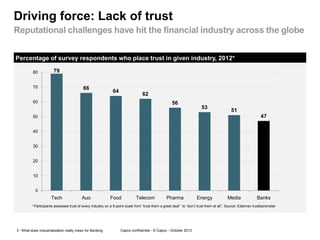

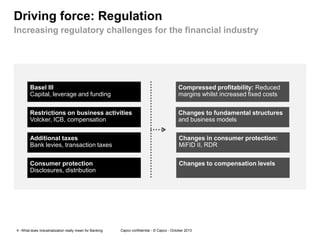

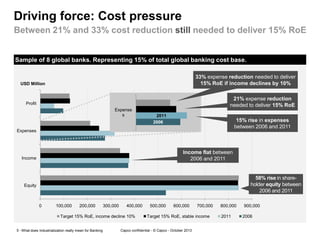

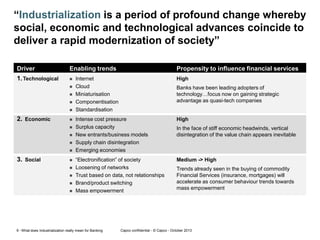

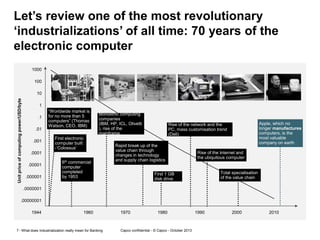

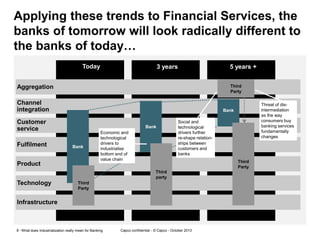

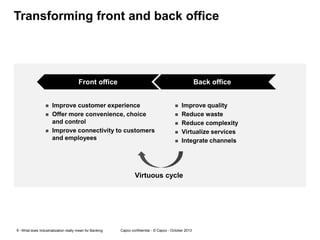

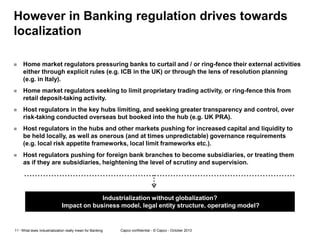

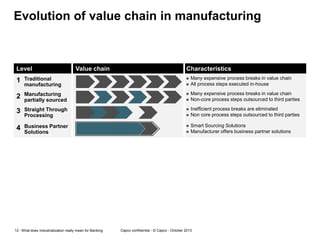

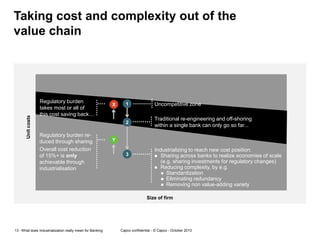

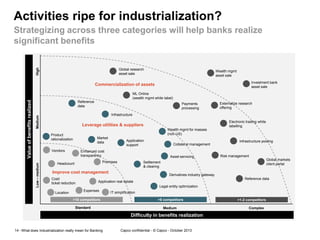

The document discusses the industrialization of banking, highlighting key drivers such as lack of trust, regulatory challenges, and cost pressures that necessitate profound changes in the industry. It explores the shifts in technology and consumer behavior that are transforming banking operations and business models, emphasizing the need for efficiency and strategic advantages. Additionally, it examines the regulatory trend towards localization that impacts globalization strategies within the banking sector.