62% 10.62% 10.75% 10.87% 10.87%

Days Sales' inventories 55 55 55 50 45 43

Inventory ( 37,834) ( 37,834) ( 37,834) ( 34,898) ( 31,891) ( 30,362)

DSI = (Inventory/COGS)/365

Price per unit = COGS per unit / (1 - % margin)

- 9. Net Present Value of Cash Flows

Year 1999 2000 2001 2002 2003 2004 2005 2006 2007 Discount Rate 9%

(+)Depreciation 980 2760 4140 4960 4960 3980 2200 820

(-) CAPX 4900 8900 6900 4100

(+/-) Working Capital ($ 2,685) ( 6,967) ( 8,429) ( 6,218) ( 3,765) ( 1,529)

Operational Cash Flow -3817 -2,768 -1,530 152 2,820 3,781 4,673 6,631 7,478

Total ($ (8,717) ($ (8,003) ( 1,297) ( 8,621) ( 13,998) ( 12,506) ( 10,183) 8,831 8,298

NPV $22,752.59 In Thousands

Sensitivity Analysis

Discount rate 5% 6% 7% 8% 9% 10% 11% 12% 13% 14% 15% 16%

NPV $31,514.02 $29,071.34 $26,806.32 $24,704.45 $22,752.59 $20,938.74 $19,252.00 $17,682.44 $16,220.98 $14,859.34 $13,589.95 $12,405.88

Capital Expenditure and Depreciation

Year 1999 2000 2001 2002 2003 2004 2005 2006 2007

Capital Equipment 4300 8600 6900 4100

Software Licence 600 300

Capital Expenditure Total 4900 8900 6900 4100

Depreciation

West 980 980 980 980 980

South 1780 1780 1780 1780 1780

Central 1380 1380 1380 1380 1380

North 820 820 820 820 820

Total Depreciation 980 2760 4140 4960 4960 3980 2200 820

Operating Expenses/Savings

Year 1999 2000 2001 2002 2003 2004 2005 2006 2007

Additonal Employees 2250 2250 2250 2250

Consultants 3511 1663 1294 739

Ongoing Operational 600 1200 1800 2400 3000 3000 3000 3000 3000

License Maintaince 100 200 300 400 400 400

Compliance Task force 300 600 600 600 300

Total Costs 6361 5513 6144 6289 4000 3700 3400 3000 3000-Cost savings from

Reduction in Employees,

Warehouse. Returns -621 -1749 -2544 -3300 -3457 -3503 -3534 -3566

Total Operating Expenses 6361 4892 4395 3745 700 243 -103 -534 -566

Revenues of Additional Units

Year 1999 2000 2001 2002 2003 2004 2005 2006 2007

Additonal Units 36 106 191 235 260 268 289 289

Additional Revenue ( 7,848) ( 23,964) ( 42,074) ( 51,367) ( 56,572) ( 58,061) 63,197 63,197

COGS ( 6,590) ( 19,358) ( 33,936) ( 41,007) ( 45,068) ( 46,395) 50,480 50,480

- 10. Margin ( 1,258) ( 4,605) ( 8,138) ( 10,360) ( 11,504) ( 11,666) 12,717 12,717

Reduction in Inventory- WC ($ 2,685) ( 6,967) ( 8,429) ( 6,218) ( 3,765) ( 1,529)

Cash Flow of ERP Project

Year 1999 2000 2001 2002 2003 2004 2005 2006 2007

Revenue 0 ( 7,848) ( 23,964) ( 42,074) ( 51,367) ( 56,572) ( 58,061) 63,197 63,197

COGS 0 ( 6,590) ( 19,358) ( 33,936) ( 41,007) ( 45,068) ( 46,395) 50,480 50,480

Gross Margin 0 1,258 4,605 8,138 10,360 11,504 11,666 12,717 12,717

Operating Expenses 6361 4892 4395 3745 700 243 -103 -534 -566

Depreciation 0 980 2760 4140 4960 4960 3980 2200 820

EBIT -6361 -4,614 -2,550 253 4,700 6,301 7,789 11,051 12,463

Tax @ 40% -2544.4 -1846 -1020 101 1880 2520 3116 4420 4985

Cash Flow -3817 -2,768 -1,530 152 2,820 3,781 4,673 6,631 7,478