Washington CAD 2015

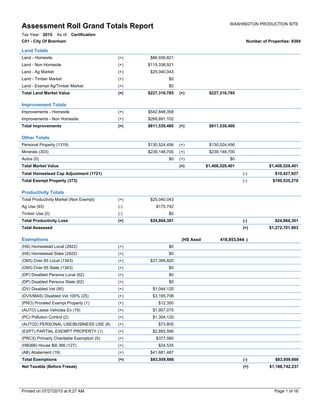

- 1. Total Improvements (=) Improvements - Non Homesite (+) (+)Improvements - Homesite Land - Homesite Land Totals (=)Total Land Market Value Land - Non Homesite Land - Ag Market Land - Timber Market Land - Exempt Ag/Timber Market (+) (+) (+) (+) (+) Improvement Totals Productivity Totals Total Productivity Market (Non Exempt) Ag Use (93) Timber Use (0) Total Productivity Loss Total Assessed (+) (-) (-) (=) C01 - City Of Brenham Number of Properties: 8394 (+) $115,336,921 $86,939,821 $25,040,043 $0 $0 $227,316,785 $227,316,785 $542,848,358 $268,691,102 $811,539,460 (+) $811,539,460 $25,040,043 $175,742 $0 $24,864,301 $24,864,301 $1,272,701,903(=) (-) Total Market Value Total Homestead Cap Adjustment (1721) Total Exempt Property (373) $1,408,529,401 $10,427,927 $100,535,270 (=) (-) (-) Other Totals Exemptions Total Exemptions (=) $83,959,666 Net Taxable (Before Freeze) (-) $83,959,666 (=) $1,188,742,237 $1,408,529,401 (HS Assd )418,853,044 Personal Property (1319) (+)$130,524,456 $130,524,456 Minerals (303) (+)$239,148,700 $239,148,700 Autos (0) (+)$0 $0 (HS) Homestead Local (2922) (+) $0 (HS) Homestead State (2922) (+) $0 (O65) Over 65 Local (1343) (+) $31,395,820 (O65) Over 65 State (1343) (+) $0 (DP) Disabled Persons Local (62) (+) $0 (DP) Disabled Persons State (62) (+) $0 (DV) Disabled Vet (95) (+) $1,044,120 (DVX/MAS) Disabled Vet 100% (25) (+) $3,195,708 (PRO) Prorated Exempt Property (1) (+) $12,350 (AUTO) Lease Vehicles Ex (19) (+) $1,957,075 (PC) Pollution Control (2) (+) $1,304,120 (AUTO2) PERSONAL USE/BUSINESS USE (6) (+) $73,805 (EXPT) PARTIAL EXEMPT PROPERTY (1) (+) $2,893,566 (PRCX) Primarly Charitable Exemption (5) (+) $377,080 (HB366) House Bill 366 (127) (+) $24,535 (AB) Abatement (19) (+) $41,681,487 Assessment Roll Grand Totals Report Tax Year: 2015 As of: Certification WASHINGTON PRODUCTION SITE Printed on 07/27/2015 at 8:27 AM Page 1 of 16

- 2. Assessment Roll Grand Totals Report Tax Year: 2015 As of: Certification WASHINGTON PRODUCTION SITE Total Improvements (=) Improvements - Non Homesite (+) (+)Improvements - Homesite Land - Homesite Land Totals (=)Total Land Market Value Land - Non Homesite Land - Ag Market Land - Timber Market Land - Exempt Ag/Timber Market (+) (+) (+) (+) (+) Improvement Totals Productivity Totals Total Productivity Market (Non Exempt) Ag Use (30) Timber Use (0) Total Productivity Loss Total Assessed (+) (-) (-) (=) C02 - City Of Burton Number of Properties: 360 (+) $1,473,740 $1,911,271 $3,115,861 $0 $0 $6,500,872 $6,500,872 $17,454,581 $4,432,946 $21,887,527 (+) $21,887,527 $3,115,861 $33,851 $0 $3,082,010 $3,082,010 $22,713,408(=) (-) Total Market Value Total Homestead Cap Adjustment (50) Total Exempt Property (30) $28,932,859 $251,111 $2,886,330 (=) (-) (-) Other Totals Exemptions Total Exemptions (=) $225,181 Net Taxable (Before Freeze) (-) $225,181 (=) $22,488,227 $28,932,859 (HS Assd )10,129,944 Personal Property (40) (+)$331,660 $331,660 Minerals (4) (+)$212,800 $212,800 Autos (0) (+)$0 $0 (HS) Homestead Local (78) (+) $0 (HS) Homestead State (78) (+) $0 (O65) Over 65 Local (51) (+) $0 (O65) Over 65 State (51) (+) $0 (DP) Disabled Persons Local (1) (+) $0 (DP) Disabled Persons State (1) (+) $0 (DV) Disabled Vet (5) (+) $60,000 (DVX/MAS) Disabled Vet 100% (1) (+) $107,272 (PRO) Prorated Exempt Property (1) (+) $43,054 (AUTO2) PERSONAL USE/BUSINESS USE (1) (+) $13,640 (HB366) House Bill 366 (5) (+) $1,215 Printed on 07/27/2015 at 8:27 AM Page 2 of 16

