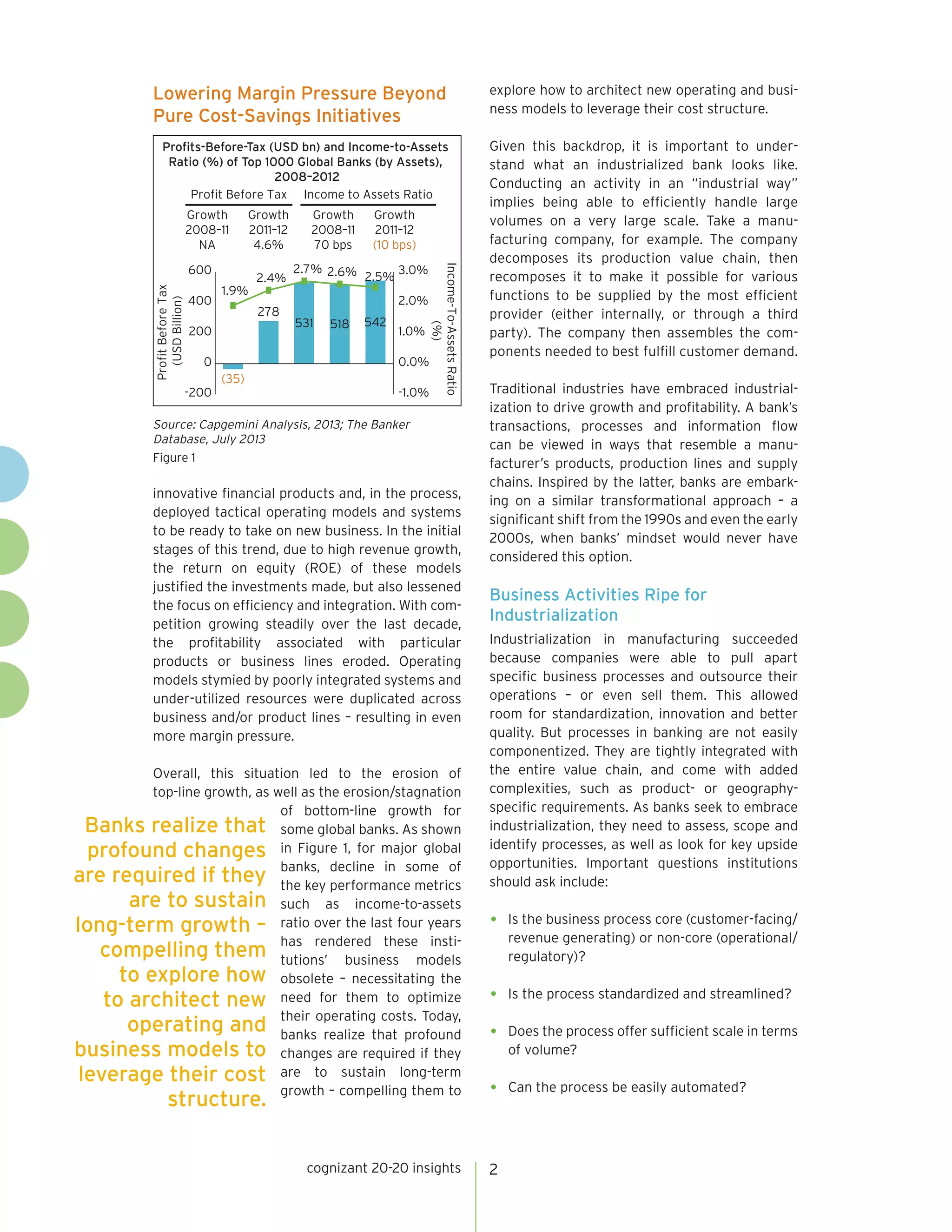

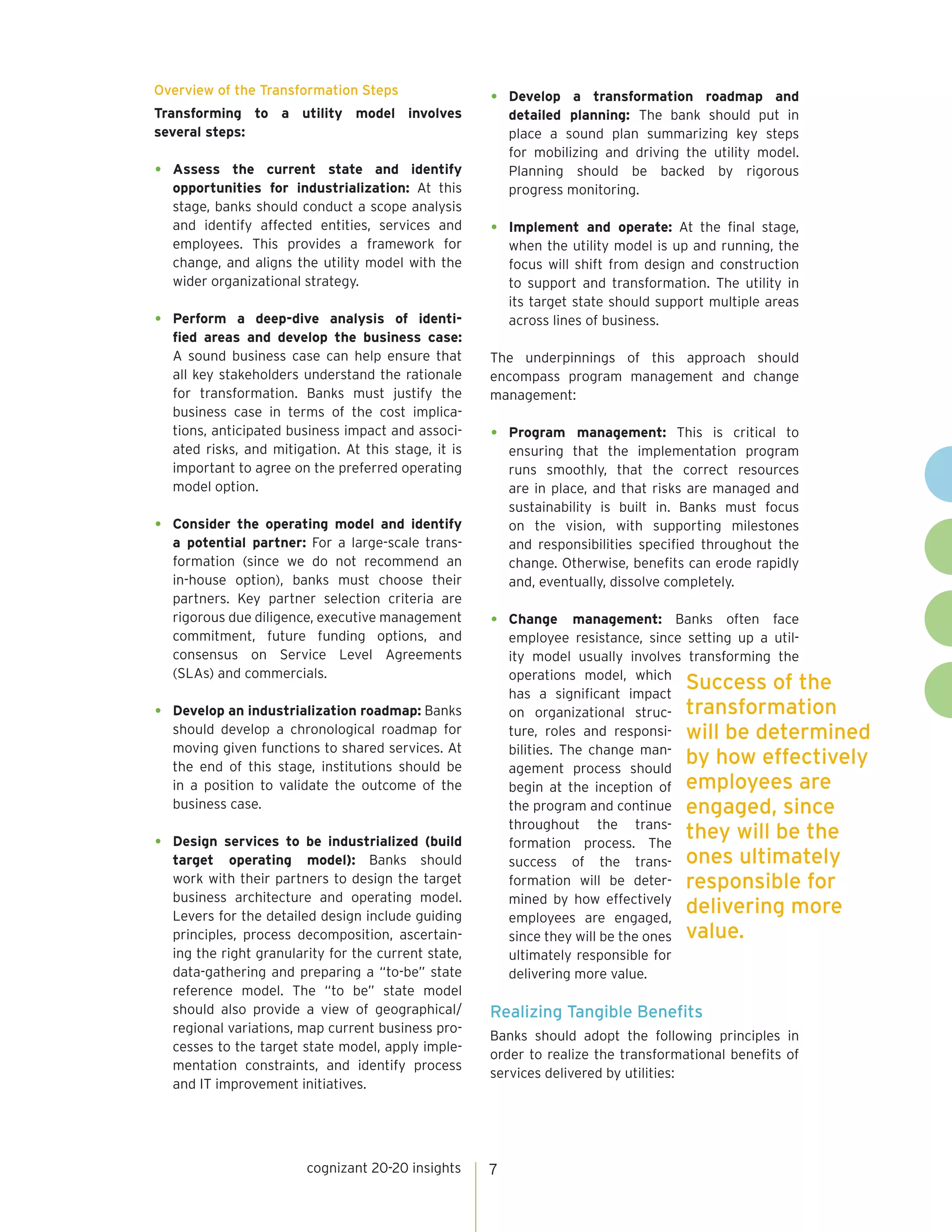

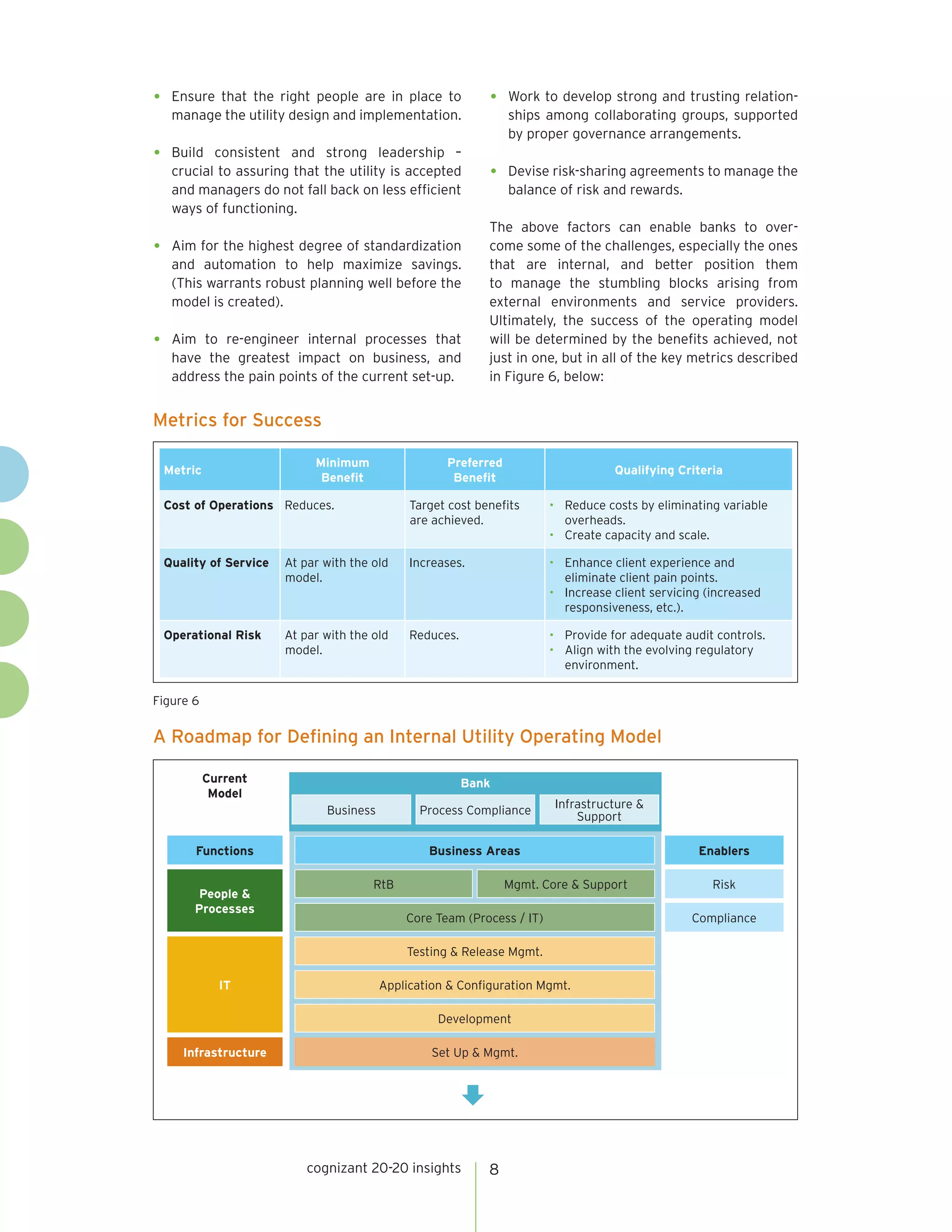

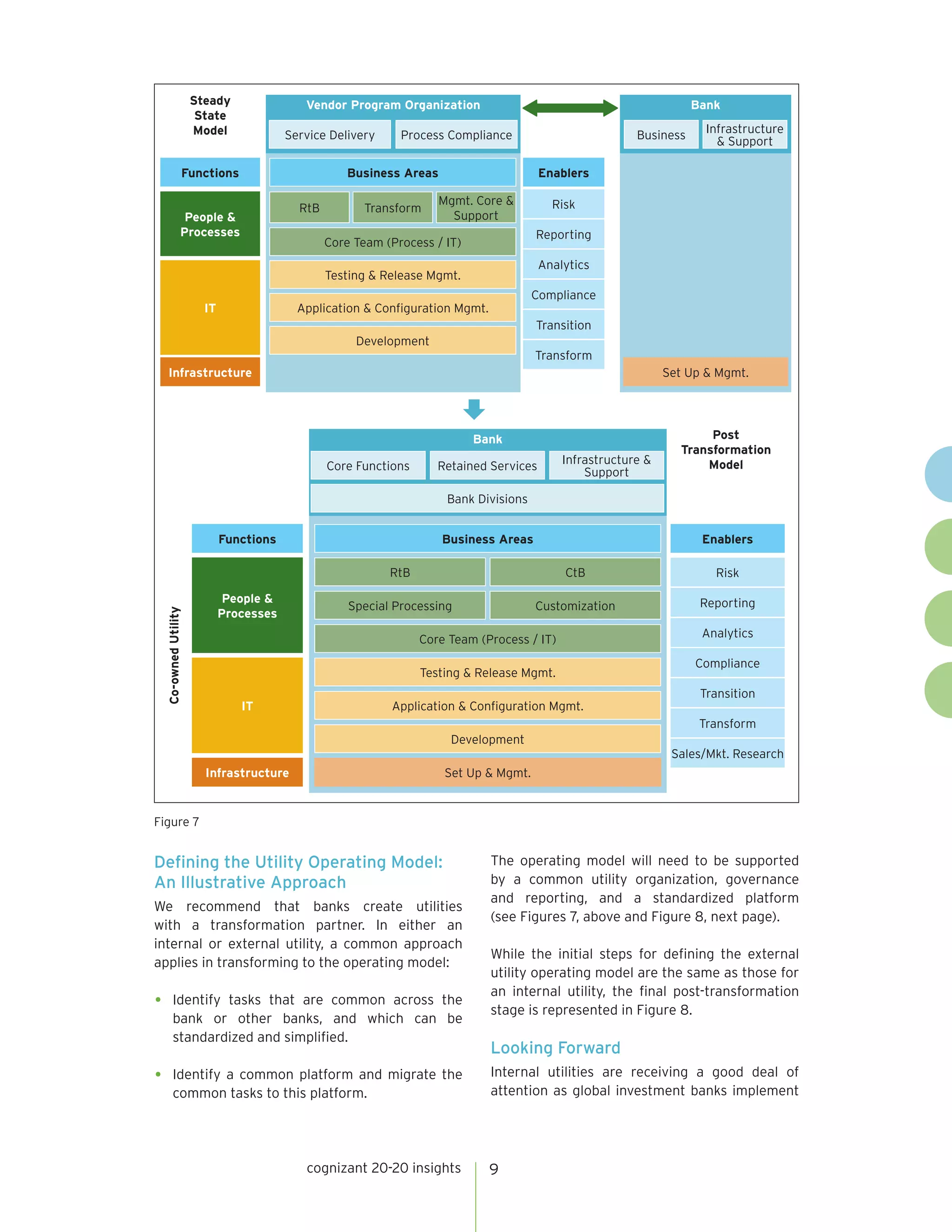

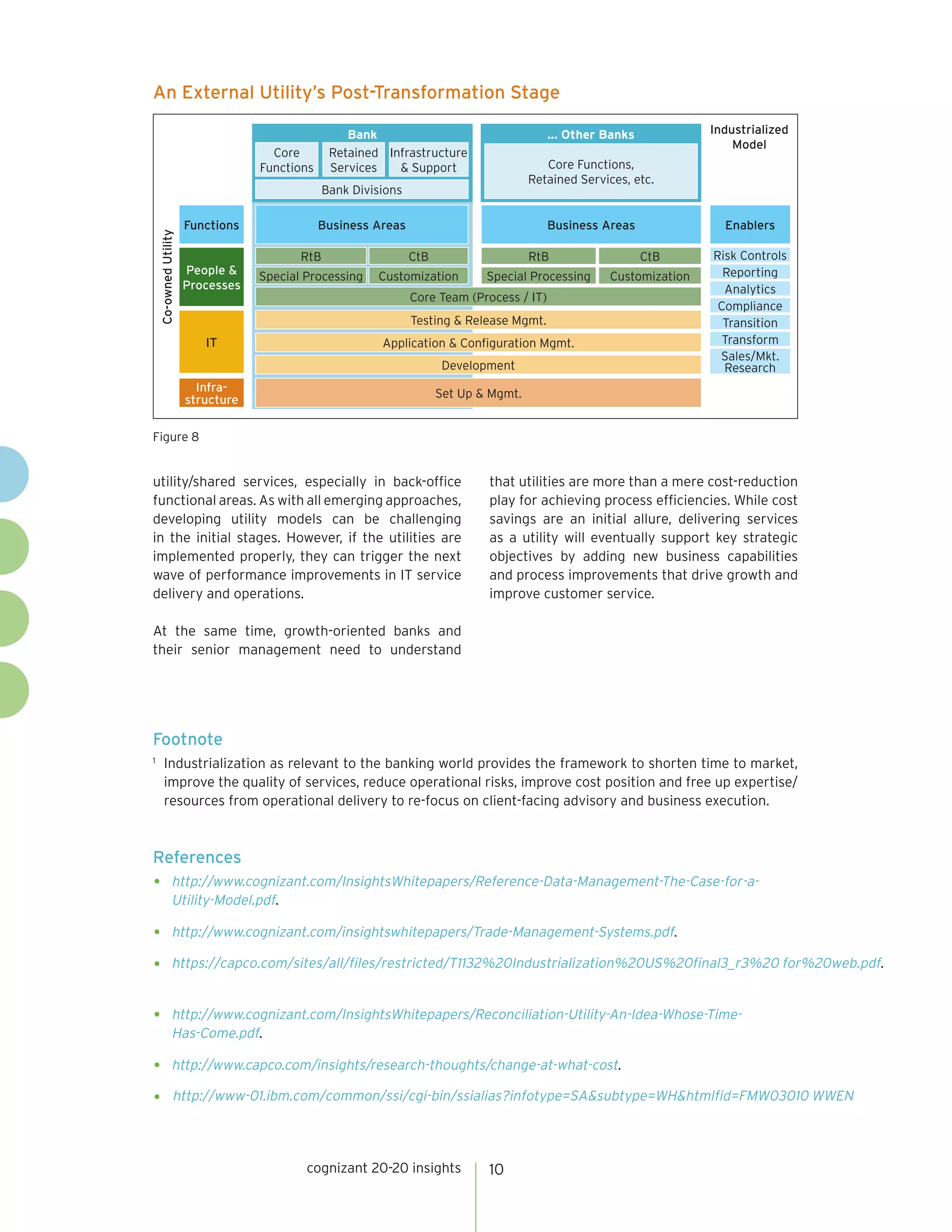

The document discusses how banks can transform their operating model through industrialization and a utility approach, enabling them to control costs, standardize operations, and enhance client experiences. It emphasizes the need for banks to reorganize their processes for efficiency, pointing out that both internal and external utility models can optimize operations but require commitment and a strategic perspective. The implementation of utility models is seen as essential to address the complexities in banking and sustain long-term growth.