Eli Lilly and Co Ratios - KeyEli Lilly and Co Ratios - Key Met.docx

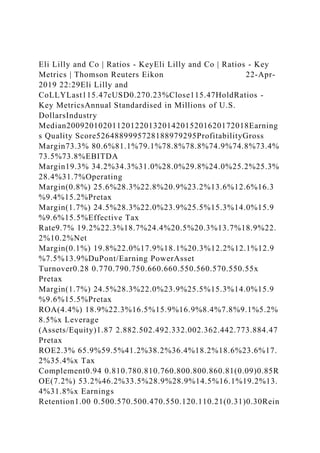

- 1. Eli Lilly and Co | Ratios - KeyEli Lilly and Co | Ratios - Key Metrics | Thomson Reuters Eikon 22-Apr- 2019 22:29Eli Lilly and CoLLYLast115.47cUSD0.270.23%Close115.47HoldRatios - Key MetricsAnnual Standardised in Millions of U.S. DollarsIndustry Median2009201020112012201320142015201620172018Earning s Quality Score5264889995728188979295ProfitabilityGross Margin73.3% 80.6%81.1%79.1%78.8%78.8%74.9%74.8%73.4% 73.5%73.8%EBITDA Margin19.3% 34.2%34.3%31.0%28.0%29.8%24.0%25.2%25.3% 28.4%31.7%Operating Margin(0.8%) 25.6%28.3%22.8%20.9%23.2%13.6%12.6%16.3 %9.4%15.2%Pretax Margin(1.7%) 24.5%28.3%22.0%23.9%25.5%15.3%14.0%15.9 %9.6%15.5%Effective Tax Rate9.7% 19.2%22.3%18.7%24.4%20.5%20.3%13.7%18.9%22. 2%10.2%Net Margin(0.1%) 19.8%22.0%17.9%18.1%20.3%12.2%12.1%12.9 %7.5%13.9%DuPont/Earning PowerAsset Turnover0.28 0.770.790.750.660.660.550.560.570.550.55x Pretax Margin(1.7%) 24.5%28.3%22.0%23.9%25.5%15.3%14.0%15.9 %9.6%15.5%Pretax ROA(4.4%) 18.9%22.3%16.5%15.9%16.9%8.4%7.8%9.1%5.2% 8.5%x Leverage (Assets/Equity)1.87 2.882.502.492.332.002.362.442.773.884.47 Pretax ROE2.3% 65.9%59.5%41.2%38.2%36.4%18.2%18.6%23.6%17. 2%35.4%x Tax Complement0.94 0.810.780.810.760.800.800.860.81(0.09)0.85R OE(7.2%) 53.2%46.2%33.5%28.9%28.9%14.5%16.1%19.2%13. 4%31.8%x Earnings Retention1.00 0.500.570.500.470.550.120.110.21(0.31)0.30Rein

- 2. vestment Rate(8.4%) 26.8%26.5%16.7%13.4%15.9%1.7%1.8%4.0%(4.1% )9.7%LiquidityQuick Ratio1.84 1.471.781.341.241.140.941.111.051.011.38Current Ratio2.98 1.902.141.601.551.471.221.531.371.321.73Times Interest Earned0.8 24.436.534.028.234.722.422.320.921.922.7Cash Cycle (Days)153.0 209.9202.8157.9166.1184.4199.9207.3216.0238.82 49.0LeverageAssets/Equity1.87 2.882.502.492.332.002.362.442. 773.884.47Debt/Equity0.28 0.700.560.520.370.300.520.550.741 .181.30% LT Debt to Total Capital20.6% 41.0%35.0%26.6%27.2%18.4%22.8%35.3%34.3% 39.3%49.2%(Total Debt - Cash) / EBITDA1.42 0.450.150.02-- 0.320.670.730.760.66OperatingA/R Turnover4.5 6.15.85.85.65.85.05.14.84.64.3Avg. A/R Days78.0 59.663.463.365.862.673.072.276.280.285.5Inv Turnover1.8 1.61.62.11.91.81.71.61.61.51.5Avg. Inventory Days202.2 230.2225.0174.0188.6207.8210.3224.7226.8241.824 3.9Avg. A/P Days133.5 79.985.579.388.386.083.489.687.083.280.3Fixed Asset Turnover3.30 2.602.863.092.912.942.462.492.602.682.77WC / Sales Growth(0.4%) (3.2%)17.9%(2.7%)(5.2%)(2.9%)(2.9%)0.1%3.6 %(0.7%)7.9%Bad Debt Allowance (% of A/R)1.8% 2.9%1.9%2.6%2.8%1.5%1.4%1.1%0.8%0.7%0.5%RO IC- 23.4%22.5%17.8%16.1%17.9%9.0%8.9%9.9%5.9%11.1%Reve nue per Employee ($)- $540,094.00$586,355.00$635,522.70$591,479.80$606,046.50$ 509,099.40$496,423.30$509,840.20$553,583.40$619,038.30 Eli Lilly and Co | Cash Flow | Eli Lilly and Co | Cash Flow | Thomson Reuters Eikon 22-Apr-2019 22:29Cash FlowAnnual Standardised in Millions of U.S. Dollars2009201020112012201320142015201620172018Earning

