Wfm 1115

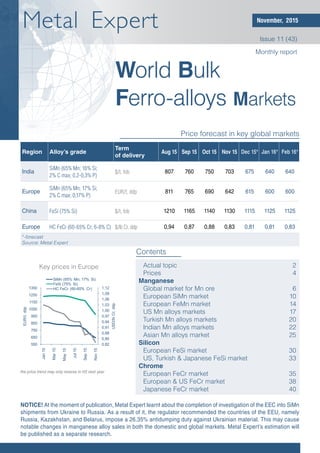

- 1. Key prices in Europe World Bulk Ferro-alloys Markets Contents Price forecast in key global markets Metal Expert Issue 11 (43) the price trend may only reverse in H2 next year Monthly report Region Alloy’s grade Term of delivery Aug 15 Sep 15 Oct 15 Nov 15 Dec 15* Jan 16* Feb 16* India SiMn (65% Mn; 16% Si; 2% C max; 0,2-0,3% P) $/t, fob 807 760 750 703 675 640 640 Europe SiMn (65% Mn; 17% Si; 2% C max; 0,17% P) EUR/t, ddp 811 765 690 642 615 600 600 China FeSi (75% Si) $/t, fob 1210 1165 1140 1130 1115 1125 1125 Europe HC FeCr (60-65% Cr; 6-8% C) $/lb Cr, ddp 0,94 0,87 0,88 0,83 0,81 0,81 0,83 *-forecast Source: Metal Expert 0,82 0,85 0,88 0,91 0,94 0,97 1,00 1,03 1,06 1,09 1,12 550 650 750 850 950 1050 1150 1250 1350 Jan15 Mar15 May15 Jul15 Sep15 Nov15 USD/lbCr,ddp EUR/t,ddp SiMn (65% Mn; 17% Si) FeSi (75% Si) HC FeCr (60-65% Cr) November, 2015 Actual topic 2 Prices 4 Manganese Global market for Mn ore 6 European SiMn market 10 European FeMn market 14 US Mn alloys markets 17 Turkish Mn alloys markets 20 Indian Mn alloys markets 22 Asian Mn alloys market 25 Silicon European FeSi market 30 US, Turkish & Japanese FeSi market 33 Chrome European FeCr market 35 European & US FeCr market 38 Japanese FeCr market 40 NOTICE! At the moment of publication, Metal Expert learnt about the completion of investigation of the EEC into SiMn shipments from Ukraine to Russia. As a result of it, the regulator recommended the countries of the EEU, namely Russia, Kazakhstan, and Belarus, impose a 26.35% antidumping duty against Ukrainian material. This may cause notable changes in manganese alloy sales in both the domestic and global markets. Metal Expert’s estimation will be published as a separate research.

- 2. World Bulk Ferro-alloys Markets November, 2015 © Metal Expert 2 Actual topic Ferroalloy prices set to bottom out Ferroalloy prices have kept decreasing in the global market this month. Man- ganese alloy prices have lost 5% in India, 8% in Europe and the USA, and 4% in Turkey and Asia. Silicon alloys have got some 3% cheaper all over the world and chrome alloys – 4% cheaper. The decreasing trend is explained by sluggish demand and oversupply. According to the WSA, carbon steel production dropped by 3% year-on-year in October. Chinese output declined by 2.2% and is now falling at a faster pace. Lower supply should have resulted in the margin recovery, but the oversupply kept pushing finished steel prices down. Specifically, prices for Chinese HRC lost $14/t reaching $256‑266/t ex-warehouse VAT excluded and export quota- tions – $260‑270/t FOB including taxes. No price recovery is possible right now in light of excessive supply coupled with lowering consumption in the Chinese domestic market. In order to maintain capacity utilization, the Chinese keep en- larging exports, offering the material at very low prices. The majority of Chinese steelmakers keep working at a loss in both the domestic and export markets. In order to prevent further losses, they tried to push long prices up last month, but in vain. The only to recover the margin is to reduce raw material prices, but it will not result in a margin recover as raw materials are already very cheap. The markets for metallurgical raw materials (excluding ferroalloys) and finished steel seem to have reached the price bottom already. In December, a slight decrease is likely to take place, but in general Chinese, Asian, European, and Turkish steelmakers have been working at a loss for quite a long time, except for some US companies. Whereas in early 2014 the price dynamics in the global ferroalloy market was in accordance with the metallurgical price trend, since May 2015 the decreasing price trend has slowed down because of the temporal stabilization in manganese ore quotations and some speculations. In H2, global prices for steel products, billets and scrap have lost some 30%, whereas those for SiMn – only 16%. In September-October, manganese ore prices slipped and the quotes for December are already voiced below the level of production expenses. Thus, ferroalloy prices will inevitably go down, following the decrease in steel product markets in August-October. Ferroalloy markets will only stabilize in February, whereas the price trend may only reverse in H2 next year.

- 3. World Bulk Ferro-alloys Markets November, 2015 © Metal Expert 3 Mn Ferroalloy prices seem to have room for decrease further, $ per tonne Back to top 0 200 400 600 800 1000 1200 100 200 300 400 500 600 Jan 14 May 14 Sep 14 Jan 15 May 15 Sep 15 HRC Steel scrap billet SiMn, R

- 4. World Bulk Ferro-alloys Markets November, 2015 © Metal Expert 4 Mn Region/alloy Term of delivery Jun 15 Jul 15 Aug 15 Sep 15 Oct 15 Nov 15 SILICOMANGANESE Europe, contract prices, 65% Mn; 17% Si; 0,17% P EUR/t, ddp 800 800 800 770 770 770 Europe, spot prices, 65% Mn; 17% Si; 0,17% P EUR/t, ddp 814 812 811 765 690 642 North, spot prices, 65% Mn; 17% Si; 0,17% P EUR/t, ddp 812 812 810 762 688 640 South, spot prices, 65% Mn; 16% Si; 0,2-0,3% P EUR/t, ddp 808 789 788 767 687 621 East, spot prices, 65% Mn; 17% Si; 0,17% P EUR/t, ddp 816 808 814 775 695 647 USA, 65% Mn; 17% Si $/t, ddp 1155 1095 1075 985 937 860 China, 65% Mn; 17% Si $/t, exw 868 848 790 740 715 675 China, 65% Mn; 17% Si $/t, fob 1520 1520 1520 1520 1520 1520 India, 65% Mn; 16% Si $/t, fob 820 821 807 760 750 703 South Korea, 65% Mn; 16% Si $/t, fob - - - - - - Turkey, 70% Mn; 17% Si from Ukraine $/t, cif 905 905 890 860 814 785 Turkey, 70% Mn; 17% Si from Georgia $/t, cif 1025 1025 1010 1005 950 - Turkey, 65% Mn; 16% Si from India $/t, cif 847 850 845 810 760 725 Turkey, 60% Mn; 14% Si from India $/t, cif 775 775 767 745 700 680 Japan, 65% Mn; 16% Si $/t, cif 835 835 825 770 760 720 HC FERROMANGANESE Europe, contract prices, 78% Mn EUR/t, ddp 770 770 770 745 745 745 Europe, spot prices, 78% Mn EUR/t, ddp 770 760 776 745 700 659 USA, 78% Mn $/t, ddp 935 900 850 835 825 810 China, 75% Mn $/t, exw 907 873 800 770 725 632 China, 75% Mn $/t, fob 1500 1500 1500 1500 1500 1500 India, 75% Mn $/t, fob 783 770 750 720 700 670 South Korea, 75% Mn $/t, fob 800 785 740 710 660 640 Japan, 75% Mn $/t, cif 799 795 765 730 718 660 Prices Dynamics of bulk ferro-alloys prices in world markets

