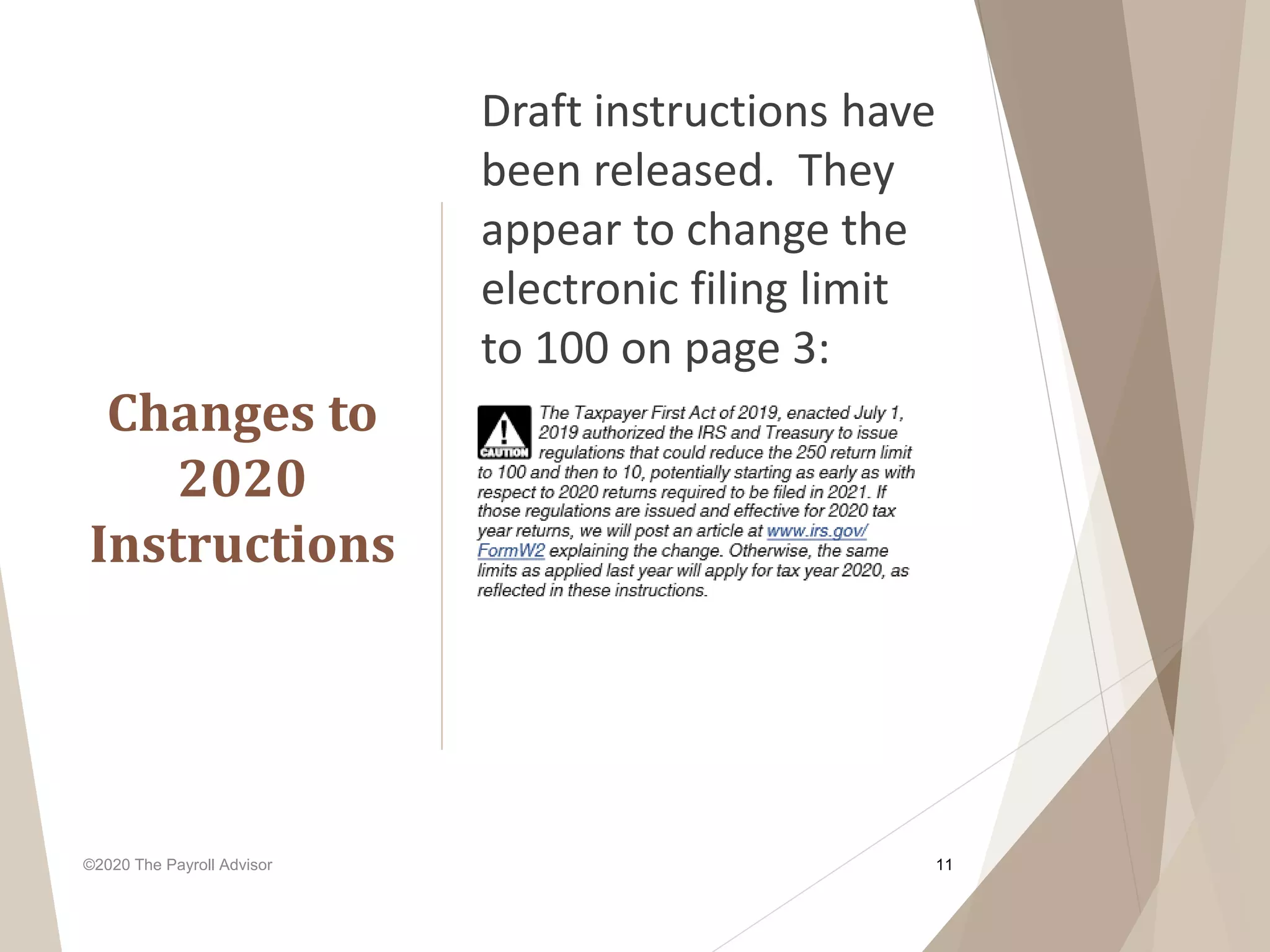

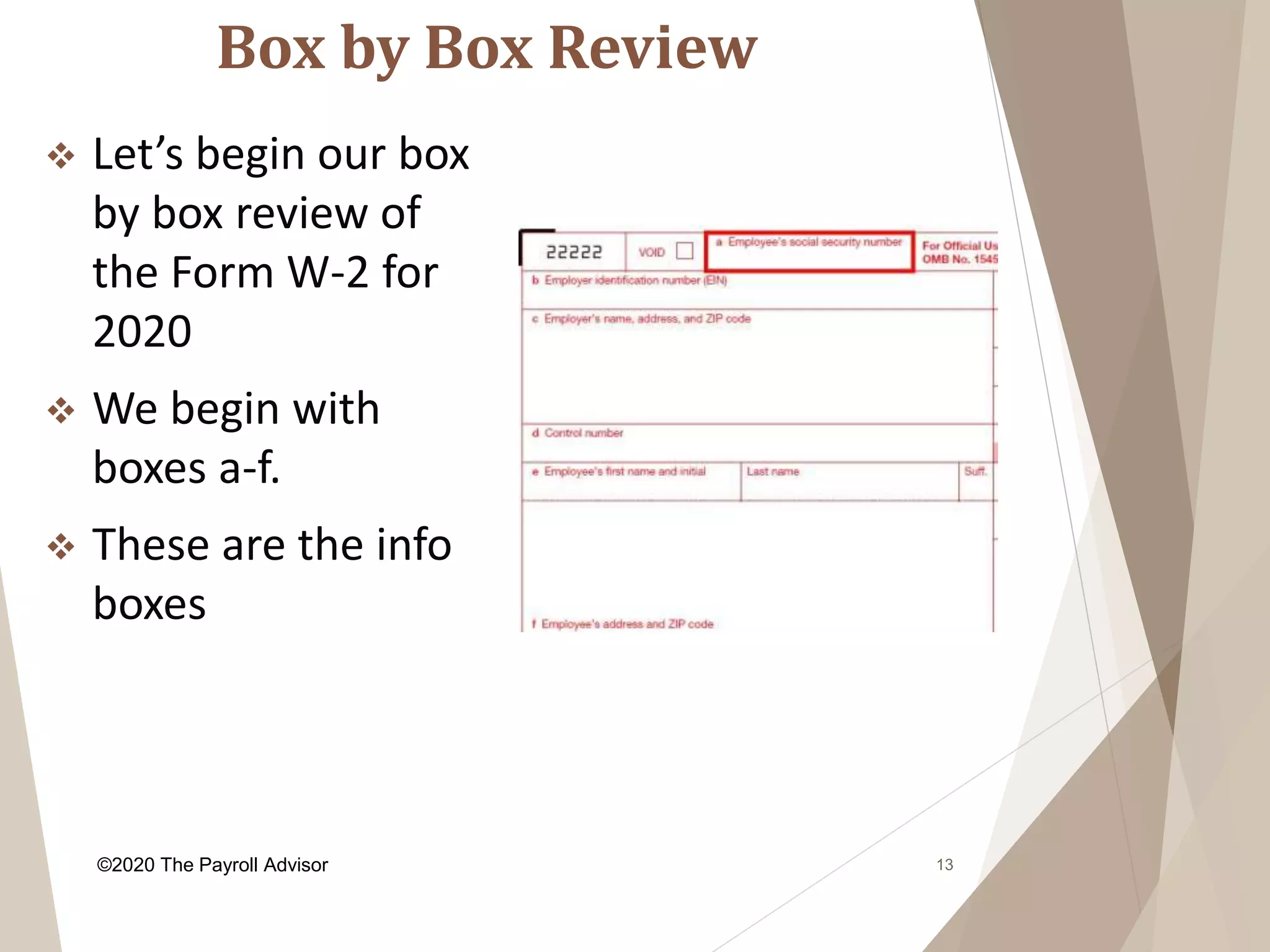

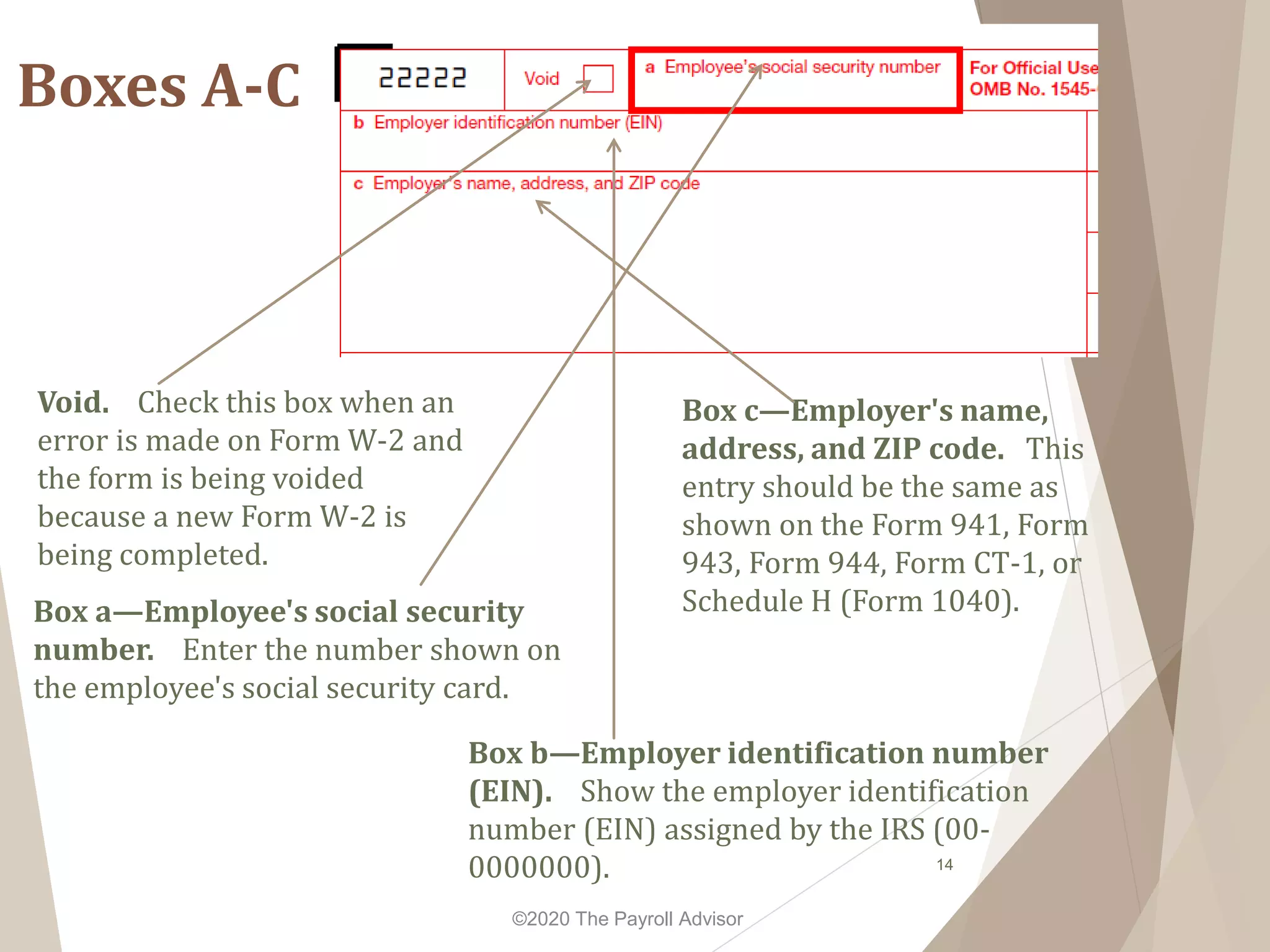

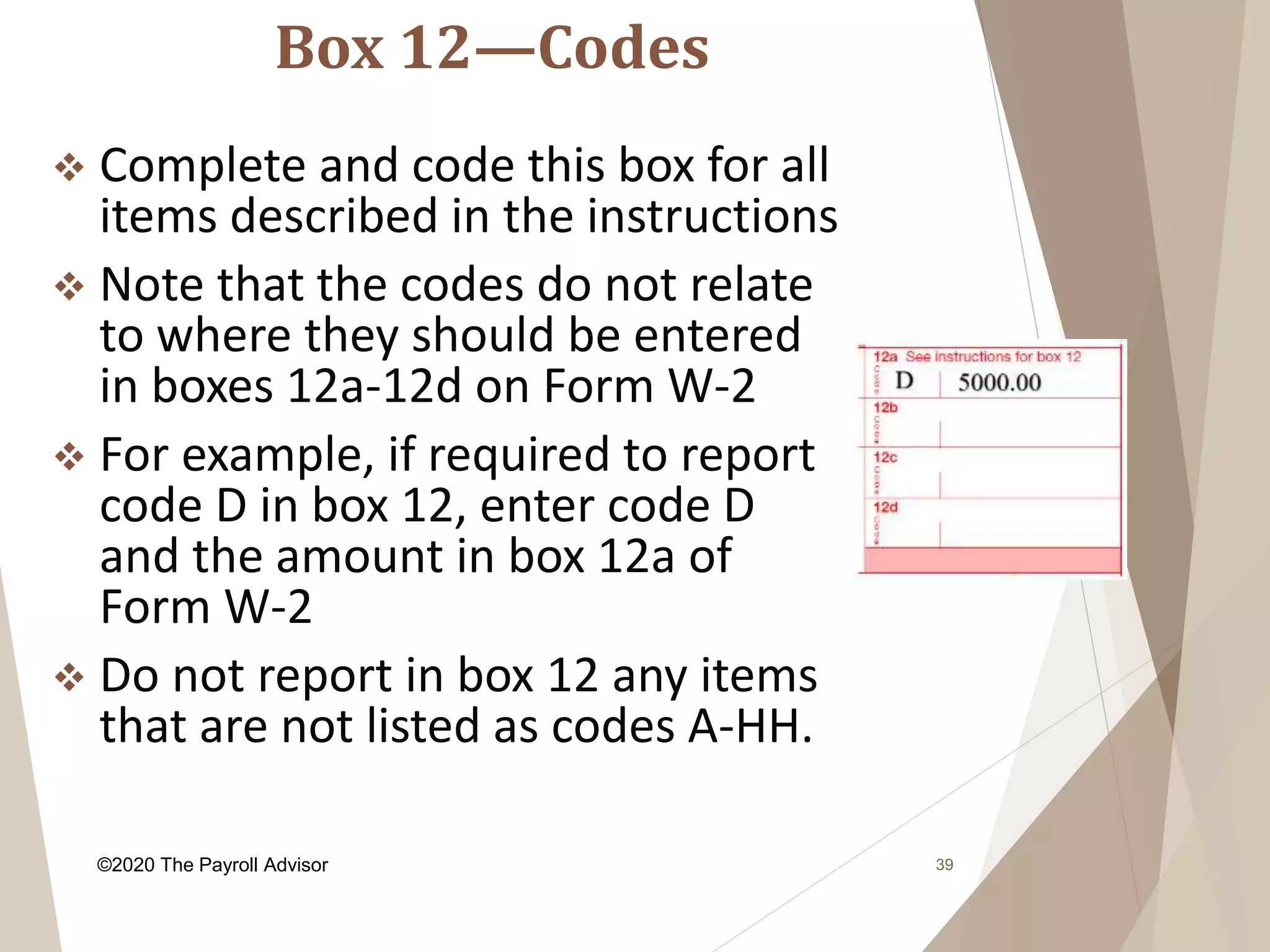