- 3. s Quality Score64 88 99 95 72 81 88 97 92 95 Period End Date31-Dec-2009 31-Dec-2010 31-Dec-2011 31-Dec-2012 31- Dec-2013 31-Dec-2014 31-Dec-2015 31-Dec-2016 31-Dec- 2017 31-Dec-2018 Period Length12 Months 12 Months 12 Months 12 Months 12 Months 12 Months 12 Months 12 Months 12 Months 12 Months Statement Date31-Dec-2009 31- Dec-2010 31-Dec-2011 31-Dec-2012 31-Dec-2013 31-Dec- 2016 31-Dec-2016 31-Dec-2016 31-Dec-2017 31-Dec- 2018 Cash Flow-Operating Activities ($ Millions)Net Income/Starting Line4,328.85,069.54,347.74,088.64,684.82,390.52,408.42,737.6 (204.1)3,232.0Depreciation/Depletion1,297.81,328.21,373.61,4 62.21,445.61,379.01,427.71,496.61,567.31,609.0Depreciation1, 297.81,328.21,373.61,462.21,445.61,379.01,427.71,496.61,567. 31,609.0Amortization--------------------Deferred Taxes189.9559.7(268.5)126.0285.936.8(748.4)439.5(787.9)326. 8Non-Cash Items(524.1)84.9533.3(320.8)(288.3)977.61,016.1661.41,835.42 ,735.4Unusual Items(1,313.6)(112.3)151.5205.00.0340.7(186.1)(3.4)-- 1,983.9Purchased R&D58.532.5252.20.037.1200.2535.030.01,112.6--Other Non- Cash Items731.0164.7129.6(525.8)(325.4)436.7667.2634.8722.8751.5 Changes in Working Capital(956.9)(185.5)1,248.4(51.2)(393.0)(325.5)(1,139.2)(484. 1)3,204.9(2,378.7)Accounts Receivable(492.9)(319.1)(188.8)361.8(152.7)117.4(304.5)(709. 4)(357.0)(996.7)Inventories(179.0)157.0203.1(307.9)(286.5)(30 7.1)(736.3)(328.2)(253.9)7.8Other Assets(84.9)340.5642.7231.0116.5673.2(288.5)(265.5)(590.1)(9 80.0)Accounts Payable(200.1)(363.9)591.4(336.1)(70.3)(809.0)190.1819.0916. 3(284.5)Taxes Payable----------------3,489.6(125.3)Cash from Operating Activities4,335.56,856.87,234.55,304.85,735.04,458.42,964.64,

- 4. 851.05,615.65,524.5Cash Flow-Investing Activities ($ Millions)Capital Expenditures(855.0)(1,186.7)(1,692.9)(1,044.2)(1,093.3)(1,565. 9)(1,626.2)(1,092.0)(2,163.6)(3,018.2)Purchase of Fixed Assets(765.0)(694.3)(672.0)(905.4)(1,012.1)(1,162.6)(1,066.2)( 1,037.0)(1,076.8)(1,210.6)Purchase/Acquisition of Intangibles(90.0)(492.4)(1,020.9)(138.8)(81.2)(403.3)(560.0)(5 5.0)(1,086.8)(1,807.6)Other Investing Cash Flow Items, Total997.8(1,973.1)(3,131.5)(1,788.6)(979.5)(2,343.2)1,653.0(2 ,047.1)(1,620.0)4,924.2Acquisition of Business0.0(609.4)(307.8)(199.3)(43.7)(551.4)(5,283.1)(45.0)(8 82.1)0.0Sale of Fixed Assets17.724.625.322.0179.415.392.673.440.73.6Sale/Maturity of Investment1,107.8584.72,138.54,355.714,555.115,063.55,230.2 3,728.07,438.56,062.0Investment, Net399.1(686.5)(250.9)375.1------------Purchase of Investments(432.3)(1,067.2)(4,459.4)(7,618.6)(15,572.9)(11,44 0.5)(4,068.7)(5,673.4)(8,001.3)(950.1)Sale of Intangible Assets- ---------0.0410.00.00.0--Other Investing Cash Flow(94.5)(219.3)(277.2)1,276.5(97.4)(5,430.1)5,272.0(130.1)( 215.8)(191.3)Cash from Investing Activities142.8(3,159.8)(4,824.4)(2,832.8)(2,072.8)(3,909.1)26. 8(3,139.1)(3,783.6)1,906.0Cash Flow-Financing Activities ($ Millions)Financing Cash Flow Items42.619.46.00.00.096.1(52.6)(300.8)(364.4)(372.8)Other Financing Cash Flow42.619.46.00.00.096.1(52.6)(300.8)(364.4)(372.8)Total Cash Dividends Paid(2,152.1)(2,165.3)(2,180.1)(2,187.4)(2,120.7)(2,101.2)(2,12 7.3)(2,158.5)(2,192.1)(2,311.8)Cash Dividends Paid - Common(2,152.1)(2,165.3)(2,180.1)(2,187.4)(2,120.7)(2,101.2) (2,127.3)(2,158.5)(2,192.1)(2,311.8)Issuance (Retirement) of Stock, Net-- 0.00.0(721.1)(1,698.1)(800.0)(749.5)(600.1)(299.8)(2,491.0)Sal e/Issuance of Common------------------

- 5. 1,659.7Repurchase/Retirement of Common-- 0.00.0(721.1)(1,698.1)(800.0)(749.5)(600.1)(299.8)(4,150.7)Co mmon Stock, Net-- 0.00.0(721.1)(1,698.1)(800.0)(749.5)(600.1)(299.8)(2,491.0)Iss uance (Retirement) of Debt, Net(3,424.2)124.0(195.8)(1,511.1)(10.5)2,638.7(181.6)2,499.62 ,998.9(729.3)Short Term Debt, Net(5,824.2)123.9(141.2)(10.5)0.02,680.6(2,680.6)1,293.21,397 .5(2,197.9)Long Term Debt Issued2,400.01.20.0---- 992.94,454.71,206.62,232.02,477.7Long Term Debt Reduction0.0(1.1)(54.6)(1,500.6)(10.5)(1,034.8)(1,955.7)(0.2)(6 30.6)(1,009.1)Long Term Debt, Net2,400.00.1(54.6)(1,500.6)(10.5)(41.9)2,499.01,206.41,601.4 1,468.6Cash from Financing Activities(5,533.7)(2,021.9)(2,369.9)(4,419.6)(3,829.3)(166.4)( 3,111.0)(559.8)142.6(5,904.9)Foreign Exchange Effects21.6(144.8)(110.9)43.9(21.5)(341.5)(85.6)(236.4)(20.5)( 63.6)Net Change in Cash(1,033.8)1,530.3(70.7)(1,903.7)(188.6)41.4(205.2)915.71,9 54.11,462.0Net Cash - Beginning Balance5,496.74,462.95,993.25,922.54,018.83,830.23,871.63,66 6.44,582.16,536.2Net Cash - Ending Balance4,462.95,993.25,922.54,018.83,830.23,871.63,666.44,58 2.16,536.27,998.2Cash Interest Paid205.9176.3167.4171.9139.7140.4129.6146.4192.7223.8Cas h Taxes Paid1,140.0861.0943.0992.01,260.0729.7969.0700.6246.51,101. 5Reported Cash from Operating Activities-------------------- Reported Cash from Investing Activities-------------------- Reported Cash from Financing Activities--------------------Free Cash Flow3,480.55,670.15,541.64,260.64,641.72,892.51,338.43,759.0 3,452.02,506.3 Eli Lilly and Co | Balance SheeEli Lilly and Co | Balance Sheet | Thomson Reuters Eikon 22-Apr-2019 22:29Eli Lilly and