- 5. World Bulk Ferro-alloys Markets November, 2015 © Metal Expert 5 Note: monthly average spot prices unless other mentioned; contract prices effective for delivery period of over three months, spot ones – for shipments within 1 month Source: Metal Expert Region/alloy Term of delivery Jun 15 Jul 15 Aug 15 Sep 15 Oct 15 Nov 15 MC FERROMANGANESE Europe, contract prices, 82% Mn EUR/t, ddp 1190 1190 1190 1135 1135 1135 Europe, spot prices, 82% Mn EUR/t, ddp 1185 1185 1185 1135 1060 1040 FERROSILICON Europe, contract prices, 75% Si EUR/t, ddp 1225 1225 1225 1170 1170 1170 Europe, spot prices, 75% Si EUR/t, ddp 1225 1205 1185 1170 1070 975 China, 75% Si $/t, fob 1210 1210 1210 1165 1140 1130 USA, 75% Si $/t, ddp 1390 1380 1370 1330 1275 1150 Turkey, 75% Si from China $/t, cif 1260 1260 1245 1212 1080 1065 Turkey, 75% Si from Vietnam $/t, cif 1132 1143 1125 1078 1015 965 Turkey, 72% Si from Vietnam $/t, cif 1095 1107 1107 1025 960 940 Turkey, 70% Si from Vietnam $/t, cif 1065 1075 1075 1000 940 915 Turkey, 75% Si from Russia $/t, cif 1187 1190 1125 1113 1055 1005 Turkey, 65% Si from Russia $/t, cif 1060 1060 1030 1010 930 905 Turkey, 65% Si from Ukraine $/t, cif 1085 1085 1085 1085 985 985 Turkey, 70% Si from India $/t, cif 1120 1135 1175 1138 1110 1090 FERROCHROME Europe, Charge chrome $/lb Cr 1,08 1,08 1,08 1,08 1,04 1,04 Europe, HC, 60-65% Cr, 6-8% C $/lb Cr, ddp 0,95 0,94 0,94 0,87 0,88 0,83 Europe, LC, 68-70% Cr; 0.10% C $/lb Cr, ddp 2,01 2,00 1,99 1,98 1,96 1,90 Japan, Charge chrome $/lb Cr 1,16 1,16 1,16 1,16 1,12 1,12 Japan, LС, 65% Cr, 0.10% C $/lb Cr, ddp 2,00 1,98 1,97 1,97 1,95 1,90 India, HC, 60% Cr, 6-8% C $/lb Cr, fob 0,82 0,80 0,79 0,74 0,72 0,70 USA, HC, 60-65% Cr, 6-8% C $/lb Cr, ddp 1,08 1,08 1,08 1,05 1,03 0,98 USA, LC, 0.10% C $/lb Cr, ddp 2,06 2,06 2,06 2,06 2,05 2,01 Back to top

- 6. World Bulk Ferro-alloys Markets November, 2015 © Metal Expert 6 Mn Price forecast for manganese ore (46% Mn) CIF China Price forecast for manganese ore (38% Mn) CIF China 3,20 3,20 3,20 3,10 2,70 2,70* 2,60 2,60 2,60 2,00 2,50 3,00 3,50 Jul15 Aug15 Sep15 Oct15 Nov15 Dec15 Jan16 Feb16 Mar16 USD/dmtu 2,70 2,65 2,65 2,65 2,50* 2,40* 2,40 2,40 2,40 1,50 2,00 2,50 3,00 3,50 Jul15 Aug15 Sep15 Oct15 Nov15 Dec15 Jan16 Feb16 Mar16 USD/dmtu Global market for Mn ore Prices for December shipments of manganese ore have not been announced at the time of publication of this report. South32 cut November prices for the material (45.5% Mn) to $2.7/dmtu, down $0.4/dmtu from October, and those for the material (48% Mn) to $2.5/dmtu. Eramet has reduced quotations of the material (44% Mn) by $2.4/dmtu. According to Metal Expert’s data, the material (38% Mn) is not shipped to China right now. All prices are CIF China. Last month, steel output rose by 2% quarter-on-quarter, losing 3% year- on-year though. In 10 months, the decrease was 2.5% y-o-y against 2.4% y-o-y in 9 months. Chinese output declined by 2.2% to 672.8 million t in 10 months. Global output (excluding China) came down by 2.8% to 670.8 million t. Steel production is believed to keep decreasing together with manganese demand. According to preliminary data, global manganese ore sales dropped by 5% year-on-year to 19.6 million t throughout January-September. Imports to China dropped by 5% to 11.8 million t and those to India – by 34% to 1.7 million t. The countries that have vertically integrated producers raised imports. Ukraine raised shipments from abroad by 47% to 1 million t, Norway – by 4% to 900,000 tpy, and France – by more than 2 times to 400,000 t. Nonetheless, these upturns are only just for in-house shipments and have no impact on the global free market. Imports to South Korea and Japan rose by a total of 6% to 1.9 million t. * - Metal Expert’s estimate

- 7. World Bulk Ferro-alloys Markets November, 2015 © Metal Expert 7 Mn Comparison of global Mn ore trade and steel ouput 1.5 1.7 1.9 2.1 2.3 2.5 2.7 2.9 May14 Jun14 Jul14 Aug14 Sep14 Oct14 Nov14 Dec14 Jan15 Feb15 Mar15 Apr15 May15 Jun15 Jul15 Aug15 Sep15 125 127 129 131 133 135 137 139 141 143 145Mn ore world trade World steel production, R '000t '000t Global manganese ore sales will keep decreasing because steel production is supposed to keep declining. Over the whole year, sales will reach 26 million t against 27 million t in 2014. Low profitability will result in production optimization by the biggest companies, and some facilities will be stopped. This month, South32 has closed Mamatwan mine, having plans on bringing it back on stream in Janu- ary. However, production at the company’s assets will drop by no more than 1.5% to 8.5 million t this year. Eramet raised output by 12% year-on-year and 8% quarter-on-quarter to 1.07 million t in Q3. Vale’s output was unchanged in annual compassion, adding 18% q-o-q though. China’s port stocks have almost stopped decreasing. In November, it reached 2.87 million t, down 0.2% m-o-m, which is comparable to 2-month imports. The stocks have been minimal since February 2014. Demand continues to fall. Production of SiMn reached 373,000 t in October, down 8.8% m-o-m, and that of FeMn – 116,000 t, down 15.7%.

- 8. World Bulk Ferro-alloys Markets November, 2015 © Metal Expert 8 Mn China’s port stocks of Mn ore get stabilized 2,0 2,2 2,4 2,6 2,8 3,0 3,2 3,4 3,6 3,8 4,0 2,0 2,5 3,0 3,5 4,0 4,5 5,0 5,5 6,0 6,5 7,0 Apr11 Sep11 Feb12 Jul12 Dec12 May13 Oct13 Mar14 Aug14 Jan15 Jun15 Nov15 mt USD/dmtu Mn ore stockpiles in ports price for Mn ore (48% Mn) Taking into account Metal Expert’s calculation of the cost of mining for the biggest producers, it is obvious that the companies with low inputs enlarge manufacture and the others, on the contrary, reduce it. Thus, the most effective producers are trying to raise their market share and force the rivals from the business. The average input cost of the ore (46% Mn), including transportation to Chinese ports, will be $2.26.dmtu this year. Manganese ore demand will keep slackening over the period under review. In January, it will reach its 3-year lowest because of the decrease in global steel output, so prices will most likely come down. Back to top

- 9. World Bulk Ferro-alloys Markets November, 2015 © Metal Expert 9 Mn Back to top Note: in ‘000 tonnes Note: $/mtu Source: Metal Expert Q2 13 Q3 13 Q4 13 Q1 14 Q2 14 Q3 14 Q4 14 Q1 15 Q2 15 South32 (BHP Billiton) Australia 1307 1182 1256 1019 1319 1210 1289 1136 1268 Africa 939 864 944 782 936 1049 1007 913 820 Assore/ARM (Assmang) Africa 858 864 864 816 816 744 744 810 780 ENRC Kazakhstan 1111 1241 942 759 1058 982 888 452 595 Eramet Comilog Gabon 908 969 966 796 849 961 846 880 997 Vale Brazil 617 621 638 470 505 654 723 592 554 Privat Ukraine 326 294 198 183 282 387 390 145 362 MOIL India 252 231 312 340 273 241 308 317 276 Ghana Manganese Company Ghana 445 484 458 454 455 436 160 310 396 Consolidated Minerals Australia 418 407 401 406 416 436 443 404 371 OM Holdings Australia 208 151 272 222 225 251 192 158 191 Africa 166 226 264 394 535 538 543 474 509 Mineracao Buritirama, Maraba Brazil 63 63 63 63 63 63 63 63 63 Renova (Kalahari Desert) Africa 675 675 675 675 675 675 675 675 675 Dynamics of Mn ore prices in world markets Global manganese ore production Term of delivery May 15 Jun 15 Jul 15 Aug 15 Sep 15 Oct 15 Nov 15 Import to China (Australia, 48% Mn) CIF 3,03 3,03 3,03 3,00 3,00 3,00 2,50 Import to China (Australia, 46% Mn) CIF 3,20 3,20 3,20 3,20 3,20 3,10 2,70 Import to China (South Africa, 38% Mn) CIF 2,70 2,70 2,70 2,65 2,65 2,65 -

- 10. World Bulk Ferro-alloys Markets November, 2015 © Metal Expert 10 Mn European SiMn spot prices forecast 814 812 811 765 690 642 615 600 600 500 600 700 800 900 Jun15 Jul15 Aug15 Sep15 Oct15 Nov15 Dec15 Jan16 Feb16 EUR/t,ddp European SiMn market Contrary to expectations, offers have not stabilized this month. The average weighted benchmark price for SiMn (65% Mn; 17% Si) has dropped from last month’s EUR 690/t DDP to EUR 642/t DDP on the back of low consumption, the collapse of manganese ore quotes, and the availability of stockpiles. SiMn surplus persisted in the European market since May, when imports from India and Ukraine increased despite comparatively stable end use. Speculations over the possible imposition of an antidumping duty against Indian material in September started then, too. It seems like European traders hurried to restock on the alloy beforehand. Fearing that a duty on Ukrainian shipments in Russia may be imposed, Ukrainian merchants tried to partially redirect sales to Europe, although the strengthening of the hryvnia was against them. In May, Europe raised imports by 68,000 t, which is the 2-year maximum. By September, SiMn surplus reached 28,000 t (30% of the average monthly consumption). The market will become balanced in late 2015, Metal Expert believes. The material leftover will not exceed 5,000-10,000 t.

