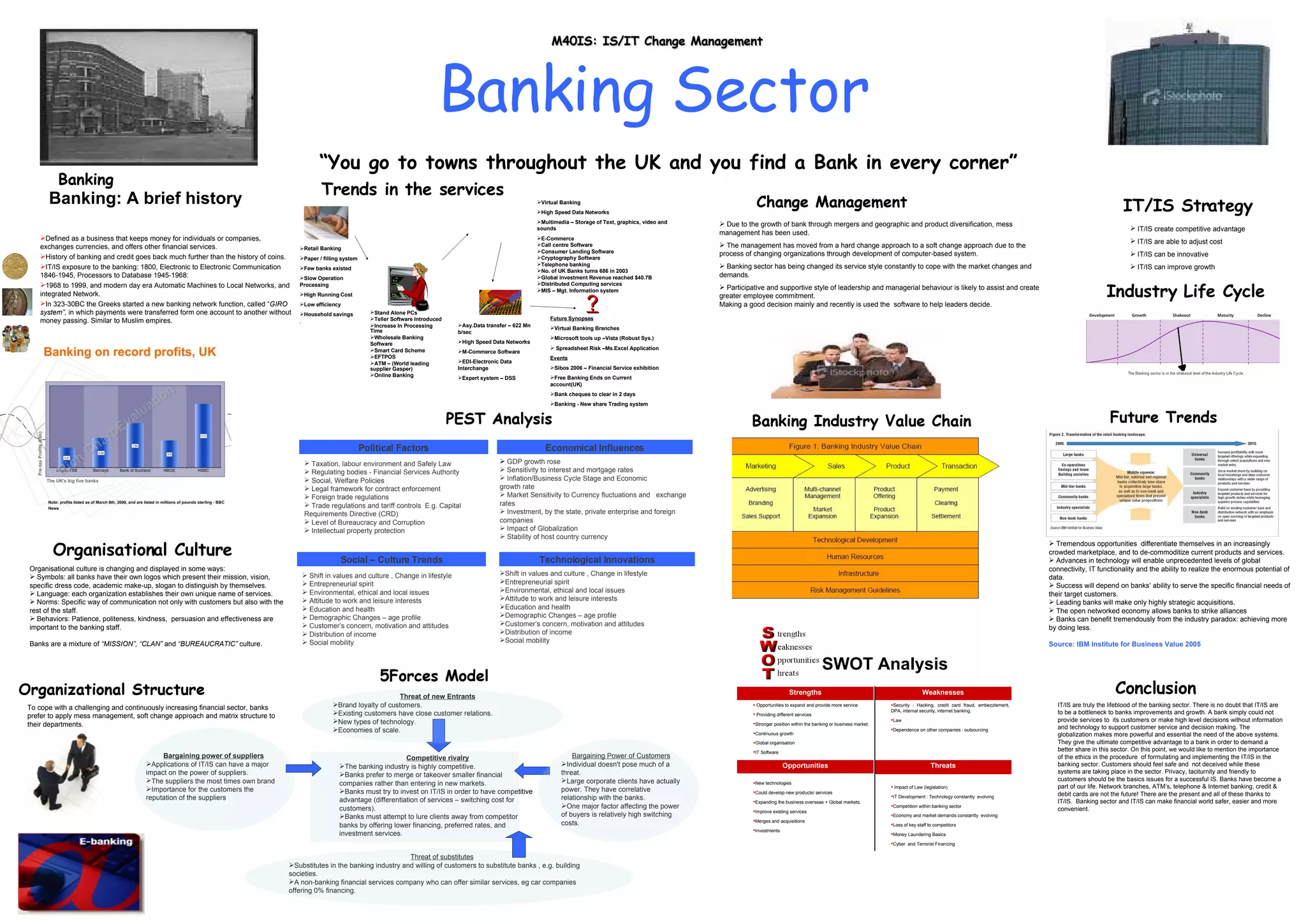

The document discusses the banking sector and the role of information technology and systems (IT/IS). It notes that IT/IS have become essential to banks' operations and competitive advantage by supporting customer service and decision making. It also discusses trends in banking technologies over time, from paper-based to increasingly digital and online systems, and factors like organizational culture, competition, regulations and threats that banks must navigate.