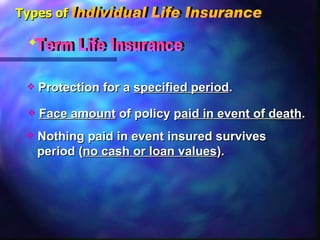

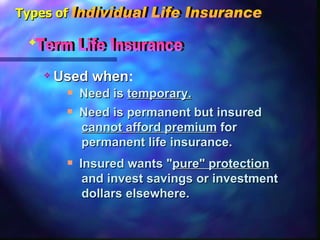

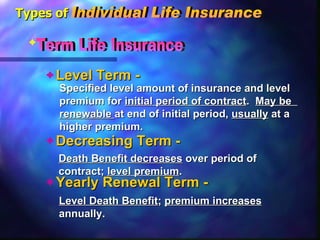

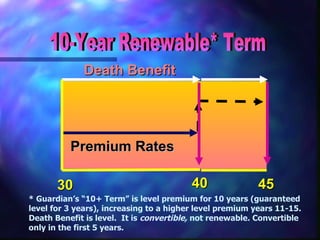

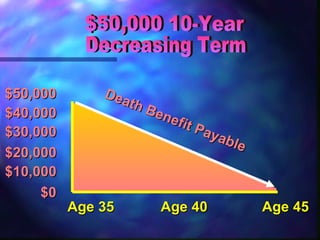

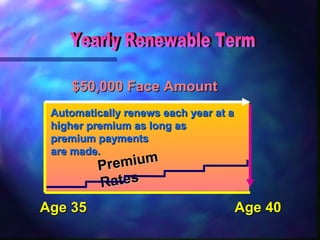

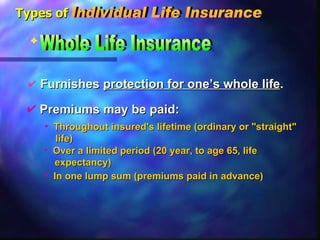

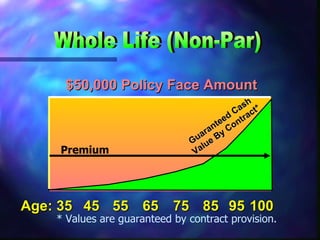

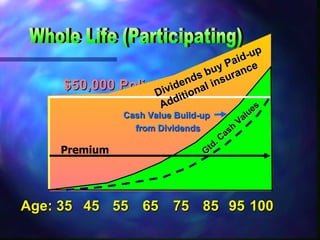

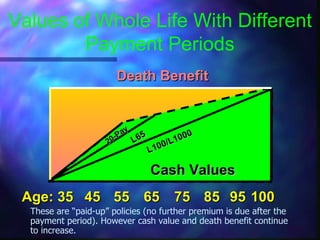

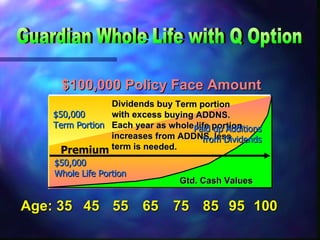

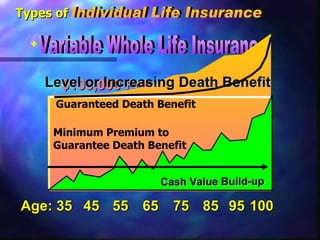

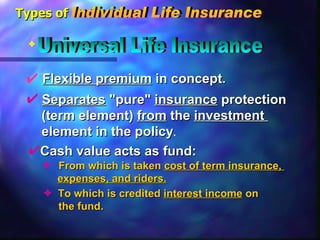

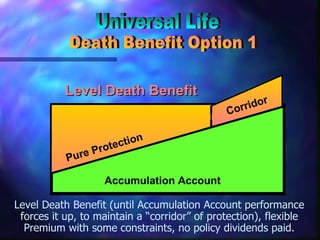

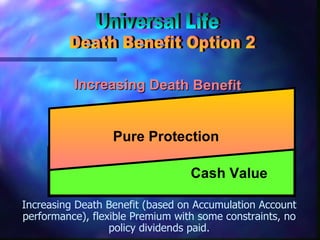

The document discusses the different types of individual life insurance, including term life insurance (which provides protection for a specified period), whole life insurance (which provides protection for one's whole life and has a savings component), universal life insurance (which separates the insurance and investment elements), and variable life insurance (where the cash value and death benefits may fluctuate based on investment performance). It provides examples of how death benefits and cash values change over time for different types and options.