- 11. World Bulk Ferro-alloys Markets November, 2015 © Metal Expert 11 Mn European SiMn market balance -60 -40 -20 0 20 40 60 Q314 Q414 Q115 Q215 Q315* Q415* Q116* '000tonnes Source: Metal Expert*- forecast SiMn shipments from abroad will come down. Imports reached a local mini- mum of 40,000 t back in September. Purchases were at this level last September, but this year steel output dropped by almost 4% (1 million t) year-on-year. Indian merchants have been working at a loss for quite a long time and they are unable to compete with Ukrainian and South African suppliers. Besides, the quality of Indian alloys is worse than that of the analogs. In H2, shipments from India to Europe reached 10,000-13,000 tpm against 18,000 tpm averagely in H1. The dynamics of shipments from Ukraine is the quite the same. Ukraine and South Africa have been forcing India from the European SiMn market for the past 3 years. In 2013, India was the biggest importer of the alloy, covering 38% of all foreign shipments, whereas the shares of Ukraine and South Africa were 19% and 6% respectively. Last year, Indian companies lost 9 percentage points, securing 20% of European imports to themselves, whereas Ukrainian and South African merchants raised their shares to 27% and 17% respectively. By Metal Expert’s preliminary estimate, in 2015 Ukraine and India will come in par, securing 30% each, whereas South African share will approximate 16%. It will be easier for Ukrainian and South African companies to compete in the low market as they both have raw material sources of their own and their national currencies keep devaluating.

- 12. World Bulk Ferro-alloys Markets November, 2015 © Metal Expert 12 Mn India lost its competitiveness in Europe (production costs comparison), $ per tonne 400 500 600 700 800 900 1000 1100 1200 1300 Jan 14 May 14 Sep 14 Jan 15 May 15 Sep 15 $/tonne Domestic price India Ukraine RSA End user activity is unlikely to recover soon. Regional steel output will reach 169.5 million t in 2015 against 171.5 million t last year. In Q1, the output will hardly exceed 42 million t, which is 5-6% lower than in 2013-2014 and 3% lower than in the post-crisis first quarter of 2010. China is still the main reason behind the negative situation in the global steel market. By late November, export prices for Chinese HRC have reached $260-265/t FOB, $20/t below Ukrainian and Turkish billet quotations. Besides, it is respectively $100/t and $95/t lower than prices for European flats and longs. The Chinese keep working with negative profitability in both the domestic and foreign markets, which is making them lower production, but not exports. China’s steel manufacture dropped by 2.2% month-on-month in October, the NBS reports. However, this decrease in not enough, Metal Expert thinks. It is still likely that European manganese alloy prices will keep decreas- ing. Stabilization is possible during the holidays in late December – early January, yet the price trend is not supposed to reverse until the end of Q1. Back to top

- 13. World Bulk Ferro-alloys Markets November, 2015 © Metal Expert 13 Mn Back to top Source: Metal Expert * - forecast, ** - preliminary data Note: in ‘000 gross tonnes Apr 15 May 15 Jun 15 Jul 15 Aug 15 Sep 15** Q4 15* Q1 16* PRODUCTION 46 47 45 44 43 48 134 129 by company Ferroatlantica 10 10 10 10 10 10 31 30 Glencore 9 9 9 8 8 8 27 27 Eramet 23 23 23 24 24 24 71 70 OFZ 4 5 3 2 1 5 5 2 Skopski Leguri 0 0 0 0 0 0 0 0 Feral 0 0 0 0 0 0 0 0 Other 0 0 0 0 0 0 0 0 EXPORT 10 8 6 13 2 4 21 19 IMPORT 48 68 52 48 59 40 142 143 by countries CIS 14 23 16 10 10 10 - - India 22 18 16 13 20 10 - - China 0 0 0 0 0 0 - - Africa 3 7 8 18 17 4 - - South America 2 1 0 0 0 0 - - Middle East 0 0 0 0 0 0 - - Other countries 8 19 12 6 12 15 - - APPARENT CONSUMPTION 85 107 91 79 100 83 255 253 STEEL PRODUCTION 14460 15552 14746 13810 12361 13761 40166 42131 ESTIMATED CONSUMPTION 89 96 91 85 76 85 248 260 BALANCE -5 11 0 -6 24 -2 7 -7 European silicomanganese market structure European silicomanganese market [Mn content] Source: Metal Expert * - forecast, ** - preliminary data Note: in ‘000 tonnes Apr 15 May 15 Jun 15 Jul 15 Aug 15 Sep 15** Q4 15* Q1 16* Production 30 31 30 29 28 31 87 84 Export 6 5 4 8 2 3 14 12 Import 32 45 35 31 39 26 93 94 Apparent Consumption 56 71 60 52 66 55 167 166 Estimated Consumption 59 63 60 56 50 56 163 171 Balance -3 8 1 -4 16 -1 4 -4

- 14. World Bulk Ferro-alloys Markets November, 2015 © Metal Expert 14 Mn European FeMn market European HC FeMn spot prices forecast 770 760 776 745 700 659 645 640 640 500 600 700 800 Jun15 Jul15 Aug15 Sep15 Oct15 Nov15 Dec15 Jan16 Feb16 EUR/t,ddp Manganese alloy prices have kept decreasing in Europe this month. The average weighted benchmark price for HC FeMn (75% Mn) has gone down from EUR 700/t DDP to EUR 659/t DDP on the back of low consumption and high competition. Prices are going down, though there is no surplus. As of late October, the accumulated shortage has reached 10,000 t (25% of the average monthly consumption) because of the notable decrease in imports. Imports will stay low in winter, whereas consumption will most likely stabilize, the deficit will continue. European HC FeMn market balance -60 -40 -20 0 20 40 60 Q314 Q414 Q115 Q215 Q315* Q415* Q116* '000tonnes Source: Metal Expert *- forecast

- 15. World Bulk Ferro-alloys Markets November, 2015 © Metal Expert 15 Mn The decrease in SiMn and FeSi prices will impact FeMn quotations. Over the year, the alloys have got 20% cheaper, whereas FeMn has dropped only by 8%. This month, the cost of the alternative blend of HC FeMn and FeSi has been EUR 150/t above that of SiMn (EUR 100/t over the year and EUR 65/t in Q1). FeMn imports are unlikely to come up in the near future. At South Af- rica’s South32, three out of the four installed furnaces are still idle. Assmang’s equipment is out of operation, too. Besides, South32 has suspended mining at Mamatwan until January at least. The material from Wessels mine will most likely be exported and the ore to cover the company’s own needs will be limited. FeMn production is unlikely to change in Europe. Production cutbacks mean an increase the fixed costs in the inputs, which is unacceptable for pro- ducers right now. Such a strategy is only useful when prices bottom out and the least effective suppliers are forced out from the market. Then, additional cutbacks may push prices up. Next month, the price decrease, if any, will moderate in the European FeMn market. Prices will stabilize after Christmas holidays. Back to top

- 16. World Bulk Ferro-alloys Markets November, 2015 © Metal Expert 16 Mn Back to top Source: Metal Expert. * - forecast, ** - preliminary data. Note: in ‘000 gross tonnes European HC FeMn market structure Apr 15 May 15 Jun 15 Jul 15 Aug 15 Sep 15** Q4 15* Q1 16* PRODUCTION 26 25 27 28 29 24 77 76 by company Glencore 11 11 11 11 11 11 28 30 Eramet 5 5 5 5 5 5 17 15 Ferroatlantica 8 8 8 8 8 8 23 23 OFZ 1 0 3 4 6 0 9 8 Others 0 0 0 0 0 0 0 0 EXPORT 2 1 3 0 0 1 3 2 IMPORT 17 20 16 18 18 14 34 40 by countries CIS 3 2 3 4 4 6 - - India 0 0 0 1 3 3 - - China 0 0 0 0 0 0 - - Africa 13 17 12 13 10 5 - - South America 0 0 0 0 0 0 - - Other countries of the world 0 0 0 1 1 1 - - APPARENT CONSUMPTION 41 44 40 46 47 38 108 114 STEEL PRODUCTION 14460 15552 14746 13810 12361 13761 40166 42131 ESTIMATED CONSUMPTION OF HC FEMN 44 47 45 42 37 42 122 128 BALANCE -3 -4 -4 4 9 -4 -14 -14 European MC&LC FeMn market structure Apr 15 May 15 Jun 15 Jul 15 Aug 15 Sep 15** Q4 15* Q1 16* PRODUCTION 24 24 24 24 24 24 67 68 by company Eramet 21 21 21 21 21 21 59 60 Ferroatlantica 3 3 3 3 3 3 8 8 Others 0 0 0 0 0 0 0 0 EXPORT 1 1 2 1 1 1 4 4 IMPORT 4 12 4 3 4 2 14 12 by countries CIS 0 1 0 0 0 0 - - India 0 0 0 0 0 0 - - China 0 0 0 0 0 0 - - Africa 4 11 4 3 4 2 - - South America 0 0 0 0 0 0 - - Middle East 0 0 0 0 0 0 - - Other countries of the world 0 0 0 0 0 0 - - APPARENT CONSUMPTION 26 35 26 25 27 25 77 76 STEEL PRODUCTION 14460 15552 14746 13810 12361 13761 40166 42131 ESTIMATED CONSUMPTION OF MC&LC FEMN 28 30 28 27 24 27 78 81 BALANCE -2 5 -3 -2 3 -2 -1 -5