- 3. Assessment Roll Grand Totals Report Tax Year: 2015 As of: Certification WASHINGTON PRODUCTION SITE **** O65 Freeze Totals Freeze Assessed Freeze Taxable Freeze Ceiling (50) **** O65 Transfer Totals Transfer Assessed Transfer Taxable Post-Percent Taxable $6,445,398 $6,407,538 $22,430.89 $0 $0 $0 Transfer Adjustment (0) $0 Freeze Adjusted Taxable (Net Taxable - Freeze Taxable - Transfer Adjustment) (=) $16,080,689 *** DP Freeze Totals Freeze Assessed Freeze Taxable Freeze Ceiling (1) *** DP Transfer Totals Transfer Assessed Transfer Taxable Post-Percent Taxable $23,073 $23,073 $58.05 $0 $0 $0 Transfer Adjustment (0) $0 Freeze Adjusted Taxable (Net Taxable - Freeze Taxable - Transfer Adjustment) (=) $16,057,616 Printed on 07/27/2015 at 8:27 AM Page 3 of 16

- 4. Assessment Roll Grand Totals Report Tax Year: 2015 As of: Certification WASHINGTON PRODUCTION SITE Total Improvements (=) Improvements - Non Homesite (+) (+)Improvements - Homesite Land - Homesite Land Totals (=)Total Land Market Value Land - Non Homesite Land - Ag Market Land - Timber Market Land - Exempt Ag/Timber Market (+) (+) (+) (+) (+) Improvement Totals Productivity Totals Total Productivity Market (Non Exempt) Ag Use (7353) Timber Use (0) Total Productivity Loss Total Assessed (+) (-) (-) (=) G01 - Washington County Number of Properties: 35509 (+) $322,188,425 $254,045,907 $2,534,309,733 $0 $0 $3,110,544,065 $3,110,544,065 $1,652,592,692 $488,403,487 $2,140,996,179 (+) $2,140,996,179 $2,534,309,733 $30,986,581 $0 $2,503,323,152 $2,503,323,152 $3,265,413,937(=) (-) Total Market Value Total Homestead Cap Adjustment (4188) Total Exempt Property (718) $5,949,751,564 $27,709,180 $153,305,295 (=) (-) (-) Other Totals Exemptions Total Exemptions (=) $109,021,005 Net Taxable (Before Freeze) (-) $109,021,005 (=) $3,156,392,932 $5,949,751,564 (HS Assd )1,278,440,773 Personal Property (2352) (+)$182,206,420 $182,206,420 Minerals (10751) (+)$516,004,900 $516,004,900 Autos (0) (+)$0 $0 (HS) Homestead Local (7967) (+) $0 (HS) Homestead State (7967) (+) $0 (O65) Over 65 Local (3647) (+) $42,539,515 (O65) Over 65 State (3647) (+) $0 (DP) Disabled Persons Local (170) (+) $1,895,530 (DP) Disabled Persons State (170) (+) $0 (DV) Disabled Vet (229) (+) $2,426,165 (DVX/MAS) Disabled Vet 100% (63) (+) $10,105,343 (PRO) Prorated Exempt Property (2) (+) $55,404 (PC) Pollution Control (4) (+) $1,701,510 (AUTO) Lease Vehicles Ex (41) (+) $4,324,035 (EXPT) PARTIAL EXEMPT PROPERTY (1) (+) $2,893,566 (PRCX) Primarly Charitable Exemption (9) (+) $626,240 (AUTO2) PERSONAL USE/BUSINESS USE (24) (+) $348,340 (HB366) House Bill 366 (2265) (+) $423,870 (AB) Abatement (19) (+) $41,681,487 Printed on 07/27/2015 at 8:27 AM Page 4 of 16