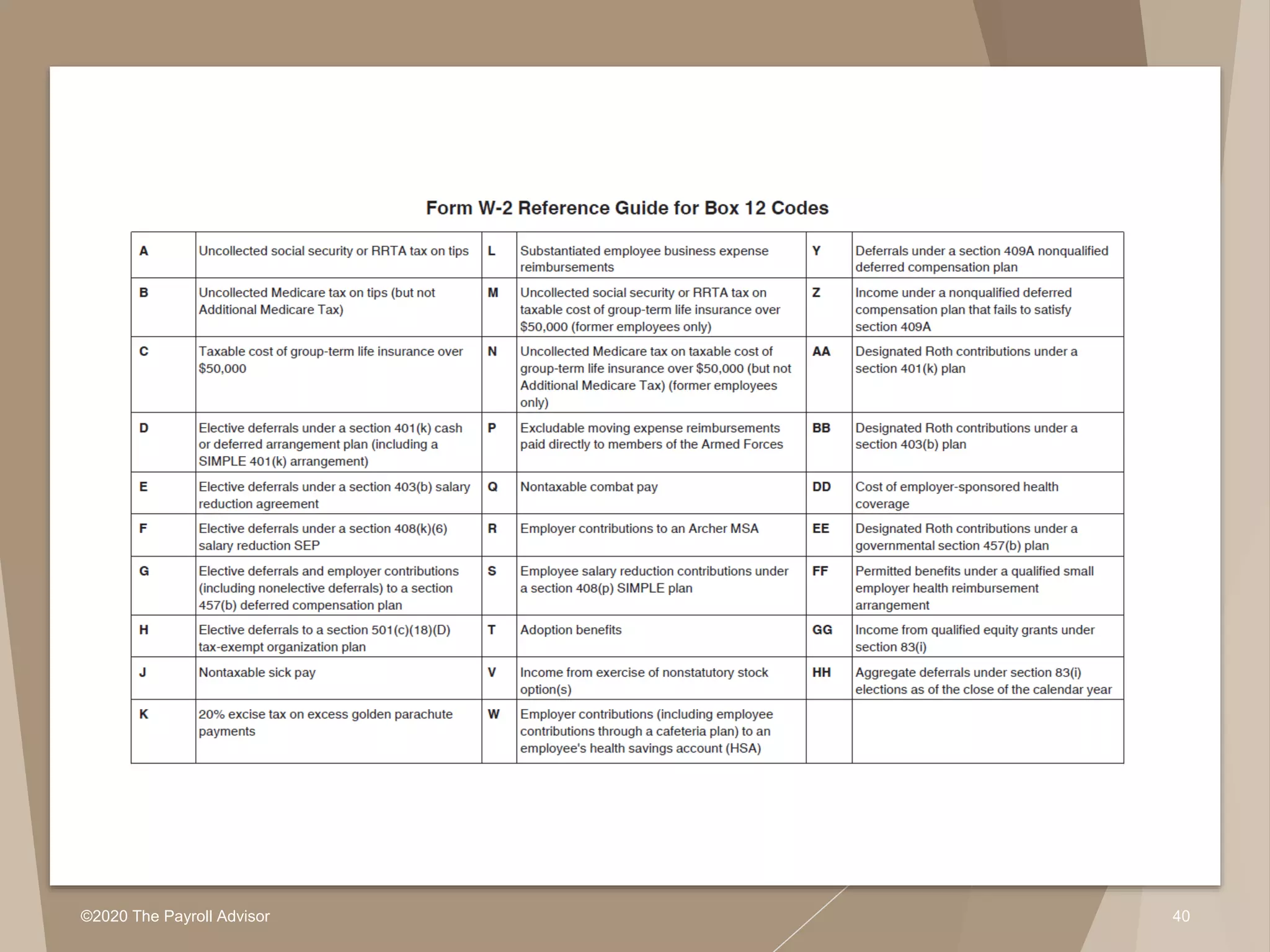

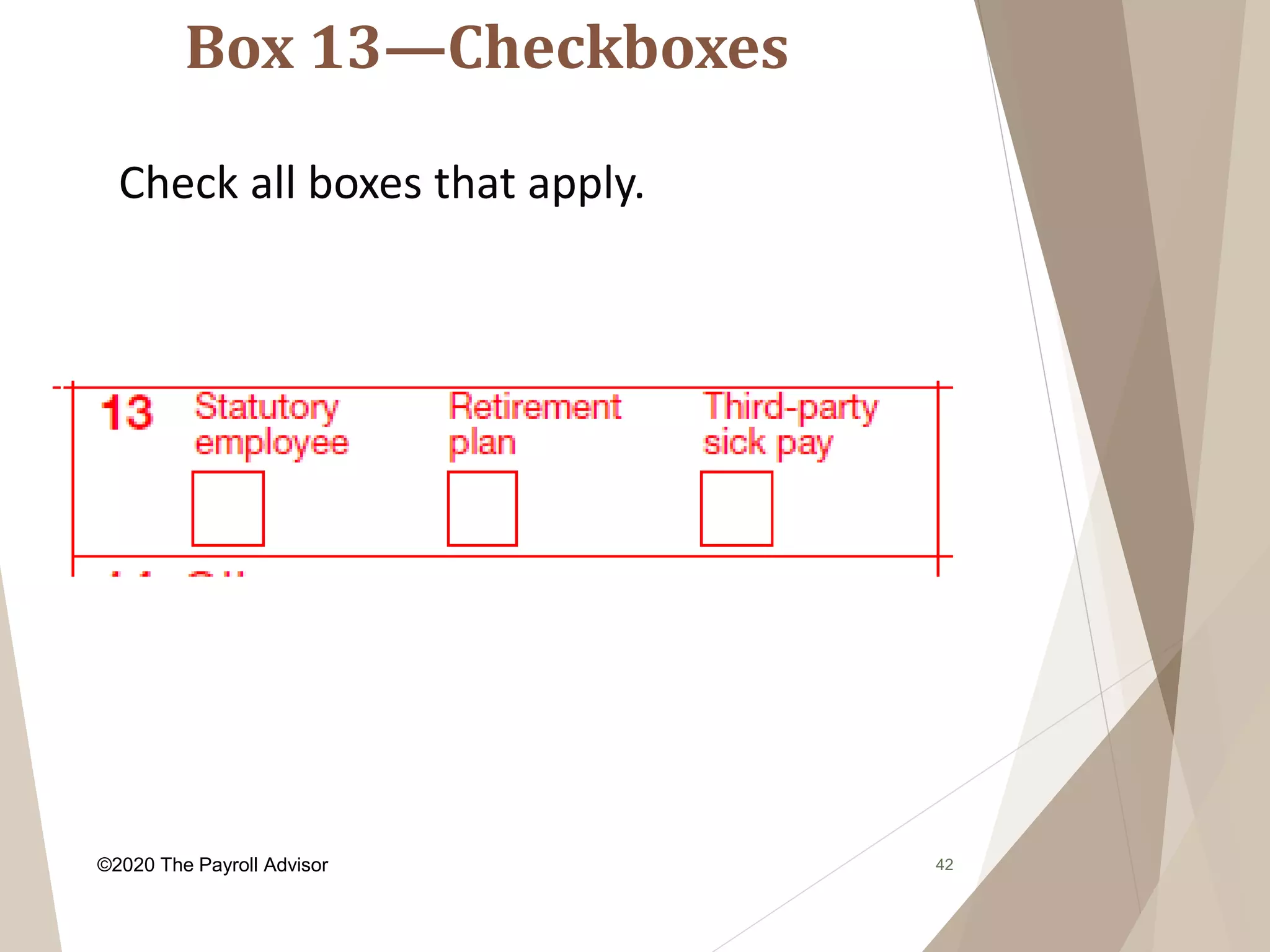

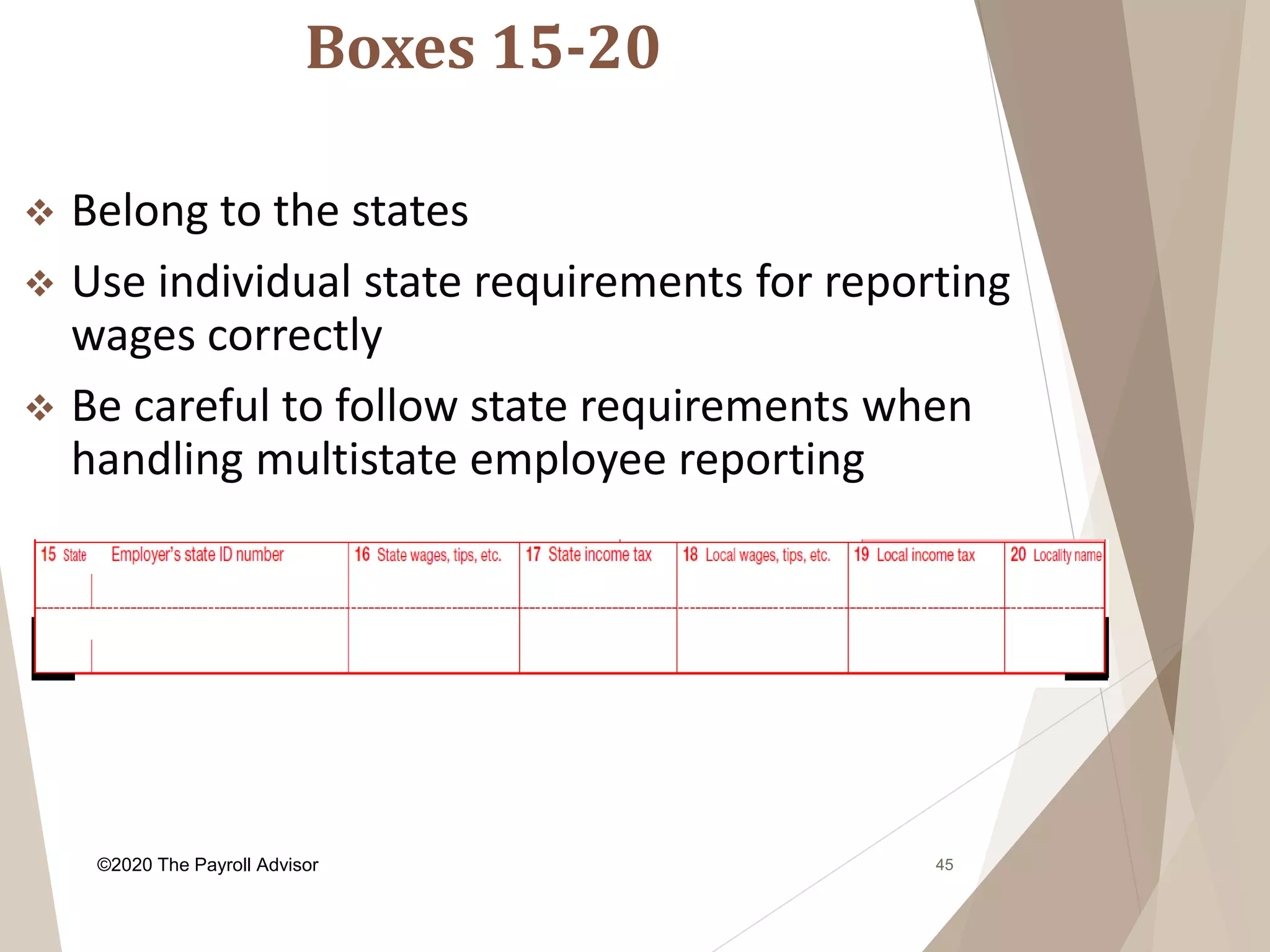

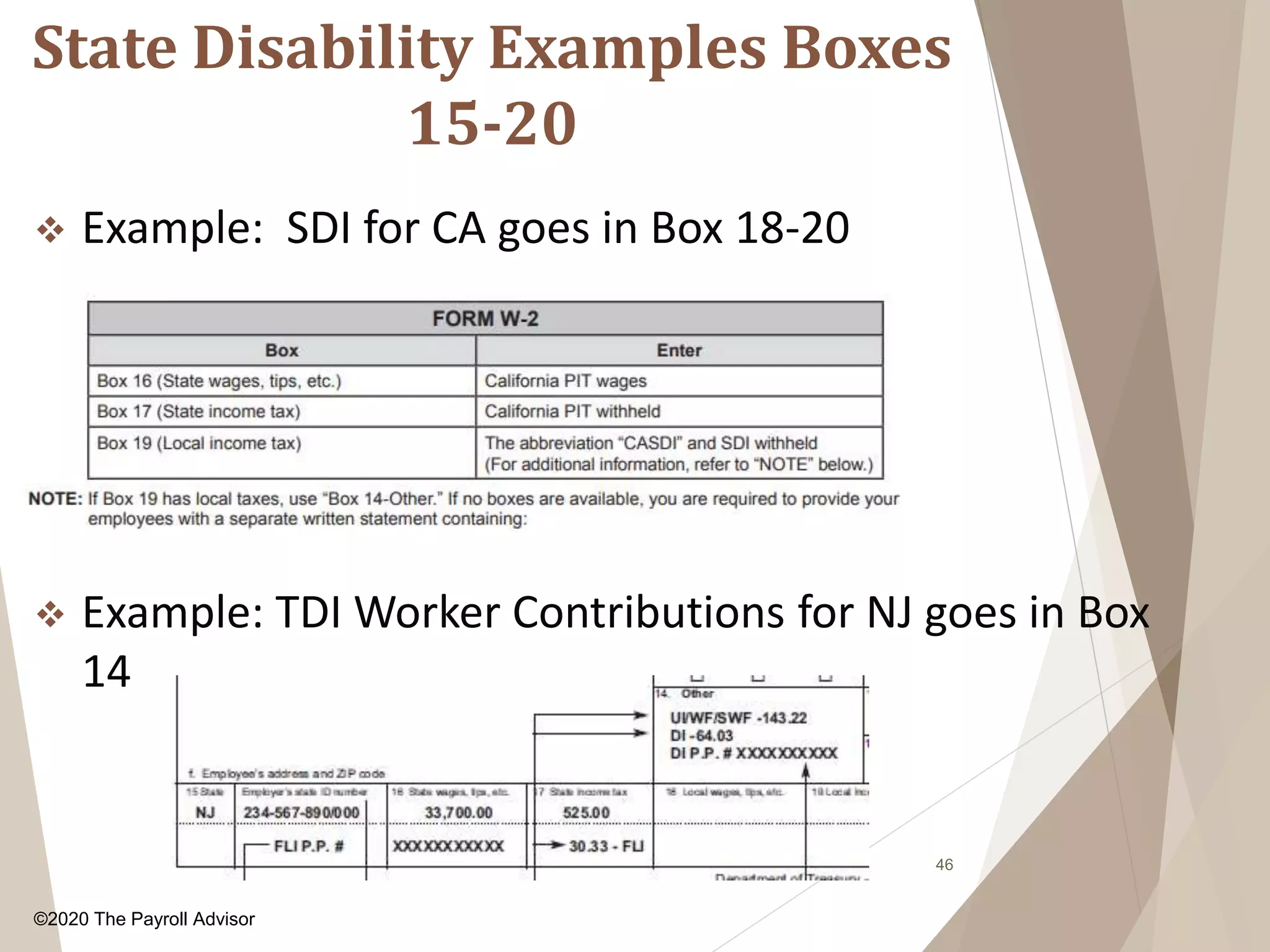