- 6. CoLLYLast115.47cUSD0.270.23%Close115.47HoldBalance SheetAnnual Standardised in Millions of U.S. Dollars2009201020112012201320142015201620172018Earning s Quality Score64 88 99 95 72 81 88 97 92 95 Period End Date31-Dec-2009 31-Dec-2010 31-Dec-2011 31-Dec-2012 31- Dec-2013 31-Dec-2014 31-Dec-2015 31-Dec-2016 31-Dec- 2017 31-Dec-2018 Statement Date31-Dec-2010 31-Dec- 2011 31-Dec-2011 31-Dec-2012 31-Dec-2014 31-Dec-2015 31- Dec-2015 31-Dec-2016 31-Dec-2017 31-Dec-2018 Assets ($ Millions)Cash and Short Term Investments4,4986,7276,8975,6845,3974,8274,4526,0398,0348, 086Cash & Equivalents4,4635,9935,9234,0193,8303,8723,6664,5826,5367, 998Short Term Investments357349751,6661,5679557851,4571,49888Accounts Receivable - Trade, Net3,3433,4943,5983,3363,4343,2353,5134,0294,5465,247Acco unts Receivable - Trade, Gross3,4533,5743,7083,4453,4973,2903,5574,0704,5855,279Pr ovision for Doubtful Accounts(110)(80)(110)(109)(62)(55)(44)(40)(39)(33)Total Receivables, Net3,8324,1584,2383,8884,0233,8014,0724,7665,2626,205Rece ivables - Other489664640552588567559737716958Total Inventory2,8502,5182,3002,6442,9292,7403,4463,5624,4584,11 2Inventories - Finished Goods9388017868349688381,0539871,211988Inventories - Work In Progress1,8301,7141,5181,7361,8681,7152,0582,1172,6982,628 Inventories - Raw Materials228221206256259315403435489507LIFO Reserve(146)(218)(211)(183)(167)(128)(69)2260(11)Prepaid Expenses1,3071,4378138227565606047351,4482,147Other Current Assets, Total--------------------Total Current Assets12,48714,84014,24813,03913,10511,92812,57415,10119, 20220,550Property/Plant/Equipment, Total -

- 7. Gross15,10014,48714,59414,91815,64716,02916,66116,77818,0 9118,464Buildings - Gross6,1226,0296,1366,3746,4906,5166,7876,9187,4267,684La nd/Improvements - Gross217208203201199205221198193193Machinery/Equipment - Gross7,8137,3567,2207,5437,7537,6107,9897,8658,6898,817Co nstruction in Progress - Gross9488941,0368001,2051,6981,6651,7981,7841,770Property /Plant/Equipment, Total - Net8,1977,9417,7607,7607,9767,9648,0548,2538,8278,920Accu mulated Depreciation, Total(6,903)(6,546)(6,834)(7,158)(7,671)(8,065)(8,607)(8,525)( 9,265)(9,545)Goodwill, Net1,1751,4241,9101,5661,5171,7584,0403,9734,3704,348Intan gibles, Net2,5253,3953,2193,1862,8142,8845,0354,3584,0293,521Intan gibles - Gross3,1944,4504,7425,2375,3355,8457,8577,7317,9505,433Ac cumulated Intangible Amortization(669)(1,055)(1,524)(2,051)(2,520)(2,961)(2,822)(3 ,373)(3,921)(1,912)Long Term Investments1,1561,7804,0306,3137,6254,5693,6475,2085,6792, 021LT Investment - Affiliate Companies157164160233354447671569585305LT Investments - Other9991,6153,8706,0807,2714,1222,9754,6395,0941,716Note Receivable - Long Term--------------------Other Long Term Assets, Total1,9211,6222,4932,5342,2137,2042,2211,9142,8744,550Def ered Income Tax - Long Term Asset------------------ 2,658Restricted Cash - Long Term--------05,4060------Other Long Term Assets1,9211,6222,4932,5342,2131,7992,2211,9142,8741,892T otal Assets27,46131,00133,66034,39935,24936,30835,56938,80644, 98143,908Liabilities ($ Millions)Accounts

- 8. Payable9681,0721,1251,1881,1191,1281,3381,3491,4111,412Pa yable/Accrued--------------------Accrued Expenses8948528059409447599678979981,055Notes Payable/Short Term Debt271561,522120001,2992,697499Current Port. of LT Debt/Capital Leases--------1,0132,68966381,010632Other Current liabilities, Total4,6784,8475,4796,2495,8415,1655,9186,8038,4218,290Div idends Payable538540542541524530539548591651Income Taxes Payable34745826214425494359119533404Other Payables1,1101,3731,7711,7771,9422,0692,5603,9154,4655,022 Deferred Income Tax - Current Liability----4221,048793--------- -Other Current Liabilities2,6842,4772,4812,7392,3282,4732,4602,2212,8322,21 3Total Current Liabilities6,5686,9278,9318,3908,9179,7418,23010,98714,5361 1,888Total Long Term Debt6,6356,7715,4655,5194,2005,3337,9728,3689,94111,640Lo ng Term Debt6,6356,7715,4655,5194,2005,3337,9728,3599,93211,632Ca pital Lease Obligations--------------997Total Debt6,6626,9276,9875,5315,2138,0227,97910,30513,64712,771 Deferred Income Tax--------------------Minority Interest2(8)(6)99151973761,080Other Liabilities, Total4,7334,8915,7295,7164,4915,8464,7775,3718,8379,472Pen sion Benefits - Underfunded2,3351,8873,0693,0121,5492,5632,1602,4543,5142 ,911Other Long Term Liabilities2,3983,0042,6602,7042,9423,2832,6162,9175,3236,56 0Total Liabilities17,93718,58120,11819,63417,61720,93420,99824,798 33,38934,080Shareholders Equity ($ Millions)Redeemable Preferred Stock, Total--------------------Preferred Stock - Non Redeemable, Net--------------------Common Stock, Total719721724717699695691689688661Common Stock719721724717699695691689688661Additional Paid-In