- 17. World Bulk Ferro-alloys Markets November, 2015 © Metal Expert 17 Mn US Mn alloys markets US SiMn spot prices forecast US HC FeMn spot prices forecast 1155 1095 1075 985 937 860 730 720 710 500 600 700 800 900 1000 1100 1200 1300 1400 Jun15 Jul15 Aug15 Sep15 Oct15 Nov15 Dec15 Jan16 Feb16 USD/t,ddp 935 900 850 835 825 810 800 780 780 500 600 700 800 900 1000 1100 1200 Jun15 Jul15 Aug15 Sep15 Oct15 Nov15 Dec15 Jan16 Feb16 USD/t,ddp The US spot market for manganese alloys has been weak this month. SiMn (65% Mn; 17% Si) has been available at $0.39/lb ($860/t) DDP, down 8.2% month- on-month, and HC FeMn (75% Mn) – at $810/t DDP, down 1.7% from October. The recession in the global steelmaking industry still has a bad influence on the ferroalloy market. By Metal Expert’s estimate, US carbon steel production will reach 79.79 million t in 2015, which is a 6-year minimum. The output is unlikely to increase in Q1, given that some local producers have stopped manu- facture until the market strengthens. In January-March, the output will drop by 3.4% quorter-on-qourter and 6.3% year-on-year to 18.62 million t. SiMn is still oversupplied, although the decrease in supply has been 18.5% y-o-y over January-November and that in consumption – 9.3% y-o-y. By Metal Expert’s estimate, SiMn stocks will reach 15,000 t by late December (some 40% of the average monthly consumption), so the market balance will be hardly reachable during Q1.

- 18. World Bulk Ferro-alloys Markets November, 2015 © Metal Expert 18 Mn US SiMn market balance -50,0 -30,0 -10,0 10,0 30,0 50,0 Q214 Q314 Q414 Q115 Q215 Q315 Q415* Q116* '000tonnes Source: Metal Expert *- forecast Imports structure is likely to change in the near future. Next quarter, SiMn production is going to be launched at Malaysian plants Pertama Fer- roalloys, OM Sarawak, and Sakura Ferroalloys, which will possibly ship their material to the USA. By Metal Expert’s estimate, Malaysia will be putting out 10,000-15,000 tpm and 30,000-35,000 tpm by end-2016. From the other hand, imports from Australia will minimize in early 2016, whereas in November its share was 16.7%. The price decrease may speed up in the near future. Given that the Novem- ber decrease in European quotations has been bigger than that in the USA, the premium value of the American market has increased by 10% month-on-month. The strengthening of the US dollar will result in lower inputs and higher competi- tion. The Georgian lari is unlikely to keep devaluating in the future, whereas the South African rand will keep getting weaker. In particular, since mid-May the lari has got a mere 2% against the dollar and rand – 20% cheaper. SiMn prices will keep decreasing in the USA amid sluggish consumption and tough competition among foreign suppliers. Back to top

- 19. World Bulk Ferro-alloys Markets November, 2015 © Metal Expert 19 Mn Back to top Source: Metal Expert * - forecast, ** - preliminary data Note: in ‘000 gross tonnes Source: Metal Expert * - forecast, ** - preliminary data Note: in ‘000 gross tonnes Apr 15 May 15 Jun 15 Jul 15 Aug 15 Sep 15 Q4 15* Q1 16* PRODUCTION 7 7 7 7 7 9 28 29 EXPORT 0,7 1,7 1,0 0,6 0,7 0,8 1,7 1,6 IMPORT 39 45 25 33 19 27 76 72 by countries Georgia 14 14 0 16 2 17 13 22 Africa 12 9 12 8 7 0 36 30 Norway 2 2 5 2 3 0 1 1 Other countries 11 20 9 7 8 10 26 19 APPARENT CONSUMPTION 45 50 32 40 26 35 102 99 STEEL PRODUCTION 6413 6844 6843 7032 6936 6557 19282 18619 ESTIMATED CONSUMPTION 34 36 36 37 37 35 102 99 BALANCE 11 14 -5 2 -11 0 0 0 Apr 15 May 15 Jun 15 Jul 15 Aug 15 Sep 15 Q4 15* Q1 16* PRODUCTION 1 1 1 1 1 1 3 3 EXPORT 2,1 1,7 1,0 1,1 1,2 1,8 4,0 4,0 IMPORT 7 36 14 10 14 9 33 43 by countries Africa 1 22 12 6 8 5 13 12 Australia 5 0 1 0 7 0 3 9 Norway 1 0 0 1 0 0 7 7 Other countries 0 2 1 3 0 4 0 6 APPARENT CONSUMPTION 6 35 14 10 14 8 32 42 STEEL PRODUCTION 6413 6844 6843 7032 6936 6557 19282 18619 ESTIMATED CONSUMPTION 19 20 20 21 20 19 56 54 BALANCE -13 15 -6 -10 -6 -11 -24 -12 USA silicomanganese market structure USA ferromanganese market structure

- 20. World Bulk Ferro-alloys Markets November, 2015 © Metal Expert 20 Mn Note: in ‘000 tonnes * - Metal Expert estimation Turkish Mn alloys markets Apr 15 May 15 Jun 15 Jul 15 Aug 15 Sep 15 PRODUCTION* 0,0 0,0 0,0 0,0 0,0 0,0 EXPORT 0,0 0,0 0,2 0,3 0,1 0,0 IMPORT 25,0 15,5 22,3 20,4 9,5 13,5 by suppliers Ukraine 18,6 8,0 16,5 16,9 8,8 11,4 India 5,3 6,0 4,7 3,0 0,5 1,6 Georgia 0,1 0,5 0,1 0,4 0,2 0,5 Norway 1,0 1,0 1,0 0,1 0,0 0,0 Others 0,0 0,0 0,0 0,0 0,0 0,0 DOMESTIC MARKET 25,0 15,5 22,2 20,1 9,4 13,4 STEEL PRODUCTION 2775 2919 2844 2539 2563 2489 ESTIMATED CONSUMPTION 21,5 22,6 22,0 19,7 19,9 19,3 BALANCE 3,5 -7,1 0,2 0,4 -10,4 -5,8 Turkish SiMn market structure Back to top

- 21. World Bulk Ferro-alloys Markets November, 2015 © Metal Expert 21 Mn Turkish FeMn market structure Note: in ‘000 tonnes Back to top Apr 15 May 15 Jun 15 Jul 15 Aug 15 Sep 15 DOMESTIC MARKET by products and suppliers HC FeMn 1,5 0,5 2,2 4,4 4,8 3,1 Russia 0,0 0,0 0,0 0,0 0,0 0,0 India 0,0 0,0 0,0 0,6 0,1 0,1 South Africa 0,7 0,0 0,0 0,3 0,0 0,2 Ukraine 0,3 0,0 2,1 2,6 2,2 2,2 Others 0,5 0,5 0,1 0,8 2,5 0,7 MC and LC FeMn 1,7 2,4 1,9 1,6 1,2 0,0 Norway 1,3 2,1 1,1 0,2 0,6 0,1 South Africa 0,0 0,0 0,0 0,0 0,0 0,0 South Korea 0,0 0,1 0,5 1,1 0,5 0,1 Ukraine 0,0 0,0 0,0 0,0 0,0 0,0 Others 0,3 0,2 0,3 0,3 0,1 -0,2 STEEL PRODUCTION 2775 2919 2844 2539 2563 2489 ESTIMATED HC FeMn CONSUMPTION 2,7 2,8 2,8 2,5 2,5 2,4 BALANCE -1,2 -2,3 -0,6 1,9 2,3 0,7 ESTIMATED MC FeMn and LC FeMn CONSUMPTION 1,0 1,1 1,1 1,0 1,0 0,9 BALANCE 0,6 1,3 0,8 0,6 0,3 -1,0