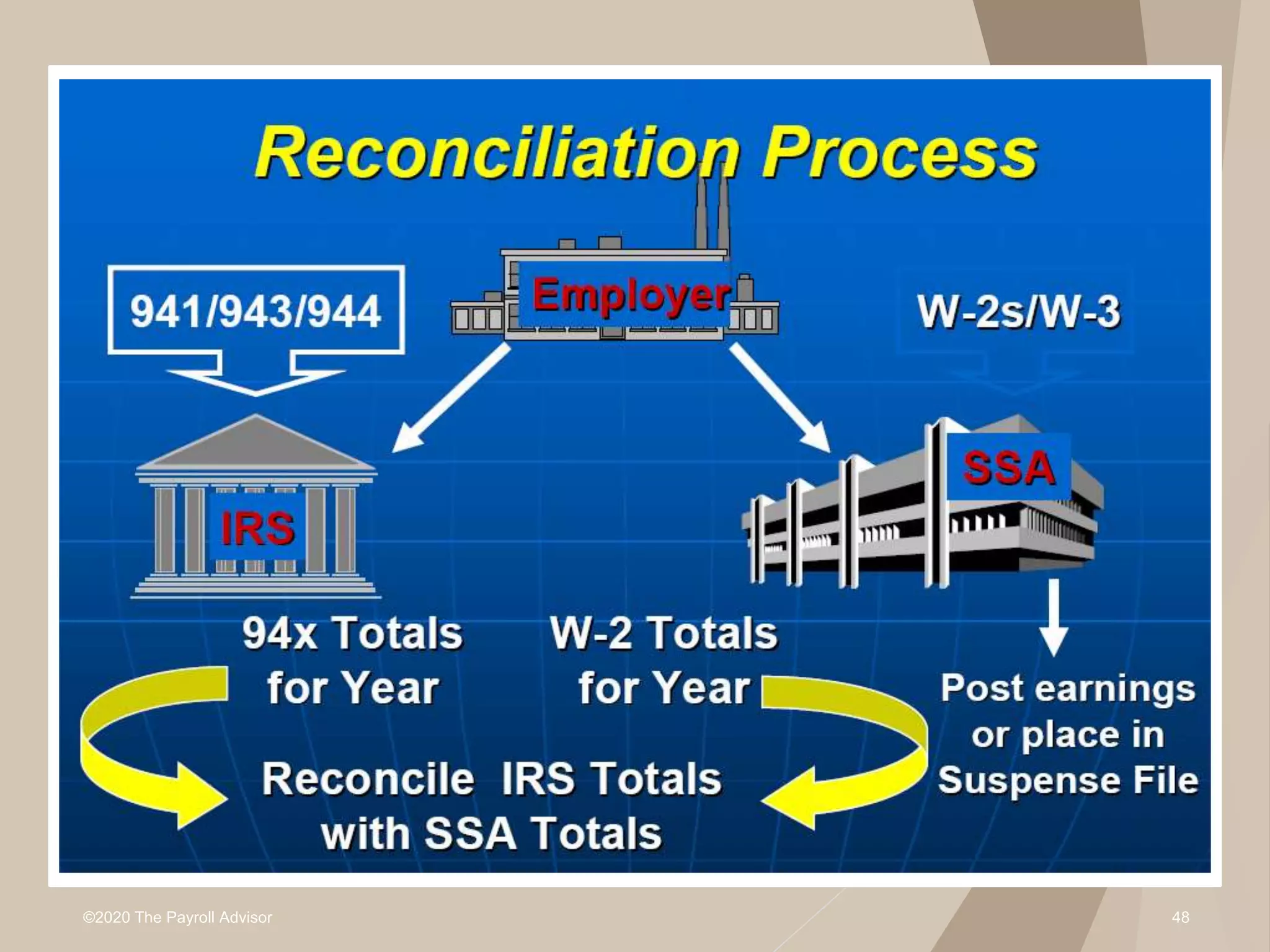

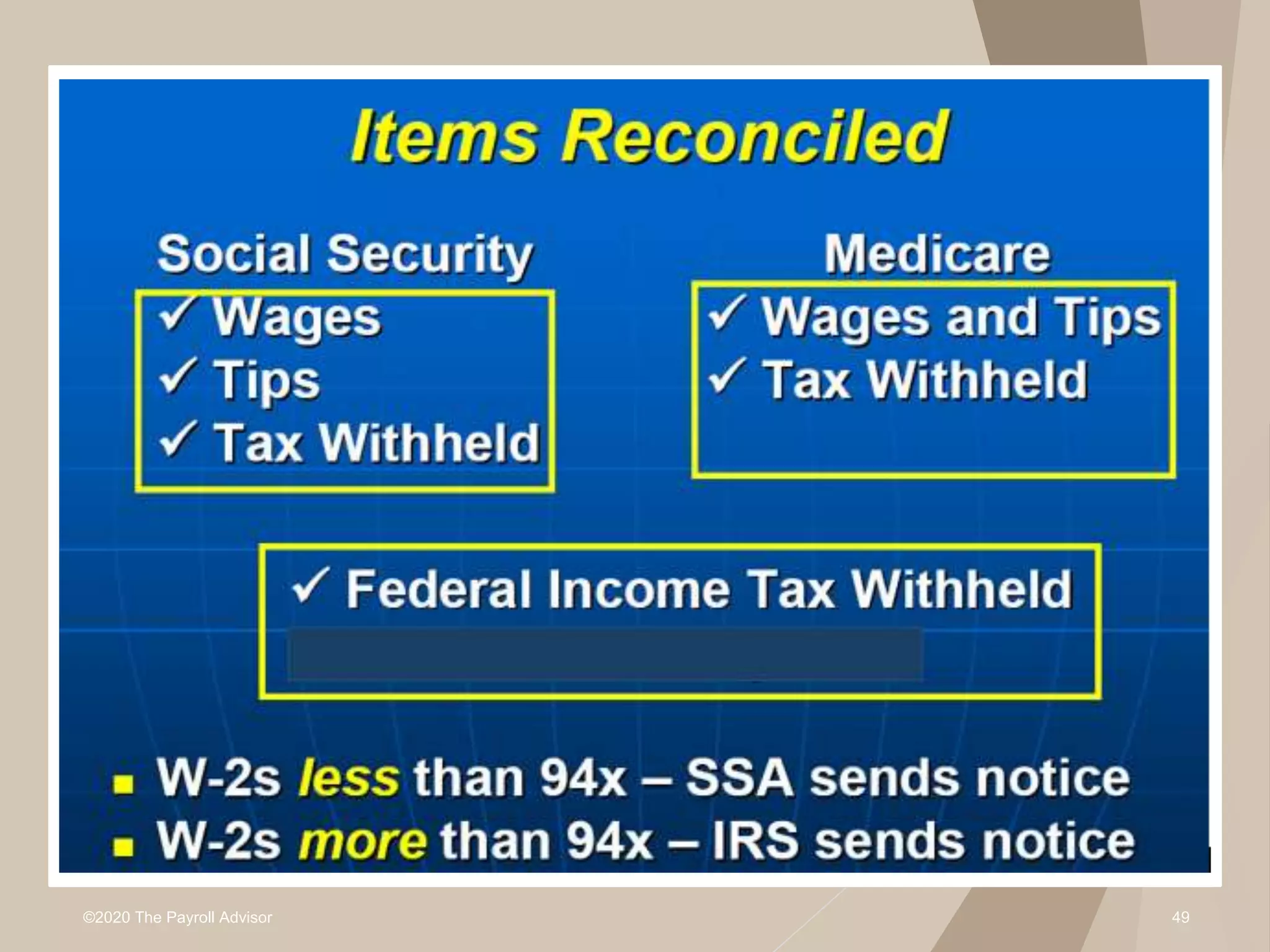

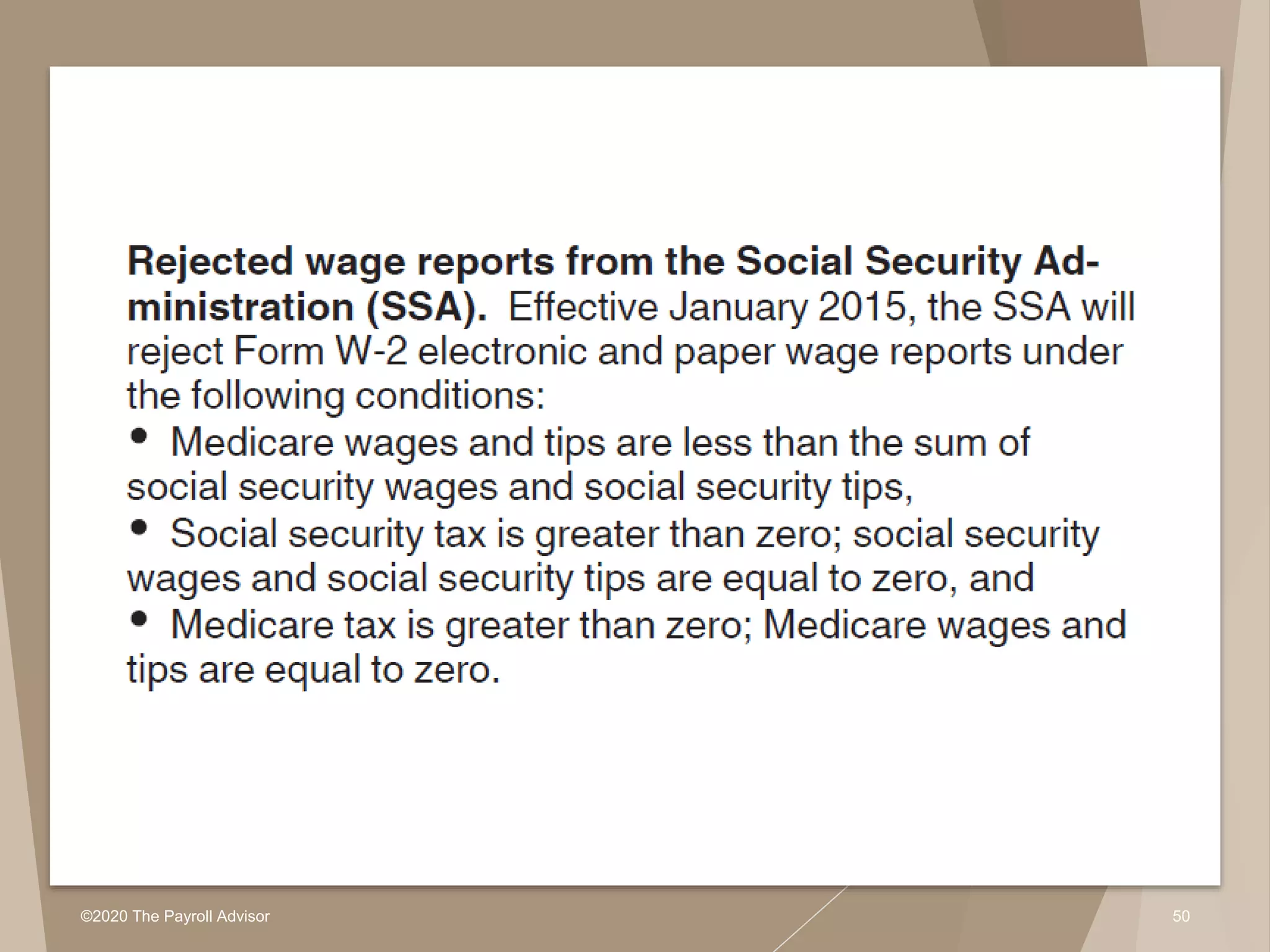

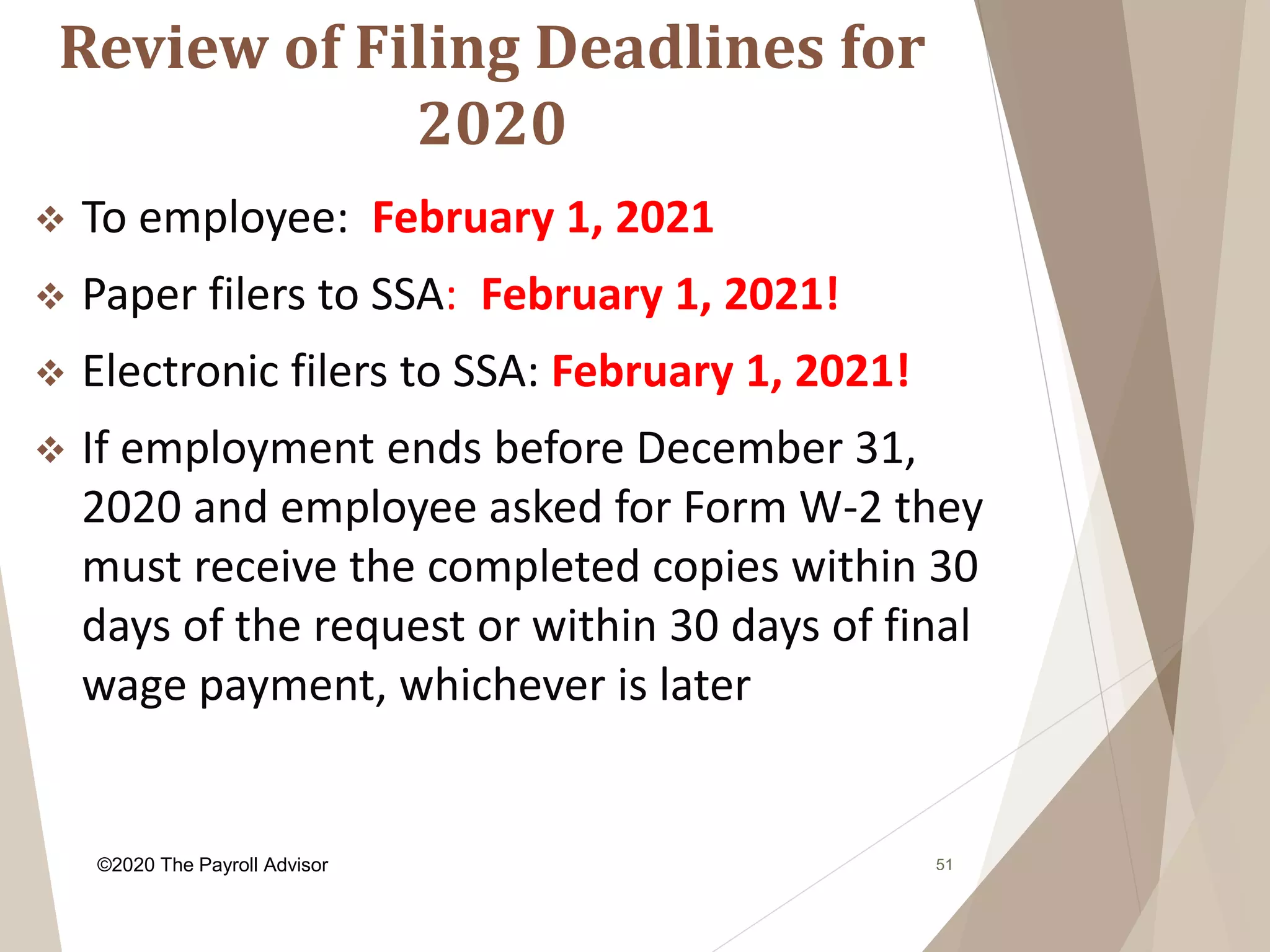