- 5. Assessment Roll Grand Totals Report Tax Year: 2015 As of: Certification WASHINGTON PRODUCTION SITE **** O65 Freeze Totals Freeze Assessed Freeze Taxable Freeze Ceiling (3439) **** O65 Transfer Totals Transfer Assessed Transfer Taxable Post-Percent Taxable $562,051,208 $514,997,553 $1,266,079.24 $3,780,330 $3,564,330 $2,574,017 Transfer Adjustment (18) $990,313 Freeze Adjusted Taxable (Net Taxable - Freeze Taxable - Transfer Adjustment) (=) $2,640,405,066 *** DP Freeze Totals Freeze Assessed Freeze Taxable Freeze Ceiling (157) *** DP Transfer Totals Transfer Assessed Transfer Taxable Post-Percent Taxable $17,789,804 $15,156,200 $41,869.63 $0 $0 $0 Transfer Adjustment (0) $0 Freeze Adjusted Taxable (Net Taxable - Freeze Taxable - Transfer Adjustment) (=) $2,625,248,866 Printed on 07/27/2015 at 8:27 AM Page 5 of 16

- 6. Assessment Roll Grand Totals Report Tax Year: 2015 As of: Certification WASHINGTON PRODUCTION SITE Total Improvements (=) Improvements - Non Homesite (+) (+)Improvements - Homesite Land - Homesite Land Totals (=)Total Land Market Value Land - Non Homesite Land - Ag Market Land - Timber Market Land - Exempt Ag/Timber Market (+) (+) (+) (+) (+) Improvement Totals Productivity Totals Total Productivity Market (Non Exempt) Ag Use (7353) Timber Use (0) Total Productivity Loss Total Assessed (+) (-) (-) (=) JC1 - Blinn College Number of Properties: 35507 (+) $322,188,425 $254,045,907 $2,534,309,733 $0 $0 $3,110,544,065 $3,110,544,065 $1,652,592,692 $488,403,487 $2,140,996,179 (+) $2,140,996,179 $2,534,309,733 $30,986,581 $0 $2,503,323,152 $2,503,323,152 $3,261,204,347(=) (-) Total Market Value Total Homestead Cap Adjustment (4188) Total Exempt Property (718) $5,945,541,974 $27,709,180 $153,305,295 (=) (-) (-) Other Totals Exemptions Total Exemptions (=) $67,339,518 Net Taxable (Before Freeze) (-) $67,339,518 (=) $3,193,864,829 $5,945,541,974 (HS Assd )1,278,440,773 Personal Property (2350) (+)$177,996,830 $177,996,830 Minerals (10751) (+)$516,004,900 $516,004,900 Autos (0) (+)$0 $0 (HS) Homestead Local (7967) (+) $0 (HS) Homestead State (7967) (+) $0 (O65) Over 65 Local (3647) (+) $42,539,515 (O65) Over 65 State (3647) (+) $0 (DP) Disabled Persons Local (170) (+) $1,895,530 (DP) Disabled Persons State (170) (+) $0 (DV) Disabled Vet (229) (+) $2,426,165 (DVX/MAS) Disabled Vet 100% (63) (+) $10,105,343 (PRO) Prorated Exempt Property (2) (+) $55,404 (PC) Pollution Control (4) (+) $1,701,510 (AUTO) Lease Vehicles Ex (41) (+) $4,324,035 (EXPT) PARTIAL EXEMPT PROPERTY (1) (+) $2,893,566 (PRCX) Primarly Charitable Exemption (9) (+) $626,240 (AUTO2) PERSONAL USE/BUSINESS USE (24) (+) $348,340 (HB366) House Bill 366 (2265) (+) $423,870 Printed on 07/27/2015 at 8:27 AM Page 6 of 16

