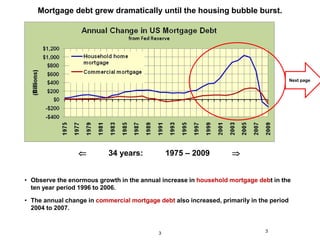

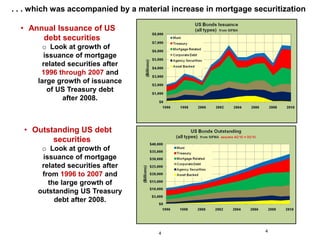

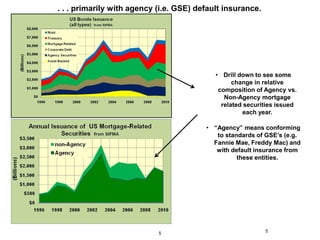

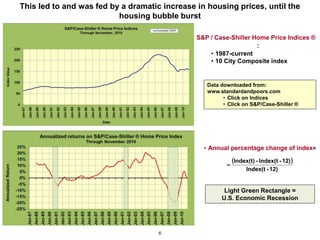

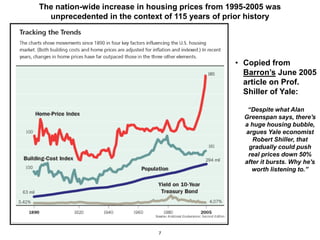

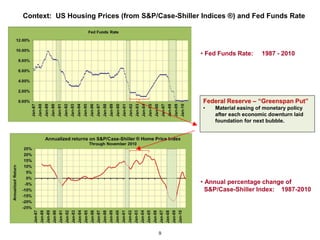

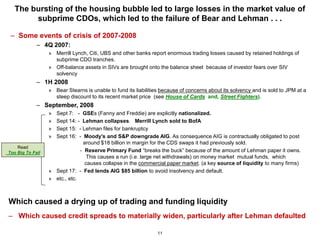

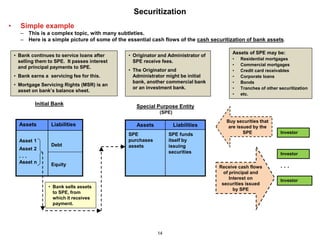

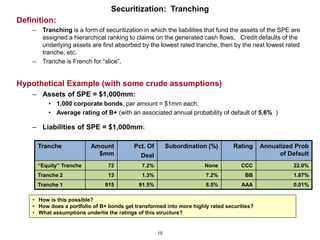

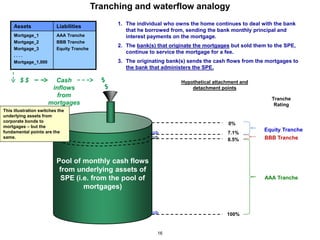

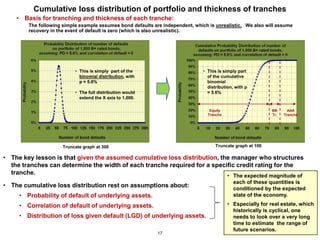

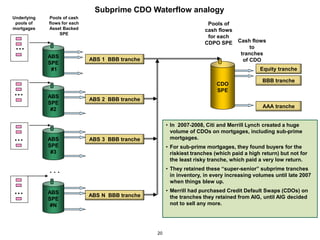

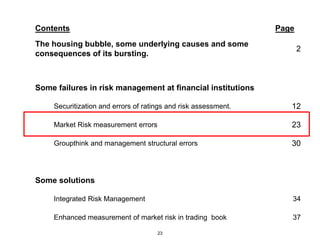

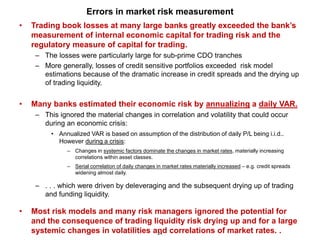

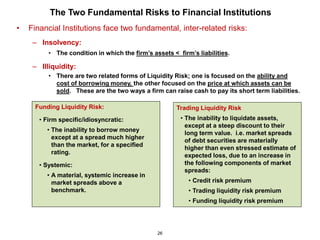

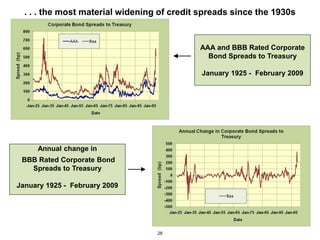

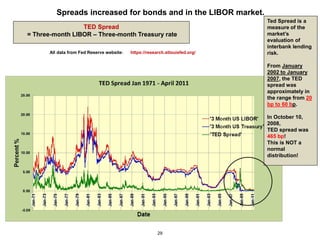

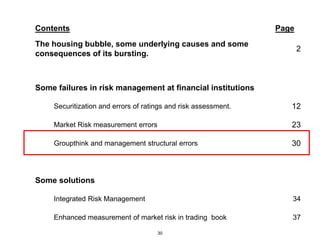

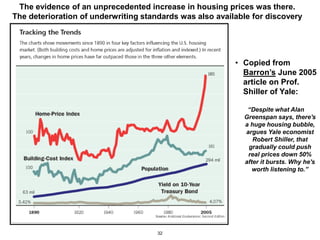

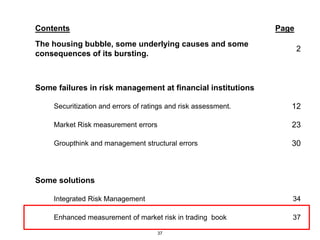

The document summarizes risk management lessons from the financial crisis. It discusses how securitization contributed to the housing bubble through lowering lending standards. It notes failures in risk assessment, with rating agencies and some banks not recognizing the risks of subprime mortgage-backed securities. The doubling of securitization led to investors taking ratings at face value without understanding the risks.