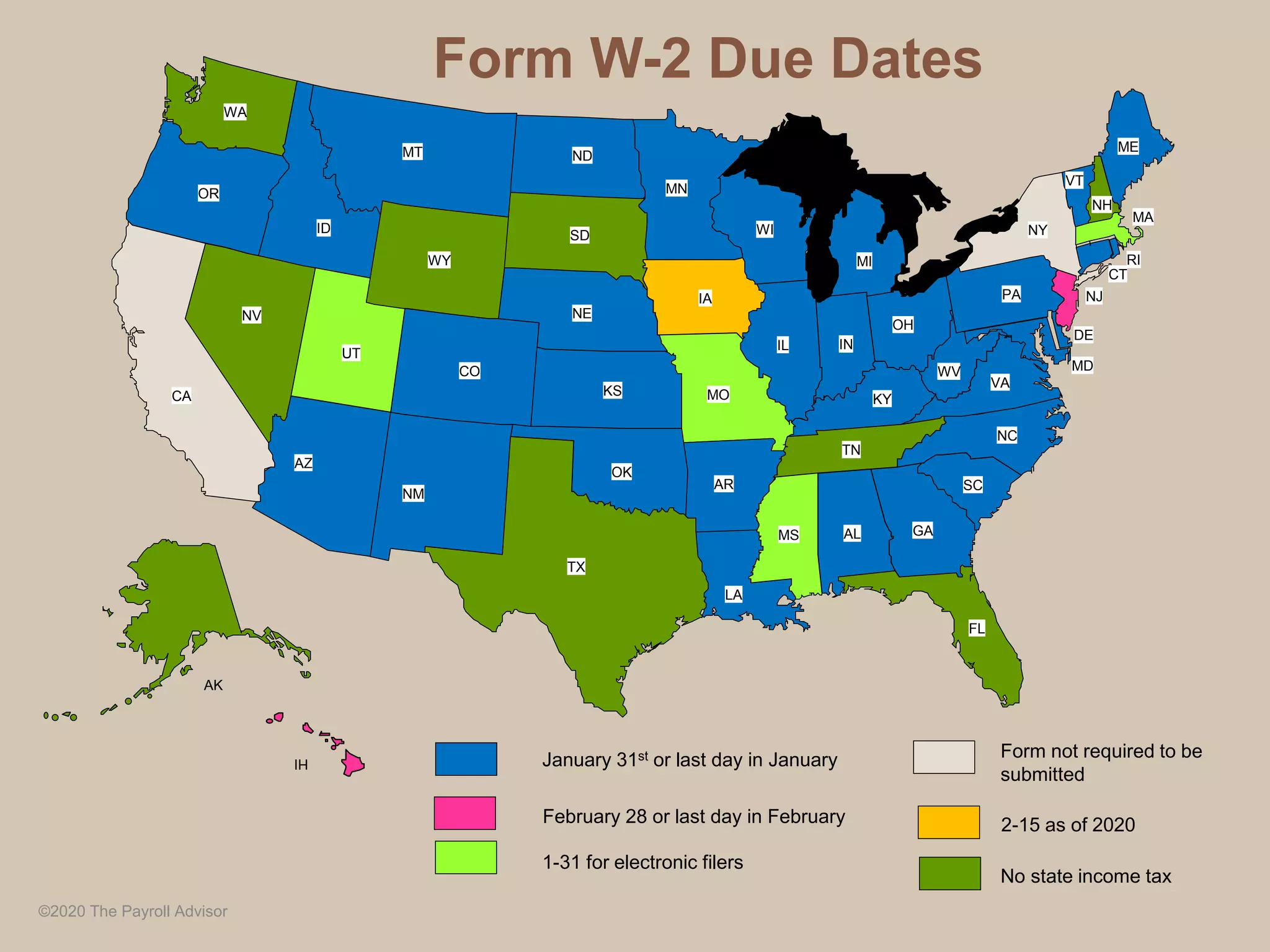

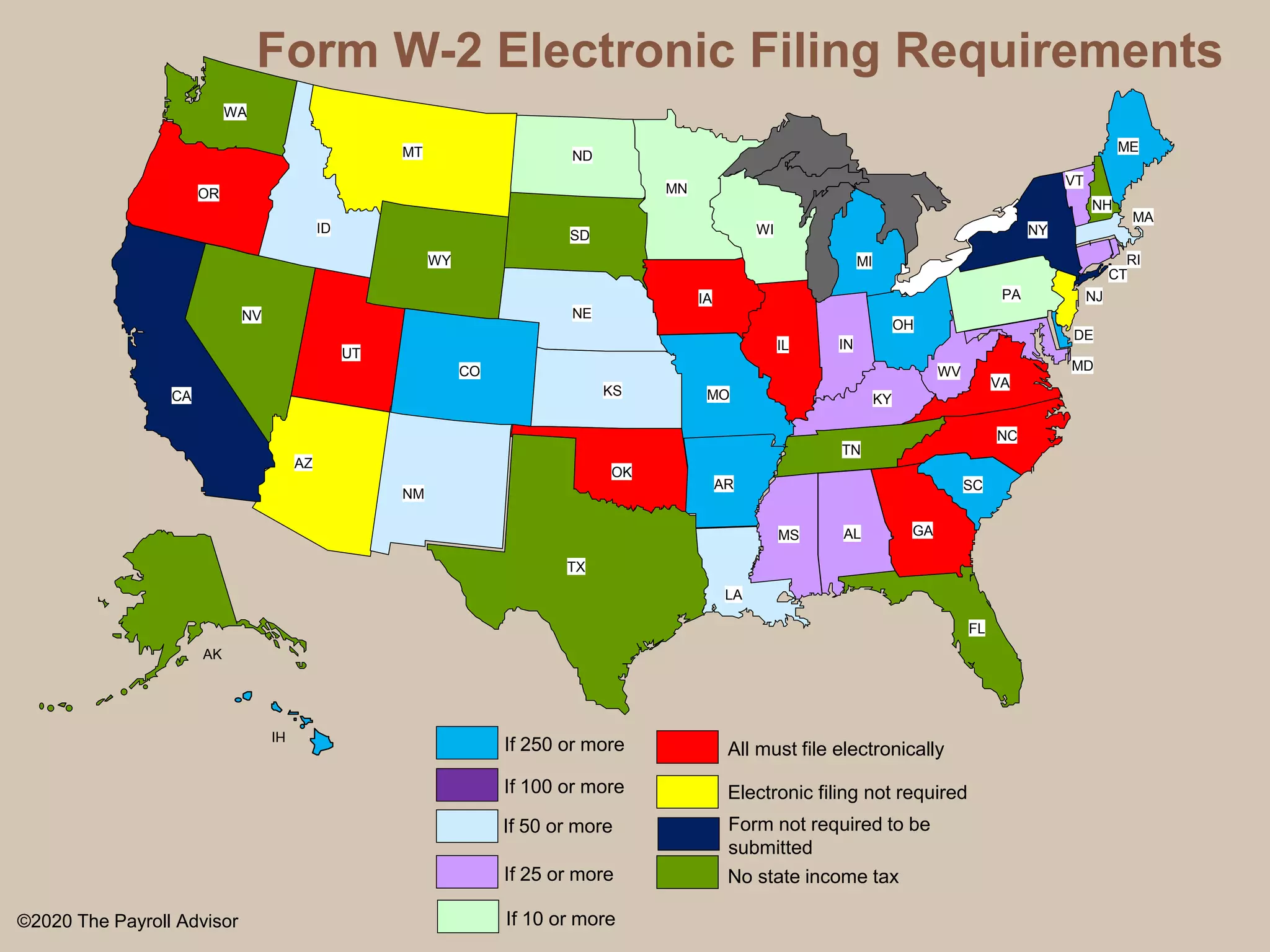

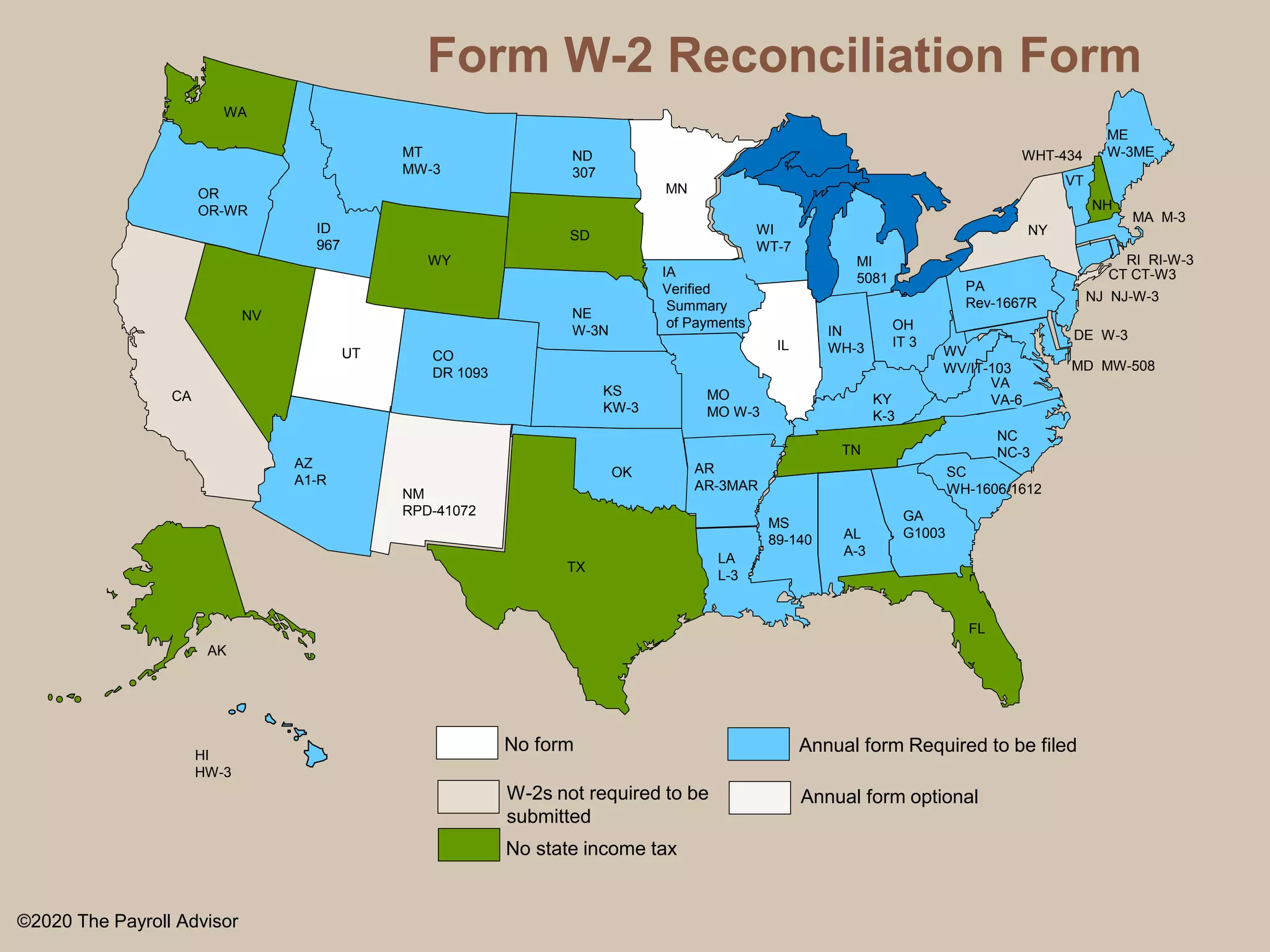

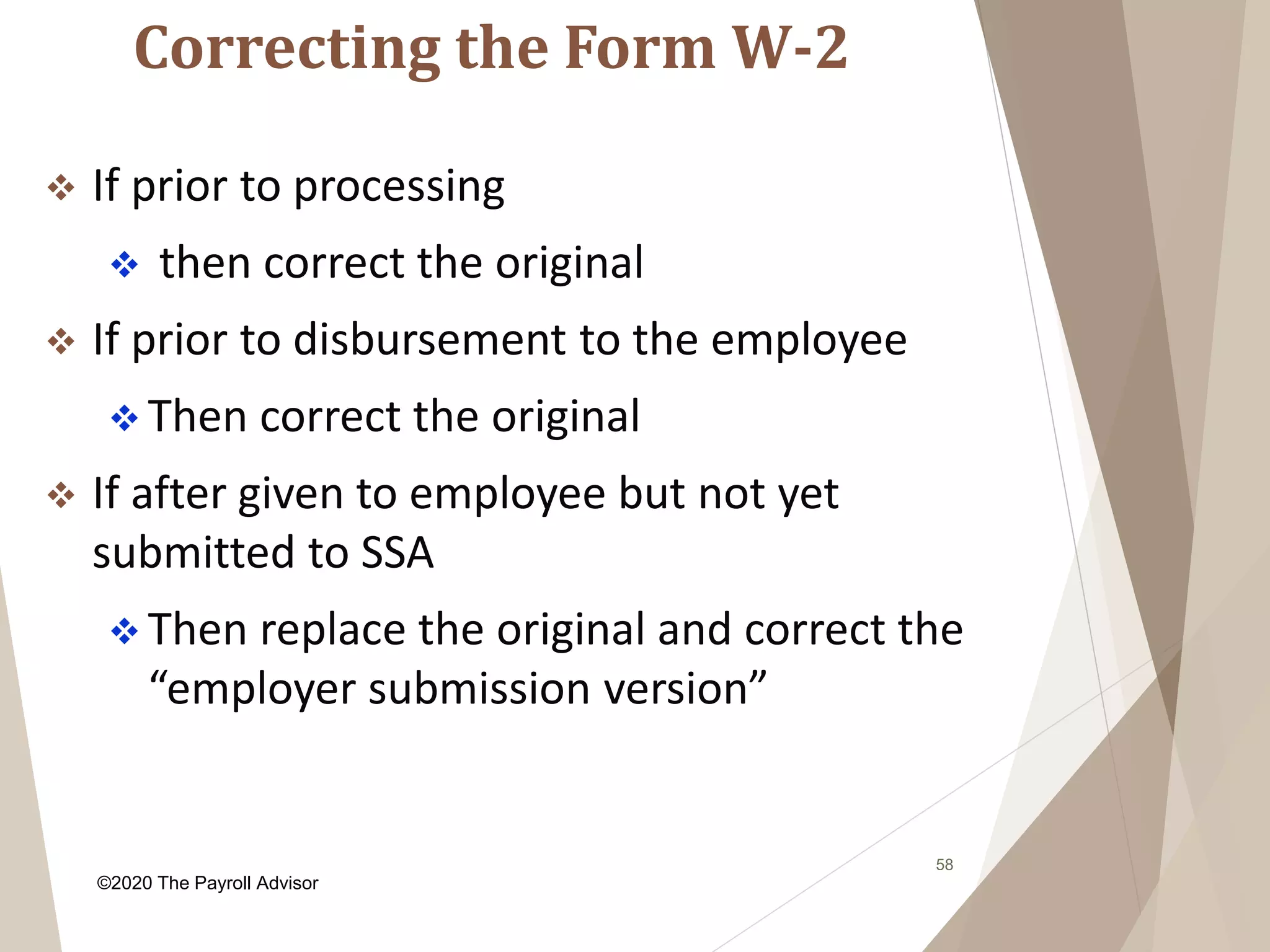