- 9. Capital4,6364,7994,8874,9635,0505,2925,5525,6415,8186,584R etained Earnings (Accumulated Deficit)9,83012,73314,89816,08816,99216,48316,01216,04613, 89411,396Treasury Stock - Common(99)(96)(95)(192)(94)(91)(90)(81)(76)(69)ESOP Debt Guarantee(77)(52)0--------------Unrealized Gain (Loss)-- 129157320510010224114(22)Other Equity, Total(5,485)(5,812)(6,887)(6,883)(5,221)(7,105)(7,604)(8,511)( 8,845)(8,720)Translation Adjustment-- 511266427463(498)(1,360)(1,867)(1,233)(1,623)Other Equity(3,013)(3,013)(3,013)(3,013)(3,013)(3,013)(3,013)(3,013 )(3,013)(3,013)Minimum Pension Liability Adjustment-- (3,176)(4,032)(4,195)(2,489)(3,402)(3,012)(3,372)(4,341)(3,857 )Other Comprehensive Income(2,472)(134)(107)(101)(182)(191)(219)(259)(258)(228)T otal Equity9,52412,42013,54214,76517,63115,37314,57114,00811,5 929,829Total Liabilities & Shareholders' Equity27,46131,00133,66034,39935,24936,30835,56938,80644, 98143,908Supplemental ($ Millions)Shares Outstanding - Common Issue 2--------------------Shares Outstanding - Common Issue 3--------------------Shares Outstanding - Common Issue 4-- ------------------Total Common Shares Outstanding1,1491,1531,1581,1441,1171,1111,1051,1011,1001, 057Shares Outs - Common Stock Primary Issue1,1491,1531,1581,1441,1171,1111,1051,1011,1001,057Tre as Shares - Common Stock Prmry Issue1113111111Treasury Shares - Common Issue 2--------------------Treasury Shares - Common Issue 3--------------------Treasury Shares - Common Issue 4--------------------Total Preferred Shares Outstanding------ --------------Treasury Shares - Preferred Issue 1-------------------- Treasury Shares - Preferred Issue 2--------------------Treasury Shares - Preferred Issue 3--------------------Treasury Shares - Preferred Issue 4--------------------Treasury Shares - Preferred Issue 5--------------------Treasury Shares - Preferred Issue 6------ --------------Minority Interest - Redeemable--------------------

- 10. Minority Interest - Non Redeemable2(8)(6)99151973761,080Total Equity & Minority Interest9,52512,41313,53614,77417,64115,38814,59014,08111, 66810,909Full-Time Employees40,36038,35038,08038,35037,92539,13541,27541,97 540,65538,680Part-Time Employees--------------------Number of Common Shareholders38,40036,70035,20033,63831,90029,30028,00026, 80025,30024,000Other Property/Plant/Equipment - Net----------- ---------Intangibles - Net--------------------Goodwill - Net1,1751,4241,9101,5661,5171,7584,0403,9734,3704,348Accu mulated Goodwill Amortization Suppl.-------------------- Accumulated Intangible Amort, Suppl.6691,0551,5242,0512,5202,9612,8223,3733,9211,912Rig ht-of-Use Assets-Cap.Lease,Net-Suppl.--------------------Right- of-Use Assets-Cap.Lease,Gross-Sup.--------------------Right-of- Use Assets-Cap.Lease,Depr.-Sup.--------------------Right-of-Use Assets-Op.Lease, Net-Suppl.--------------------Right-of-Use Assets-Op.Lease, Gross-Sup.--------------------Right-of-Use Assets-Op.Lease, Depr.-Sup.--------------------Non-Current Marketable Securities,Suppl.--------------------Contract Assets - Short Term--------------------Contract Assets - Long Term-------- ------------Deferred Revenue - Current--------------------Deferred Revenue - Long Term--------------------Short Term Debt Financial Sector, Suppl.--------------------Curr Port - LTD/Cap Lse Fin Sec., Suppl.--------------------Long Term Debt Financial Sector, Suppl.--------------------Capital Lease Oblig. - Fin Sector, Suppl--------------------Curr. Port. of LT Capital Leases, Suppl.------------------5Curr Port of LT Operating Leases, Suppl.--------------------Long-Term Operating Lease Liabs., Suppl.--------------------Curr Derivative Liab. Hedging, Suppl.--- -----------------Curr Derivative Liab. Spec./Trdg, Suppl.---------- ----------Non-Curr Derivative Liab. Hedging, Suppl--------------- -----Non-Curr Derivative Liab Spec/Trdg Suppl------------------- -Leverage Ratio (Basel 3)--------------------Net Stable Funding Ratio (Basel 3)--------------------Liquidity Coverage Ratio