- 7. Assessment Roll Grand Totals Report Tax Year: 2015 As of: Certification WASHINGTON PRODUCTION SITE **** O65 Freeze Totals Freeze Assessed Freeze Taxable Freeze Ceiling (3439) **** O65 Transfer Totals Transfer Assessed Transfer Taxable Post-Percent Taxable $562,051,208 $514,997,553 $232,042.33 $3,780,330 $3,564,330 $2,974,161 Transfer Adjustment (18) $590,169 Freeze Adjusted Taxable (Net Taxable - Freeze Taxable - Transfer Adjustment) (=) $2,678,277,107 *** DP Freeze Totals Freeze Assessed Freeze Taxable Freeze Ceiling (157) *** DP Transfer Totals Transfer Assessed Transfer Taxable Post-Percent Taxable $17,789,804 $15,156,200 $7,478.33 $0 $0 $0 Transfer Adjustment (0) $0 Freeze Adjusted Taxable (Net Taxable - Freeze Taxable - Transfer Adjustment) (=) $2,663,120,907 Printed on 07/27/2015 at 8:27 AM Page 7 of 16

- 8. Assessment Roll Grand Totals Report Tax Year: 2015 As of: Certification WASHINGTON PRODUCTION SITE Total Improvements (=) Improvements - Non Homesite (+) (+)Improvements - Homesite Land - Homesite Land Totals (=)Total Land Market Value Land - Non Homesite Land - Ag Market Land - Timber Market Land - Exempt Ag/Timber Market (+) (+) (+) (+) (+) Improvement Totals Productivity Totals Total Productivity Market (Non Exempt) Ag Use (7353) Timber Use (0) Total Productivity Loss Total Assessed (+) (-) (-) (=) RD1 - Washington Co Fm Number of Properties: 35509 (+) $322,188,425 $254,045,907 $2,534,309,733 $0 $0 $3,110,544,065 $3,110,544,065 $1,652,592,692 $488,403,487 $2,140,996,179 (+) $2,140,996,179 $2,534,309,733 $30,986,581 $0 $2,503,323,152 $2,503,323,152 $3,265,413,937(=) (-) Total Market Value Total Homestead Cap Adjustment (4188) Total Exempt Property (718) $5,949,751,564 $27,709,180 $153,305,295 (=) (-) (-) Other Totals Exemptions Total Exemptions (=) $121,368,014 Net Taxable (Before Freeze) (-) $121,368,014 (=) $3,144,045,923 $5,949,751,564 (HS Assd )1,278,440,773 Personal Property (2352) (+)$182,206,420 $182,206,420 Minerals (10751) (+)$516,004,900 $516,004,900 Autos (0) (+)$0 $0 (HS) Homestead Local (7967) (+) $0 (HS) Homestead State (7967) (+) $12,387,420 (O65) Over 65 Local (3647) (+) $42,539,515 (O65) Over 65 State (3647) (+) $0 (DP) Disabled Persons Local (170) (+) $1,895,530 (DP) Disabled Persons State (170) (+) $0 (DV) Disabled Vet (229) (+) $2,426,165 (DVX/MAS) Disabled Vet 100% (63) (+) $10,064,932 (PRO) Prorated Exempt Property (2) (+) $55,404 (PC) Pollution Control (4) (+) $1,701,510 (AUTO) Lease Vehicles Ex (41) (+) $4,324,035 (EXPT) PARTIAL EXEMPT PROPERTY (1) (+) $2,893,566 (PRCX) Primarly Charitable Exemption (9) (+) $626,240 (AUTO2) PERSONAL USE/BUSINESS USE (24) (+) $348,340 (HB366) House Bill 366 (2265) (+) $423,870 (AB) Abatement (19) (+) $41,681,487 Printed on 07/27/2015 at 8:27 AM Page 8 of 16