- 22. World Bulk Ferro-alloys Markets November, 2015 © Metal Expert 22 Mn Indian Mn alloys markets SiMn spot prices forecast in India 820 821 807 760 750 703 675 640 640 600 650 700 750 800 850 Jun15 Jul15 Aug15 Sep15 Oct15 Nov15 Dec15 Jan16 Feb16 USD/t,fob This month, Indian SiMn (65% Mn; 16% Si) has been available at $680-700/t FOB India, down $60/t month-on-month, and the material (60% Mn; 14% Si) – at $625-650/t FOB India, down $60/t. Indian merchants are still pressured by sluggish demand in the global market and intense competition. Their positions are still quite shaky in Europe and Turkey. Despite the equalization of the chances in the competition with the Ukrainians, the competition with the Europeans is still rather intense. The Europeans try to offload stocks before the end of the year and thus are keener to grant discounts. The gap between Indian and European prices could reach EUR 50/t at times during this month. Demand will possibly burst in the middle of Q1 as the Europeans will try to restock on the alloy before the imposition of an antidumping duty in March. However, demand will not be strong enough for a price recovery, taking into account the negative market picture. The situation may be aggravated by the appearance of a new rival, Malay- sia. A number of ferroalloy plants are going to be launched there in the future. In Q1, SiMn production will possibly be commenced in Pertama Ferroalloys, OM Sarawak, and Sakura Ferroalloys. At first, Malaysia is estimated to be pro- ducing 10,000-15,000 tpm, but the output may increase to 30,000-35,000 tpm by the end of 2016. New players plan to embrace the markets of Europe, Asia, and the USA, low electricity tariffs and cheap raw materials to be their main competitive advantage. In the meantime, a lot of Indian suppliers lose their ability to further cut offers. Most of the country’s producers have been working at a loss for the third consecutive month. Production expenses declined by $29/t as a result of the decrease in cost of both import and local manganese ore. Nevertheless, the losses have increased by $19/t to $39/t this month (including all possible

- 23. World Bulk Ferro-alloys Markets November, 2015 © Metal Expert 23 Mn compensations). Although there are no incentives for shipments to Europe, some sellers are entering the competitive struggle there, thus suffering huge losses (some $74/t). Within the next few months, the decrease in the alloy prices will be faster than that in raw material quotations, so the profitability will also be on the way down (to $30/t monthly). Only financially strong companies and those few who have their own raw material sources will manage to survive under these circumstances. However, they may soon reach the edge of profitability as well, for their pricing bottom is estimated to be at $700/t FOB India. Under the circumstances, Indian producers will either have to reduce or stop manufacture. This year, SiMn production may total 1.47 million t (down 9.4% year-on-year) on the back of excessive supply resulting from bad de- mand. In Q1, producers will have to cut output again because of the worsening financial state, some will leave the market. Production may be decreased by 20,000-25,000 t as compared to the previous period to 320,000 t; the volumes of SiMn available for export is estimated to amount to 100,000 t, down 22.5%. However, these measures are likely to show some positive results only in mid- or long-term perspective. In the coming months, Indian suppliers will not be able to recover prices because of the negative trend in the global market. However, the capabil- ity for price cuts will be limited in view of the difficult financial state of Indian producers. Back to top

- 24. World Bulk Ferro-alloys Markets November, 2015 © Metal Expert 24 Mn Back to top Source: Metal Expert * - forecast, ** - preliminary data *** - volumes available for export Note: in ‘000 gross tonnes Indian SiMn market structure Q1 15 Q2 15 Q3 15 Q4 15* Q1 16* PRODUCTION 401 372 351 345 320 by company Abhijeet Group 22 13 21 - - Bhaskar Group 5 6 5 - - Cosmic Ferro Alloys 5 3 3 - - Nava Bharat Ventures Ltd. 25 7 5 - - Other 345 345 317 - - IMPORT 0 0 0 0 0 DOMESTIC CONSUMPTION 224 201 231 216 220 EXPORT 177 171 120 129*** 100*** by countries Japan 41 36 27 - - Taiwan 26 22 14 - - Turkey 14 16 5 - - Netherlands 10 9 5 - - South Korea 9 7 6 - - Thailand 8 7 7 - - Germany 5 5 1 - - Ukraine 1 1 1 - - Others 63 68 54 - - STEEL PRODUCTION 22504 22724 22347 22450 22850

- 25. World Bulk Ferro-alloys Markets November, 2015 © Metal Expert 25 Mn Asian Mn alloys market Japanese SiMn spot prices forecast Japanese HC FeMn spot prices forecast 835 835 825 770 760 720 700 680 680 600 650 700 750 800 850 Jun15 Jul15 Aug15 Sep15 Oct15 Nov15 Dec15 Jan16 Feb16 USD/t,CIF 799 795 765 730 718 660 630 620 620 550 600 650 700 750 800 Jun15 Jul15 Aug15 Sep15 Oct15 Nov15 Dec15 Jan16 Feb16 USD/t,CIF The Japan’s market for manganese alloys has again collapsed this month. Prices for Indian SiMn (65% Mn; 16% Si) have dipped by $50/t to $710-730/t CIF Japan. Korean HC FeMn (75% Mn) has been available at $640-660/t CIF Japan, down $65/t, and Indian material – at $660-680/t CIF Japan, down $35/t. Like earlier, there will be no support from the consuming industry. Japan is going to produce 106 million t of steel in FY 2016 (ends in March 2016), down 3.5% from FY 2015. As a result, consumption of SiMn will drop to 340,000 t and that of FeMn – to 426,000 t. Supply of FeMn is going to increase in December-February, whereas that of SiMn will decline. Japan will produce 59,600 t of FeMn in winter (up 14.3%); SiMn production will remain at 9,300 t. Due to the usual production cutbacks, South Korea will be able to export only 26,000 t of HC FeMn (down 17%), of which 20-30% may be shipped to Japan. Low profits make Indian producers reduce manufacture, which is why the amount of SiMn available for export will be at about 100,000 t in Q1 (down 29,000 t), of which 20-30% may be supplied to Japan. SiMn supply structure is changing in Japan and the competition in the seg- ment is getting tougher. As expected, TEMCO has enlarged shipments to Japan. Last quarter, imports from Australia increased by 8,300 t quarter-on-quarter to 10,000 t, its share in the Japanese market coming up from 2.1% to 13%. The share of the alloy imported from Vietnam rose from 13% to 20%. Meanwhile, Indian merchants lost 17% of the Japanese market over April-September, cov- ering only 35% of it. The situation is likely to stay difficult for Indian suppliers, given the expected launch of manganese alloy manufacture in Malaysia. The competition in the Japanese market is going to strengthen in the near future, and Indians will possibly be the ones to yield their market share.

- 26. World Bulk Ferro-alloys Markets November, 2015 © Metal Expert 26 Mn Japan SiMn market structure 46% 49% 52% 46% 35% Q3 14 Q4 14 Q1 15 Q2 15 Q3 15 India Asian countries Domestic production CIS countries Australia Others The competition is also getting intense for Indian FeMn exporters. South Korean suppliers reduced prices by $65/t and still keep the bottom end of the price range in the Japanese market, their prices being $30/t lower than Indian quotations ($5/t in October). Thus, the Indians will have to accept the price de- crease, or they will lose their market share in Japan. However, Indian suppliers are losing their ability to give considerable discounts as their profitability has been negative over the past few months. HC FeMn spot prices in Japan 630 680 730 780 830 880 930 980 1030 1080 Oct14 Nov14 Dec14 Jan15 Feb15 Mar15 Apr15 May15 Jun15 Jul15 Aug15 Sep15 Oct15 Nov15 USD/t,CIF Source: Metal Expert HC FeMn (75% Mn) origin India HC FeMn (75% Mn) origin South Korea Sellers will have to do business in a rather narrow market within the next several months, given that consumption is going to decrease further and the Malaysians will enter the market soon. High competition will eventually result in further price decrease. Back to top