- 11. (Basel 3)--------------------Capital Adequacy - Core Tier 1 (Value)--------------------Capital Adequacy - Hybrid Tier 1 (Value)--------------------Capital Adequacy -Tier 1 Capital (Value)--------------------Capital Adequacy -Tier 2 Capital (Value)--------------------Capital Adequacy -Tier 3 Capital (Value)--------------------Capital Adequacy - Total Capital (Value)--------------------Total Risk-Weighted Capital------------- -------Capital Adequacy - Core Tier 1 Capital %------------------- -Capital Adequacy - Tier 1 Capital %--------------------Capital Adequacy - Tier 2 Capital %--------------------Capital Adequacy - Tier 3 Capital %--------------------Capital Adequacy - Total Capital %--------------------Trading Account-------------------- Credit Exposure--------------------Non-Performing Loans--------- -----------Assets under Management--------------------Total Current Assets less Inventory9,63712,32211,94810,39510,1769,1889,12811,54014,7 4416,438Net Debt Incl. Pref.Stock & Min.Interest2,16619284(144)(175)3,2093,5464,3395,6895,765T angible Book Value, Common Equity5,8247,6028,41410,01313,30010,7315,4975,6773,1931,96 0Reported Total Assets--------------------Reported Total Liabilities--------------------Shareholders' Equity Excl. Stock Subscr.--------------------Reported Shareholder's Equity----------- ---------Reported Net Assets--------------------Reported Net Assets to Total Assets--------------------Reported Return on Assets--------------------Reported Return on Equity---------------- ----Islamic Investments & Deposits--------------------Islamic Receivables--------------------Islamic Debt-------------------- Islamic Section, Supplemental--------------------Debt & Lease, Pension Items ($ Millions)Total Long Term Debt, Supplemental2,5702,5762,7372,235---- 2,0472,2403,0843,800Long Term Debt Maturing within 1 Year20181,51012----66351,009635Long Term Debt Maturing in Year 2161,520101,010----63599960434Long Term Debt Maturing in Year 31,510161,0109----8036033942Long Term Debt Maturing in Year 4141,0105204----602211,439Long Term

- 12. Debt Maturing in Year 51,010122011,000----111,467750Long Term Debt Maturing in 2-3 Years1,5261,5361,0201,019---- 1,4381,602607976Long Term Debt Maturing in 4-5 Years1,0241,0222071,204----60221,4692,189Long Term Debt Matur. in Year 6 & Beyond0000----0000Total Capital Leases, Supplemental39396142----16141312Capital Lease Payments Due in Year 11414815----5555Capital Lease Payments Due in Year 277611----4333Capital Lease Payments Due in Year 377611----4333Capital Lease Payments Due in Year 45462---- 1111Capital Lease Payments Due in Year 55462----1111Capital Lease Payments Due in 2-3 Years13131322----9776Capital Lease Payments Due in 4-5 Years99125----2221Cap. Lease Pymts. Due in Year 6 & Beyond33290----0000Total Operating Leases, Supplemental403572515647620-- 934874773805Operating Lease Payments Due in Year 1109109112145137--133135131156Operating Lease Payments Due in Year 2788178116109--91115112128Operating Lease Payments Due in Year 3788178116109--9111511289Operating Lease Payments Due in Year 43952506774-- 122858675Operating Lease Payments Due in Year 53952506774--122858658Operating Lease Pymts. Due in 2-3 Years156163155232218--181231225217Operating Lease Pymts. Due in 4-5 Years78103100134147--245170172133Oper. Lse. Pymts. Due in Year 6 & Beyond60198148136118-- 376339246300Operating Leases - Interest Cost-------------------- Total Funded Status(2,398)(1,893)(2,975)(2,957)(372)-- (1,247)(1,810)(2,610)(1,744)Pension Obligation - Domestic7,5548,1159,19110,4249,976-- 11,71912,45615,09813,662Post-Retirement Obligation2,0332,0892,3092,3381,757-- 1,4671,4951,7291,544Plan Assets - Domestic6,0096,9837,1868,2879,482-- 9,99610,18011,84511,064Plan Assets - Post- Retirement1,1811,3281,3391,5181,880-- 1,9441,9612,3722,398Funded Status - Domestic(1,545)(1,132)(2,005)(2,137)(495)--

- 13. (1,724)(2,276)(3,254)(2,598)Funded Status - Post- Retirement(852)(761)(970)(820)122-- 476467644854Accumulated Obligation - Domestic-- 7,2308,2009,4609,130--2,0289,80511,95711,032Accumulated Obligation - Post-Retirement2,0332,0892,3092,338---- 246223225189Period End Assumptions-------------------- Discount Rate - Domestic5.90%5.90%5.60%5.00%4.90%-- 4.30%3.90%3.40%3.90%Discount Rate - Post- Retirement6.00%5.80%5.10%4.30%5.00%-- 4.50%4.30%3.70%4.40%Compensation Rate - Domestic3.70%3.70%3.70%3.40%3.40%-- 3.40%3.40%3.40%3.40%Net Assets Recognized on Balance Sheet2,5782,8762,9323,1133,231-- (1,486)(2,026)(2,828)(1,903)Prepaid Benefits - Domestic-------- 881--26230107196Prepaid Benefits - Post-Retirement-------- 366--7226898691,044Accrued Liabilities - Domestic(1,545)(1,191)(2,166)(2,263)(1,376)-- (1,985)(2,306)(3,361)(2,794)Accrued Liabilities - Foreign------- -----(239)(216)(218)(182)Accrued Liabilities - Post- Retirement(852)(761)(970)(820)(244)-- (246)(223)(225)(167)Other Assets, Net - Domestic3,8693,8534,9155,2433,597----------Other Assets, Net - Post-Retirement1,1069741,1529537----------Asset Allocation-- ------------------Equity % - Domestic50.30%35.20%26.67%28.52%30.42%-- 27.57%26.41%28.71%24.74%Equity % - Post- Retirement20.40%14.13%10.31%11.40%10.99%-- 9.50%9.43%9.51%7.79%Debt Securities % - Domestic10.00%16.15%17.69%17.83%14.96%-- 17.03%20.21%20.22%20.87%Debt Securities % - Post- Retirement4.00%6.36%6.71%6.57%4.94%-- 5.05%5.64%5.24%5.11%Real Estate % - Domestic-- 1.81%5.69%6.08%5.50%--5.17%4.95%4.76%4.75%Real Estate % - Post-Retirement----2.05%2.33%1.95%-- 1.71%1.77%1.39%1.16%Private Investments % - Domestic35.40%40.57%44.29%42.80%41.89%--