- 9. Assessment Roll Grand Totals Report Tax Year: 2015 As of: Certification WASHINGTON PRODUCTION SITE **** O65 Freeze Totals Freeze Assessed Freeze Taxable Freeze Ceiling (3439) **** O65 Transfer Totals Transfer Assessed Transfer Taxable Post-Percent Taxable $562,051,208 $514,997,553 $594,990.45 $3,780,330 $3,564,330 $3,275,679 Transfer Adjustment (18) $288,651 Freeze Adjusted Taxable (Net Taxable - Freeze Taxable - Transfer Adjustment) (=) $2,628,759,719 *** DP Freeze Totals Freeze Assessed Freeze Taxable Freeze Ceiling (157) *** DP Transfer Totals Transfer Assessed Transfer Taxable Post-Percent Taxable $17,789,804 $15,156,200 $18,704.48 $0 $0 $0 Transfer Adjustment (0) $0 Freeze Adjusted Taxable (Net Taxable - Freeze Taxable - Transfer Adjustment) (=) $2,613,603,519 Printed on 07/27/2015 at 8:27 AM Page 9 of 16

- 10. Assessment Roll Grand Totals Report Tax Year: 2015 As of: Certification WASHINGTON PRODUCTION SITE Total Improvements (=) Improvements - Non Homesite (+) (+)Improvements - Homesite Land - Homesite Land Totals (=)Total Land Market Value Land - Non Homesite Land - Ag Market Land - Timber Market Land - Exempt Ag/Timber Market (+) (+) (+) (+) (+) Improvement Totals Productivity Totals Total Productivity Market (Non Exempt) Ag Use (5631) Timber Use (0) Total Productivity Loss Total Assessed (+) (-) (-) (=) S01 - Brenham ISD Number of Properties: 25674 (+) $257,788,503 $224,350,496 $1,944,508,886 $0 $0 $2,426,647,885 $2,426,647,885 $1,437,321,233 $443,207,824 $1,880,529,057 (+) $1,880,529,057 $1,944,508,886 $23,398,423 $0 $1,921,110,463 $1,921,110,463 $2,788,922,977(=) (-) Total Market Value Total Homestead Cap Adjustment (3737) Total Exempt Property (625) $4,864,320,317 $25,065,652 $129,221,225 (=) (-) (-) Other Totals Exemptions Total Exemptions (=) $235,104,665 Net Taxable (Before Freeze) (-) $235,104,665 (=) $2,553,818,312 $4,864,320,317 (HS Assd )1,142,323,935 Personal Property (2132) (+)$170,672,615 $170,672,615 Minerals (5000) (+)$386,470,760 $386,470,760 Autos (0) (+)$0 $0 (HS) Homestead Local (7025) (+) $0 (HS) Homestead State (7025) (+) $170,337,283 (O65) Over 65 Local (3164) (+) $14,700,547 (O65) Over 65 State (3164) (+) $30,195,977 (DP) Disabled Persons Local (147) (+) $0 (DP) Disabled Persons State (147) (+) $1,291,836 (DV) Disabled Vet (195) (+) $2,008,859 (DVX/MAS) Disabled Vet 100% (55) (+) $6,768,172 (PRO) Prorated Exempt Property (1) (+) $12,350 (PC) Pollution Control (4) (+) $1,701,510 (AUTO) Lease Vehicles Ex (36) (+) $4,121,170 (EXPT) PARTIAL EXEMPT PROPERTY (1) (+) $2,893,566 (PRCX) Primarly Charitable Exemption (7) (+) $494,310 (AUTO2) PERSONAL USE/BUSINESS USE (19) (+) $285,840 (HB366) House Bill 366 (1574) (+) $293,245 Printed on 07/27/2015 at 8:27 AM Page 10 of 16

- 11. Assessment Roll Grand Totals Report Tax Year: 2015 As of: Certification WASHINGTON PRODUCTION SITE **** O65 Freeze Totals Freeze Assessed Freeze Taxable Freeze Ceiling (2978) **** O65 Transfer Totals Transfer Assessed Transfer Taxable Post-Percent Taxable $492,823,856 $372,770,826 $2,926,602.64 $10,045,260 $8,248,260 $6,421,912 Transfer Adjustment (49) $1,826,348 Freeze Adjusted Taxable (Net Taxable - Freeze Taxable - Transfer Adjustment) (=) $2,179,221,138 *** DP Freeze Totals Freeze Assessed Freeze Taxable Freeze Ceiling (136) *** DP Transfer Totals Transfer Assessed Transfer Taxable Post-Percent Taxable $16,007,778 $10,922,658 $112,085.67 $78,300 $43,300 $34,655 Transfer Adjustment (1) $8,645 Freeze Adjusted Taxable (Net Taxable - Freeze Taxable - Transfer Adjustment) (=) $2,168,289,835 Printed on 07/27/2015 at 8:27 AM Page 11 of 16