- 27. World Bulk Ferro-alloys Markets November, 2015 © Metal Expert 27 Mn SiMn market structure in Japan Apr 15 May 15 Jun 15 Jul 15 Aug 15 Sep 15 PRODUCTION 4,8 3,7 4,4 3,2 3,6 3,1 EXPORT 0,00 0,01 0,00 0,00 0,01 0,00 IMPORT 24,7 23,1 17,3 22,9 19,7 24,1 by country India 16,2 11,2 8,4 8,1 9,0 9,7 Vietnam 1,1 6,2 2,8 5,4 4,3 5,3 Kazachstan 5,7 1,5 4,6 2,6 3,9 2,2 Ukraine 0,0 1,6 0,0 0,0 0,0 0,0 Indonesia 0,6 0,2 0,4 1,0 0,6 0,8 Australia 0,5 0,5 0,6 4,1 0,5 5,2 Others 0,7 1,8 0,4 1,6 1,4 0,9 APPARENT CONSUMPTION 30 27 22 26 23 27 CARBON STEEL PRODUCTION 8 402 8 918 8 535 8 841 8 796 8 575 ESTIMATED CONSUMPTION 26 27 23 24 23 24 BALANCE 4 0 -2 3 0 3 Back to top Source: Metal Expert Note: in ‘000 gross tonnes HC FeMn market structure in Japan Apr 15 May 15 Jun 15 Jul 15 Aug 15 Sep 15 PRODUCTION 19,1 23,2 19,7 19,3 14,5 14,3 EXPORT 0,07 0,03 0,03 0,07 0,04 0,06 IMPORT 6,8 8,1 3,9 3,7 9,2 3,5 by country South Korea 2,0 4,9 1,3 1,8 4,2 0,8 Australia 0,0 1,5 0,5 0,5 2,5 0,5 India 2,0 1,4 1,6 0,9 1,5 0,7 South Africa 2,8 0,3 0,5 0,5 1,0 1,0 Norway 0,0 0,0 0,0 0,0 0,0 0,5 Others 0,0 0,0 0,0 0,0 0,0 0,0 APPARENT CONSUMPTION 26 31 24 23 24 18 CARBON STEEL PRODUCTION 8 402 8 918 8 535 8 841 8 796 8 575 ESTIMATED CONSUMPTION 34 36 35 36 36 35 BALANCE -8 -5 -11 -13 -12 -17 Back to top

- 28. World Bulk Ferro-alloys Markets November, 2015 © Metal Expert 28 Mn South Korea SiMn market structure Apr 15 May 15 Jun 15 Jul 15 Aug 15 Sep 15 PRODUCTION 15,7 17,0 16,4 15,2 14,5 17,7 EXPORT 2,1 1,3 1,7 2,4 2,4 3,6 IMPORT 9,4 10,3 6,6 6,9 5,0 7,5 by country Ukraine 4,4 5,9 3,7 4,7 1,4 3,2 India 2,9 2,9 0,9 1,2 1,9 2,7 Vietnam 2,0 1,4 2,0 1,0 1,7 0,6 Others 0,1 0,1 0,0 0,0 0,0 1,0 APPARENT CONSUMPTION 23 26 21 20 17 22 CARBON STEEL PRODUCTION 5745 6019 5859 5919 5749 5643 ESTIMATED CONSUMPTION 24 25 25 25 24 24 BALANCE -1 0 -3 -5 -7 -2 Back to top Source: Metal Expert Note: in ‘000 gross tonnes

- 29. World Bulk Ferro-alloys Markets November, 2015 © Metal Expert 29 Mn Source: Metal Expert Note: in ‘000 gross tonnes South Korea HC FeMn market structure Apr 15 May 15 Jun 15 Jul 15 Aug 15 Sep 15 PRODUCTION 19,1 22,1 19,1 16,1 16,1 18,1 EXPORT 10,7 13,9 13,1 10,9 10,7 12,7 by country Japan 4,0 3,2 2,2 3,8 1,1 1,9 Taiwan 1,6 1,7 0,1 0,3 2,3 3,4 United Arab Emirates 1,8 1,2 1,3 1,2 1,2 1,5 Saudi Arabia 0,5 2,0 1,0 1,0 1,0 1,4 Netherlands 0,0 1,0 1,8 1,7 0,8 1,6 Turkey 0,0 0,0 2,5 0,6 2,5 1,0 Others 2,9 4,7 4,1 2,2 1,9 1,9 IMPORT 0,2 0,3 1,3 0,6 0,6 0,0 Australia 0,0 0,0 0,0 0,0 0,0 0,0 India 0,2 0,3 1,3 0,6 0,6 0,0 APPARENT CONSUMPTION 9 9 7 6 6 5 CARBON STEEL PRODUCTION 5745 6019 5859 5919 5749 5643 ESTIMATED CONSUMPTION 9 10 9 9 9 9 BALANCE -1 -1 -2 -4 -3 -4 Back to top

- 30. 30 Mn World Bulk Ferro-alloys Markets November, 2015 © Metal Expert 30 Si European FeSi market European FeSi spot prices forecast Chinese FeSi export prices forecast 1225 1205 1185 1170 1070 975 940 920 900 600 700 800 900 1000 1100 1200 1300 1400 Jun15 Jul15 Aug15 Sep15 Oct15 Nov15 Dec15 Jan16 Feb16 EUR/t,ddp 1210 1210 1210 1165 1140 1130 1115 1125 1125 1000 1050 1100 1150 1200 1250 Jun15 Jul15 Aug15 Sep15 Oct15 Nov15 Dec15 Jan16 Feb16 USD/t,fob This month, European merchants have had to reduce FeSi quotes once again due to low demand and intense competition. The average monthly price for the alloy (75% Si) has dropped by EUR 95/t month-on-month to EUR 975/t DDP, reaching its 6-year minimum. The US dollar price has dropped by $166/t due to the 5.3% euro devaluation. Supply has remained excessive in Europe this month. Merchants will most likely fail to offload stocks without losses until the year end. Over the whole year, the surplus may reach 25,000 t, which is 44% of the average monthly consump- tion. In January-February, the market balance is unlikely to recover amid low consumption and the inflow of import material. Balance of European FeSi market -30 -20 -10 0 10 20 30 Q314 Q414 Q115 Q215 Q315 Q415* Q116* '000tonnes Source: Metal Expert *- forecast

- 31. 31 Mn World Bulk Ferro-alloys Markets November, 2015 © Metal Expert 31 Si Shipments from Malaysia keep depressing the European market. Supply of Malaysian material increases gradually, at the moment accounting for some 4% in the supply structure. Besides, the EUR 20-100/t competitive advantage over European prices (in terms of European quality) allows Malaysians to further strengthen their positions. Soon, Malaysia may cover 7-10% of the European market, and the only measure the Europeans can take to prevent it is to initiate an antidumping investigation against Malaysian material. There will be no support from the consuming industry within the next few months. The situation in the steelmaking industry is unfavourable due to the upturn in purchases of cheap steel from China (this year, exports from the country may add 17% reaching 110 million t) and constant decrease in domestic quotations. The problem is unlikely to be resolved soon, as the European authori- ties delay making the decision on protective measures. As a result, European steelmakers will keep pressuring raw material prices in order to maintain profit- ability. Besides, steel output will drop by 5.6% year-on-year to 42.1 million t in Q1, so FeSi consumption will approximate 60,000-64,000 tpm. European FeSi production may be enlarged. Next quarter, it will add 6.4% quarter-on-quarter to 123,000 t, owing to recovery of operations at Icelandic Alloys (120,000 tpy). However, some companies may lower output in view of the unfavourable market environment. FeSi prices will inevitably keep falling amid excessive supply and the negative conditions in the steelmaking segment. Back to top

- 32. 32 Mn World Bulk Ferro-alloys Markets November, 2015 © Metal Expert 32 Si Back to top Source: Metal Expert * - forecast, ** - preliminary data Note: in ‘000 tonnes Source: Metal Expert * - forecast, ** - preliminary data Note: in ‘000 tonnes Apr 15 May 15 Jun 15 Jul 15 Aug 15 Sep 15** Q4 15* Q1 16* PRODUCTION 40 42 42 43 43 43 116 123 by company Elkem 11 11 11 12 12 12 26 35 Ferroatlantica 6 6 6 5 5 5 16 16 Finnfjord 7 7 7 7 7 7 22 22 Fesil 7 7 7 7 7 7 20 20 Other 10 11 11 12 12 12 32 31 EXPORT 4 4 4 5 3 3 10 10 IMPORT 23 33 24 26 20 27 73 76 by countries CIS 4 8 5 4 5 5 - - India 3 3 3 4 2 2 - - China 0 0 0 0 0 0 - - Africa 5 3 4 4 1 1 - - South America 0 7 2 2 2 5 - - Middle East 0 2 1 1 1 2 - - APPARENT CONSUMPTION 59 70 62 64 60 67 179 190 STEEL PRODUCTION 14460 15552 14746 13810 12361 13761 40166 42131 ESTIMATED CONSUMPTION 62 67 63 59 53 59 173 181 BALANCE -3 3 -1 5 7 7 6 8 European ferrosilicon market structure European ferrosilicon market [Si content] Apr 15 May 15 Jun 15 Jul 15 Aug 15 Sep 15** Q4 15* Q1 16* Production 30 31 32 32 32 32 87 92 Export 3 3 3 4 2 2 7 7 Import 17 24 18 19 15 20 54 56 Apparent Consumption 44 53 46 48 45 50 134 141 Estimated Consumption 46 50 47 44 40 44 129 135 Balance -2 3 -1 3 5 6 5 6