- 14. 42.96%41.84%39.04%42.88%Private Investments % - Post- Retirement17.30%19.56%21.88%20.81%79.38%-- 81.62%80.83%80.83%82.97%Other Investments % - Domestic4.30%6.27%5.66%4.77%7.23%-- 7.27%6.59%7.27%6.75%Other Investments % - Post- Retirement58.30%59.95%59.05%58.89%2.73%-- 2.11%2.32%3.03%2.97%Total Plan Obligations9,58710,20411,50012,76211,734-- 13,18713,95116,82715,206Total Plan Assets7,1898,3118,5259,80511,361--11,93912,14114,21713,462 Eli Lilly and Co | Income StateEli Lilly and Co | Income Statement | Thomson Reuters Eikon 22- Apr-2019 22:28Eli Lilly and CoLLYLast115.47cUSD0.270.23%Close115.47HoldIncome StatementAnnual Standardised in Millions of U.S. Dollars2009201020112012201320142015201620172018Earning s Quality Score64 88 99 95 72 81 88 97 92 95 Period End Date31-Dec-2009 31-Dec-2010 31-Dec-2011 31-Dec-2012 31- Dec-2013 31-Dec-2014 31-Dec-2015 31-Dec-2016 31-Dec- 2017 31-Dec-2018 Period Length12 Months 12 Months 12 Months 12 Months 12 Months 12 Months 12 Months 12 Months 12 Months 12 Months Statement Date31-Dec-2009 31- Dec-2010 31-Dec-2011 31-Dec-2012 31-Dec-2013 31-Dec- 2014 31-Dec-2015 31-Dec-2016 31-Dec-2017 31-Dec- 2018 Revenue21,83623,07624,28722,60323,11319,61619,95921, 22222,87124,556Net Sales21,83623,07624,28722,60323,11319,61619,95921,22222,8 7124,556Other Revenue, Total--------------------Total Revenue21,83623,07624,28722,60323,11319,61619,95921,2222 2,87124,556Cost of Revenue, Total4,2474,3665,0684,7974,9084,9335,0375,6556,0706,430Cos t of Revenue4,2474,3665,0684,7974,9084,9335,0375,6556,0706,430 Gross Profit17,58918,71019,21917,80718,20514,68314,92215,56716,8 0118,126Selling/General/Admin. Expenses,

- 15. Total6,8937,0537,8807,5147,1266,6216,5336,4526,5886,632Sel ling/General/Administrative Expense6,8937,0537,8807,5147,1266,6216,5336,4526,5886,632 Research & Development4,3274,8845,0215,2785,5314,7344,7965,2445,2825 ,307Depreciation/Amortization--------------------Interest Expense, Net - Operating--------------------Interest/Investment Income - Operating--------------------Interest Expense(Income) - Net Operating--------------------Interest Exp.(Inc.),Net- Operating, Total--------------------Unusual Expense (Income)7832427892811786691,0694132,7862,466Purchased R&D Written-Off9050388057200535301,1131,984Restructuring Charge9914225275----141127697143Litigation23000------------- -Impairment-Assets Held for Use36450150207121469227256976339Other Unusual Expense (Income)------------16700--Other Operating Expenses, Total---- 0--------------Other, Net----0--------------Total Operating Expense16,24916,54618,75817,86917,74316,95617,43617,7632 0,72620,835Operating Income5,5876,5305,5294,7345,3702,6602,5233,4592,1453,721I nterest Expense, Net Non- Operating(261)(186)(186)(178)(160)(149)(161)(185)(225)(272)I nterest Expense - Non- Operating(292)(212)(212)(199)(160)(187)(216)(233)(282)(272)I nterest Capitalized - Non-Operating30262621--38554857-- Interest/Invest Income - Non- Operating75528010512012187109167161Interest Income - Non- Operating75528010512012187109167161Interest Income(Exp), Net Non-Operating--------------------Interest Inc.(Exp.),Net- Non-Op., Total(186)(134)(106)(73)(40)(28)(74)(77)(58)(111)Gain (Loss) on Sale of Assets--------------------Other, Net(43)129(73)747559368342(8)110186Other Non-Operating Income (Expense)(43)129(73)747559368342(8)110186Net Income Before Taxes5,3586,5255,3505,4085,8893,0002,7903,3742,1973,796Pr

- 16. ovision for Income Taxes1,0291,4561,0021,3201,205610382636488388Net Income After Taxes4,3295,0704,3484,0894,6852,3912,4082,7381,7103,407Mi nority Interest--------------------Equity In Affiliates--------------- -----U.S. GAAP Adjustment--------------------Net Income Before Extra. Items4,3295,0704,3484,0894,6852,3912,4082,7381,7103,407Ac counting Change--------------------Discontinued Operations------ --------------Extraordinary Item----------------(1,914)(175)Tax on Extraordinary Items--------------------Total Extraordinary Items- ---------------(1,914)(175)Net Income4,3295,0704,3484,0894,6852,3912,4082,738(204)3,232P referred Dividends--------------------General Partners' Distributions--------------------Miscellaneous Earnings Adjustment--------------------Pro Forma Adjustment--------------- -----Interest Adjustment - Primary EPS--------------------Total Adjustments to Net Income--------------------Income Available to Com Excl ExtraOrd4,3295,0704,3484,0894,6852,3912,4082,7381,7103,40 7Income Available to Com Incl ExtraOrd4,3295,0704,3484,0894,6852,3912,4082,738(204)3,232 Basic Weighted Average Shares1,0981,1061,1141,1131,0811,0701,0621,0581,0521,028B asic EPS Excluding Extraordinary Items3.944.583.903.674.332.232.272.591.633.32Basic EPS Including Extraordinary Items3.944.583.903.674.332.232.272.59(0.19)3.14Dilution Adjustment--------------------Diluted Net Income4,3295,0704,3484,0894,6852,3912,4082,738(204)3,232D iluted Weighted Average Shares1,0981,1061,1141,1171,0851,0741,0661,0621,0521,034Di luted EPS Excluding ExtraOrd Items3.944.583.903.664.322.232.262.581.633.30Diluted EPS Including ExtraOrd Items3.944.583.903.664.322.232.262.58(0.19)3.13Supplemental