- 12. Assessment Roll Grand Totals Report Tax Year: 2015 As of: Certification WASHINGTON PRODUCTION SITE Total Improvements (=) Improvements - Non Homesite (+) (+)Improvements - Homesite Land - Homesite Land Totals (=)Total Land Market Value Land - Non Homesite Land - Ag Market Land - Timber Market Land - Exempt Ag/Timber Market (+) (+) (+) (+) (+) Improvement Totals Productivity Totals Total Productivity Market (Non Exempt) Ag Use (1678) Timber Use (0) Total Productivity Loss Total Assessed (+) (-) (-) (=) S02 - Burton ISD Number of Properties: 9449 (+) $61,602,582 $27,433,531 $579,029,347 $0 $0 $668,065,460 $668,065,460 $209,052,039 $44,752,663 $253,804,702 (+) $253,804,702 $579,029,347 $7,402,408 $0 $571,626,939 $571,626,939 $451,889,407(=) (-) Total Market Value Total Homestead Cap Adjustment (439) Total Exempt Property (90) $1,050,171,847 $2,582,941 $24,072,560 (=) (-) (-) Other Totals Exemptions Total Exemptions (=) $27,637,816 Net Taxable (Before Freeze) (-) $27,637,816 (=) $424,251,591 $1,050,171,847 (HS Assd )131,103,405 Personal Property (214) (+)$7,319,605 $7,319,605 Minerals (5535) (+)$120,982,080 $120,982,080 Autos (0) (+)$0 $0 (HS) Homestead Local (893) (+) $0 (HS) Homestead State (893) (+) $21,192,335 (O65) Over 65 Local (456) (+) $0 (O65) Over 65 State (456) (+) $4,017,196 (DP) Disabled Persons Local (23) (+) $0 (DP) Disabled Persons State (23) (+) $176,087 (DV) Disabled Vet (28) (+) $315,390 (DVX/MAS) Disabled Vet 100% (8) (+) $1,353,234 (PRO) Prorated Exempt Property (1) (+) $43,054 (AUTO) Lease Vehicles Ex (5) (+) $202,865 (AUTO2) PERSONAL USE/BUSINESS USE (5) (+) $62,500 (PRCX) Primarly Charitable Exemption (2) (+) $131,930 (HB366) House Bill 366 (766) (+) $143,225 Printed on 07/27/2015 at 8:27 AM Page 12 of 16

- 13. Assessment Roll Grand Totals Report Tax Year: 2015 As of: Certification WASHINGTON PRODUCTION SITE **** O65 Freeze Totals Freeze Assessed Freeze Taxable Freeze Ceiling (436) **** O65 Transfer Totals Transfer Assessed Transfer Taxable Post-Percent Taxable $66,023,896 $51,153,909 $429,678.26 $774,080 $669,080 $622,259 Transfer Adjustment (3) $46,821 Freeze Adjusted Taxable (Net Taxable - Freeze Taxable - Transfer Adjustment) (=) $373,050,861 *** DP Freeze Totals Freeze Assessed Freeze Taxable Freeze Ceiling (21) *** DP Transfer Totals Transfer Assessed Transfer Taxable Post-Percent Taxable $1,782,026 $1,097,571 $11,657.33 $0 $0 $0 Transfer Adjustment (0) $0 Freeze Adjusted Taxable (Net Taxable - Freeze Taxable - Transfer Adjustment) (=) $371,953,290 Printed on 07/27/2015 at 8:27 AM Page 13 of 16