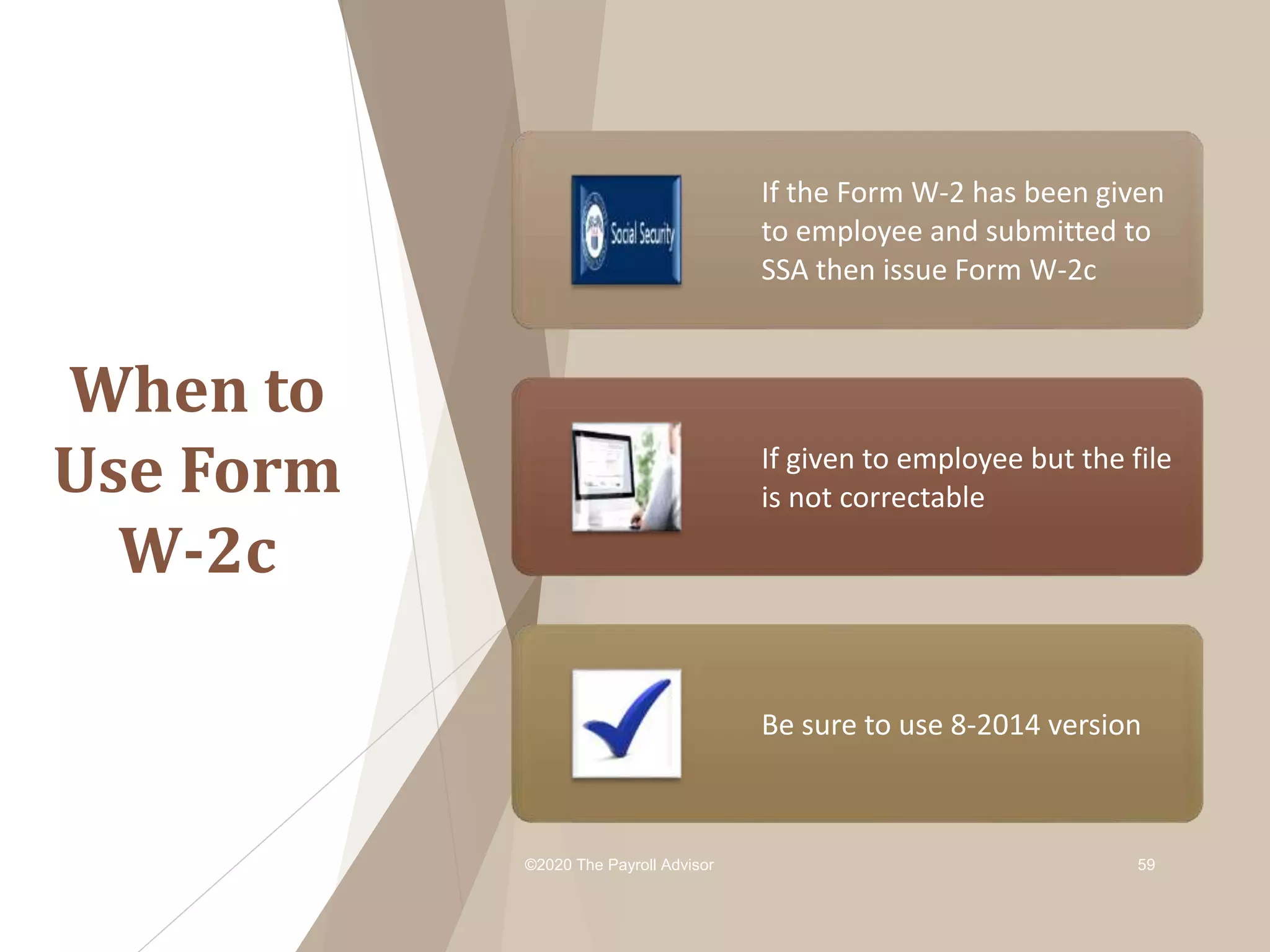

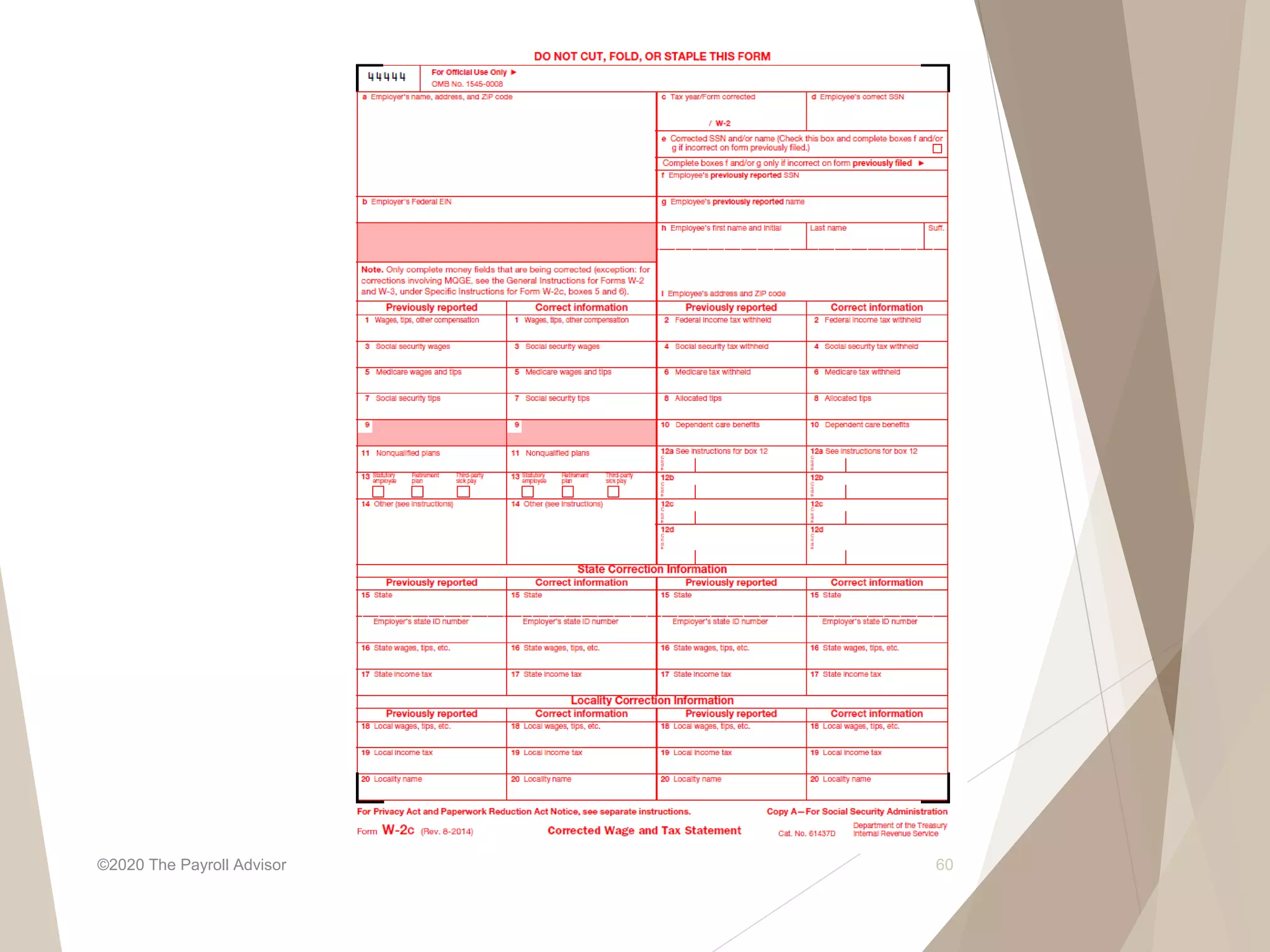

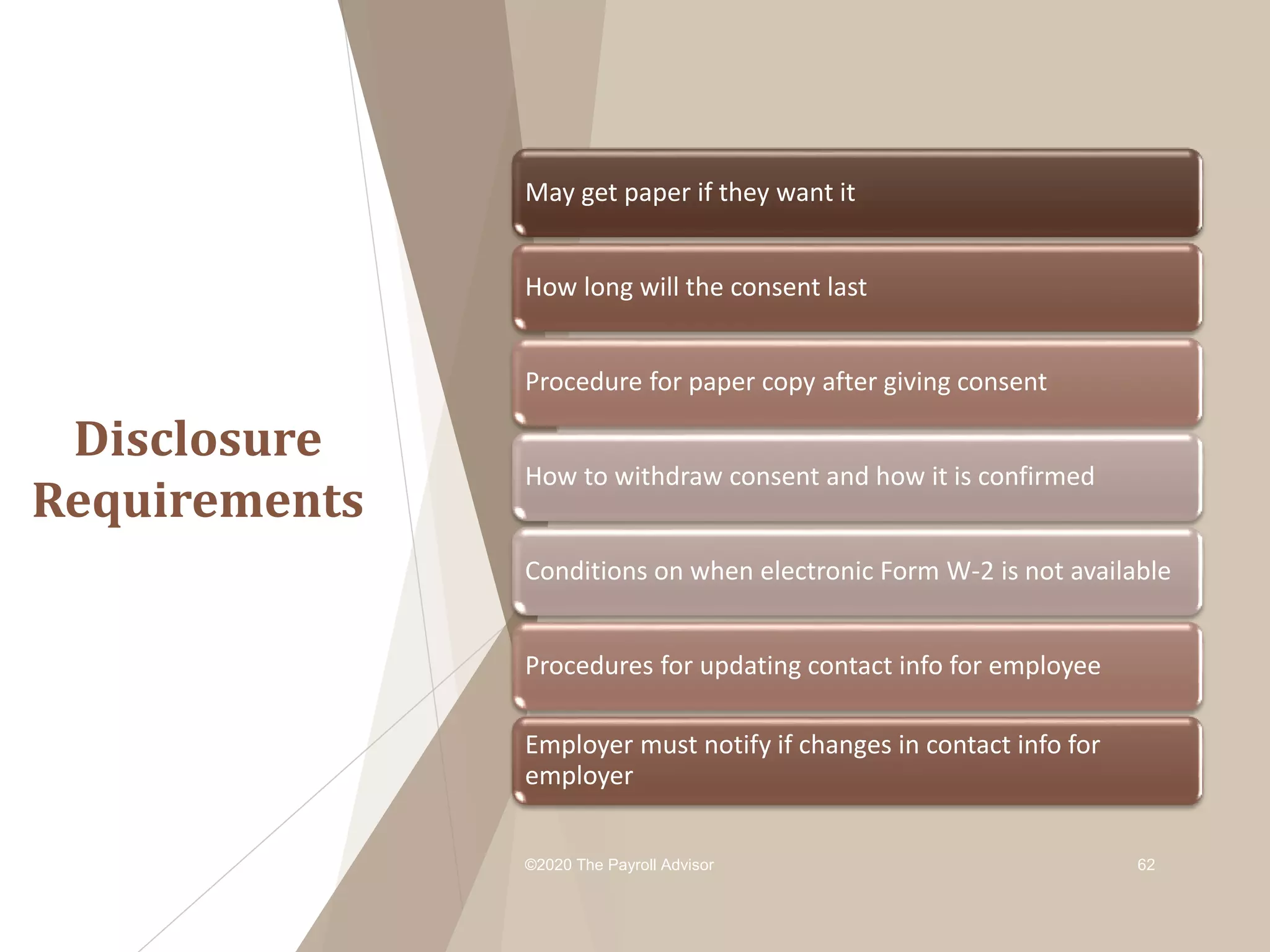

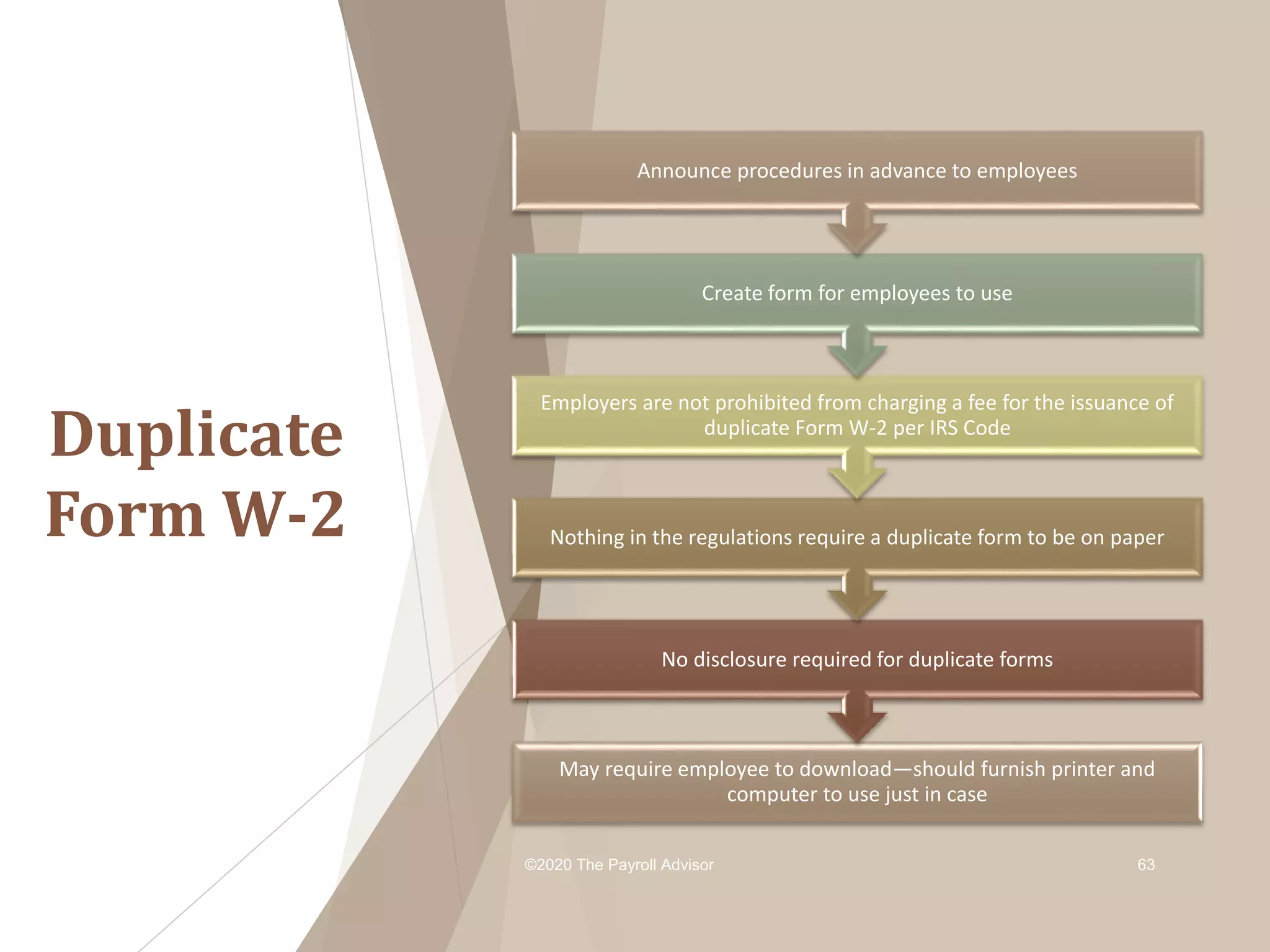