- 33. 33 Mn World Bulk Ferro-alloys Markets November, 2015 © Metal Expert 33 Si US, Turkish & Japanese FeSi market Back to top Source: Metal Expert * - forecast, ** - preliminary data Note: in ‘000 gross tonnes USA FeSi market structure Apr 15 May 15 Jun 15 Jul 15 Aug 15 Sep 15 Q4 15* Q1 16* PRODUCTION 7,5 7 6,2 3,5 3,5 3,5 21 21 EXPORT 1,1 0,9 0,9 0,7 0,6 0,6 2,4 2,2 IMPORT 32,5 24,1 8,8 6,8 30,7 20,0 46,5 38,0 by country Russia 16,0 16,2 0,0 0,0 16,2 0,5 19,0 17,0 China 9,3 4,6 5,3 3,9 7,4 8,4 16,0 9,0 Venezuela 2,9 0,0 0,0 0,0 3,3 4,8 0,0 0,0 Others 4,3 3,4 3,5 2,8 3,8 6,3 11,5 12,0 APPARENT CONSUMPTION 39 30 14 10 34 23 65 57 STAINLESS STEEL PRODUC- TION 6413 6844 6843 7032 6936 6557 19282 18619 ESTIMATED CONSUMPTION 20,9 22,3 22,3 22,9 22,6 21,3 62,7 60,6 BALANCE 18,1 8,0 -8,1 -13,4 11,1 1,6 2,4 -3,8

- 34. 34 Mn World Bulk Ferro-alloys Markets November, 2015 © Metal Expert 34 Si Back to top Note: in ‘000 tonnes * - Metal Expert estimation Source: Metal Expert Note: in ‘000 gross tonnes Apr 15 May 15 Jun 15 Jul 15 Aug 15 Sep 15 EXPORT 0,1 0,1 0,1 0,2 0,1 0,1 IMPORT 4,7 6,3 7,8 10,1 8,1 4,2 by suppliers China 0,7 2,9 2,5 2,4 2,6 2,0 Russia 3,0 1,9 2,6 3,5 1,8 0,8 Egypt 0,0 0,0 0,0 0,0 0,0 0,0 Macedonia 0,0 0,0 1,0 1,0 0,0 0,0 Ukraine 0,0 0,1 0,4 1,4 0,0 0,0 Others 0,9 1,3 1,3 1,8 3,7 1,3 DOMESTIC MARKET 4,6 6,2 7,6 10,0 8,0 4,1 STEEL PRODUCTION 2775 2919 2844 2539 2563 2489 ESTIMATED CONSUMPTION 7,3 7,7 7,5 6,7 6,8 6,6 BALANCE -2,7 -1,5 0,1 3,3 1,2 -2,5 Apr 15 May 15 Jun 15 Jul 15 Aug 15 Sep 15 EXPORT 0,2 0,2 0,3 0,1 0,2 0,4 IMPORT 50,1 39,0 31,8 48,7 30,3 29,5 by country China 31,9 21,2 20,6 28,3 15,9 12,4 Russia 10,7 9,1 1,5 10,8 5,4 10,2 Brazil 2,3 4,2 5,9 5,2 4,8 3,7 Vietnam 1,0 0,4 0,5 0,6 0,0 0,1 Others 4,2 4,2 3,2 3,9 4,2 3,1 APPARENT CONSUMPTION 50 39 31 49 30 29 CARBON STEEL PRODUCTION 8 402 8 918 8 535 8 841 8 796 8 575 ESTIMATED CONSUMPTION 34 36 34 36 35 34 BALANCE 16 3 -3 13 -5 -5 Turkish FeSi market structure FeSi market structure in Japan

- 35. 35 Mn World Bulk Ferro-alloys Markets November, 2015 © Metal Expert 35 Cr European FeCr market HC FeCr (60-65%) spot price forecast in Europe, DDP LC FeCr (65-70%) spot price forecast in Europe, DDP 0,95 0,94 0,94 0,87 0,88 0,83 0,81 0,81 0,83 0,60 0,70 0,80 0,90 1,00 1,10 Jun15 Jul15 Aug15 Sep15 Oct15 Nov15 Dec15 Jan16 Feb16 USD/lbCr 2,01 2,00 1,99 1,98 1,96 1,90 1,88 1,88 1,88 1,20 1,40 1,60 1,80 2,00 2,20 Jun15 Jul15 Aug15 Sep15 Oct15 Nov15 Dec15 Jan16 Feb16 USD/lbCr This month, European prices for HC FeCr (60-65% Cr; 6-8% C) have dropped by around 5% month-on-month to $0.83/lb Cr DDP and those for LC material (65-70% Cr; 0.1% C) – by 1.5% to $1.90/lb Cr DDP. Supply is still excessive in Europe. By the end of November, the accumulated surplus reached 7,500 t of FeCr in content, some 16% of the average monthly consumption. European FeCr market balance, in content -15,0 -10,0 -5,0 0,0 5,0 10,0 15,0 20,0 25,0 Q214 Q314 Q414 Q115 Q215 Q315 Q415* Q116* '000tonnes Source: Metal Expert*-forecast

- 36. 36 Mn World Bulk Ferro-alloys Markets November, 2015 © Metal Expert 36 Cr Demand will stay low and will prevent the price increase in short-run. Steelmakers are forced to reduce capacity utilization amid intense competition with foreign suppliers and the consequent price decrease. Over January- November, a total of 6.7 million t of stainless steel was melted in Europe, down 3.3% year-on-year. In December, sellers will be trying to minimize their finished steel inventories, so the output is going to lose another 8-10% m-o-m reaching 450,000 t. The usual recover in Q1 will not exceed 10% (25% in 2015, 19% in 2014). Although South African merchants are having financial problems, the 5% rand devaluation in November will make them increase discounts. The surplus is unlikely to lessen in the global market, although charge chrome production will drop by 2.5% this year as South Africa’s IFM (200,000 tpy) and Tata Steel KZN (150,000 tpy) are still idle. Eskom, a local energy producer, insist on an increase in electricity tariffs during the next financial year by 16.6% against the approved 8%. Coupled with the falling chrome alloy prices, it will make produc- ers cut manufacture. Three out of the four European FeCr plants are still running at 100% capac- ity utilization. This year, Europe is going to put out 612,000 t of chrome alloys, up 8% year-on-year. Most producers do not plan any production cutbacks in Q1. Chrome ore prices are on the way down, too. Prices for South African material (40-42% Cr2O3) and (42-44% Cr2O3) have gone down by 13% to $127/t CIF China and $143/t CIF China respectively. Turkish prices have gone down by 11% to $177/t CIF China for lump ore (40-42% Cr2O3) and $193/t CIF China for the material (46-48% Cr2O3). Prices seems to be close to the bottom as the major- ity of local miners are forced to reduce manufacture due to substantial losses. The price trend in the chrome alloy market is not going to reverse soon because of high supply and low consumption. Yet, the decrease may slow down, given that prices are already too close to production cost. Back to top

- 37. 37 Mn World Bulk Ferro-alloys Markets November, 2015 © Metal Expert 37 Cr Source: Metal Expert * - forecast, ** - preliminary data Note: in ‘000 gross tonnes Source: Metal Expert * - forecast, ** - preliminary data Note: in ‘000 gross tonnes Apr 15 May 15 Jun 15 Jul 15 Aug 15 Sep 15 Q4 15** Q1 16* PRODUCTION 36 48 52 49 49 50 155 164 by company Outokumpu 24 36 40 42 42 42 125 125 Vargon Alloys 8,3 8,3 8,3 5,0 5,0 6,0 21 30 Albanian Chrome 3,0 3,5 3,2 2,7 2,0 2,5 9 9 Other 0 0 0 0 0 0 0 0 EXPORT 1,3 4,9 9,7 21,7 13,6 14,5 20 24 IMPORT 77 85 76 75 49 68 185 211 by countries South Africa 44 57 58 58 34 49 138 148 Zimbabwe 13,8 5,0 0,4 2,5 0,8 6,0 7 8 Russia 1,2 0,5 0,7 0,7 0,2 0,5 2 8 Kazakhstan 4,3 6,9 2,8 1,9 2,1 0,5 5 7 Turkey 3,9 2,2 2,8 1,7 2,0 1,9 9 8 India 4,7 3,7 4,8 4,9 3,3 5,1 10 9 Other 4,3 9,5 6,9 4,9 7,0 5,1 16 24 APPARENT CONSUMPTION 111 127 118 102 84 104 319 385 STAINLESS STEEL PRODUCTION 630 665 666 553 420 600 1490 1750 Apr 15 May 15 Jun 15 Jul 15 Aug 15 Sep 15 Q4 15** Q1 16* PRODUCTION 2,5 2,5 2,7 2,7 2,7 2,7 8 8 by producers Elektrowerk Weisweiler GmbH 2,7 2,7 2,7 2,7 2,7 2,7 8 8 EXPORT 0,7 0,9 1,4 1,5 0,5 0,7 4 4 IMPORT 5,0 7,0 6,6 5,9 4,3 6,7 20 16 by countries Russia 2,0 2,4 1,9 1,9 1,4 3,1 8 9 Other 3,0 4,6 4,7 4,0 2,8 3,6 12 7 APPARENT CONSUMPTION 6,8 8,6 7,9 7,1 6,4 8,7 23,5 19,5 STAINLESS STEEL PRODUCTION 630 665 666 553 420 600 1560 1750 European HC FeCr & Charge Chrome market structure European LC and MC FeCr market structure Back to top