- 14. Assessment Roll Grand Totals Report Tax Year: 2015 As of: Certification WASHINGTON PRODUCTION SITE Total Improvements (=) Improvements - Non Homesite (+) (+)Improvements - Homesite Land - Homesite Land Totals (=)Total Land Market Value Land - Non Homesite Land - Ag Market Land - Timber Market Land - Exempt Ag/Timber Market (+) (+) (+) (+) (+) Improvement Totals Productivity Totals Total Productivity Market (Non Exempt) Ag Use (44) Timber Use (0) Total Productivity Loss Total Assessed (+) (-) (-) (=) S03 - Giddings I S D Number of Properties: 473 (+) $2,797,340 $2,261,880 $10,771,500 $0 $0 $15,830,720 $15,830,720 $6,214,650 $443,000 $6,657,650 (+) $6,657,650 $10,771,500 $185,750 $0 $10,585,750 $10,585,750 $20,590,893(=) (-) Total Market Value Total Homestead Cap Adjustment (12) Total Exempt Property (4) $31,248,740 $60,587 $11,510 (=) (-) (-) Other Totals Exemptions Total Exemptions (=) $1,969,848 Net Taxable (Before Freeze) (-) $1,969,848 (=) $18,621,045 $31,248,740 (HS Assd )5,013,433 Personal Property (3) (+)$4,110 $4,110 Minerals (307) (+)$8,756,260 $8,756,260 Autos (0) (+)$0 $0 (HS) Homestead Local (49) (+) $490,083 (HS) Homestead State (49) (+) $1,122,580 (O65) Over 65 Local (27) (+) $75,000 (O65) Over 65 State (27) (+) $250,000 (DV) Disabled Vet (2) (+) $24,000 (HB366) House Bill 366 (34) (+) $8,185 Printed on 07/27/2015 at 8:27 AM Page 14 of 16

- 15. Assessment Roll Grand Totals Report Tax Year: 2015 As of: Certification WASHINGTON PRODUCTION SITE **** O65 Freeze Totals Freeze Assessed Freeze Taxable Freeze Ceiling (24) **** O65 Transfer Totals Transfer Assessed Transfer Taxable Post-Percent Taxable $2,979,536 $1,763,391 $17,204.94 $0 $0 $0 Transfer Adjustment (0) $0 Freeze Adjusted Taxable (Net Taxable - Freeze Taxable - Transfer Adjustment) (=) $16,857,654 *** DP Freeze Totals Freeze Assessed Freeze Taxable Freeze Ceiling (0) *** DP Transfer Totals Transfer Assessed Transfer Taxable Post-Percent Taxable $0 $0 $0.00 $0 $0 $0 Transfer Adjustment (0) $0 Freeze Adjusted Taxable (Net Taxable - Freeze Taxable - Transfer Adjustment) (=) $16,857,654 Printed on 07/27/2015 at 8:27 AM Page 15 of 16

- 16. Assessment Roll Grand Totals Report Tax Year: 2015 As of: Certification WASHINGTON PRODUCTION SITE Total Improvements (=) Improvements - Non Homesite (+) (+)Improvements - Homesite Land - Homesite Land Totals (=)Total Land Market Value Land - Non Homesite Land - Ag Market Land - Timber Market Land - Exempt Ag/Timber Market (+) (+) (+) (+) (+) Improvement Totals Productivity Totals Total Productivity Market (Non Exempt) Ag Use (6) Timber Use (0) Total Productivity Loss Total Assessed (+) (-) (-) (=) W01 - Oak Hill W/d Number of Properties: 192 (+) $789,280 $4,485,460 $982,742 $0 $0 $6,257,482 $6,257,482 $29,429,750 $1,586,482 $31,016,232 (+) $31,016,232 $982,742 $11,431 $0 $971,311 $971,311 $36,275,813(=) (-) Total Market Value Total Homestead Cap Adjustment (56) Total Exempt Property (4) $37,911,618 $386,134 $278,360 (=) (-) (-) Other Totals Exemptions Total Exemptions (=) $361,229 Net Taxable (Before Freeze) (-) $361,229 (=) $35,914,584 $37,911,618 (HS Assd )30,097,416 Personal Property (22) (+)$580,954 $580,954 Minerals (3) (+)$56,950 $56,950 Autos (0) (+)$0 $0 (HS) Homestead Local (124) (+) $0 (HS) Homestead State (124) (+) $0 (O65) Over 65 Local (54) (+) $0 (O65) Over 65 State (54) (+) $0 (DP) Disabled Persons Local (3) (+) $0 (DP) Disabled Persons State (3) (+) $0 (DV) Disabled Vet (3) (+) $32,000 (DVX/MAS) Disabled Vet 100% (1) (+) $328,020 (HB366) House Bill 366 (4) (+) $1,209 Printed on 07/27/2015 at 8:27 AM Page 16 of 16