- 17. ($ Millions)DPS - Common Stock Primary Issue1.961.961.961.961.961.962.002.042.082.25Dividends per Share - Com Stock Issue 2--------------------Dividends per Share - Com Stock Issue 3--------------------Dividends per Share - Com Stock Issue 4--------------------Special DPS - Common Stock Primary Issue--------------------Special DPS - Common Stock Issue 2--------------------Special DPS - Common Stock Issue 3--- -----------------Special DPS - Common Stock Issue 4-------------- ------Gross Dividends - Common Stock2,1532,1672,1832,1872,1032,1082,1362,1682,2352,372Pro Forma Stock Compensation Expense--------------------Net Income after Stock Based Comp. Exp.--------------------Basic EPS after Stock Based Comp. Exp.--------------------Diluted EPS after Stock Based Comp. Exp.--------------------(Gain) Loss on Sale of Assets, Suppl.--------------------Impairment-Assets Held for Sale, Suppl.--------------------Impairment-Assets Held for Use, Suppl.--------------------Litigation Charge, Supplemental--- -----------------Purchased R&D Written-Off, Supplemental------- -------------Restructuring Charge, Supplemental-------------------- Other Unusual Expense(Income), Suppl.--------------------Non- Recurring Items, Supplemental, Total--------------------Total Special Items7832427892811786691,0694132,7862,466Normalized Income Before Taxes6,1416,7676,1395,6896,0673,6693,8593,7874,9846,262Eff ect of Special Items on Income Taxes1334375692595737237149Inc Tax Ex Impact of Sp Items1,1621,4991,0771,3881,229705455709859438Normalized Income After Taxes4,9785,2695,0624,3014,8382,9643,4053,0784,1255,824No rmalized Inc. Avail to Com.4,9785,2695,0624,3014,8382,9643,4053,0784,1255,824Bas ic Normalized EPS4.534.764.543.864.482.773.212.913.925.67Diluted Normalized EPS4.534.764.543.854.462.763.192.903.925.63EPS, Supplemental--------------------Funds From Operations - REIT---

- 18. -----------------Amort of Acquisition Costs, Supplemental-------- ------------Amort of Intangibles, Supplemental277386469563555536632688683559Amort. of Right-of-Use Intang.Assets,Sup--------------------Depreciation, Supplemental8147497327547758437968098841,050Depreciatio n of Right-of-Use Assets,Sup.--------------------Interest Expense, Supplemental261186186178160149161185225272Interest Capitalized, Supplemental(30)(26)(26)(21)--(38)(55)(48)(57)-- Interest Expense on Lease Liabs., Suppl.-------------------- Interest Expense (Financial Oper), Suppl--------------------Net Revenues--------------------Rental Expense, Supplemental338256267286227227226221225223Labor & Related Expense Suppl.--------------------Stock-Based Compensation, Supplemental369231147142145156218255281280Advertising Expense, Supplemental--------------------Equity in Affiliates, Supplemental--------------------Minority Interest, Supplemental-- ------------------Income Taxes - Non-Recurring Tax Change------ ----------1,914175Research & Development Exp, Supplemental4,3274,8845,0215,2785,5314,7344,7965,2445,282 5,307Audit Fees8999910131315--Audit-Related Fees112111111--Tax Fees113212675--All Other Fees00100000- ---Reported Recurring Revenue--------------------Reported Net Premiums Written--------------------Reported Total Revenue------ --------------Reported Operating Revenue-------------------- Reported Total Cost of Revenue--------------------Reported Total Sales, General & Admin.--------------------Reported Gross Profit--------------------Reported Operating Profit------------------ --Reported Operating Profit Margin--------------------Reported Ordinary Profit--------------------Reported Net Income After Tax--------------------Reported Basic EPS-------------------- Reported Diluted EPS--------------------Reported Net Business Profits--------------------Islamic Income--------------------Zakat--- -----------------Islamic Section, Supplemental-------------------- Normalized EBIT6,3706,7726,3185,0155,5483,3293,5923,8714,9316,187Nor

- 19. malized EBITDA7,4617,9077,5196,3326,8784,7085,0205,3686,4997,796 Tax & Pension Items ($ Millions)Current Tax - Total8679131,4081,1949395731,130197(58)35Current Tax - Domestic46376671597259169661(57)(101)(54)Current Tax - Foreign7725147605415534064223793980Current Tax - Local4923(23)56126(2)48(125)410Deferred Tax - Total162542(406)12626637(748)440546353Deferred Tax - Domestic83624(399)87297(83)(690)51780264Deferred Tax - Foreign80(55)(35)30(28)120(66)(83)(256)286Deferred Tax - Local0(27)279(3)07603Income Tax - Total1,0291,4561,0021,3201,205610382636488388Income Tax by Region - Total--------------------Domestic Pension Plan Expense167184207313441243404244673257Interest Cost - Domestic418432448455437473477421413461Service Cost - Domestic242219236253287241316278331304Prior Service Cost - Domestic899444101265Expected Return on Assets - Domestic(585)(638)(686)(685)(702)(757)(782)(752)(776)(848) Actuarial Gains and Losses - Domestic85163200286415282383286288334Curtailments & Settlements - Domestic----------------941Other Pension, Net - Domestic----------------3170Foreign Pension Plan Expense------- -----(91)(86)(90)(80)Prior Service Cost - Foreign------------ (91)(86)(90)(80)Post-Retirement Plan Expense9110310711082(45)(95)(125)(30)(182)Interest Cost - Post-Retirement120121118115988663535357Service Cost - Post-Retirement54577263503345394642Prior Service Cost - Post- Retirement(36)(37)(43)(40)(36)(38)(91)(86)(90)(80)Expected Return on Assets - Post- Retir.(118)(123)(129)(127)(131)(146)(150)(150)(161)(178)Actu arial Gains and Losses - Post- Retir.72858998101213819186Curtailments & Settlements - Post-Retir.----------------66(29)Other Post-Retirement, Net------- ---------380Total Pension Expense38640743255052319821733553(4)Defined Contribution