- 38. 38 Mn World Bulk Ferro-alloys Markets November, 2015 © Metal Expert 38 Cr European & US FeCr market Source: Metal Expert * - forecast, ** - preliminary data Note: in ‘000 gross tonnes Source: Metal Expert * - forecast, ** - preliminary data Note: in ‘000 tonnes Apr 15 May 15 Jun 15 Jul 15 Aug 15 Sep 15 Q4 15* Q4 15* DLA sales 2,5 0,3 0,5 0,0 0,0 0,0 0,2 0,1 EXPORT 0,6 0,5 0,8 0,8 0,7 0,5 2,0 2,0 Canada 0,5 0,5 0,8 0,8 0,6 0,5 - - IMPORT 65 41 16 25 46 38 105 109 by country South Africa 42,6 30,7 8,4 1,5 16,8 16,0 - - Finland 0,0 0,0 0,0 7,5 7,1 16,1 - - Kazakhstan 0,0 0,0 0,0 11,0 0,0 0,0 - - Zimbabwe 1,8 1,0 1,7 4,2 3,1 3,9 - - APPARENT CONSUMPTION 66,6 40,8 15,4 24,4 44,8 37,9 103,6 107,6 USA HC FeCr & Charge Chrome market structure European FeCr market structure [in Cr content] Back to top Apr 15 May 15 Jun 15 Jul 15 Aug 15 Sep 15 Q4 15* Q1 16* Production 22 29 31 30 29 30 92 96 Export 1,2 3,4 6,4 13,2 8,1 8,6 14 16 Import 46 51 45 44 29 41 112 124 Apparent Consumption 67 76 70 60 50 63 191 207 Estimated Consumption 70 74 74 61 47 67 173 194 Balance -3 3 -4 -1 4 -4 18 13

- 39. 39 Mn World Bulk Ferro-alloys Markets November, 2015 © Metal Expert 39 Cr USA FeCr market structure [in Cr content] Source: Metal Expert, 100% Mn weight basis * - forecast, ** - preliminary data Note: in ‘000 tonnes Apr 15 May 15 Jun 15 Jul 15 Aug 15 Sep 15 Q4 15* Q4 15* DLA sales 1,8 2,6 0,4 0,1 0,1 0,0 1,0 0,7 Export 0,5 0,5 0,7 0,6 1,0 0,5 2,0 2,0 Import 44,0 26,2 10,3 17,5 31,2 23,4 71,3 72,8 Apparent Consumption 45 28 10 17 30 23 70 71 Estimated Consumption 27 27 27 27 27 27 74 80 Source: Metal Expert * - forecast, ** - preliminary data Note: in ‘000 gross tonnes Apr 15 May 15 Jun 15 Jul 15 Aug 15 Sep 15 Q4 15* Q4 15* DLA sales 0,3 3,6 0,1 0,1 0,2 0,0 1,2 0,9 EXPORT 0,2 0,3 0,3 0,1 0,8 0,2 1,0 1,1 Canada 0,2 0,3 0,3 0,1 0,1 0,2 0,0 0,0 IMPORT 12,4 6,1 2,1 4,4 6,1 1,3 13,5 12,3 by country Russia 9,6 5,0 0,3 1,3 3,5 0,1 - - Germany 0,5 0,5 0,9 0,6 0,3 0,4 - - China 0,9 0,3 0,2 0,9 0,8 0,4 - - Kazakhstan 0,6 0,0 0,0 1,2 0,0 0,0 - - APPARENT CONSUMPTION 12 9 2 4 6 1 14 12 USA LC and MC FeCr market structure Back to top

- 40. 40 Mn World Bulk Ferro-alloys Markets November, 2015 © Metal Expert 40 Cr Source: Metal Expert Note: in ‘000 gross tonnes Japanese FeCr market Japanese HC FeCr & Charge Chrome market structure Back to top Apr 15 May 15 Jun 15 Jul 15 Aug 15 Sep 15 EXPORT 0,01 0,00 0,01 0,00 0,01 0,01 IMPORT 51 62 62 38 64 51 by countries Kazakhstan 33,3 21,8 34,9 22,0 20,3 16,5 South Africa 12,3 33,1 19,8 9,8 40,2 25,9 India 3,8 3,1 5,5 5,0 2,3 4,3 Finland 1,0 1,4 1,2 1,1 1,1 1,2 TURKEY 0,0 2,6 0,0 0,0 0,1 0,0 Others 0,7 0,1 0,4 0,4 0,3 3,5 APPARENT CONSUMPTION 51 62 62 38 64 51 SPECIAL STEEL PRODUCTION 1 549 1 593 1 536 1 562 1 496 1 597 by types Stainless steel 205 220 225 231 232 246 Other specialty steel 1 345 1 372 1 311 1 331 1 265 1 352 ESTIMATED CONSUMPTION 50 53 53 54 54 57 BALANCE 2 9 9 -16 11 -6

- 41. 41 Mn World Bulk Ferro-alloys Markets November, 2015 © Metal Expert 41 Cr Source: Metal Expert Note: in ‘000 gross tonnes Japanese FeCr market structure [in Cr content] Source: Metal Expert Note: in ‘000 gross tonnes Apr 15 May 15 Jun 15 Jul 15 Aug 15 Sep 15 Production 1,3 1,3 1,3 1,3 1,3 1,3 Export 0,2 0,2 0,2 0,2 0,1 0,1 Import 34,3 39,6 41,0 26,1 38,8 32,8 Apparent Consumption 35 41 42 27 40 34 Estimated Consumption 33 35 35 36 35 37 Balance 3 6 7 -8 5 -3 Japanese LC FeCr market structure Back to top Apr 15 May 15 Jun 15 Jul 15 Aug 15 Sep 15 PRODUCTION 2,0 2,0 2,0 2,0 2,0 2,0 EXPORT 0,3 0,3 0,3 0,3 0,2 0,2 IMPORT 3,7 6,2 5,1 3,9 3,8 4,7 by countries Russia 1,2 1,2 1,2 1,6 0,9 2,2 South Africa 0,8 2,0 2,5 1,1 1,4 0,3 China 0,9 1,2 0,4 0,2 0,8 0,6 Kazakhstan 0,7 1,4 1,1 0,6 0,5 1,3 Others 0,1 0,4 0,0 0,3 0,2 0,2 APPARENT CONSUMPTION 5 8 7 6 6 7 SPECIAL STEEL PRODUCTION 1 549 1 593 1 536 1 562 1 496 1 597 by types Stainless steel 205 220 225 231 232 246 Other specialty steel 1 345 1 372 1 311 1 331 1 265 1 352 ESTIMATED CONSUMPTION 5 5 5 5 5 6 BALANCE 0 3 2 0 0 1

- 42. This publication is for information purposes only. The information contained in this document has been compiled from sources believed to be reliable. Metal Expert cannot be made liable for any loss no matter how it may arise. © Metal Expert 2004-2015. All rights reserved. No part of this publication (text, data or graphic) may be reproduced, stored in corporate data retrieval systems or transmitted in any form without obtaining Metal Expert’s prior written consent. Metal Expert News Analytics Forecasts Consulting Advertising Conferences www.metalexpert-group.com tel +38 056 239 88 50, 370 12 06, 370 12 07 e-mail subscriptions@metalexpert-group.com World Bulk Ferro-alloys Markets on-line access to publications, statistics and archives pdf-version and excel-version of statistics consultations of leading experts Subscription / Trials: Chief Editor: Alexandr Andreev e-mail a.andreev@metalexpert-group.com Metal Expert Ukraine: 48-b Naberezhnaya Pobedy, Dnepropetrovsk 49094, Ukraine tel +38 056 239 88 50 +38 056 370 12 06, 370 12 07 e-mail subscriptions@metalexpert-group.com Metal Expert Russia: Metal Expert LLC office 403, 73 Volokolamskoye shosse Moscow, 125424 tel / fax +7 499 346 09 35, +7 495 775 60 55 e-mail subscriptions@metalexpert-group.com Metal Expert LLC: 2470 Hodges Bend Cir., Sugar Land, TX 77479, USA tel +1 832 545 50 23 e-mail s.sadikhov@metalexpert-group.com k.hashimova@metalexpert-group.com Metal Expert Group AG: Todistrasse 38, Zurich, Switzerland, 8002 tel +41 44 735 6015, +41 43 523 0098 e-mail office@unikomag.com Offices