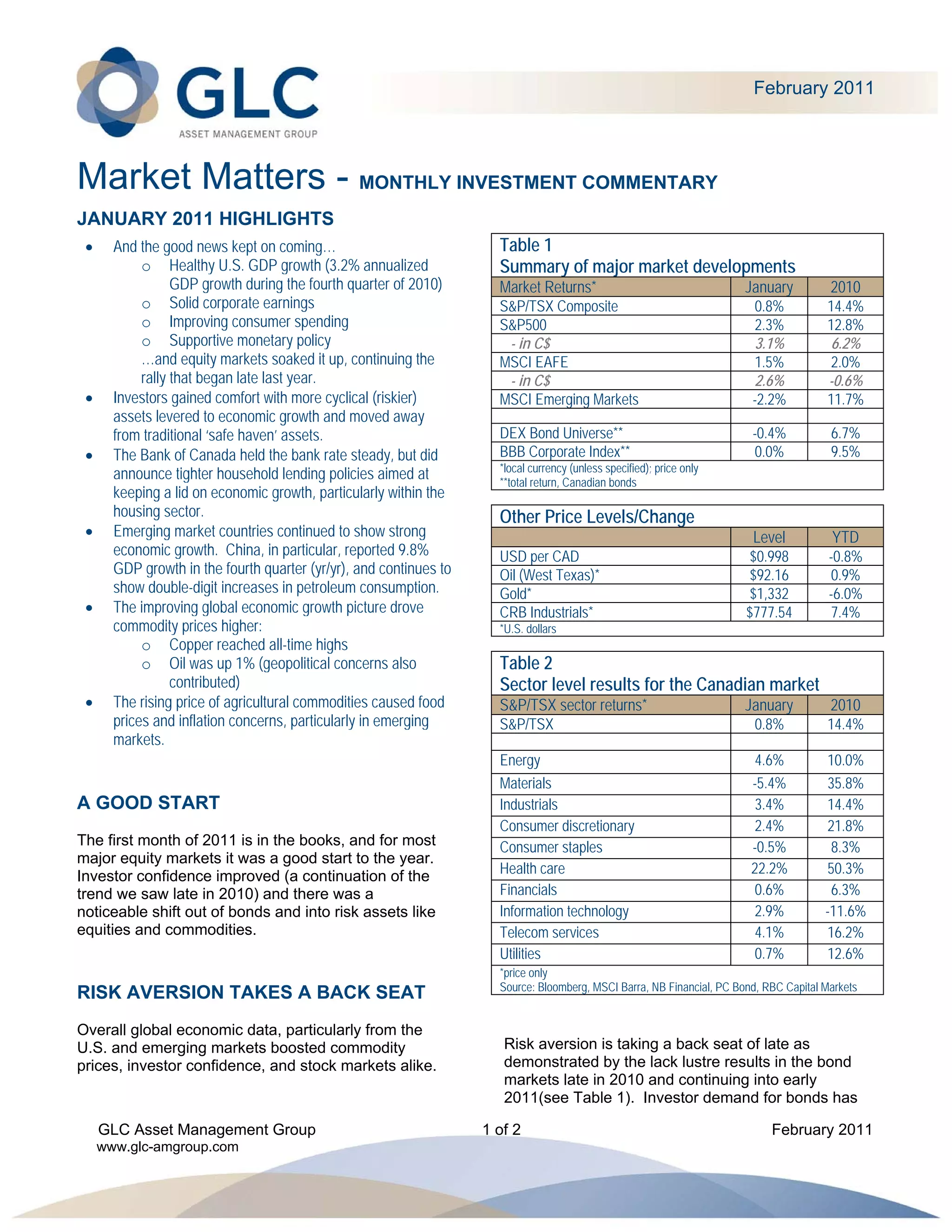

- Major stock markets started 2011 positively, continuing the rally from late 2010, as improving economic data boosted investor confidence.

- Investors shifted funds out of bonds and into riskier assets like equities and commodities, showing reduced risk aversion.

- Commodity prices rose due to stronger global growth, helping energy stocks, while materials stocks lagged.

- While the economic outlook remains positive overall, inflation concerns in emerging markets and potential market corrections pose risks.