- 20. Expense - Domestic128120118127------------Assumptions-------- ------------Discount Rate - Domestic6.70%5.90%5.60%5.00%4.30%4.90%4.00%4.30%3.90 %3.40%Discount Rate - Post- Retirement6.90%6.00%5.80%5.10%4.30%5.00%4.10%4.50%4.3 0%3.70%Expected Rate of Return - Domestic8.80%8.80%8.50%8.40%8.40%8.10%7.40%7.40%7.40 %7.30%Expected Rate of Return - Post- Retir.9.00%9.00%8.80%8.80%8.80%8.50%8.00%8.00%8.00%8. 00%Compensation Rate - Domestic4.10%3.70%3.70%3.70%3.40%3.40%3.40%3.40%3.40 %3.40%Total Plan Interest Cost537553566570535558539474466518Total Plan Service Cost296276309316337274361317378346Total Plan Expected Return(703)(761)(815)(812)(833)(903)(932)(902)(937)(1,026)T otal Plan Other Expense----------------3550Dividends and Capital ChangesEli Lilly Ord ShsCash Dividend$0.49 I$0.49 I$0.49 I$0.49 I$0.49 I$0.50 I$0.51 I$0.52 I$0.56 I$0.65 I(14- Dec) Ann. (13-Dec) Ann. (12-Dec) Ann. (17-Dec) Ann. (16- Dec) Ann. (15-Dec) Ann. (08-Dec) Ann. (13-Dec) Ann. (11- Dec) Ann. (19-Dec) Ann. $0.49 F$0.49 F$0.49 F$0.49 F$0.49 F$0.49 F$0.50 F$0.51 F$0.52 F$0.56 F(19-Oct) Ann. (18-Oct) Ann. (17-Oct) Ann. (15-Oct) Ann. (21-Oct) Ann. (20-Oct) Ann. (19-Oct) Ann. (17-Oct) Ann. (16-Oct) Ann. (15-Oct) Ann. $0.49 I$0.49 I$0.49 I$0.49 I$0.49 I$0.49 I$0.50 I$0.51 I$0.52 I$0.56 I(22-Jun) Ann. (21-Jun) Ann. (20-Jun) Ann. (19- Jun) Ann. (18-Jun) Ann. (16-Jun) Ann. (15-Jun) Ann. (20-Jun) Ann. (19-Jun) Ann. (18-Jun) Ann. $0.49 I$0.49 I$0.49 I$0.49 I$0.49 I$0.49 I$0.50 I$0.51 I$0.52 I$0.56 I(20-Apr) Ann. (19- Apr) Ann. (18-Apr) Ann. (16-Apr) Ann. (06-May) Ann. (05- May) Ann. (04-May) Ann. (02-May) Ann. (01-May) Ann. (08- May) Ann. Dividends & Capital Changes After Dec-2018Eli Lilly Ord Shs2019Exchange OfferAdj. Factor 1x(30-Apr) INSTRUCTIONS

- 21. Discussion #3.1: Employee Engagement One popular measure of human capital today is employee engagement, which is defined as the degree to which employees focus, produce, innovate, contribute, and actively engage organizational goals. How do you see engagement? What are some of the examples of engagement metrics that an organization may collect and assess? In what ways do organizational actions across the “capital management star” impact employee engagement? Discussion #3.2: Cultural Assumptions To fully engage the realities around human capital and return on investment, some cultural assumptions must be made that ensures the prohibition of silo development in an organization. Please define and give an example of a cultural assumption. What cultural assumptions can be developed that mitigate and prohibit silo development within organizations? FIN469 Investment Analysis Deliverable Template Spring 2019 Please answer – and provide the data to substantiate - the following items in your deliverable for your assigned company. This project’s main deliverable should not exceed eight pages, front & back, 12 font, double spaced (although you may include an appendix of any length or form necessary). 1) Download and provide the last five years income statements. Download and provide the last five years cash flow statements. Download and provide the last five years balance sheets. Please include a brief paragraph for each statement that provides the story for each. The story may suggest issues of

- 22. profitability, cash flow, growth, etc. For these last five years, importantly, provide the adjustments and/or calculations for the free cash flows needed for the Discounted Free Cash Flow (DCF) model, either has an addition to the income statement or as a separate statement. Highlight this. 2) Highlight the abbreviated forecast of the next five years income statement, explicitly – and only - providing any line items and explanations that are material to your investment story. The only line items I want / need to see are the critical ones to your forecast. Highlight the abbreviated forecast of the next five years cash flow statement, explicitly – and only - providing any line item explanations that are material to your investment story. Highlight the abbreviated forecast of the next five-year DCF forecasts (i.e., year by year) and the normalized, constant growth calculation for forecast years 6 to infinity. Again, highlight this. 3) Provide a DCF model based valuation range, explaining in brief, your inputs. This range will serve as an “absolute valuation” metric and will be calculated by discounting your individual five year FCFF forecasts by a realistic WACC, discounting the constant growth by the WACC, subtracting out debt and dividing by shares outstanding. Highlight this absolute valuation range. 4) Provide 10-year price/earnings, price/book, and price/sales charts, commenting on today’s relative valuation AND providing the forecasted P/E, etc. metrics that you selected to use in your forecasts. For example, substantiate your P/E ratio and earnings per share forecast inputs that will provide your P/E valuation. These “relative values” will serve as range value inputs for your final valuation range. Highlight this relative valuation range. Note: The DCF absolute value range will be combined with the

- 23. P/metric relative value ranges to form a final range of value. For example, if the DCF suggests $38/share and the P/metrics suggest $34–37, your valuation range – combining the absolute and relative values – would be $34–38/share. 5) Discuss the important “systematic factors” (inflation, interest rates, industrial production, etc.) that you believe will drive this security’s return, explaining why you chose to include the ones that you did. You may wish to supply a simply regression to prove your point (hint)…. 6) Discuss the important “fundamentals” (profitability, growth, cash flows, etc.) that you believe will drive this security’s future return, explaining why you chose the ones that you did. Comment also on the “embedded expectations” that you believe the market is focusing on (please recall that any good analysis is about understanding the embedded expectations in the market price and how those expectations change so as to drive a higher or lower price). 7) Given your analysis, would you recommend a buy or a sell on this equity security? Explain your recommendation in a “summary paragraph” that you would provide as an executive summary with your employer. Highlight this in a single paragraph, seeking to make sure it is an accurate and complete storyline of your analysis. 8) Provide the duration, convexity, and yield to maturity of any fixed income instrument of this company that matures after 2025. 9) Provide the Black-Scholes valuation of any option of this company that expires within the next 12 months (please be sure to provide your inputs as well as a brief discussion of your volatility assumptions). Briefly compare your valuation (V) to that last price (P) traded in the market.