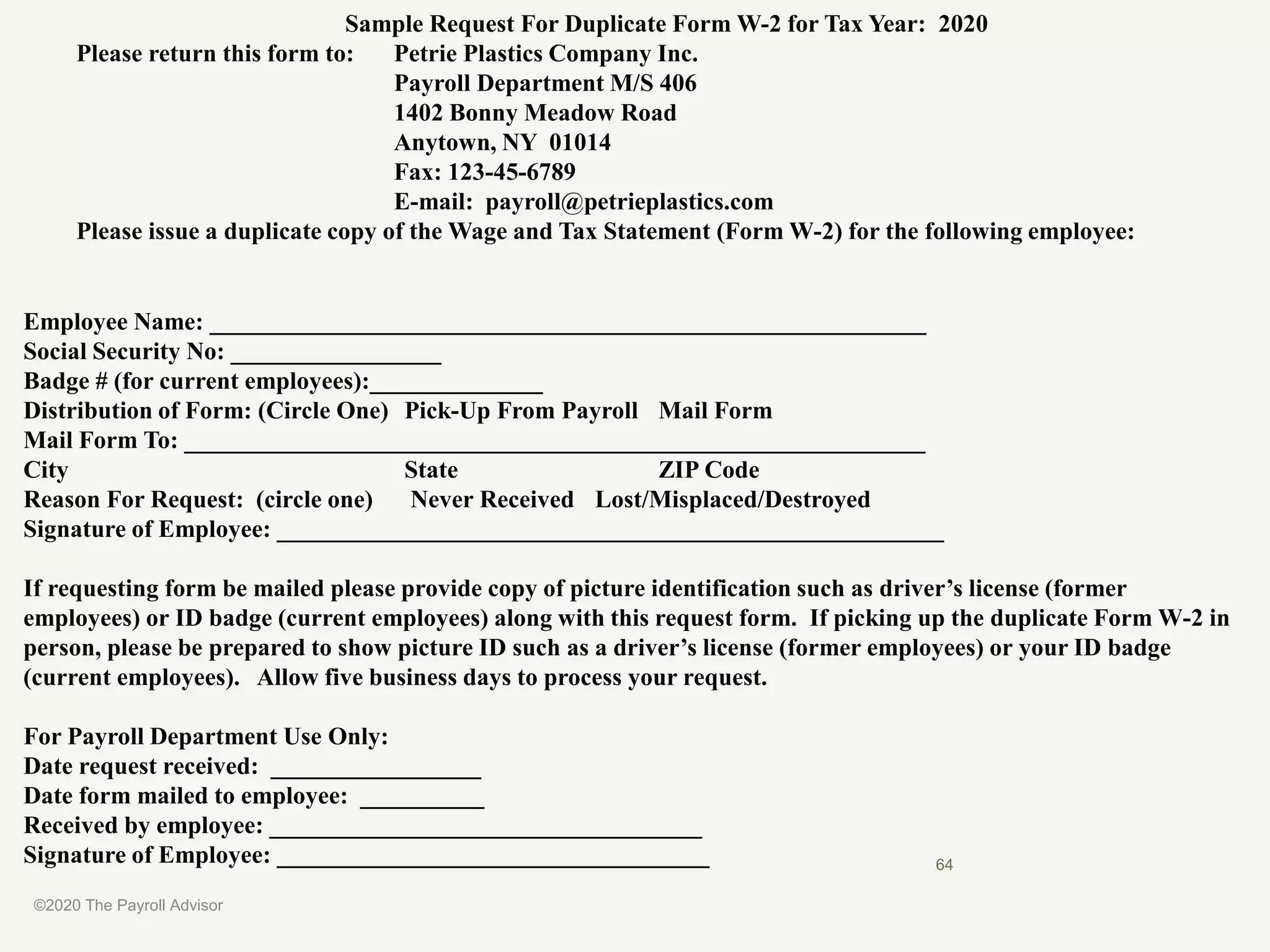

The document outlines the W-2 form guidelines for 2020, detailing changes, instructions, and best practices for handling employee tax documentation. It emphasizes the importance of accurate employee information and the implications of filing timelines to ensure compliance with IRS and SSA regulations. Additionally, it highlights technological solutions and tools to streamline HR processes related to payroll and benefits management.