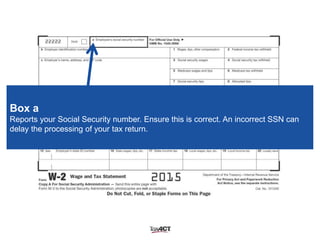

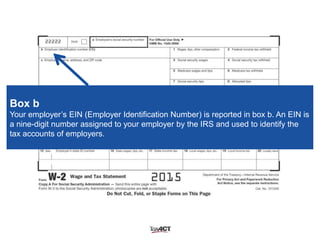

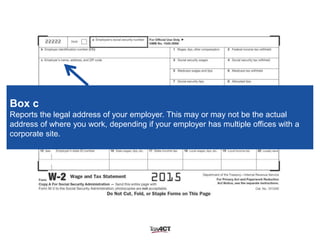

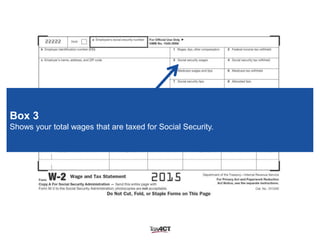

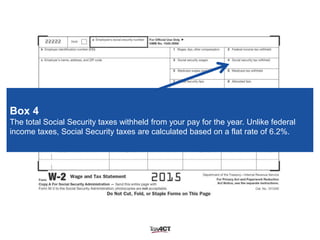

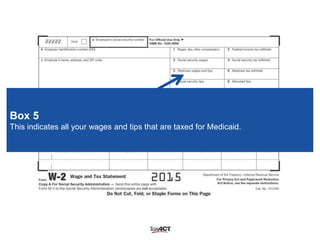

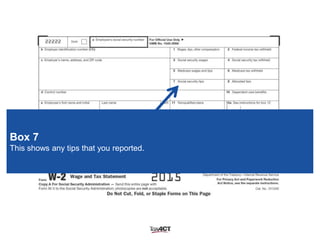

Form W-2 is an essential tax document that reports an employee's earnings and tax withholdings, including details like the employee's Social Security number, employer's identification number, and taxable wages. Each box on the form serves a specific purpose, such as reporting federal income tax withheld and state tax information. The document provides a comprehensive breakdown of what each section of Form W-2 signifies and its implications for tax processing.